South Carolina Pump Installation And Repair Services Contract - Self-Employed

Description

How to fill out South Carolina Pump Installation And Repair Services Contract - Self-Employed?

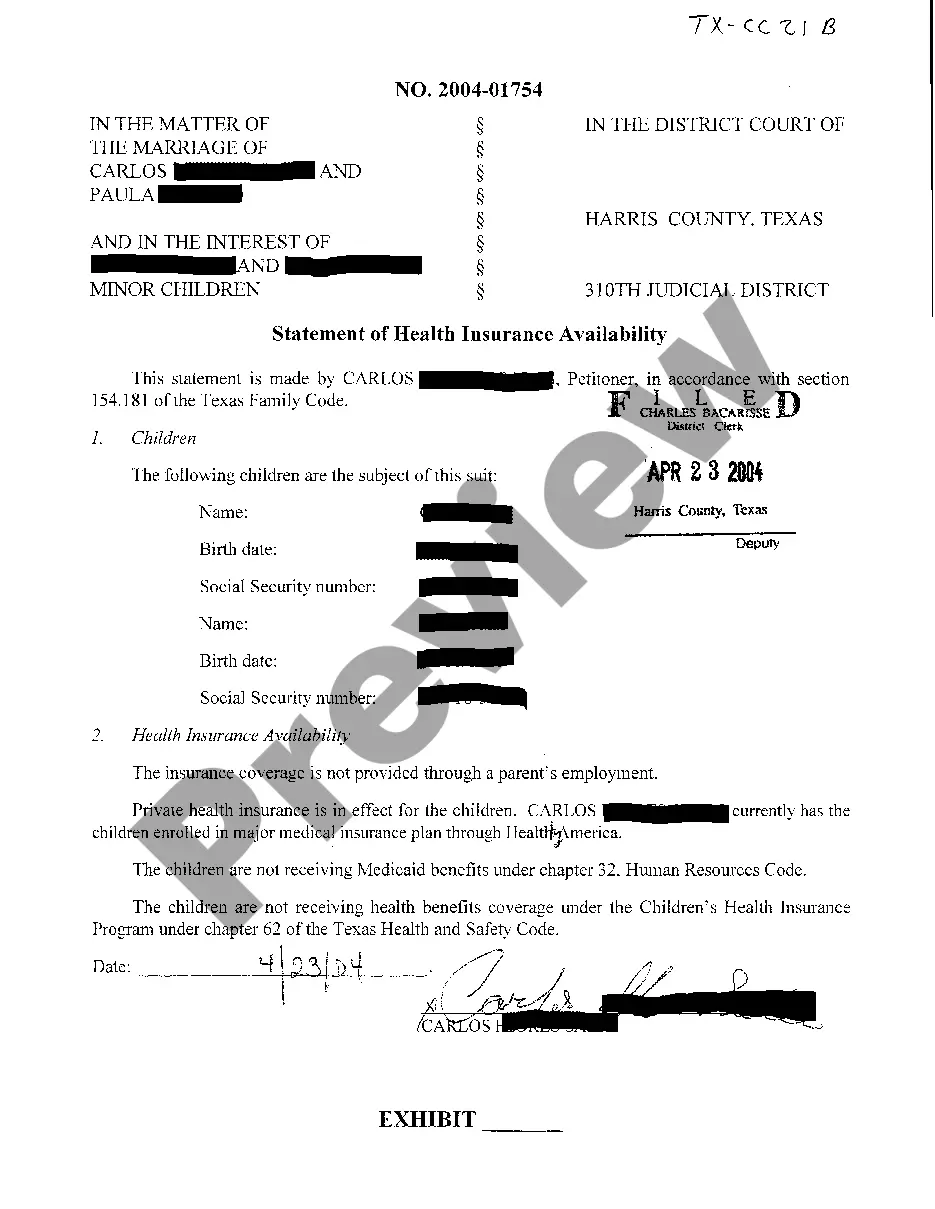

You are able to invest hours on the web trying to find the authorized record web template that suits the state and federal specifications you want. US Legal Forms supplies 1000s of authorized kinds that are reviewed by professionals. It is simple to obtain or produce the South Carolina Pump Installation And Repair Services Contract - Self-Employed from my services.

If you already possess a US Legal Forms account, it is possible to log in and then click the Acquire button. After that, it is possible to comprehensive, edit, produce, or signal the South Carolina Pump Installation And Repair Services Contract - Self-Employed. Every single authorized record web template you purchase is yours eternally. To obtain yet another duplicate of the acquired develop, proceed to the My Forms tab and then click the corresponding button.

If you are using the US Legal Forms internet site the first time, keep to the easy instructions listed below:

- Initially, be sure that you have chosen the best record web template for the area/area of your choosing. Read the develop outline to make sure you have chosen the correct develop. If readily available, utilize the Review button to look from the record web template at the same time.

- If you want to get yet another variation in the develop, utilize the Look for industry to find the web template that fits your needs and specifications.

- When you have identified the web template you would like, click Get now to move forward.

- Find the costs plan you would like, type your accreditations, and register for an account on US Legal Forms.

- Total the deal. You can use your Visa or Mastercard or PayPal account to cover the authorized develop.

- Find the formatting in the record and obtain it to your gadget.

- Make changes to your record if needed. You are able to comprehensive, edit and signal and produce South Carolina Pump Installation And Repair Services Contract - Self-Employed.

Acquire and produce 1000s of record web templates using the US Legal Forms web site, that provides the largest selection of authorized kinds. Use skilled and express-specific web templates to tackle your business or specific requirements.

Form popularity

FAQ

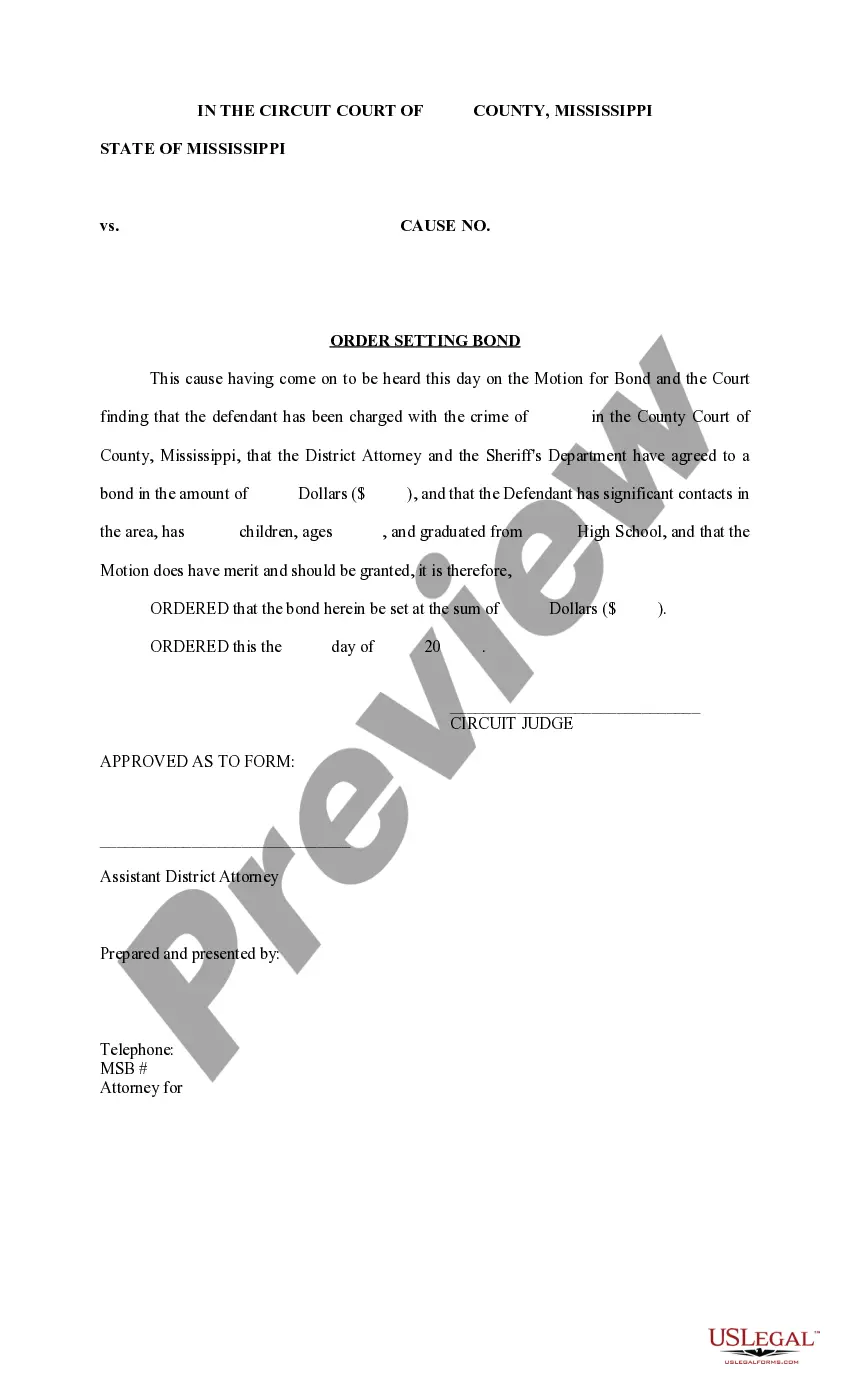

The Sales Tax is imposed on the sales at retail of tangible personal property and certain services. The Use Tax is imposed of the storage, use or consumption of tangible personal property and certain services when purchased at retail from outside the state for storage, use or consumption in South Carolina.

Services in South Carolina are generally not taxable.

Labor is non-taxable when the labor is stated as a separate line item from the parts. Maintenance and warranty agreements may be taxable (check here for exemptions). CXML suppliers should collect sales tax.

You'll need a general contractor license from the South Carolina Contractor's Licensing Board to work on most residential, commercial and industrial construction projects over $5,000, although there are a few exceptions.

REPAIR PARTS, SUPPLIES, AND LABOR SC Regulation 117-174.191 reads: (a) When repairs require only service or services with the use of an inconsequential amount of materials, the amount received is not subject to tax.

Many sellers believe there is a general exemption from sales tax for labor charges. However, in California many types of labor charges are subject to tax. Tax applies to charges for producing, fabricating, or processing tangible personal property for your customers.

Repair parts purchased to repair, in South Carolina, machines that will not be used in manufacturing tangible personal property for sale will be subject to the sales and use tax.

SC Regulation 117-314.2 states: Building materials when purchased by builders, contractors, or landowners for use in adding to, repairing or altering real property are subject to either the sales or use tax at the time of purchase by such builder, contractor, or landowner.