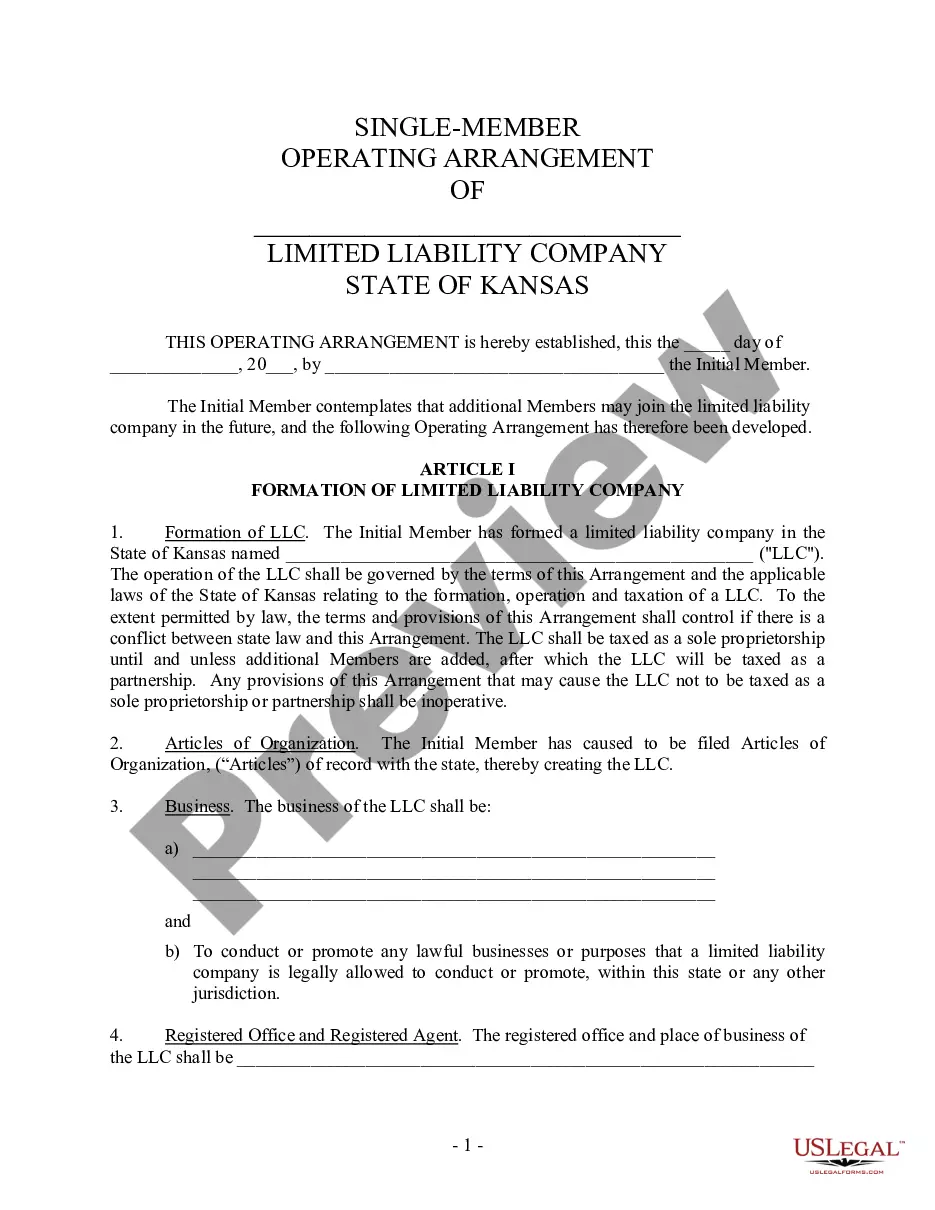

The South Carolina Accounting Agreement for Self-Employed Independent Contractors is a legally binding document that outlines the terms and conditions between a self-employed individual and their clients. This agreement serves as a guide for both parties involved in the contractual relationship, ensuring transparency, clarity, and protection of rights. Here are some relevant keywords to better understand the South Carolina Accounting Agreement — Self-Employed Independent Contractor: 1. Independent Contractor: This refers to an individual who works for themselves rather than being an employee of a company. Independent contractors have their own business and provide services to clients on a contractual basis. 2. South Carolina: The specific location where the agreement is intended to be enforced. South Carolina is a state located on the east coast of the United States, known for its historic cities, beautiful coastline, and vibrant business community. 3. Accounting Agreement: This agreement focuses on the provision of accounting services by the self-employed individual. It outlines the scope of work, payment terms, confidentiality, and other important considerations in the accounting profession. 4. Self-Employed: The individual who is engaged in this agreement is self-employed. They work on their own, without being employed by or affiliated with a company. This allows them to have more independence and flexibility in their work arrangements. 5. Terms and Conditions: The agreement includes specific terms and conditions that both parties agree upon, such as the duration of the agreement, the deliverables, deadlines, payment details, and any penalties or termination clauses that may apply. Different types of South Carolina Accounting Agreement — Self-Employed Independent Contractor: 1. General Accounting Agreement: This agreement covers a wide range of accounting services, including basic bookkeeping, financial statement preparation, tax filings, and other related tasks. 2. Payroll Accounting Agreement: This type of agreement focuses specifically on payroll-related services, including processing employee wages, handling tax withholding, and generating payroll reports. 3. Tax Accounting Agreement: This agreement is designed for individuals or businesses who require assistance with tax-related matters. It involves preparing and filing tax returns, ensuring compliance with tax laws, and offering tax planning advice. 4. Forensic Accounting Agreement: This specialized agreement is for individuals or organizations requiring investigative accounting services. It involves the examination of financial records, identifying fraudulent activities, and providing expert testimony in legal proceedings. By utilizing an appropriate South Carolina Accounting Agreement — Self-Employed Independent Contractor, both parties can establish a clear understanding of their obligations, minimizing potential disputes and ensuring a professional working relationship. It is always recommended consulting legal professionals when drafting or signing such agreements to ensure compliance with state and federal laws.

Independent Contractor Agreement South Carolina

Description

How to fill out South Carolina Accounting Agreement - Self-Employed Independent Contractor?

Discovering the right legal papers design can be a battle. Of course, there are tons of templates accessible on the Internet, but how can you obtain the legal kind you will need? Use the US Legal Forms website. The service provides a huge number of templates, for example the South Carolina Accounting Agreement - Self-Employed Independent Contractor, that you can use for organization and personal requirements. All the kinds are checked by pros and satisfy federal and state demands.

If you are already authorized, log in to your account and click on the Down load button to get the South Carolina Accounting Agreement - Self-Employed Independent Contractor. Make use of your account to check from the legal kinds you possess bought formerly. Visit the My Forms tab of your own account and obtain one more duplicate from the papers you will need.

If you are a fresh user of US Legal Forms, here are easy instructions that you should comply with:

- First, make sure you have selected the proper kind to your town/state. You can look over the form utilizing the Preview button and browse the form description to ensure it is the right one for you.

- In the event the kind will not satisfy your preferences, make use of the Seach discipline to discover the proper kind.

- Once you are positive that the form is suitable, click the Get now button to get the kind.

- Opt for the prices program you would like and enter in the necessary information. Design your account and pay for the order utilizing your PayPal account or credit card.

- Opt for the file file format and acquire the legal papers design to your gadget.

- Full, revise and print out and signal the acquired South Carolina Accounting Agreement - Self-Employed Independent Contractor.

US Legal Forms will be the largest catalogue of legal kinds where you can discover various papers templates. Use the company to acquire skillfully-made papers that comply with condition demands.

Form popularity

FAQ

Becoming an independent contractor is one of the many ways to be classified as self-employed. By definition, an independent contractor provides work or services on a contractual basis, whereas, self-employment is simply the act of earning money without operating within an employee-employer relationship.

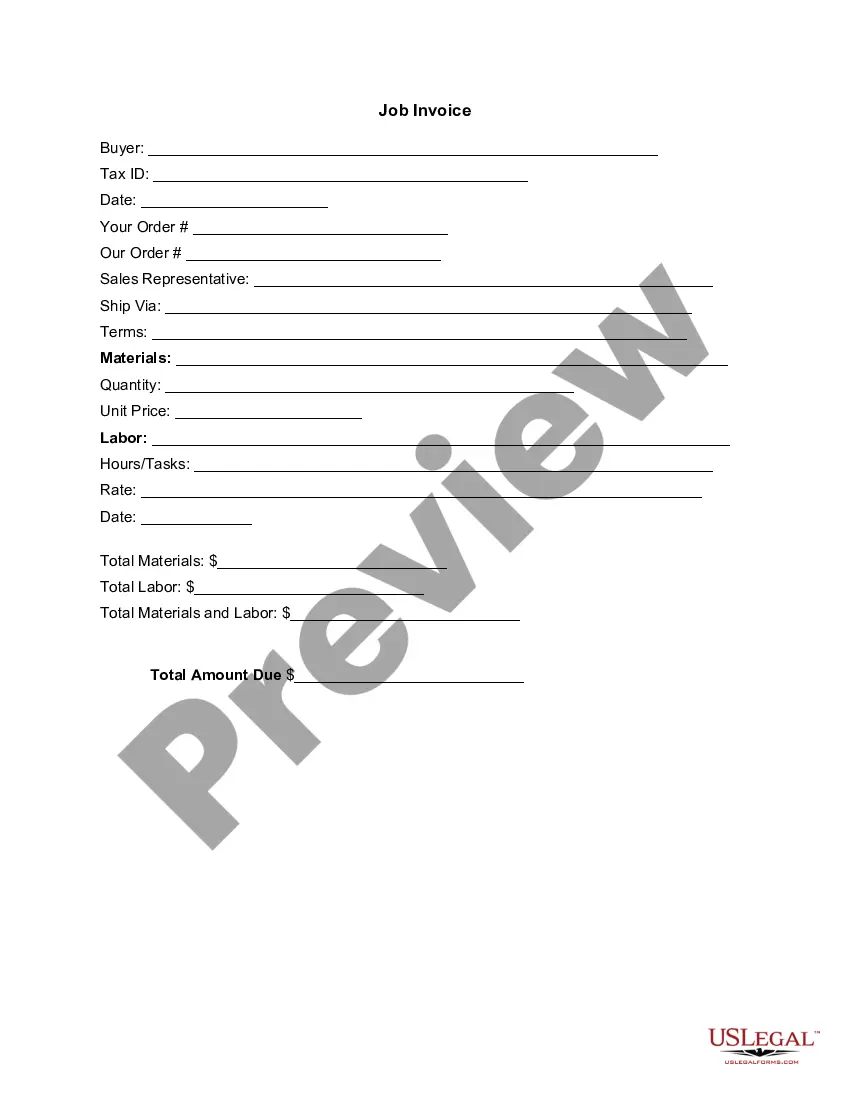

Accrual Method Accounting When you operate a business providing services as an independent contractor, you have the option of using the accrual method of accounting for your contractor earnings and expenses while reporting your personal income and deductions using the cash method.

An independent contractor agreement is a legally binding document signed by a 1099 employee and the company that hires them. It outlines the scope of work and the terms under which that work will be completed, which goes a long way to making sure both parties are on the same page about the project from the start.

Independent contractors are self-employed workers who provide services for an organisation under a contract for services. Independent contractors are not employees and are typically highly skilled, providing their clients with specialist skills or additional capacity on an as needed basis.

The general rule is that an individual is an independent contractor if the payer has the right to control or direct only the result of the work and not what will be done and how it will be done. If you are an independent contractor, then you are self-employed.

Independent contractors generally report their earnings to the IRS quarterly using Form 1040-ES, Estimated Tax for Individuals. This covers both their federal income tax and self-employment tax liabilities. They may also have to pay state and local taxes according to their state and local government guidelines.

Here is a list of some of the things you can write off on your 1099 if you are self-employed:Mileage and Car Expenses.Home Office Deductions.Internet and Phone Bills.Health Insurance.Travel Expenses.Meals.Interest on Loans.Subscriptions.More items...?

Becoming an independent contractor is one of the many ways to be classified as self-employed. By definition, an independent contractor provides work or services on a contractual basis, whereas, self-employment is simply the act of earning money without operating within an employee-employer relationship.

How do I create an Independent Contractor Agreement?State the location.Describe the type of service required.Provide the contractor's and client's details.Outline compensation details.State the agreement's terms.Include any additional clauses.State the signing details.

What Should Be in a Construction Contract?Identifying/Contact Information.Title and Description of the Project.Projected Timeline and Completion Date.Cost Estimate and Payment Schedule.Stop-Work Clause and Stop-Payment Clause.Act of God Clause.Change Order Agreement.Warranty.More items...