A South Carolina Partition Deed for Mineral/Royalty Interests is a legal document used to divide ownership or interests in mineral rights or royalty payments among multiple parties. This deed is commonly employed when the co-owners or heirs of these interests wish to separate their rights or share the benefits derived from oil, gas, coal, or other mineral resources. Keywords: South Carolina, partition deed, mineral interests, royalty interests, co-owners, heirs, ownership, benefits, oil, gas, coal, mineral resources. Different Types of South Carolina Partition Deed for Mineral/Royalty Interests: 1. Mineral Interest Partition Deed: This type of partition deed specifically deals with dividing ownership rights in mineral resources, such as oil, gas, or coal. It allows co-owners or heirs to separate their interests in these resources and define their respective shares. 2. Royalty Interest Partition Deed: A royalty interest partition deed is used when individuals want to allocate shares of royalty payments derived from the extraction and production of minerals. It enables co-owners or heirs to establish their rights to receive a portion of the royalties generated from the use of their mineral resources. 3. Estate Planning Partition Deed: This type of partition deed is often utilized in estate planning scenarios, when the owner wishes to distribute their mineral or royalty interests among heirs or beneficiaries. It ensures a smooth transition of ownership and helps avoid potential conflicts or disputes in the future. 4. Co-Ownership Partition Deed: When multiple parties jointly own mineral or royalty interests and wish to separate their shares, a co-ownership partition deed is used. It outlines the specific division of ownership rights, ensuring clarity and avoiding any potential disagreements regarding ownership percentages. 5. Partition Deed with Buyout Provision: In some cases, co-owners or heirs may choose to include a buyout provision in their partition deed. This provision allows one party to buy out the others' interests in the mineral or royalty rights. It offers a mechanism for an equitable transfer of ownership and can be helpful when not all parties wish to remain involved in the ownership arrangement. These various types of South Carolina Partition Deeds for Mineral/Royalty Interests provide legal frameworks to allocate, separate, or distribute ownership rights and benefits associated with mineral resources. By utilizing these deeds, individuals can establish clear and enforceable agreements regarding their interests in South Carolina's mineral or royalty assets.

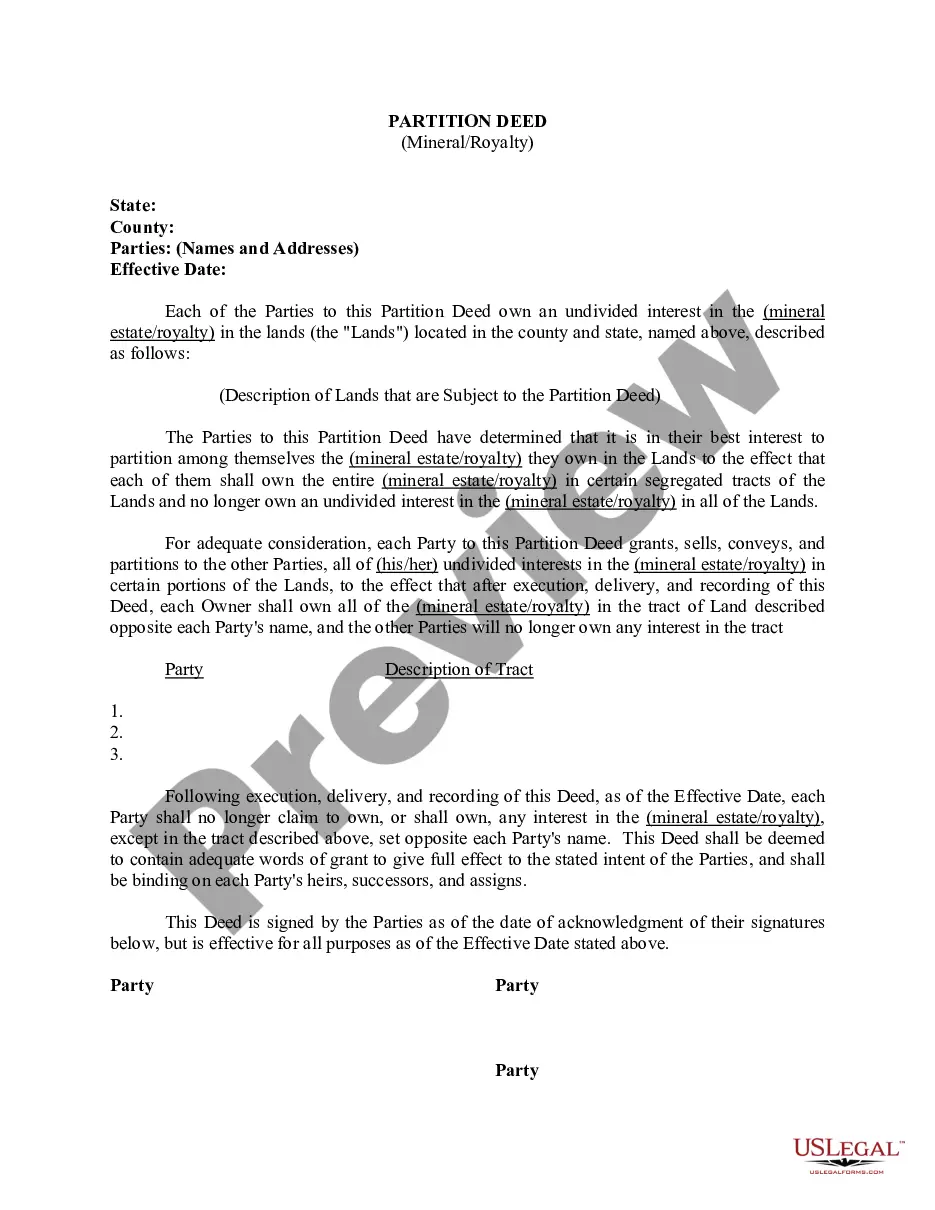

South Carolina Partition Deed for Mineral / Royalty Interests

Description

How to fill out South Carolina Partition Deed For Mineral / Royalty Interests?

Discovering the right lawful file format could be a have difficulties. Of course, there are tons of web templates available on the Internet, but how can you discover the lawful form you require? Utilize the US Legal Forms website. The services provides a large number of web templates, for example the South Carolina Partition Deed for Mineral / Royalty Interests, that can be used for company and personal requires. Each of the kinds are checked by professionals and meet federal and state specifications.

If you are currently listed, log in for your accounts and click on the Acquire switch to obtain the South Carolina Partition Deed for Mineral / Royalty Interests. Make use of accounts to search through the lawful kinds you have bought previously. Visit the My Forms tab of your accounts and obtain yet another backup of your file you require.

If you are a fresh customer of US Legal Forms, listed here are simple recommendations so that you can follow:

- First, make certain you have selected the right form for your area/county. You are able to check out the shape making use of the Review switch and read the shape explanation to make certain it will be the best for you.

- In the event the form will not meet your needs, take advantage of the Seach industry to find the correct form.

- Once you are sure that the shape is suitable, click the Acquire now switch to obtain the form.

- Opt for the pricing program you desire and enter in the required information and facts. Build your accounts and buy an order utilizing your PayPal accounts or Visa or Mastercard.

- Pick the file file format and acquire the lawful file format for your device.

- Complete, edit and print and sign the acquired South Carolina Partition Deed for Mineral / Royalty Interests.

US Legal Forms is definitely the biggest collection of lawful kinds where you can see a variety of file web templates. Utilize the company to acquire professionally-made files that follow state specifications.