South Carolina Subordination of Lien is a legal process that allows for the rearrangement of lien priority among different creditors or lenders involved in a property transaction. This subordination is typically accomplished through a legal document known as a Subordination Agreement, which is often associated with Deeds of Trust or Mortgages. In South Carolina, there are different types of Subordination of Liens depending on the specific circumstances. Some common types include: 1. Subordination of Deed of Trust: This type of subordination occurs when a new lien is being created, and it needs to take priority over an existing Deed of Trust. The parties involved, including the borrower, lender, and holder of the existing lien, can enter into a Subordination Agreement to establish the new lien's priority. 2. Subordination of Mortgage: Similar to the subordination of a Deed of Trust, this type of subordination is specific to Mortgage agreements. When refinancing a property or obtaining additional financing, the existing Mortgage holder may be required to subordinate their lien to the new lender, enabling them to take priority. 3. Subordination of Priority: In some cases, there may be multiple lien holders with conflicting priorities. If all parties agree, they can execute a Subordination Agreement to rearrange the priority of their liens. This ensures that each creditor will receive repayment in the agreed-upon order in case of foreclosure or sale of the property. South Carolina Subordination of Lien is an essential legal mechanism that protects the interests of lenders and borrowers involved in real estate transactions. It allows lenders to have a proper order of priority, establishing their rights in case of default or foreclosure. Borrowers benefit from obtaining financing or refinancing options while complying with the requirements set by existing lenders. Overall, Subordination of Liens plays a vital role in maintaining a transparent and efficient real estate market in South Carolina.

South Carolina Subordination of Lien (Deed of Trust/Mortgage)

Description

How to fill out South Carolina Subordination Of Lien (Deed Of Trust/Mortgage)?

Are you currently in a position where you require paperwork for sometimes enterprise or specific uses virtually every day? There are a variety of authorized document layouts available online, but finding versions you can trust isn`t simple. US Legal Forms provides 1000s of type layouts, much like the South Carolina Subordination of Lien (Deed of Trust/Mortgage), which can be published to meet federal and state requirements.

In case you are presently familiar with US Legal Forms internet site and also have an account, simply log in. After that, you are able to obtain the South Carolina Subordination of Lien (Deed of Trust/Mortgage) design.

If you do not have an accounts and wish to begin using US Legal Forms, abide by these steps:

- Discover the type you want and make sure it is for that proper town/region.

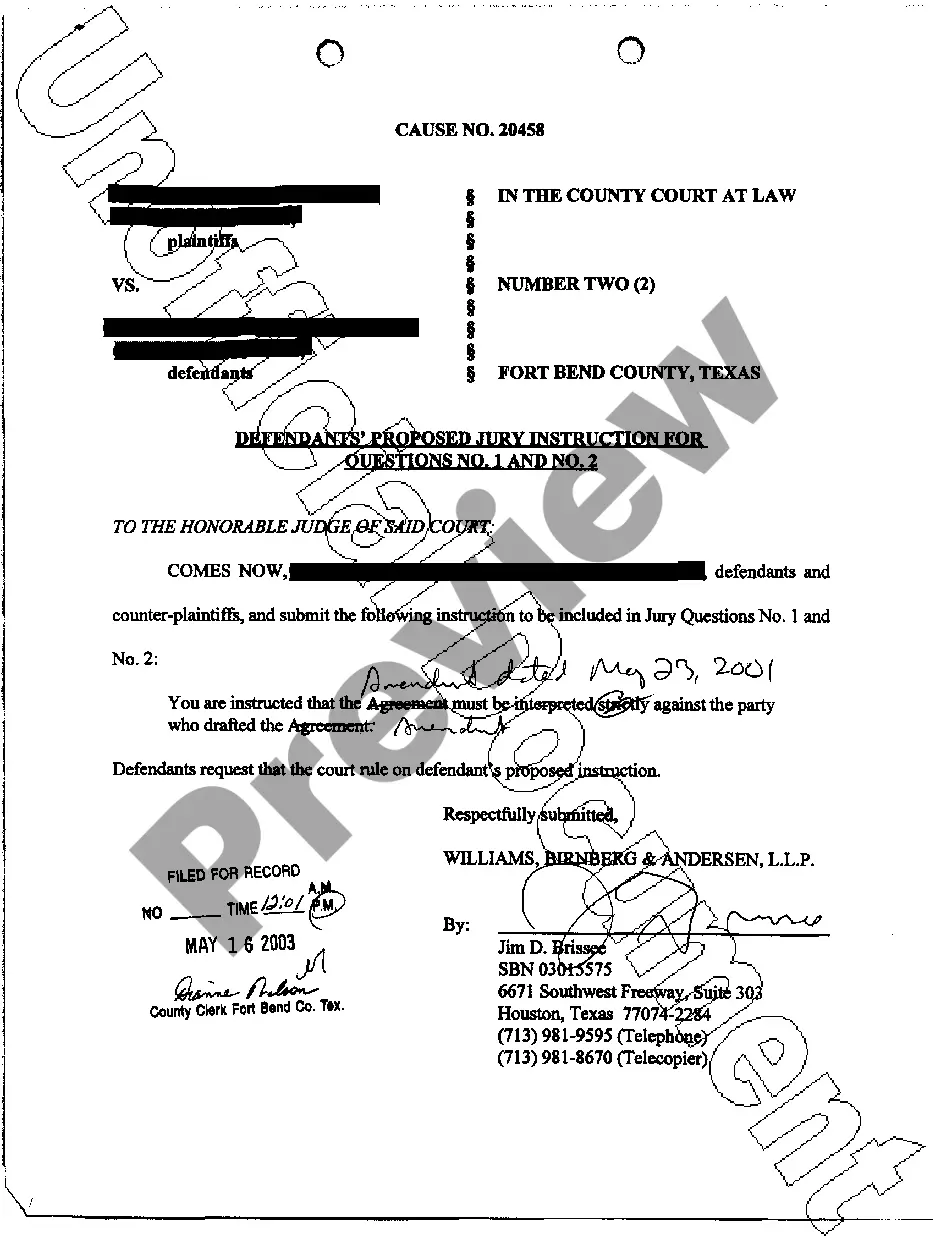

- Utilize the Review key to examine the form.

- Read the outline to ensure that you have selected the appropriate type.

- When the type isn`t what you are seeking, make use of the Search field to get the type that suits you and requirements.

- Once you get the proper type, click Acquire now.

- Opt for the rates prepare you need, fill in the desired details to create your account, and buy the transaction utilizing your PayPal or bank card.

- Decide on a hassle-free document format and obtain your version.

Discover every one of the document layouts you may have purchased in the My Forms menu. You can get a more version of South Carolina Subordination of Lien (Deed of Trust/Mortgage) whenever, if possible. Just go through the essential type to obtain or print the document design.

Use US Legal Forms, probably the most comprehensive variety of authorized varieties, to save time and prevent blunders. The support provides professionally made authorized document layouts that you can use for a range of uses. Create an account on US Legal Forms and start making your lifestyle a little easier.

Form popularity

FAQ

The lienholder should file a petition with the Court of Common Pleas for the county in which the property is located containing a statement of the contract on which the lien is based, the amount due, a description of the property subject to the lien and ?all other material facts and circumstances.? S.C.

If the married couple or joint owners of a property do not have a tenancy by the entireties title, any lien can attach to the person's interest in the property. Whether it's judgment or confessed judgment, the lien will attach to the homeowner's interest, making the lienor a co-owner of the property.

Involuntary Lien: A lien imposed against property without consent of the owner. Taxes, special assessments, federal income tax liens, and State tax liens are examples of involuntary liens.

This Security Instrument secures to Lender (i) the. repayment of the Loan, and all renewals, extensions, and modifications of the Note, and (ii) the performance. of Borrower's covenants and agreements under this Security Instrument and the Note.

Pursuant to S.C. Code Ann. § 29-5-10 et. seq., a contractor, subcontractor or supplier with a lien claim can file a mechanics' lien within 90 days of the date of the last furnishing of labor or materials.

About South Carolina Notice of Intent to Lien Form No one wants to be forced to file a mechanics lien, and this document gives all of the parties involved one final chance to take care of the payment issues on a project. This form advises the party that a lien will be filed if payment is not received within 10 days.

Mortgage States and Deed of Trust States StateMortgage StateDeed of Trust StateOregonYPennsylvaniaYRhode IslandYSouth CarolinaY47 more rows

Generally, all documents presented for recording require: An original, ?wet? signed document. Signature of the Party of the First Part. ... Two witnesses to the signature. A South Carolina Probate or Acknowledgement. A property description to include a recorded plat reference or metes and bounds description.