This form is used to resolve any question as to how royalty is to be paid to the Parties in the event of production, under the Lease, on any part of the Lands. The Parties are entering into this Agreement to stipulate and agree to the ownership of each Party's respective share of the royalty reserved in the Lease payable for production attributable to their Interests from a well located anywhere on the Lands.

South Carolina Agreement Governing Payment of Nonparticipating Royalty Under Segregated Tracts Covered by one Oil and Gas Lease

Description

How to fill out Agreement Governing Payment Of Nonparticipating Royalty Under Segregated Tracts Covered By One Oil And Gas Lease?

Are you currently in the position the place you need to have documents for both enterprise or person purposes virtually every working day? There are plenty of legitimate document layouts available online, but getting types you can rely is not simple. US Legal Forms gives a large number of kind layouts, much like the South Carolina Agreement Governing Payment of Nonparticipating Royalty Under Segregated Tracts Covered by one Oil and Gas Lease, which can be composed to fulfill federal and state specifications.

When you are already informed about US Legal Forms web site and have an account, basically log in. Following that, you are able to obtain the South Carolina Agreement Governing Payment of Nonparticipating Royalty Under Segregated Tracts Covered by one Oil and Gas Lease format.

Should you not come with an accounts and need to begin using US Legal Forms, abide by these steps:

- Obtain the kind you need and ensure it is for that right city/area.

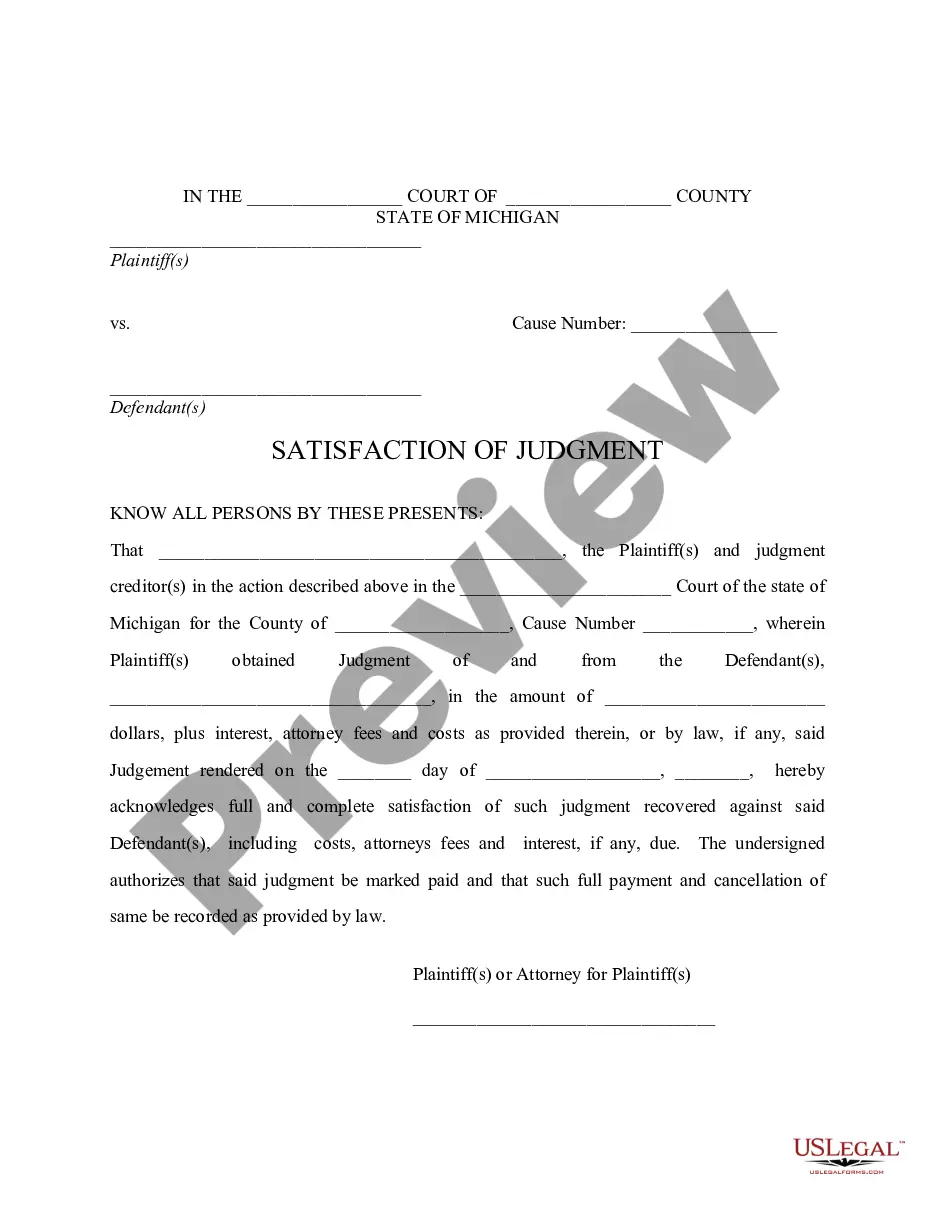

- Utilize the Review button to review the form.

- Look at the description to actually have chosen the proper kind.

- When the kind is not what you`re searching for, make use of the Search discipline to find the kind that fits your needs and specifications.

- Whenever you find the right kind, just click Acquire now.

- Pick the prices prepare you need, submit the required information and facts to create your money, and pay for the order using your PayPal or charge card.

- Select a convenient file structure and obtain your backup.

Discover all of the document layouts you might have purchased in the My Forms food list. You can get a additional backup of South Carolina Agreement Governing Payment of Nonparticipating Royalty Under Segregated Tracts Covered by one Oil and Gas Lease anytime, if possible. Just select the needed kind to obtain or printing the document format.

Use US Legal Forms, by far the most extensive collection of legitimate forms, in order to save some time and stay away from errors. The service gives expertly manufactured legitimate document layouts that you can use for an array of purposes. Generate an account on US Legal Forms and initiate creating your way of life a little easier.

Form popularity

FAQ

Royalty Clause There are two types of royalties, a net and a gross royalty. Normally, the oil and gas lease contains a net royalty. If the lease provides for a net royalty, this means that post-production deductions will be taken from the royalty.

An ?unless? clause provides that the lease terminates unless the lessee has either made the required payments or commenced drilling operations. Lessees can therefore be terminated from the lease by failure to pay the proper amount, by the due date, in the proper form, to the proper party.

Hear this out loud PauseThe lessee of an oil or gas lease can assign the entire lease or part of it. In other words, the lessee can sell or transfer part of the estate or the entire estate to which they have the working rights. The assignee is assigned the working interest and lease obligations, including override royalty.

Hear this out loud Pause'Assigning' a lease simply means transferring your lease to another person so that they become the new tenant. Once the assignment has taken place the lease continues to exist and the new tenant becomes liable for all of the tenant's obligations in the lease.

Hear this out loud PauseAny partial assignment of any lease shall segregate the assigned and retained portions thereof, and as above provided, release and discharge the assignor from all obligations thereafter accruing with respect to the assigned lands; and such segregated leases shall continue in full force and effect for the primary term ...

Hear this out loud PauseWhat is assignment of a lease? The process of assignment of a lease is essentially selling the lease to a third party (the ?assignee?). If you are a commercial property tenant, your contract likely contains a clause that allows you to assign your lease to a new tenant.

The definition of assignment in real estate is the sale, transfer, or conveyance of a whole property ownership/rights or part of it to another party. The term in the oil and gas industry is used for sale, transfer, or conveyance of working interest, lease, royalty, overriding royalty interest, or net profit interest.

An assignment of oil and gas lease is a contractual agreement between a landowner and an oil or gas company in which the company gains the right to explore for, develop, and produce oil and gas from the property.