South Carolina Clauses Relating to Venture IPO

Description

How to fill out Clauses Relating To Venture IPO?

US Legal Forms - one of several largest libraries of legitimate varieties in the USA - provides an array of legitimate file themes you can download or produce. While using website, you may get thousands of varieties for enterprise and individual functions, sorted by classes, says, or keywords and phrases.You will find the most recent variations of varieties such as the South Carolina Clauses Relating to Venture IPO in seconds.

If you have a registration, log in and download South Carolina Clauses Relating to Venture IPO from the US Legal Forms library. The Obtain option can look on every single kind you perspective. You gain access to all formerly acquired varieties inside the My Forms tab of the accounts.

If you want to use US Legal Forms for the first time, here are easy instructions to get you started:

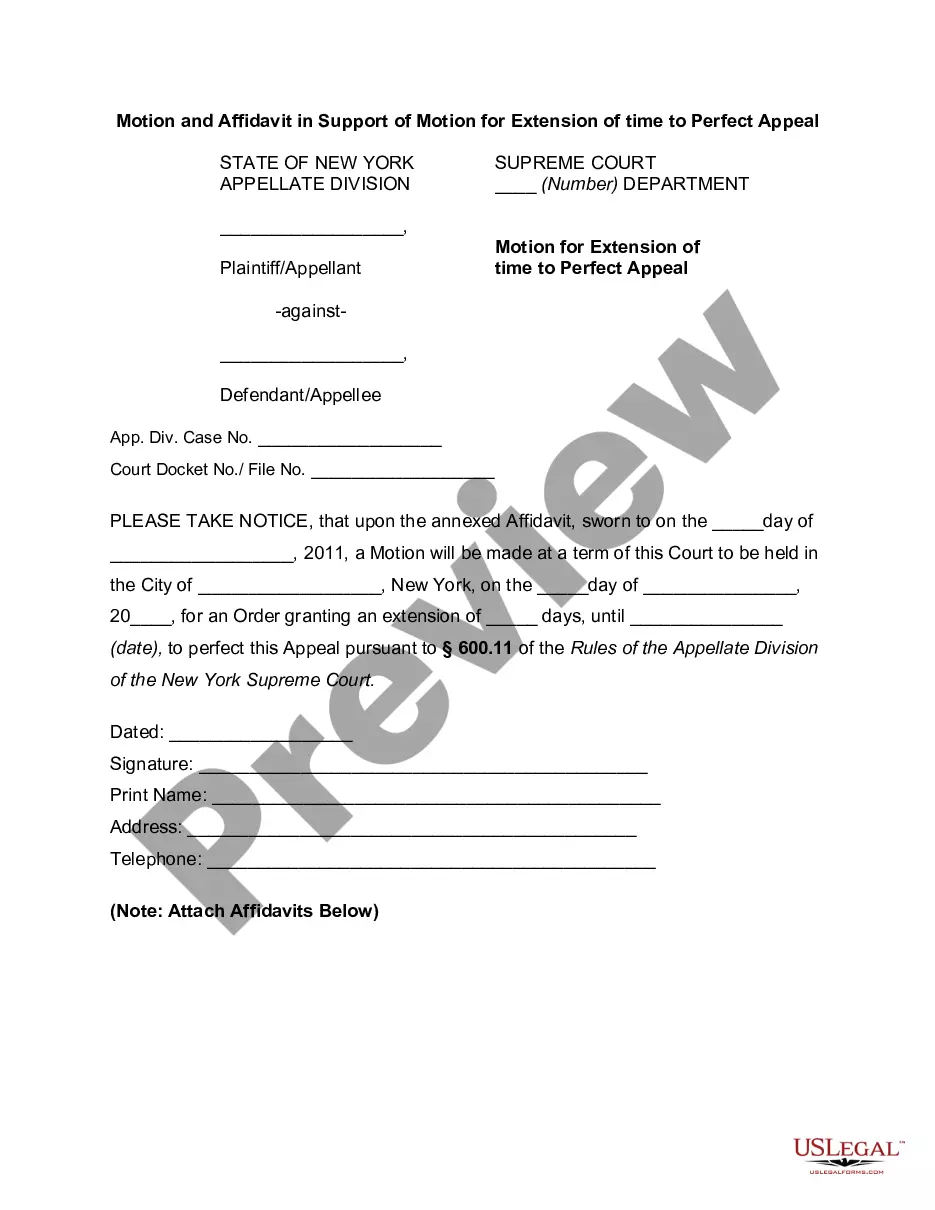

- Ensure you have picked the right kind for your personal city/area. Select the Preview option to review the form`s content material. Look at the kind description to ensure that you have selected the appropriate kind.

- In the event the kind doesn`t fit your demands, utilize the Search discipline near the top of the display to discover the one that does.

- In case you are pleased with the form, verify your decision by clicking on the Buy now option. Then, opt for the pricing program you favor and give your accreditations to register for an accounts.

- Method the deal. Use your bank card or PayPal accounts to perform the deal.

- Find the structure and download the form on your own product.

- Make changes. Fill up, change and produce and signal the acquired South Carolina Clauses Relating to Venture IPO.

Every design you included in your money does not have an expiration day and it is your own forever. So, in order to download or produce yet another copy, just visit the My Forms segment and click on in the kind you require.

Gain access to the South Carolina Clauses Relating to Venture IPO with US Legal Forms, by far the most substantial library of legitimate file themes. Use thousands of professional and express-distinct themes that meet up with your company or individual requires and demands.

Form popularity

FAQ

What is venture capital? Technically, venture capital (VC) is a form of private equity. The main difference is that while private equity investors prefer stable companies, VC investors usually come in during the startup phase. Venture capital is usually given to small companies with incredible growth potential.

A venture capital-backed IPO (Initial Public Offering) is the process by which a privately held startup or company raises capital by offering its shares to the public for the first time. In this case, the company has received funding from venture capital firms to help grow and develop the business.

A venture capitalist (VC) is a private equity investor that provides capital to companies with high growth potential in exchange for an equity stake. A VC investment could involve funding startup ventures or supporting small companies that wish to expand but have no access to the equities markets.

What is a Venture Capital-Backed Company? A venture capital-backed company (also referred to as a 'venture-backed company') is a company whose equity is partly or wholly held by one or more venture capital (VC) firms.

Understanding Venture Capital-Backed IPOs Venture capital is a type of private equity. This kind of financing is provided by investors and firms to companies with high-growth potential or to those that demonstrate high growth.

A venture capital-backed IPO refers is the initial public offering of a company previously financed by private investors. Venture capitalists use VC-backed IPOs to recover their investments in a company. Investors wait for the most optimal time to conduct an IPO to make sure they earn the best possible return.

The Key Holders each agree to hold all shares of voting capital stock of the Company registered in their respective names or beneficially owned by them as of the date hereof and any and all other securities of the Company legally or beneficially acquired by each of the Key Holders after the date hereof (hereinafter ...

backed company is a business that is at least partially funded by a venture capital (VC) firm's investment fund. VCbacked companies are often startups that raise money in exchange for equity from VCs and other private market investors. These companies tend to be in a growth stage.