South Carolina Form of Anti-Money Laundering Policy

Description

How to fill out Form Of Anti-Money Laundering Policy?

US Legal Forms - one of the largest libraries of lawful types in the States - provides an array of lawful document layouts you may obtain or printing. Utilizing the internet site, you may get thousands of types for organization and individual reasons, categorized by types, says, or keywords.You can find the newest models of types just like the South Carolina Form of Anti-Money Laundering Policy in seconds.

If you have a registration, log in and obtain South Carolina Form of Anti-Money Laundering Policy from your US Legal Forms local library. The Acquire switch will appear on each kind you perspective. You gain access to all earlier downloaded types in the My Forms tab of your own profile.

If you wish to use US Legal Forms the very first time, listed below are simple recommendations to help you started:

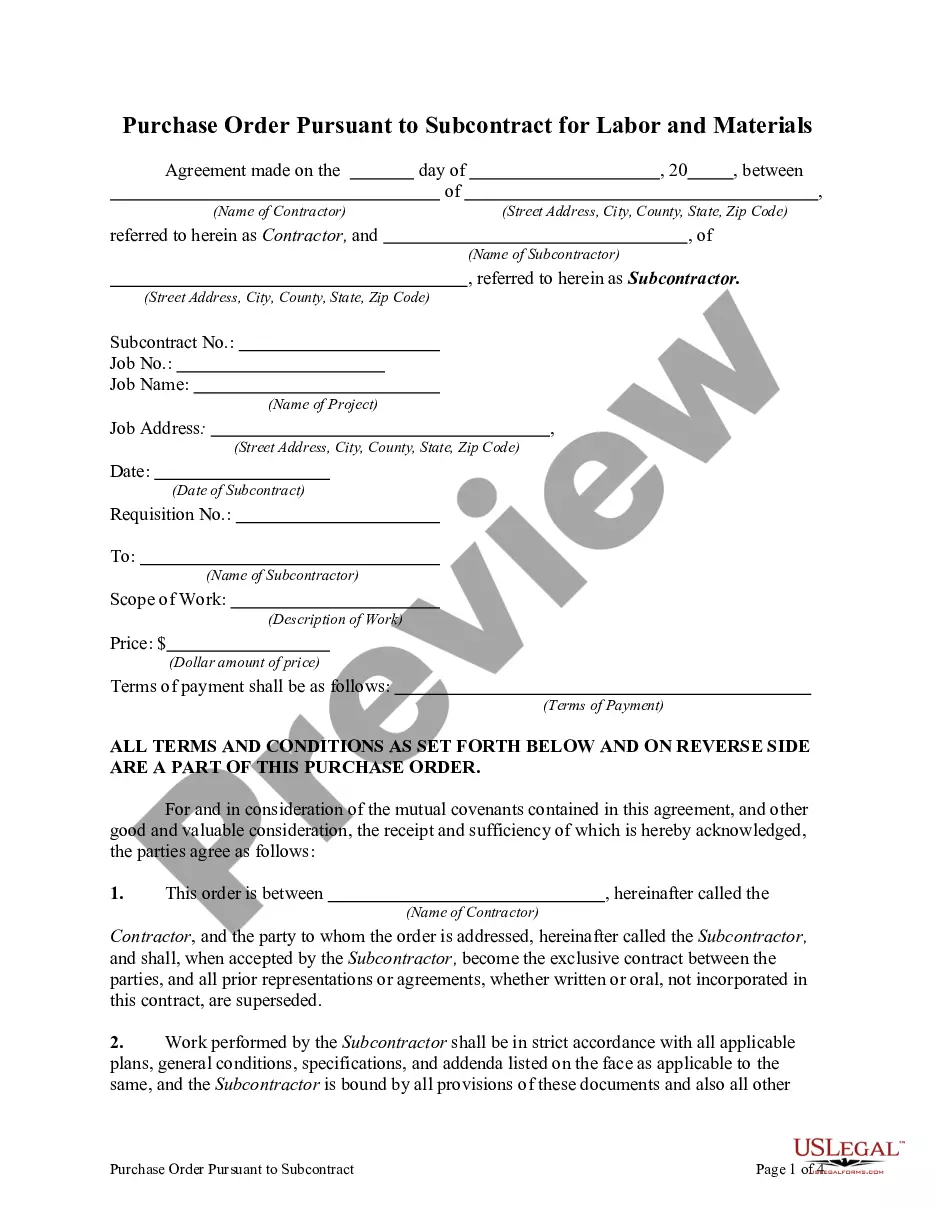

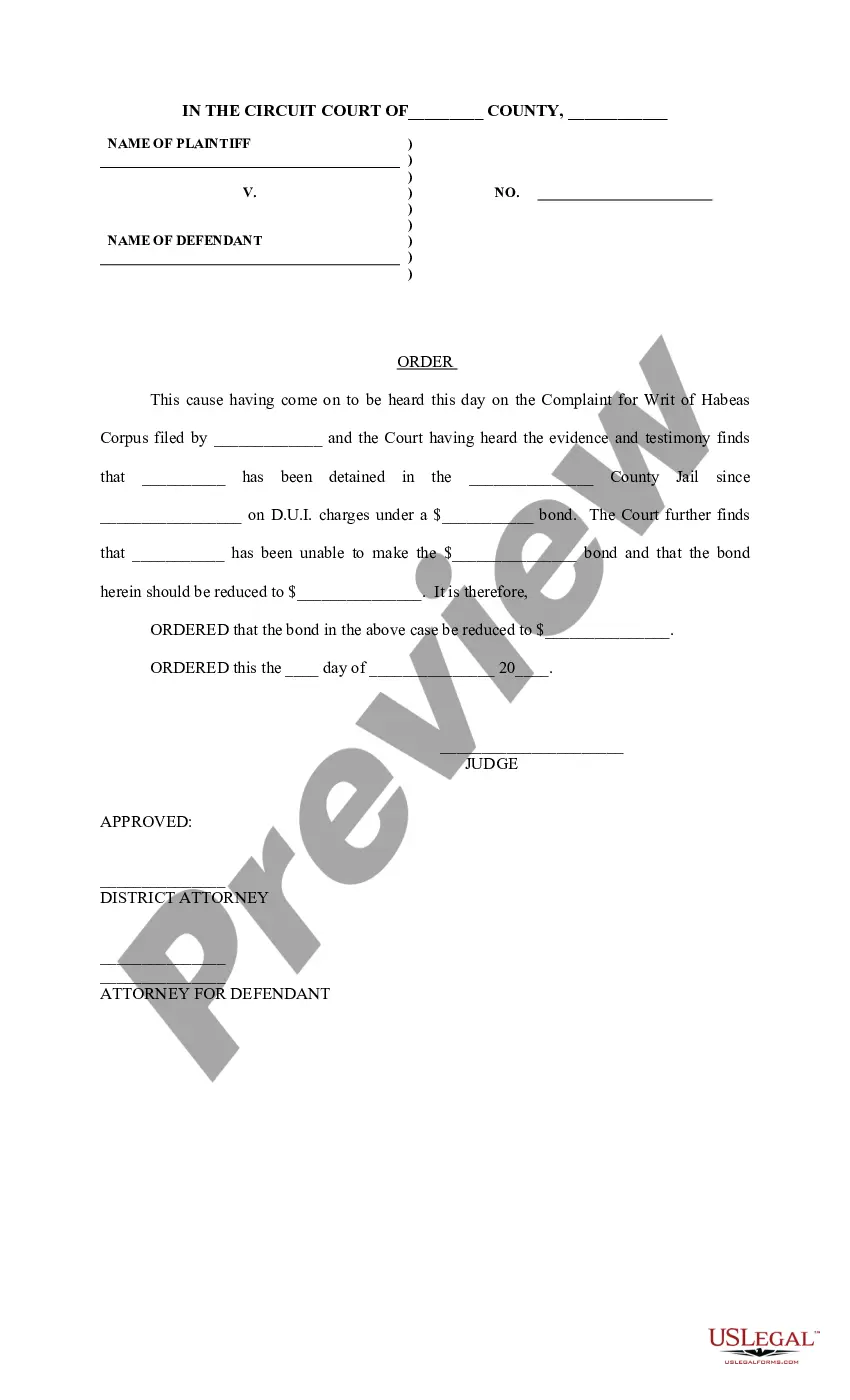

- Be sure you have picked out the right kind to your city/county. Click the Preview switch to check the form`s content. Browse the kind information to ensure that you have chosen the correct kind.

- In the event the kind does not fit your requirements, take advantage of the Research field near the top of the display screen to get the one who does.

- If you are pleased with the shape, affirm your choice by visiting the Purchase now switch. Then, opt for the costs program you like and provide your qualifications to register for the profile.

- Procedure the purchase. Make use of Visa or Mastercard or PayPal profile to complete the purchase.

- Find the file format and obtain the shape on your system.

- Make alterations. Fill up, revise and printing and indication the downloaded South Carolina Form of Anti-Money Laundering Policy.

Each and every design you put into your bank account lacks an expiration date and it is the one you have eternally. So, in order to obtain or printing an additional backup, just proceed to the My Forms portion and click on about the kind you require.

Get access to the South Carolina Form of Anti-Money Laundering Policy with US Legal Forms, one of the most extensive local library of lawful document layouts. Use thousands of professional and condition-certain layouts that meet up with your business or individual needs and requirements.

Form popularity

FAQ

Section 16-17-735. Persons impersonating officials or law enforcement officers; persons falsely asserting authority of law; offenses; punishment. Section 16-17-740. Sale or possession of "cigarette load"; penalty.

Code § 16-1-60, Violent crimes defined, and a non-violent crime is any crime that is not listed in § 16-1-60. To further complicate matters, ?violent crime? does not necessarily mean that you cannot be paroled or must serve 85% of the sentence ? no-parole and 85% crimes are separately defined in SC law.

SECTION 16-1-57. Classification of third or subsequent conviction of certain property crimes. A person convicted of an offense for which the term of imprisonment is contingent upon the value of the property involved must, upon conviction for a third or subsequent offense, be punished as prescribed for a Class E felony.

South Carolina Code § 16-17-720 defines Impersonating a Law Enforcement Officer as a Class C Misdemeanor offense. A conviction of Impersonating a Law Enforcement Officer can result in the following consequences: A fine up to $500.00. Imprisonment for up to 1 year.

SECTION 16-17-500. Sale or purchase of tobacco products to minors; proof of age; location of vending machines; penalties; smoking cessation programs. (A) It is unlawful for an individual to sell, furnish, give, distribute, purchase for, or provide a tobacco product to a minor under the age of eighteen years.

Misrepresenting your identification to a police officer is also covered by SC Code § 16-17-725. Whether the false information was given to the officer 1) during a traffic stop or 2) to evade arrest or avoid criminal charges, it is a misdemeanor that carries up to 30 days in jail or a $200 fine.

An accessory in a felony conviction, is considered a Category C Felony, with punishments of between 1-5 years in state prison, and/or up to $10,000 in fines.