This document is an Investment Advisory Agreement that appoints the investment advisor as attorney-in-fact to the trustee. It details the duties and obligations of the investment advisor and provides indemnity to the advisor. It also spells out the duration and termination of the agreement and the governing law of the agreement.

South Carolina Investment Advisory Agreement

Description

How to fill out Investment Advisory Agreement?

Are you inside a placement where you will need documents for sometimes enterprise or individual functions virtually every day? There are a variety of legitimate papers layouts accessible on the Internet, but finding kinds you can trust isn`t straightforward. US Legal Forms provides 1000s of type layouts, such as the South Carolina Investment Advisory Agreement, which can be published to fulfill state and federal demands.

If you are currently familiar with US Legal Forms web site and have a merchant account, merely log in. Afterward, you can download the South Carolina Investment Advisory Agreement format.

Unless you come with an account and wish to start using US Legal Forms, adopt these measures:

- Get the type you require and ensure it is for the right metropolis/state.

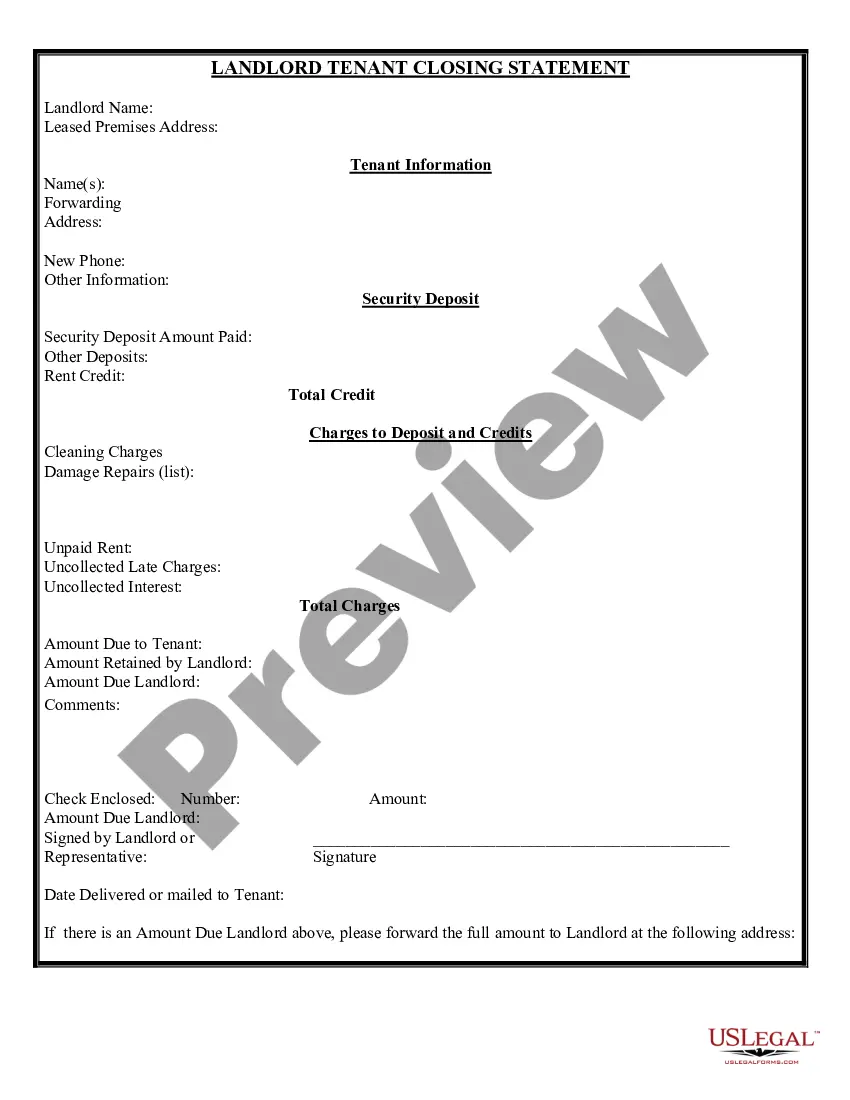

- Use the Preview switch to analyze the shape.

- Look at the description to ensure that you have chosen the proper type.

- In the event the type isn`t what you`re seeking, use the Research discipline to get the type that meets your needs and demands.

- When you discover the right type, click on Acquire now.

- Select the costs prepare you would like, complete the necessary info to make your bank account, and purchase your order with your PayPal or credit card.

- Select a convenient paper format and download your version.

Discover all of the papers layouts you might have bought in the My Forms menu. You can aquire a additional version of South Carolina Investment Advisory Agreement whenever, if needed. Just click on the required type to download or print the papers format.

Use US Legal Forms, probably the most considerable collection of legitimate varieties, in order to save time and avoid errors. The support provides expertly produced legitimate papers layouts which you can use for an array of functions. Create a merchant account on US Legal Forms and commence generating your daily life a little easier.

Form popularity

FAQ

An investment advisor is an individual or a firm that specializes in advising clients on the buying and selling of securities, in exchange for a fee. There are two ways this can happen. First, an investment advisory can offer their services by working directly with their clients to offer investment advice.

An advisory agreement is the main document used to memorialize, in writing, the relationship between the Registered Investment Advisor (?RIA?) and client. Among other things it generally outlines the services to be offered, the fees to be charged, and the overall expectations of the RIA/client relationship.

This agreement spells out the scope and terms of the services your financial advisor will offer, as well as any authority you give them to manage your financial accounts. Knowing what's in the typical agreement can help you better understand what you're signing off on when working with a financial advisor.

Firms that have less than $100 million of assets under continuous and regular management (See Form ADV for calculation instructions of regulatory assets under management) generally must register with the state or states in which they have a place of business and in which they have clients, while firms that have more ...

The Securities and Exchange Commission (the "Commission" or "SEC") regulates investment advisers, primarily under the Investment Advisers Act of 1940 (the "Advisers Act"), and the rules adopted under that statute (the "rules").

While the Advisers Act does not require a written agreement between an advisor and its clients, it contains a handful of requirements regarding the content and parameters of any advisory contract, whether or not it is in written form.

A financial advisor contract, also known as an advisory agreement, specifies that the advisor is legally required to serve their client's needs. This agreement outlines the legal relationship between the advisor and the client.

This section exempts offers and sales of securities (including plan interests and guarantees pursuant to paragraph (d)(2)(ii) of this section) under a written compensatory benefit plan (or written compensation contract) established by the issuer, its parents, its majority-owned subsidiaries or majority-owned ...