This employee stock option plan grants the optionee (the employee) a non-qualified stock option under the company's stock option plan. The option allows the employee to purchase shares of the company's common stock up to the number of shares listed in the agreement.

South Carolina Employee Stock Option Agreement

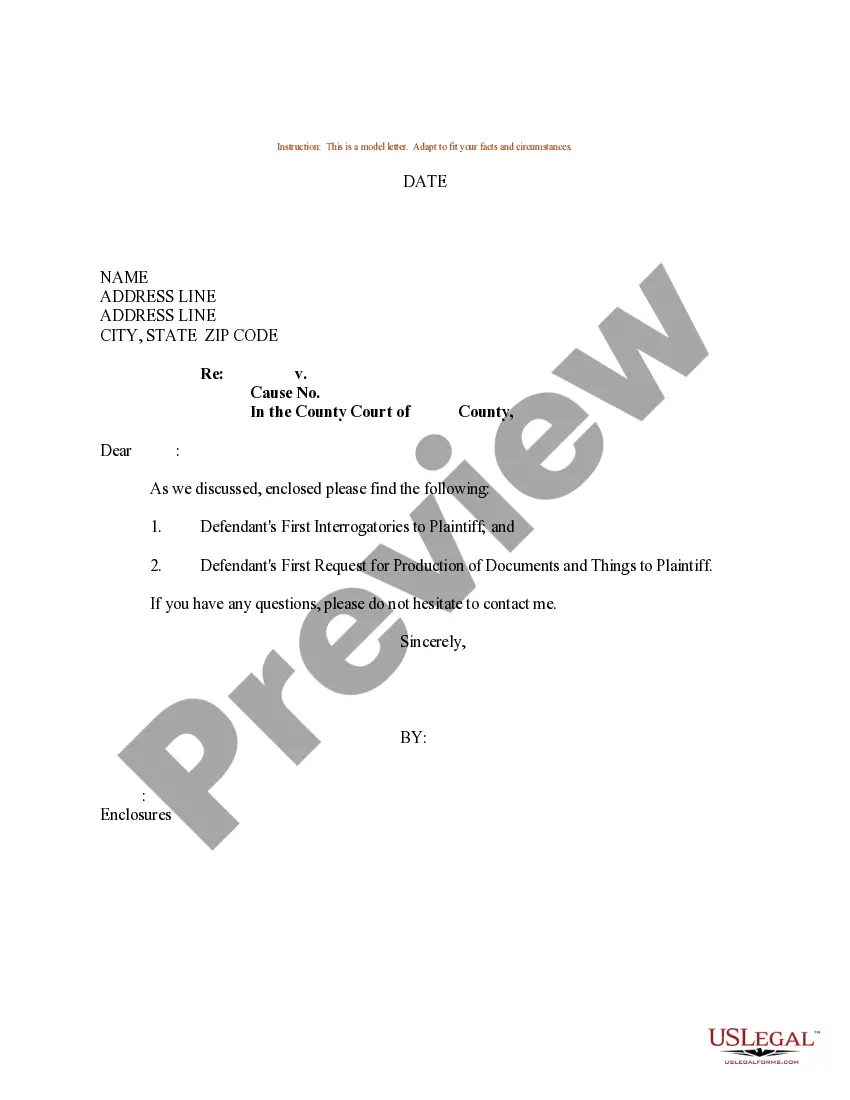

Description

How to fill out Employee Stock Option Agreement?

US Legal Forms - among the most significant libraries of lawful varieties in the United States - delivers an array of lawful papers themes you can obtain or produce. While using website, you may get thousands of varieties for company and personal purposes, categorized by categories, suggests, or search phrases.You can find the latest models of varieties such as the South Carolina Employee Stock Option Agreement within minutes.

If you currently have a membership, log in and obtain South Carolina Employee Stock Option Agreement through the US Legal Forms catalogue. The Obtain option can look on each and every type you look at. You have access to all formerly saved varieties from the My Forms tab of your own profile.

If you want to use US Legal Forms the first time, allow me to share easy directions to help you get started off:

- Make sure you have picked out the correct type for your personal town/county. Go through the Review option to analyze the form`s content. See the type explanation to ensure that you have selected the appropriate type.

- In the event the type doesn`t satisfy your requirements, utilize the Lookup area on top of the screen to find the one that does.

- In case you are content with the shape, verify your decision by clicking the Get now option. Then, select the pricing prepare you like and supply your qualifications to register for the profile.

- Process the financial transaction. Utilize your charge card or PayPal profile to finish the financial transaction.

- Pick the formatting and obtain the shape on your gadget.

- Make adjustments. Fill up, revise and produce and sign the saved South Carolina Employee Stock Option Agreement.

Each format you included with your account lacks an expiry date which is your own property for a long time. So, in order to obtain or produce yet another backup, just check out the My Forms portion and then click in the type you will need.

Get access to the South Carolina Employee Stock Option Agreement with US Legal Forms, one of the most substantial catalogue of lawful papers themes. Use thousands of skilled and express-certain themes that meet your organization or personal requires and requirements.

Form popularity

FAQ

An employee stock purchase plan allows you to buy company stock at a bargain price. Discounts usually range from 5% to 15%. For example, if you work and participate in Hilton's ESPP, you can buy Hilton stock at a 15% discount. If Hilton's stock is trading at $130/share, they'll buy it at $110.50/share for you.

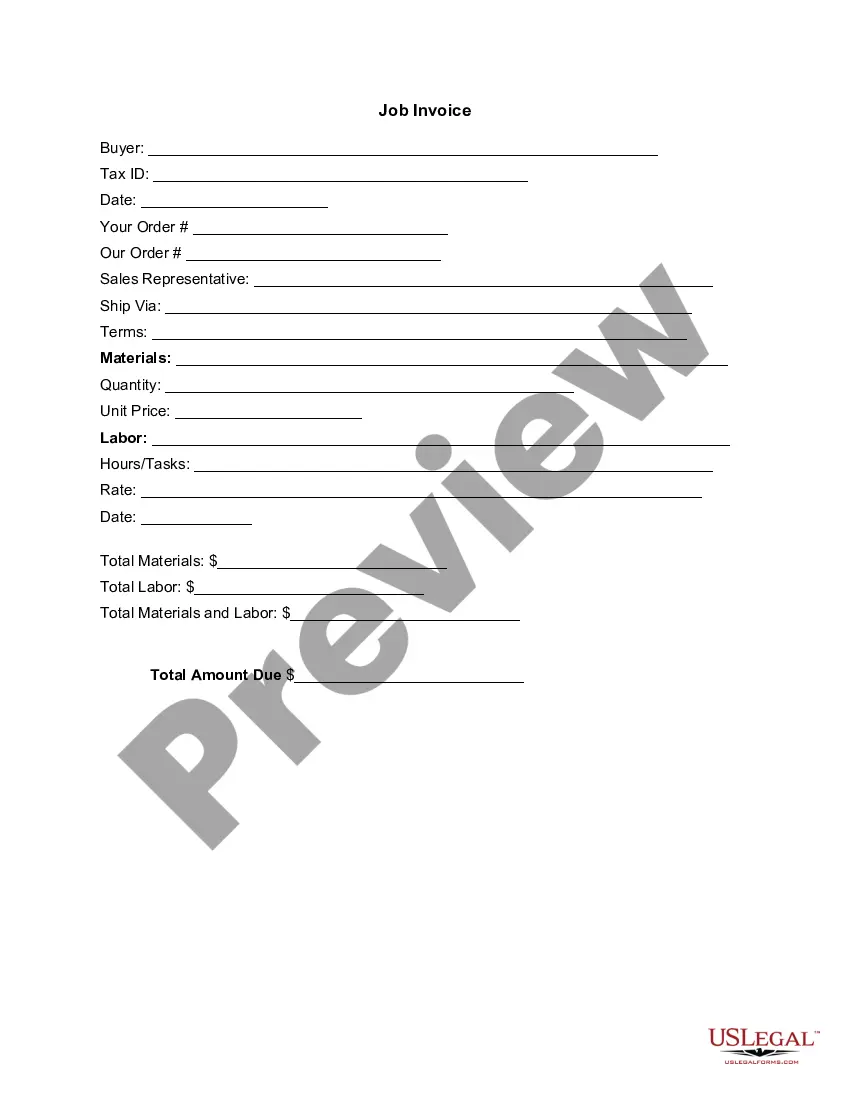

Here's an example of an employee stock options contract. An employee is granted 1,000 stock options, vesting over 5 years. The strike price is $100 per share. Under a phased vesting schedule, 20% of the shares (or 200 options) vest per year.

What is a Stock Option Agreement? A stock option agreement refers to a contract between a company and an employee, independent contractor, or a consultant. Employers use it as a form of employee compensation. Both parties submit to operate within the terms, conditions, and restrictions stipulated in the agreement.

With stock-based compensation, employees in an early-stage business are offered stock options in addition to their salaries. The percentage of a company's shares reserved for stock options will typically vary from 5% to 15% and sometimes go up as high as 20%, depending on the development stage of the company.

What Is an Example of an ESOP? Consider an employee who has worked at a large tech firm for five years. Under the company's ESOP, they have the right to receive 20 shares after the first year, and 100 shares total after five years. When the employee retires, they will receive the share value in cash.

For example, you may be granted the right to buy 1,000 shares, with the options vesting 25% per year over four years with a term of 10 years. So 25% of the ESOs, conferring the right to buy 250 shares would vest in one year from the option grant date, another 25% would vest two years from the grant date, and so on.