South Carolina Irrevocable Power of Attorney for Transfer of Stock by Executor

Description

How to fill out South Carolina Irrevocable Power Of Attorney For Transfer Of Stock By Executor?

If you have to full, acquire, or printing authorized papers layouts, use US Legal Forms, the most important variety of authorized types, which can be found online. Make use of the site`s easy and handy research to find the files you want. Numerous layouts for company and personal functions are sorted by types and says, or keywords and phrases. Use US Legal Forms to find the South Carolina Irrevocable Power of Attorney for Transfer of Stock by Executor in just a handful of click throughs.

If you are previously a US Legal Forms customer, log in for your profile and click the Obtain button to get the South Carolina Irrevocable Power of Attorney for Transfer of Stock by Executor. You may also gain access to types you previously saved from the My Forms tab of the profile.

If you work with US Legal Forms the first time, follow the instructions listed below:

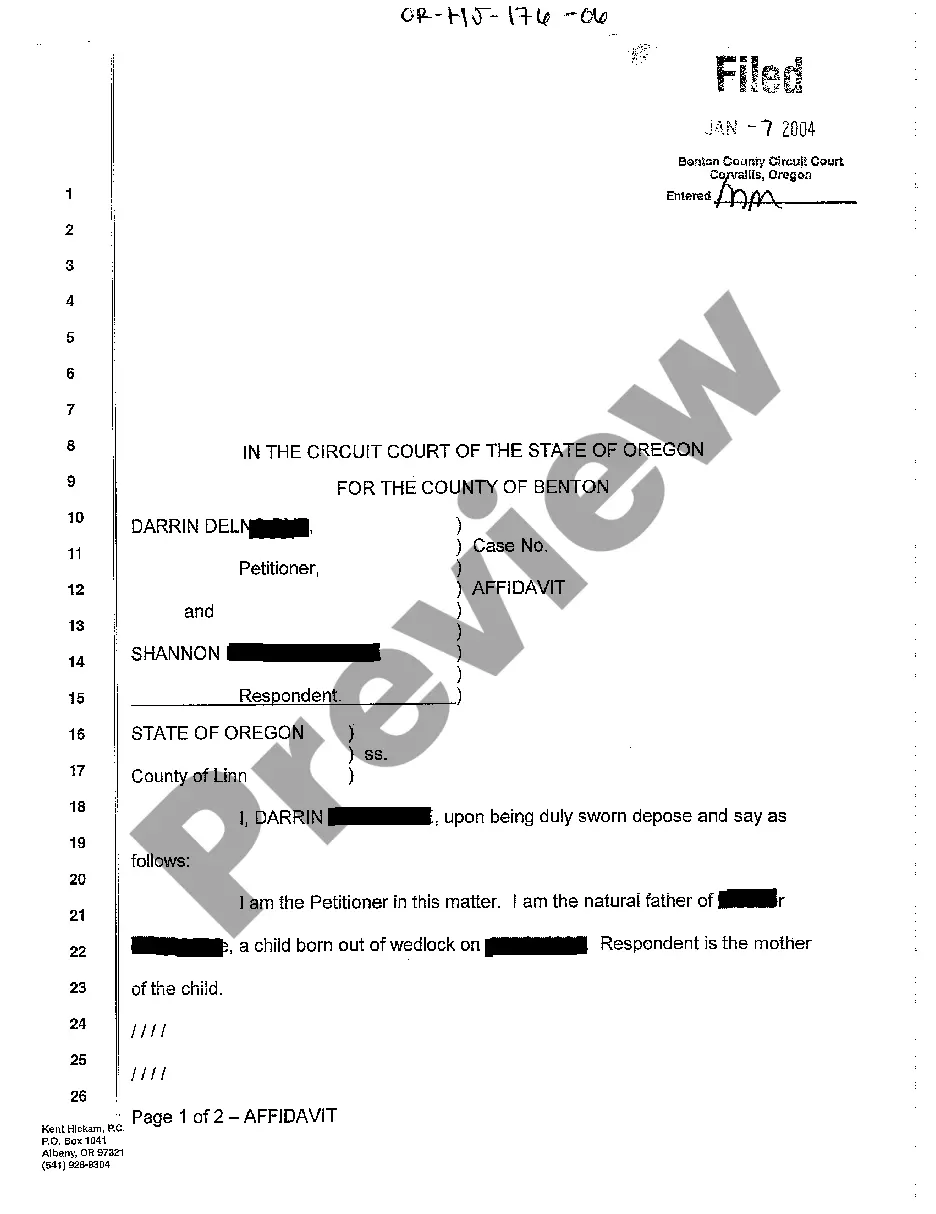

- Step 1. Ensure you have chosen the shape for your proper town/region.

- Step 2. Make use of the Preview solution to check out the form`s articles. Don`t forget to learn the outline.

- Step 3. If you are unhappy with the kind, use the Search discipline near the top of the screen to find other types of the authorized kind web template.

- Step 4. After you have found the shape you want, click the Purchase now button. Choose the rates program you favor and put your credentials to register on an profile.

- Step 5. Procedure the transaction. You can use your credit card or PayPal profile to accomplish the transaction.

- Step 6. Select the formatting of the authorized kind and acquire it on your own device.

- Step 7. Full, modify and printing or indication the South Carolina Irrevocable Power of Attorney for Transfer of Stock by Executor.

Every authorized papers web template you purchase is your own property permanently. You may have acces to every kind you saved within your acccount. Click on the My Forms segment and pick a kind to printing or acquire yet again.

Be competitive and acquire, and printing the South Carolina Irrevocable Power of Attorney for Transfer of Stock by Executor with US Legal Forms. There are millions of skilled and condition-particular types you may use to your company or personal needs.

Form popularity

FAQ

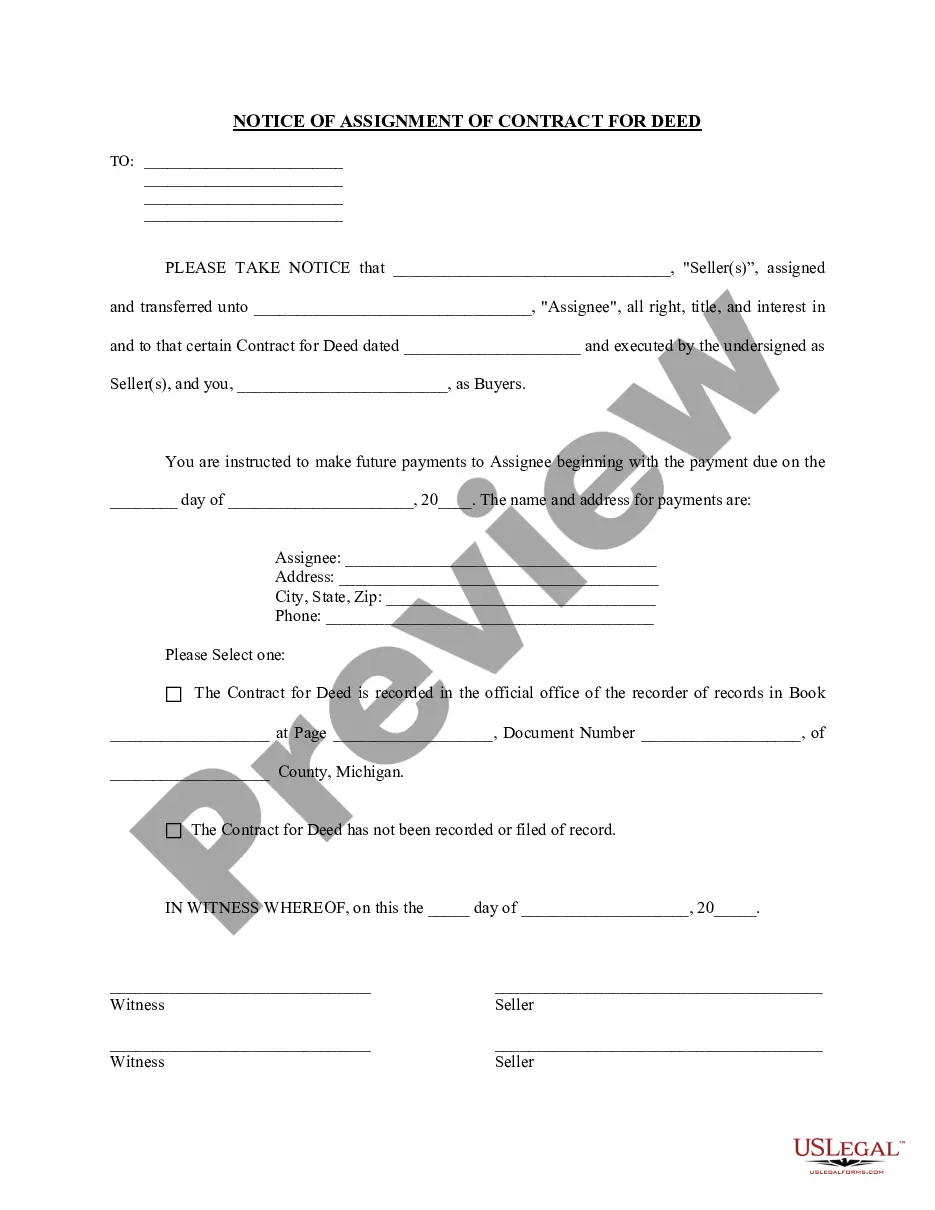

To transfer cash or securities, the trustee will open an account in the trust's name, and the grantor will instruct his or her bank or broker to move the funds from his or her account to the trust's account. For real estate, a deed is used to transfer legal title of the property from the grantor to the trust.

Can an executor appoint another executor? If they are unable to act temporarily, for example, they live abroad; it is possible to give a Power of Attorney to another person to act on their behalf. The executor can delegate the functions he/she has to carry out to the attorney.

Moving Stocks or Bonds to a Trust To put stocks or bonds that you hold into a trust, you typically use a document called a securities assignment (sometimes called a "stock power"). This document asks the securities' transfer agent for permission to transfer the securities to your trust.

South Carolina does not have a statutory POA, but does require that a durable POA clearly state that the agent's authority will not be revoked if the principal becomes disabled of incapacitated. Power of Attorney forms are available on numerous websites, including SC.gov.

The basic laws of agency apply to this relationship. When a principal dies or is sequestrated as a result of insolvency, all powers of attorney executed by him/her lapse. It follows that the agent's power to act in terms of the lapsed power of attorney also ceases on the principal's death or insolvency.

The registration of the document is not compulsory. When it is to be registered it should be presented at the sub-registrar's office with jurisdiction over the immovable property referred to in the document. Notarising a power of attorney is as good as registration .

The specific requirements and restrictions for PoA forms will vary in each state; however, in South Carolina, your Power of Attorney will require notarization and the signatures of two witnesses. If your agent will manage real estate transactions, the Power of Attorney must be notarized and recorded with your county.

South Carolina Requires Powers of Attorney to Be Recorded On January 1, 2017, South Carolina's Uniform Power of Attorney Act went into effect, requiring durable POAs to be recorded in order for the agent to exercise their powers once the principal has become incapacitated.

Attorneys can even make payments to themselves. However, as with all other payments they must be in the best interests of the donor. This can be difficult to determine and may cause a conflict of interests between the interests of an Attorney and the best interests of their donor.

The specific requirements and restrictions for PoA forms will vary in each state; however, in South Carolina, your Power of Attorney will require notarization and the signatures of two witnesses. If your agent will manage real estate transactions, the Power of Attorney must be notarized and recorded with your county.