South Carolina UCC3 Financing Statement Amendment Addendum

Description South Carolina Ucc Forms

How to fill out South Carolina UCC3 Financing Statement Amendment Addendum?

The work with papers isn't the most straightforward task, especially for people who rarely work with legal papers. That's why we advise making use of accurate South Carolina UCC3 Financing Statement Amendment Addendum templates made by skilled attorneys. It gives you the ability to eliminate troubles when in court or working with formal organizations. Find the templates you require on our site for high-quality forms and accurate explanations.

If you’re a user having a US Legal Forms subscription, simply log in your account. When you’re in, the Download button will immediately appear on the template web page. Soon after downloading the sample, it will be stored in the My Forms menu.

Customers without an activated subscription can easily create an account. Make use of this simple step-by-step guide to get your South Carolina UCC3 Financing Statement Amendment Addendum:

- Make sure that file you found is eligible for use in the state it’s required in.

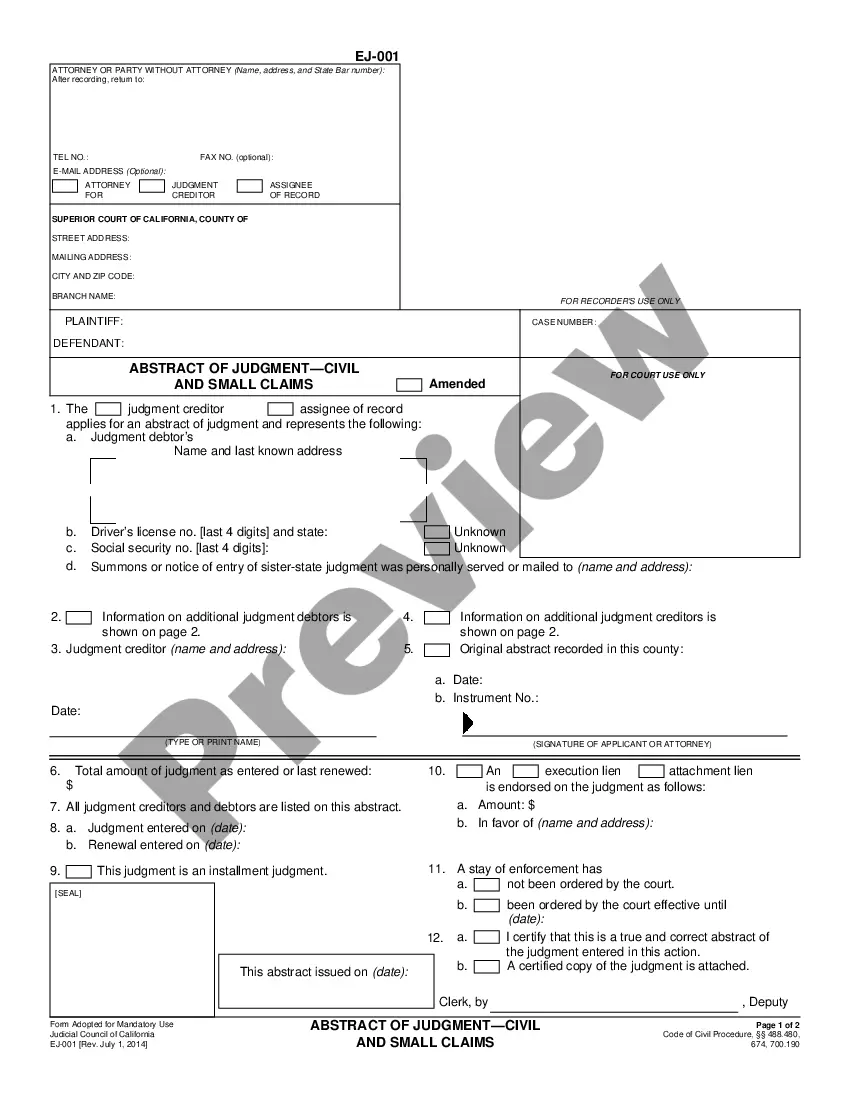

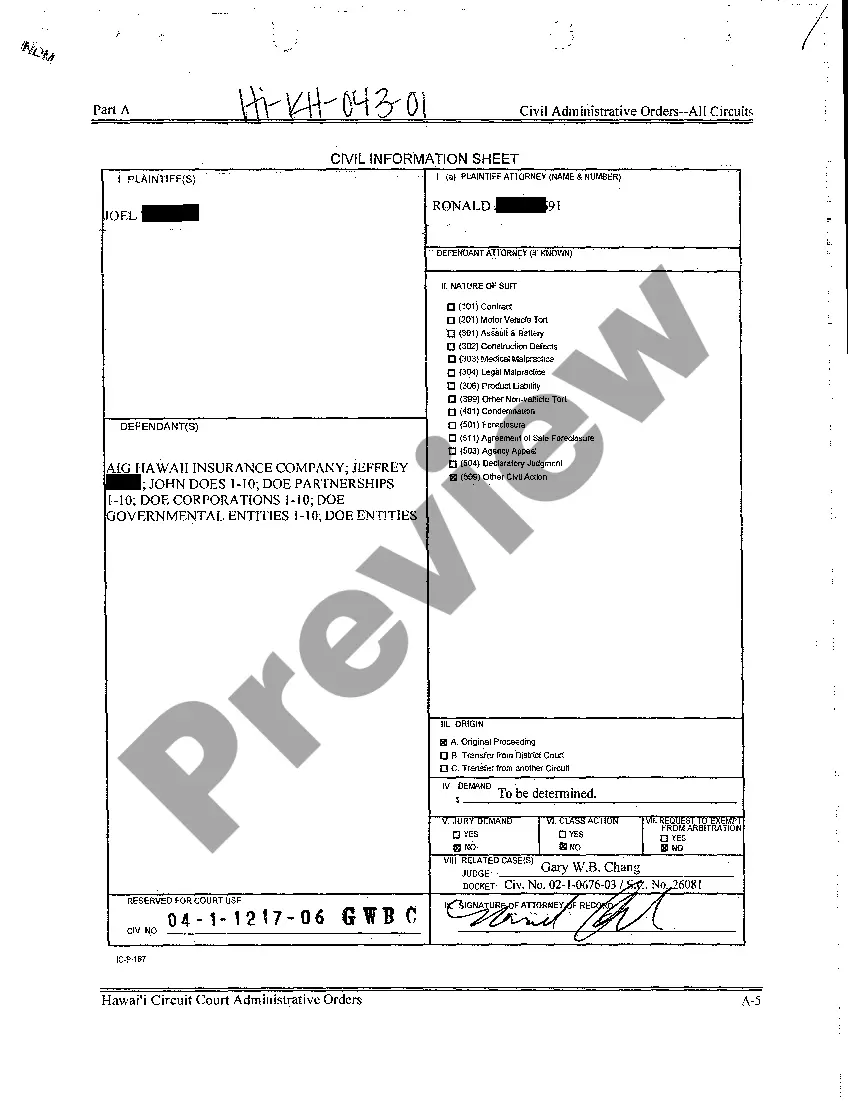

- Confirm the document. Use the Preview feature or read its description (if readily available).

- Click Buy Now if this sample is the thing you need or return to the Search field to get a different one.

- Select a convenient subscription and create your account.

- Make use of your PayPal or credit card to pay for the service.

- Download your document in a wanted format.

Right after doing these straightforward actions, you can fill out the form in an appropriate editor. Double-check completed info and consider requesting a lawyer to examine your South Carolina UCC3 Financing Statement Amendment Addendum for correctness. With US Legal Forms, everything becomes much simpler. Try it out now!

Form popularity

FAQ

Rules vary by State around releasing a UCC lien after a borrower satisfied the debt. Primarily there are two main ways to remove them. One way is by having the lender file a UCC-3 Financing Statement Amendment. Another way to remove a UCC filing is by swearing an oath of full payment at the secretary of state office.

After receiving your request, the lender has 20 days to terminate the UCC filing.

To assign (1) some or all of Assignor's right to amend the identified financing statement, or (2) the Assignor's right to amend the identified financing statement with respect to some (but not all) of the collateral covered by the identified financing statement: Check box in item 3 and enter name of Assignee in item 7a

If you ever find yourself in that frustrating situation the answer is: Yes, you can, providing there is no existing obligation to the lender. This is provided for in Section 9-513 of the Uniform Commercial Code.

A UCC-3 termination statement (a Termination) is a required filing that terminates a security interest that has been perfected by a UCC-1 filing. 1. A Termination for personal property is accomplished by completing and filing form UCC-3 with the Secretary of State's office in the appropriate state.

Also known as a UCC-3, and, depending on the context, a UCC-3 financing statement amendment, a UCC-3 termination statement, and a UCC-3 continuation statement. Under the Uniform Commercial Code, a UCC-3 is used to continue, assign, terminate, or amend an existing UCC-1 financing statement (UCC-1).

A UCC-1 financing statement (an abbreviation for Uniform Commercial Code-1) is a legal form that a creditor files to give notice that it has or may have an interest in the personal property of a debtor (a person who owes a debt to the creditor as typically specified in the agreement creating the debt).

Rules vary by State around releasing a UCC lien after a borrower satisfied the debt. Primarily there are two main ways to remove them. One way is by having the lender file a UCC-3 Financing Statement Amendment. Another way to remove a UCC filing is by swearing an oath of full payment at the secretary of state office.

Enter your information. The type of information you can use to search UCC filings varies among states. Retrieve your results. The website will return results based on the information you entered. Record financial statement numbers.