South Carolina UCC3 Financing Statement Amendment

Description South Carolina Ucc Forms

How to fill out South Carolina UCC3 Financing Statement Amendment?

The work with papers isn't the most simple task, especially for people who almost never deal with legal paperwork. That's why we advise using accurate South Carolina UCC3 Financing Statement Amendment templates made by skilled lawyers. It gives you the ability to stay away from difficulties when in court or dealing with formal institutions. Find the files you want on our site for high-quality forms and correct descriptions.

If you’re a user with a US Legal Forms subscription, just log in your account. Once you are in, the Download button will automatically appear on the file page. Right after downloading the sample, it’ll be stored in the My Forms menu.

Users with no an activated subscription can quickly create an account. Follow this short step-by-step help guide to get your South Carolina UCC3 Financing Statement Amendment:

- Make sure that the form you found is eligible for use in the state it’s required in.

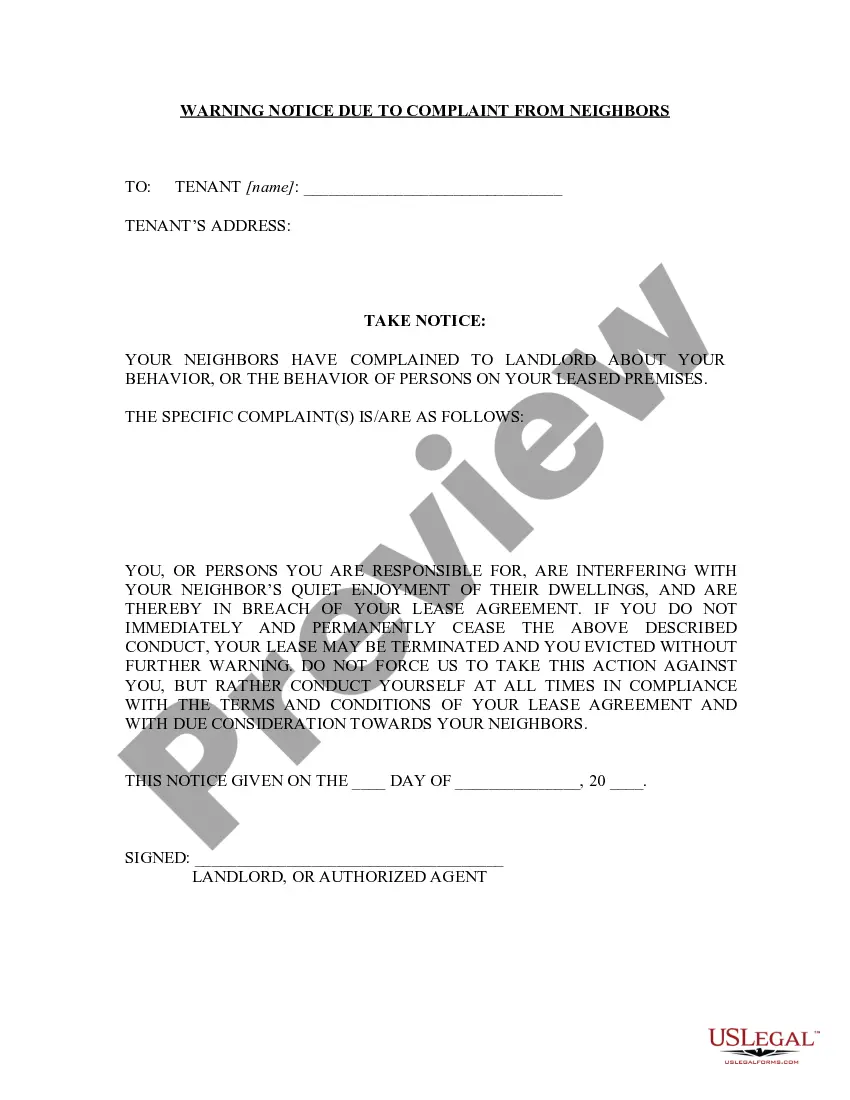

- Verify the document. Utilize the Preview option or read its description (if offered).

- Click Buy Now if this file is the thing you need or use the Search field to get another one.

- Choose a suitable subscription and create your account.

- Utilize your PayPal or credit card to pay for the service.

- Download your document in a wanted format.

Right after completing these straightforward steps, you can complete the sample in a preferred editor. Double-check completed details and consider requesting a lawyer to review your South Carolina UCC3 Financing Statement Amendment for correctness. With US Legal Forms, everything gets easier. Test it now!

Form popularity

FAQ

Also known as a UCC-3, and, depending on the context, a UCC-3 financing statement amendment, a UCC-3 termination statement, and a UCC-3 continuation statement. Under the Uniform Commercial Code, a UCC-3 is used to continue, assign, terminate, or amend an existing UCC-1 financing statement (UCC-1).

A UCC1 financing statement is effective for a period of five years. A record that is not continued before its lapse date will cease to be effective, costing the secured party their perfected status and perhaps their priority position to collect. Once a financing statement has lapsed, it cannot be revived.

To assign (1) some or all of Assignor's right to amend the identified financing statement, or (2) the Assignor's right to amend the identified financing statement with respect to some (but not all) of the collateral covered by the identified financing statement: Check box in item 3 and enter name of Assignee in item 7a

A UCC-1 financing statement (an abbreviation for Uniform Commercial Code-1) is a legal form that a creditor files to give notice that it has or may have an interest in the personal property of a debtor (a person who owes a debt to the creditor as typically specified in the agreement creating the debt).

After receiving your request, the lender has 20 days to terminate the UCC filing.

If you're approved for a small-business loan, a lender might file a UCC financing statement or a UCC-1 filing. This is just a legal form that allows for the lender to announce lien on a secured loan. This allows for the lender to seize, foreclose or even sell the underlying collateral if you fail to repay your loan.

Form UCC3 is used to amend (make changes to) a UCC1 filing.However, it is important to note that for a UCC1 filing a termination is only an amendment and that the UCC1 filing may be amended further, even after a termination has been filed. Box 3 Continuation A UCC1 filing is good for five years.

Rules vary by State around releasing a UCC lien after a borrower satisfied the debt. Primarily there are two main ways to remove them. One way is by having the lender file a UCC-3 Financing Statement Amendment. Another way to remove a UCC filing is by swearing an oath of full payment at the secretary of state office.

Rules vary by State around releasing a UCC lien after a borrower satisfied the debt. Primarily there are two main ways to remove them. One way is by having the lender file a UCC-3 Financing Statement Amendment. Another way to remove a UCC filing is by swearing an oath of full payment at the secretary of state office.