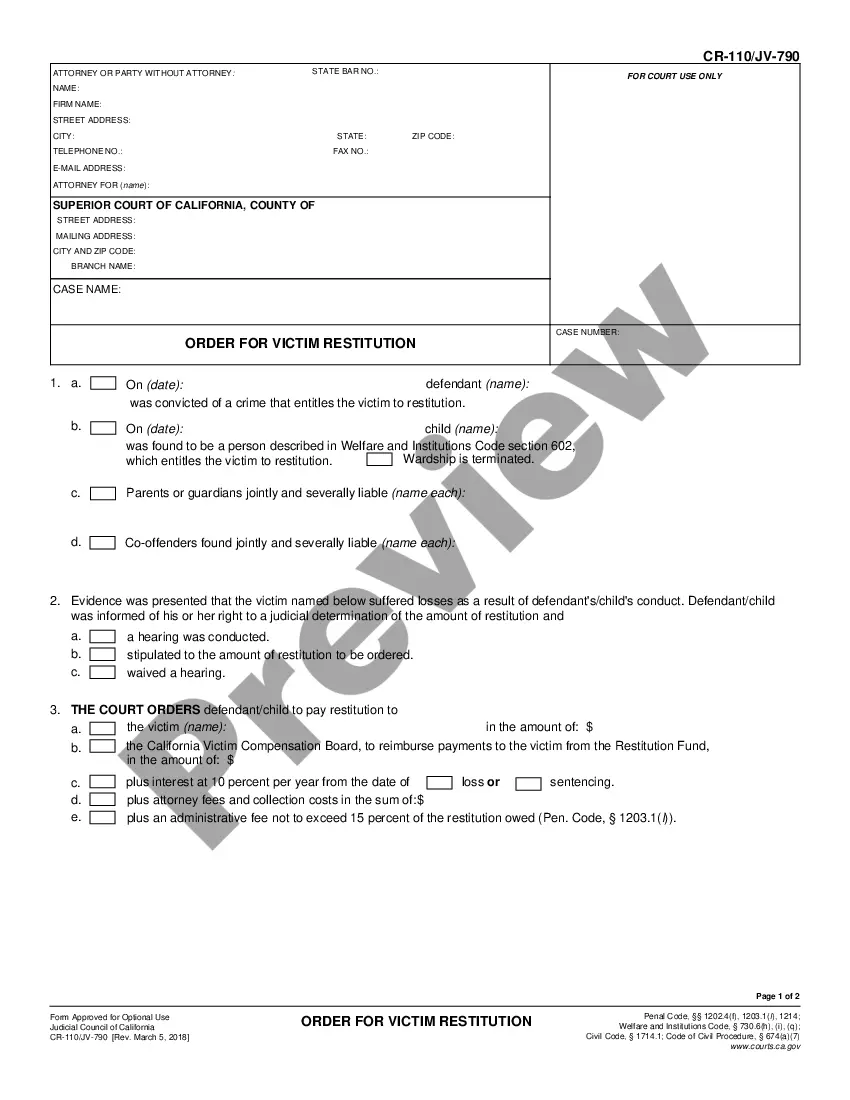

Correction Statement used to report inaccurate or wrongly filed records (as designated in the form) on file with the South Carolina filing office.

South Carolina UCC5 Correction Statement

Description

How to fill out South Carolina UCC5 Correction Statement?

Creating documents isn't the most easy process, especially for those who almost never deal with legal paperwork. That's why we recommend utilizing accurate South Carolina UCC5 Correction Statement templates made by professional lawyers. It gives you the ability to eliminate problems when in court or handling formal organizations. Find the documents you require on our website for top-quality forms and correct information.

If you’re a user having a US Legal Forms subscription, just log in your account. When you’re in, the Download button will automatically appear on the template web page. Soon after downloading the sample, it will be stored in the My Forms menu.

Customers without an active subscription can easily get an account. Follow this brief step-by-step guide to get the South Carolina UCC5 Correction Statement:

- Make certain that the document you found is eligible for use in the state it is necessary in.

- Confirm the file. Make use of the Preview feature or read its description (if readily available).

- Click Buy Now if this file is what you need or utilize the Search field to get a different one.

- Select a convenient subscription and create your account.

- Use your PayPal or credit card to pay for the service.

- Download your file in a required format.

After finishing these easy steps, you are able to complete the sample in your favorite editor. Double-check filled in data and consider requesting an attorney to examine your South Carolina UCC5 Correction Statement for correctness. With US Legal Forms, everything becomes much simpler. Try it out now!

Form popularity

FAQ

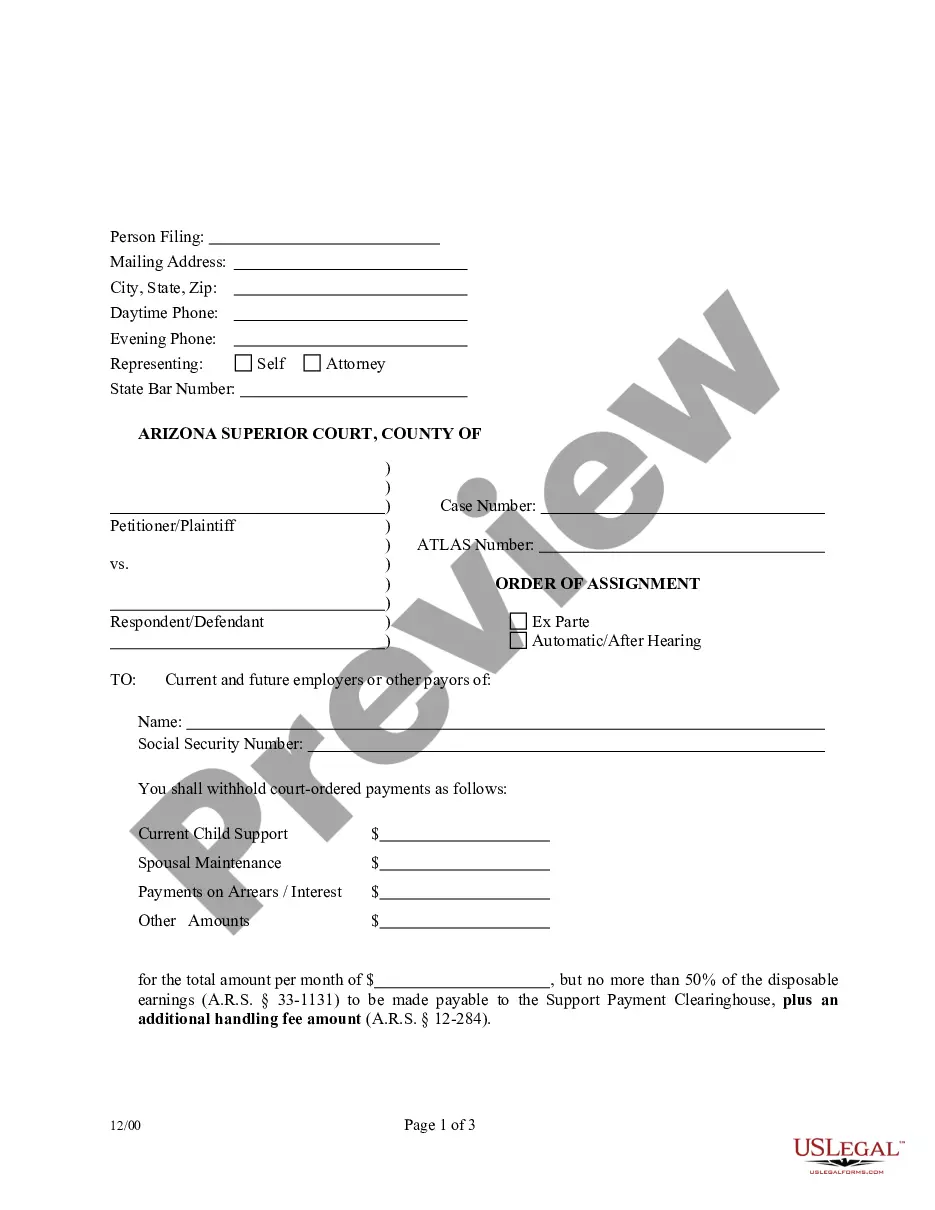

Enter your information. The type of information you can use to search UCC filings varies among states. Retrieve your results. The website will return results based on the information you entered. Record financial statement numbers.

UCC5 Information Statement Form A UCC5, filed by either the debtor or secured party, is solely intended to 'inform' third parties searching the UCC public records of the following: 'RECORD IS INACCURATE' 'RECORD WAS WRONGFULLY FILED' 'RECORD FILED BY PERSON NOT ENTITLED TO DO SO'

UCC liens filed with Secretary of State offices act as a public notice by the "creditor" of the creditor's interest in the property.

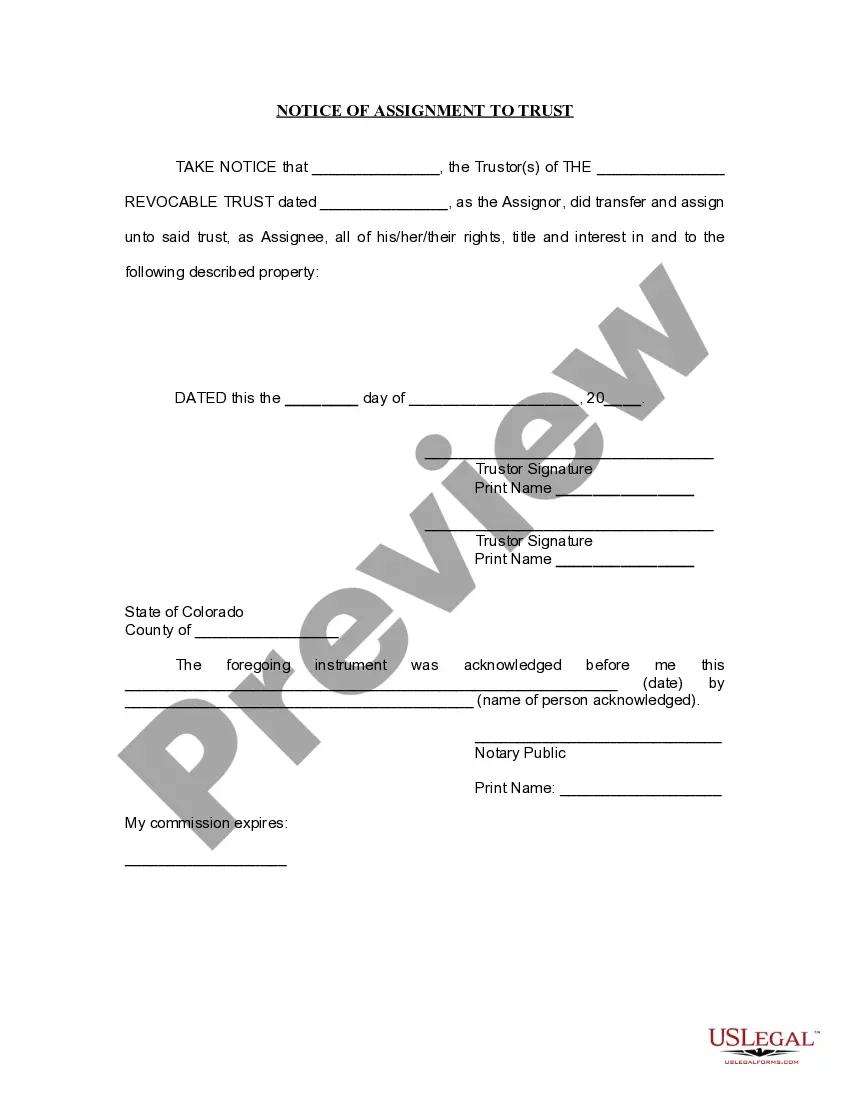

Uniform Commercial Code (UCC) filings allow creditors to notify other creditors about a debtor's assets used as collateral for a secured transaction. UCC liens filed with Secretary of State offices act as a public notice by the "creditor" of the creditor's interest in the property.

You can always check the status of UCC filings against your business through your business credit report or searching UCC lien public records.

In all cases, you should file a UCC-1 with the secretary of state's office in the state where the debtor is incorporated or organized (if a business), or lives (if an individual).

After receiving your request, the lender has 20 days to terminate the UCC filing.

In all cases, you should file a UCC-1 with the secretary of state's office in the state where the debtor is incorporated or organized (if a business), or lives (if an individual).

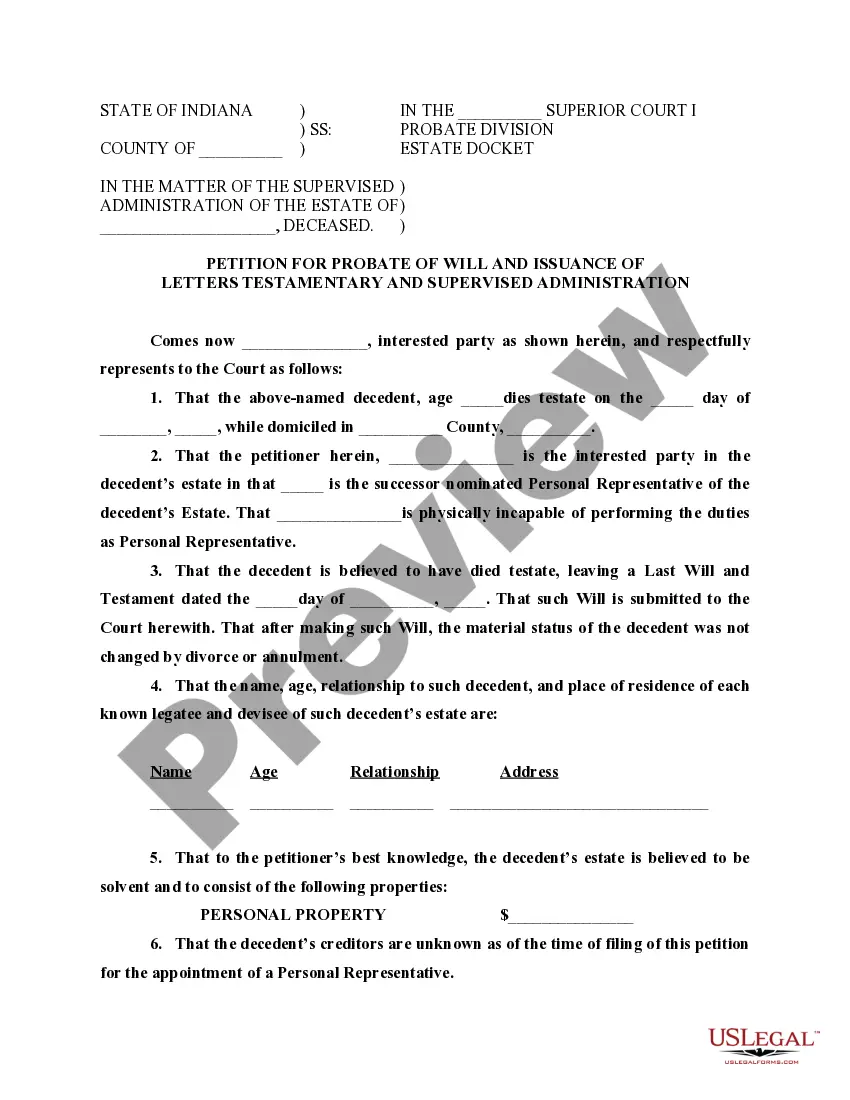

Filer Information. Name and phone number of contact at filer. Email contact at filer. Debtor Information. Organization or individual's name. Mailing address. Secured Party Information. Organization or individual's name. Mailing address. Collateral Information. Description of collateral.