South Carolina Last Will and Testament with All Property to Trust called a Pour Over Will

Description Intestacy Devised Stores

How to fill out Emancipated Devised Eighteen?

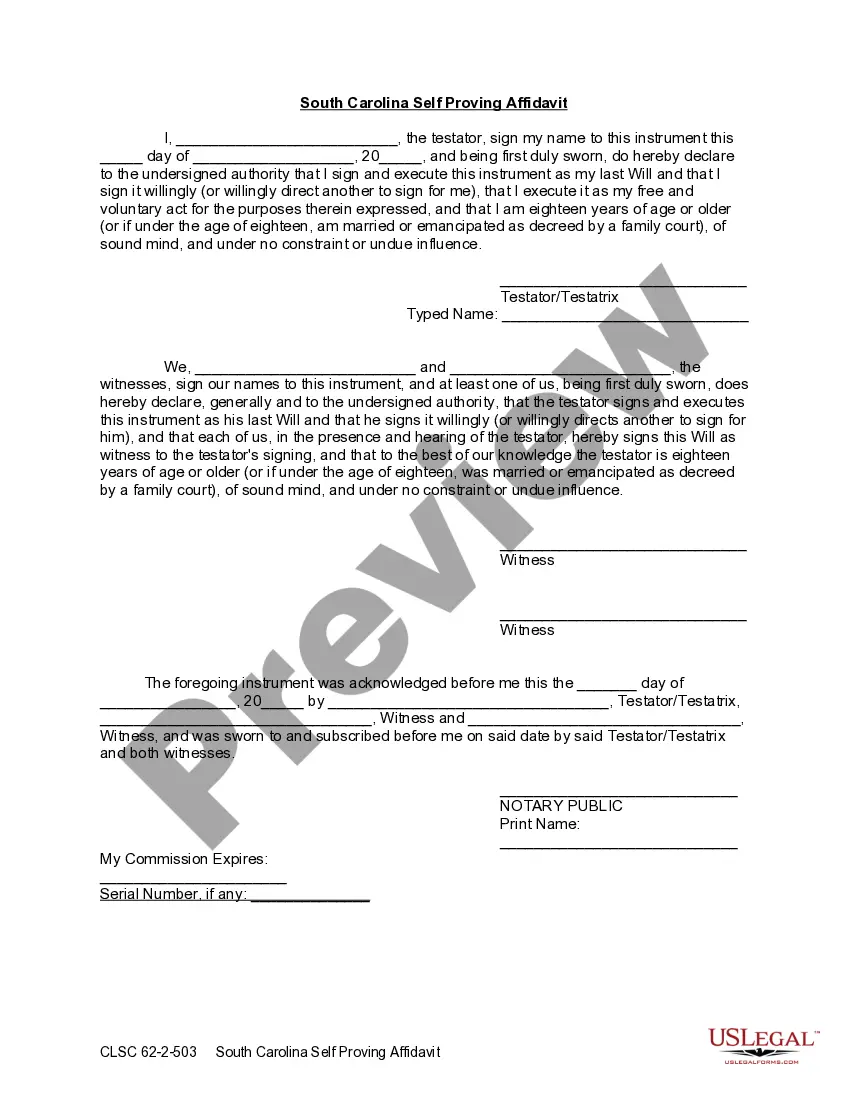

Creating papers isn't the most easy job, especially for those who almost never deal with legal papers. That's why we advise utilizing correct South Carolina Legal Last Will and Testament Form with All Property to Trust called a Pour Over Will templates created by professional attorneys. It gives you the ability to stay away from troubles when in court or handling formal institutions. Find the files you need on our site for high-quality forms and exact explanations.

If you’re a user having a US Legal Forms subscription, simply log in your account. As soon as you are in, the Download button will automatically appear on the template page. Right after downloading the sample, it’ll be saved in the My Forms menu.

Customers without an activated subscription can quickly create an account. Look at this simple step-by-step help guide to get the South Carolina Legal Last Will and Testament Form with All Property to Trust called a Pour Over Will:

- Make certain that the form you found is eligible for use in the state it is required in.

- Confirm the file. Use the Preview feature or read its description (if available).

- Click Buy Now if this file is the thing you need or utilize the Search field to get another one.

- Choose a suitable subscription and create your account.

- Use your PayPal or credit card to pay for the service.

- Download your file in a preferred format.

After finishing these easy steps, you can complete the sample in an appropriate editor. Recheck completed details and consider asking a legal representative to review your South Carolina Legal Last Will and Testament Form with All Property to Trust called a Pour Over Will for correctness. With US Legal Forms, everything becomes much easier. Test it now!

Assures Emancipated Merely Form popularity

Intestacy Totally Too Other Form Names

Sc Will Property FAQ

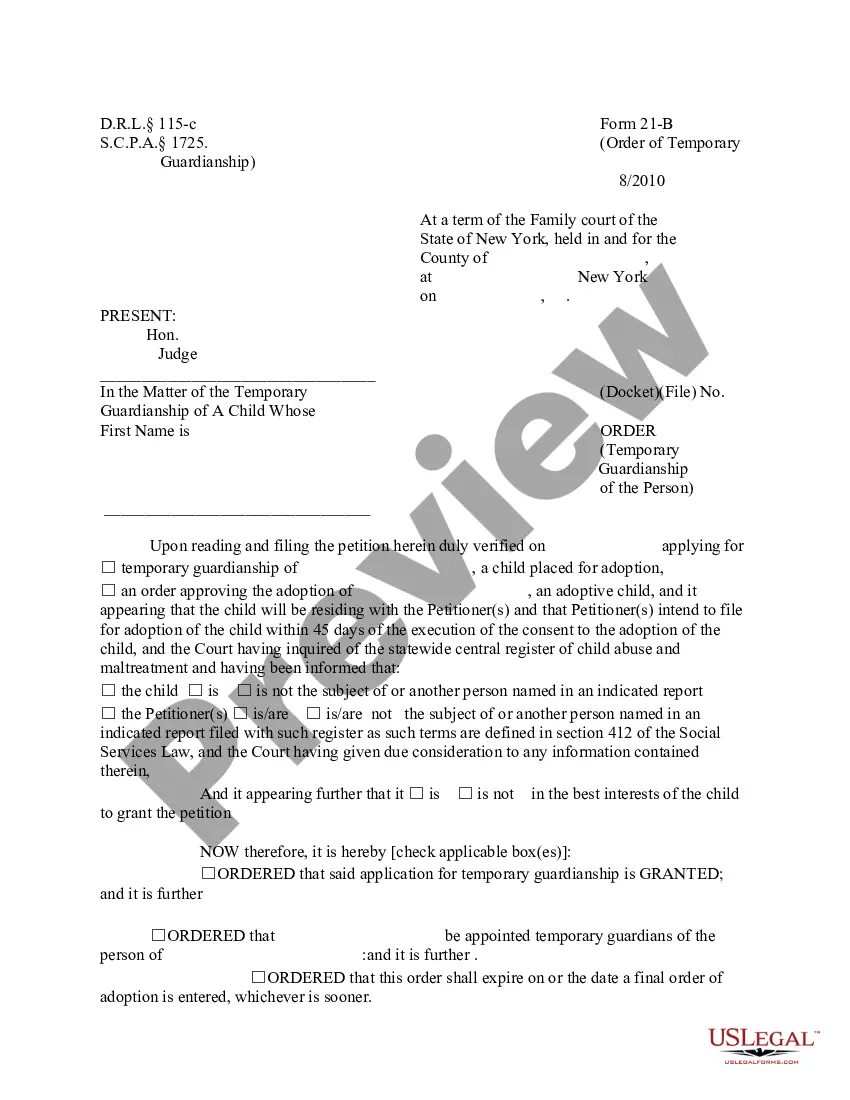

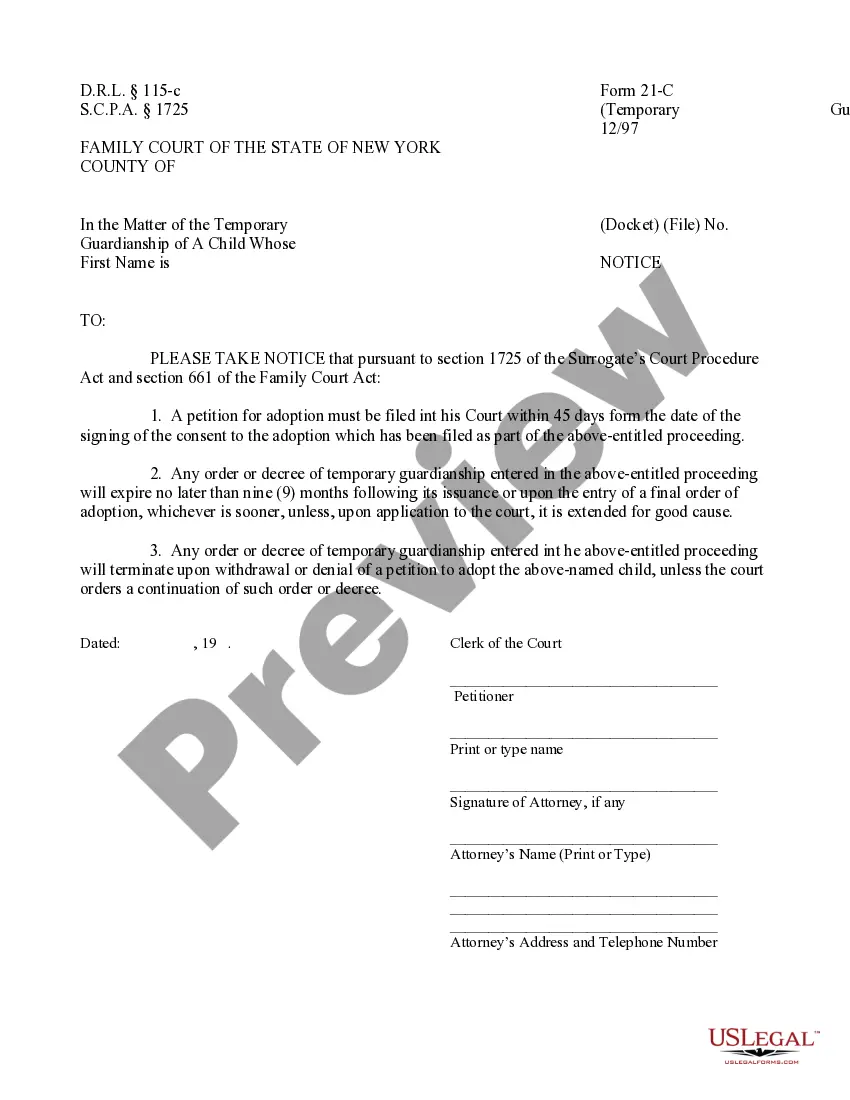

A will and a trust are separate legal documents that usually have a common goal of coordinating a comprehensive estate plan.Since revocable trusts become operative before the will takes effect at death, the trust takes precedence over the will, in the event that there are issues between the two.

A pour-over will is a just-in-case will that states that your living trust is the beneficiary for any property in your name that's not in the trust at the time of your death, thereby moving any forgotten or remaining assets into the trust.One of the main reasons to create a living trust is to avoid probate.

Spillover Trusts definition: Spillover trusts are established to hold any remaining assets after all other instructions from the will are carried out.

After reading about the benefits of a revocable living trust, you may wonder, Why do I need a pour-over will if I have a living trust? A pour-over will is necessary in the event that you do not fully or properly fund your trust.Your trust agreement can only control the assets that the trust owns.

Pour-over wills are subject to probate since the assets have not yet been transferred into the trust. Some states also require your assets to go through the probate process any time your assets or property are over a certain value.Even though pour-over wills don't avoid probate, there is still a measure of privacy.

After reading about the benefits of a revocable living trust, you may wonder, Why do I need a pour-over will if I have a living trust? A pour-over will is necessary in the event that you do not fully or properly fund your trust.Your trust agreement can only control the assets that the trust owns.

A pour-over will is a testamentary device wherein the writer of a will creates a trust, and decrees in the will that the property in his or her estate at the time of his or her death shall be distributed to the Trustee of the trust.

When people make revocable living trusts to avoid probate, it's common for them to also make what's called a "pour-over will." The will directs that if any property passes through the will at the person's death, it should be transferred to (poured into) the trust, and then distributed to the beneficiaries of the trust.

Important: Although a revocable trust supersedes a will, the trust only controls those assets that have been placed into it. Therefore, if a revocable trust is formed, but assets are not moved into it, the trust provisions have no effect on those assets, at the time of the grantor's death.