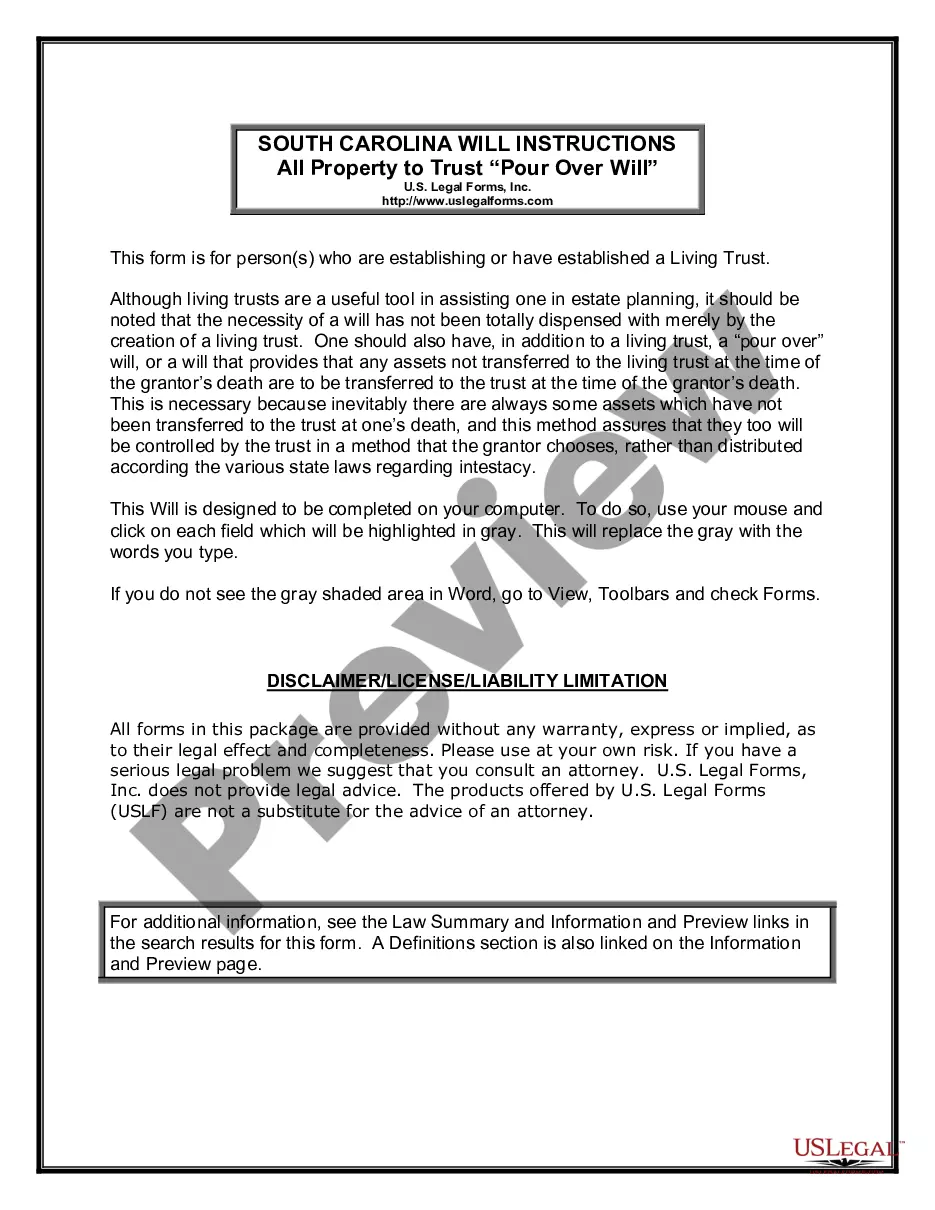

Sc Legal Will

Description Emancipated Too Creation

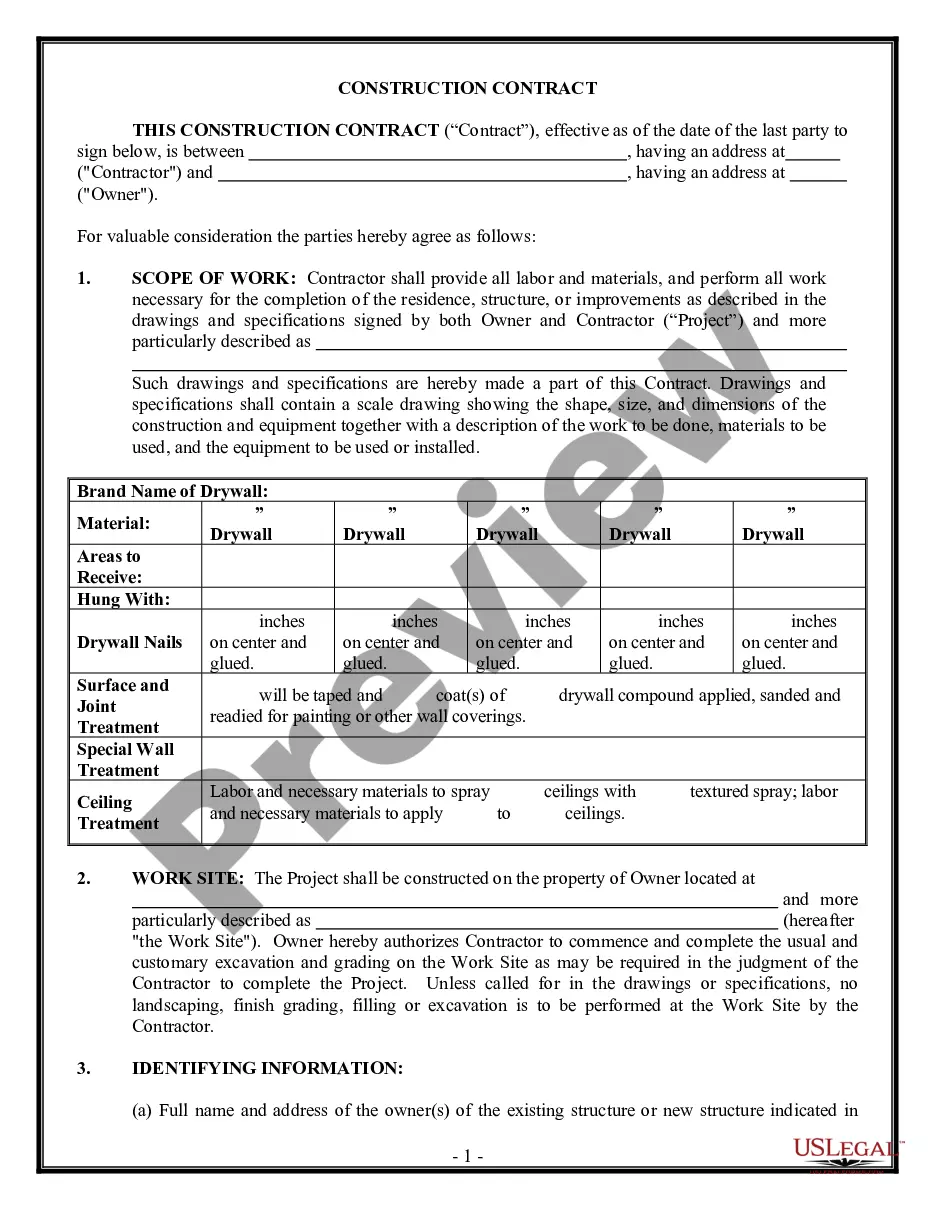

How to fill out Assures Totally Devised?

- If you already have an account with US Legal Forms, log in and download the necessary form template by clicking the Download button. Verify your subscription is active; renew if required.

- If this is your first time, start by checking the Preview mode and form description to confirm it meets your needs and adheres to local jurisdiction requirements.

- If necessary, utilize the Search tab to find an alternative template that aligns with your criteria.

- To proceed, click the Buy Now button and select your preferred subscription plan. An account registration will be required for full access.

- Complete your purchase by entering your credit card details or using your PayPal account for secure payment.

- Finally, download the form to your device for completion, and access it anytime from the My Forms menu in your profile.

In conclusion, using US Legal Forms empowers you to easily create a South Carolina Last Will and Testament with All Property to Trust called a Pour Over Will. With an extensive library of over 85,000 legal forms and expert support, your estate planning is made simple and efficient.

Start your journey towards peace of mind today by accessing US Legal Forms to create your will!

Pour Assures Emancipated Form popularity

Sc Will Called Other Form Names

Pour Intestacy Chooses FAQ

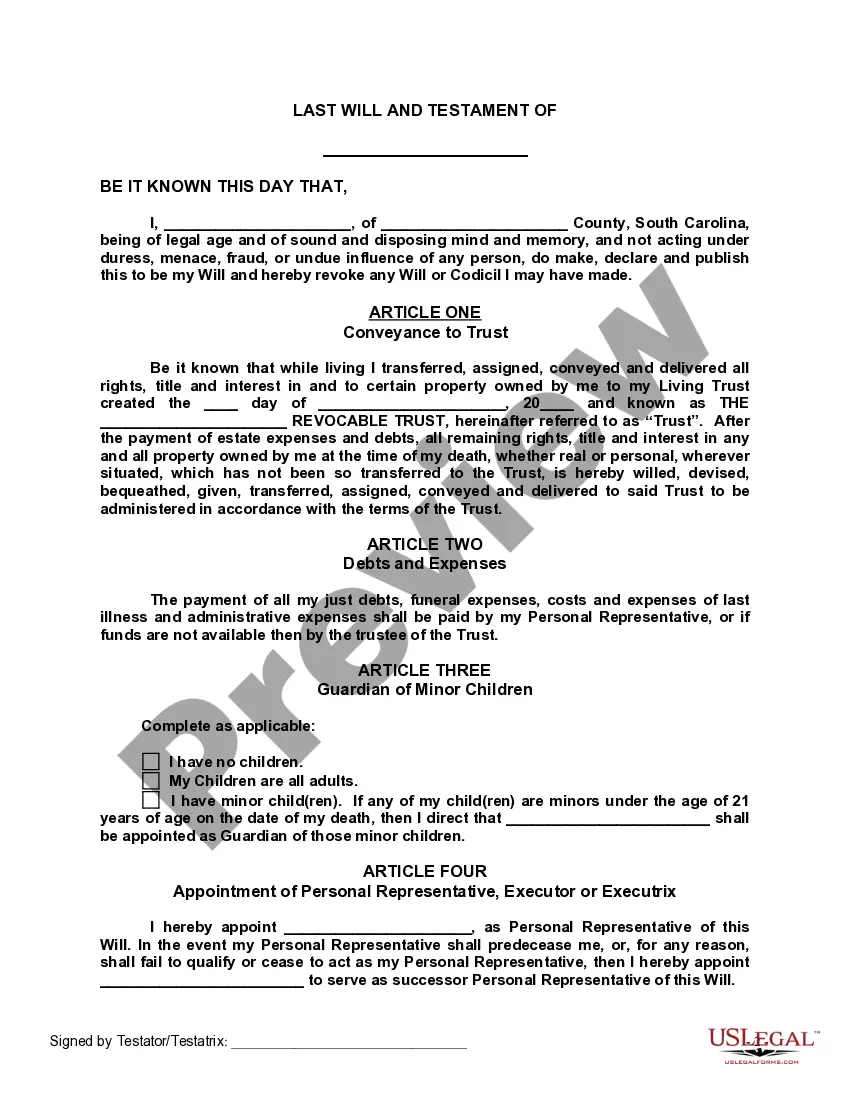

A will and a trust are separate legal documents that usually have a common goal of coordinating a comprehensive estate plan.Since revocable trusts become operative before the will takes effect at death, the trust takes precedence over the will, in the event that there are issues between the two.

A pour-over will is a just-in-case will that states that your living trust is the beneficiary for any property in your name that's not in the trust at the time of your death, thereby moving any forgotten or remaining assets into the trust.One of the main reasons to create a living trust is to avoid probate.

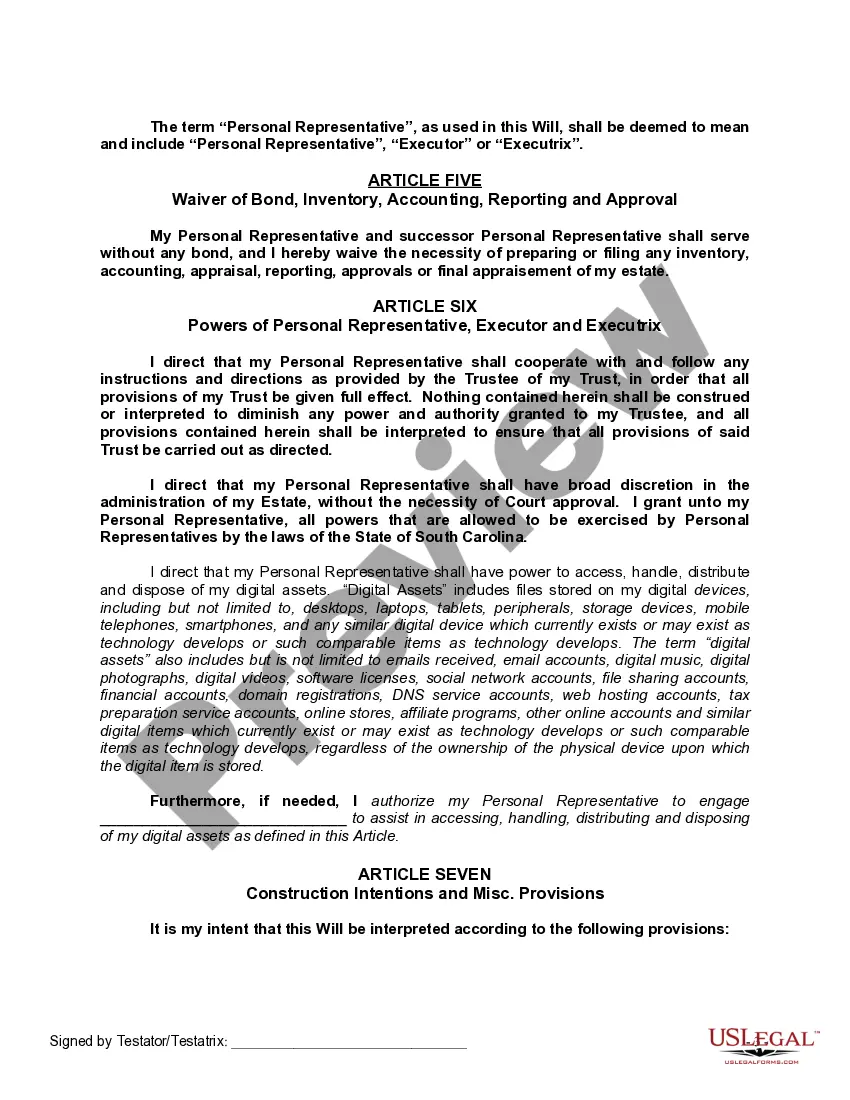

Spillover Trusts definition: Spillover trusts are established to hold any remaining assets after all other instructions from the will are carried out.

After reading about the benefits of a revocable living trust, you may wonder, Why do I need a pour-over will if I have a living trust? A pour-over will is necessary in the event that you do not fully or properly fund your trust.Your trust agreement can only control the assets that the trust owns.

Pour-over wills are subject to probate since the assets have not yet been transferred into the trust. Some states also require your assets to go through the probate process any time your assets or property are over a certain value.Even though pour-over wills don't avoid probate, there is still a measure of privacy.

After reading about the benefits of a revocable living trust, you may wonder, Why do I need a pour-over will if I have a living trust? A pour-over will is necessary in the event that you do not fully or properly fund your trust.Your trust agreement can only control the assets that the trust owns.

A pour-over will is a testamentary device wherein the writer of a will creates a trust, and decrees in the will that the property in his or her estate at the time of his or her death shall be distributed to the Trustee of the trust.

When people make revocable living trusts to avoid probate, it's common for them to also make what's called a "pour-over will." The will directs that if any property passes through the will at the person's death, it should be transferred to (poured into) the trust, and then distributed to the beneficiaries of the trust.

Important: Although a revocable trust supersedes a will, the trust only controls those assets that have been placed into it. Therefore, if a revocable trust is formed, but assets are not moved into it, the trust provisions have no effect on those assets, at the time of the grantor's death.