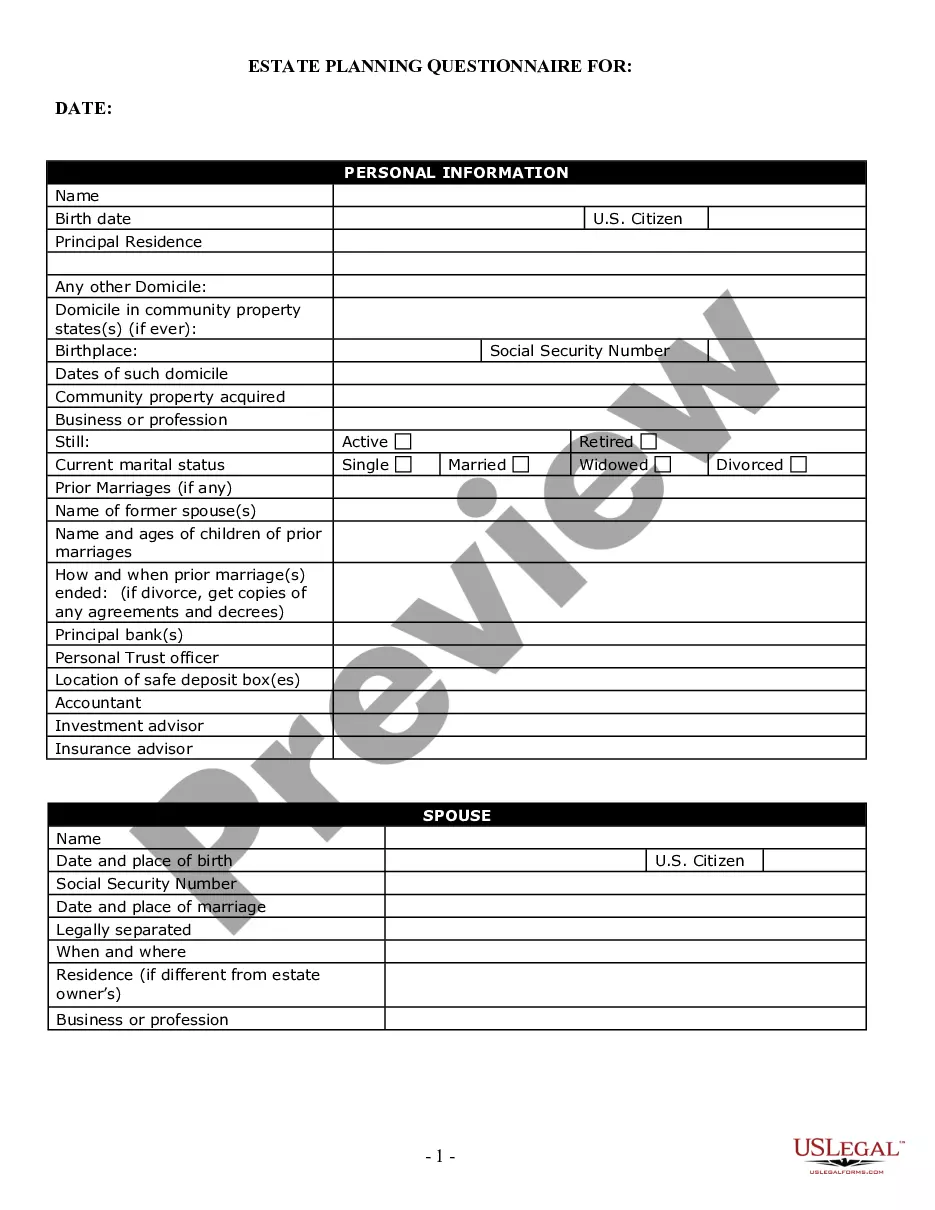

South Carolina Estate Planning Questionnaire and Worksheets

Description

How to fill out South Carolina Estate Planning Questionnaire And Worksheets?

The work with documents isn't the most simple process, especially for people who almost never work with legal paperwork. That's why we advise making use of accurate South Carolina Estate Planning Questionnaire and Worksheets samples created by skilled attorneys. It gives you the ability to prevent problems when in court or handling official institutions. Find the samples you need on our site for top-quality forms and accurate descriptions.

If you’re a user with a US Legal Forms subscription, just log in your account. As soon as you’re in, the Download button will immediately appear on the template webpage. After downloading the sample, it will be stored in the My Forms menu.

Users without an activated subscription can quickly get an account. Use this brief step-by-step help guide to get your South Carolina Estate Planning Questionnaire and Worksheets:

- Ensure that the form you found is eligible for use in the state it is needed in.

- Confirm the document. Make use of the Preview option or read its description (if readily available).

- Click Buy Now if this file is the thing you need or utilize the Search field to find a different one.

- Choose a convenient subscription and create your account.

- Utilize your PayPal or credit card to pay for the service.

- Download your file in a required format.

Right after completing these easy steps, you are able to fill out the sample in an appropriate editor. Check the completed data and consider requesting a lawyer to examine your South Carolina Estate Planning Questionnaire and Worksheets for correctness. With US Legal Forms, everything becomes much simpler. Test it now!

Form popularity

FAQ

Step 1: Create a checklist of important documents (and their locations) Step 2: List the names and contact information of key associates. Step 3: Catalog your digital asset inventory. Step 4: Ensure all documents are organized and accessible.

A Last Will and Testament. When it comes to estate planning, having a last will and testament is likely the first thing that will come to mind. A Document Granting Power of Attorney. An Advance Medical Directive. Revocable Living Trust.

Fill out your attorney's intake questionnaire. Gather your financial documents. Bring copies of your current estate plan documents. Divorce agreements, premarital agreements, and other relevant contracts. Choose your executors and health care agents.

More Than a Last Will. Itemize Your Inventory. Follow with Non-Physical Assets. Assemble a List of Debts. Make a Memberships List. Make Copies of Your Lists. Review Your Retirement Account. Update Your Insurance.

Bank accounts. Brokerage or investment accounts. Retirement accounts and pension plans. A life insurance policy.

Creating an estate plan is a lot like getting into better shape. Step 1: Sign a will. Step 2: Name beneficiaries. Step 3: Dodge estate taxes. Step 4: Leave a letter. Step 5: Draw up a durable power of attorney. Step 6: Create an advance health care directive.

There are four main elements of an estate plan; these include a will, a living will and healthcare power of attorney, a financial power of attorney, and a trust.