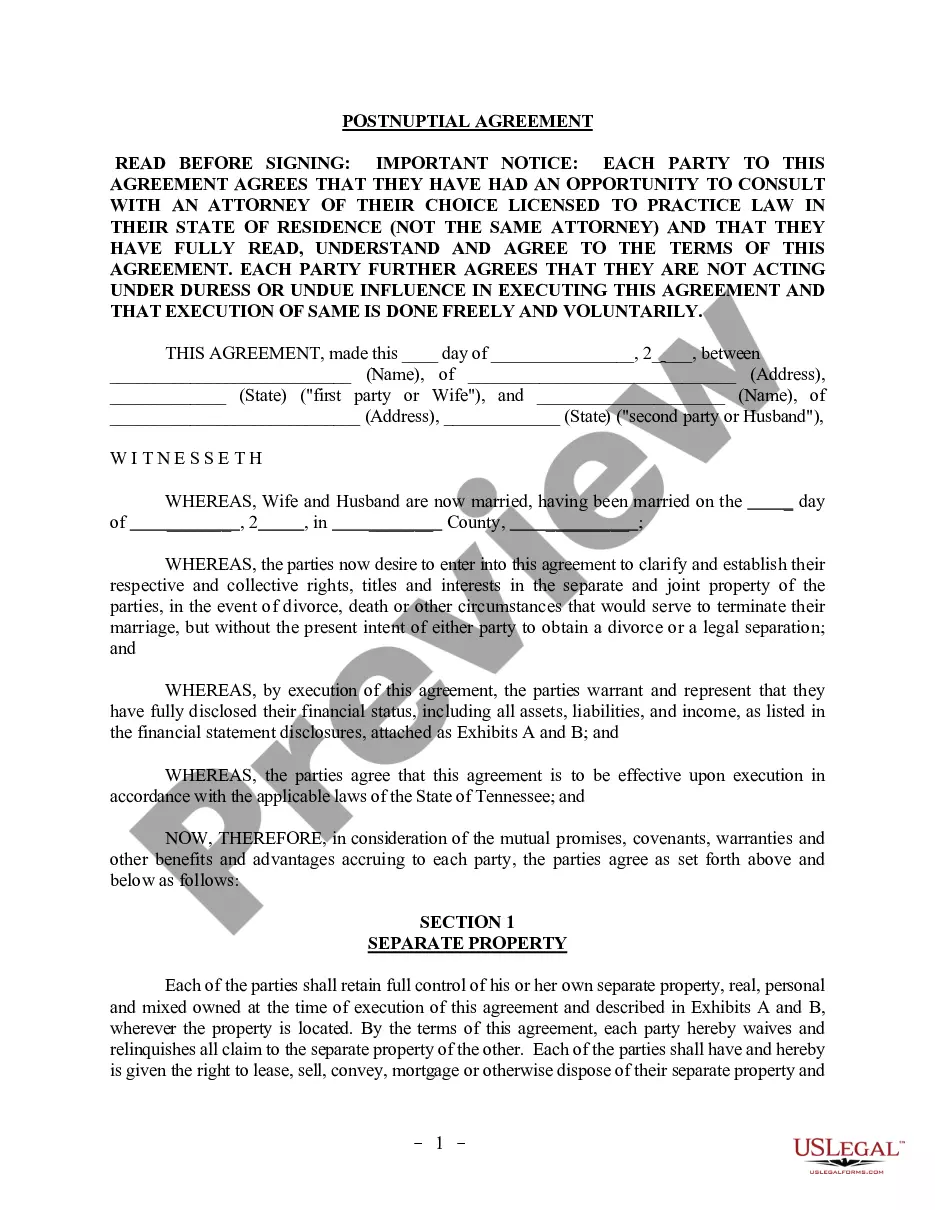

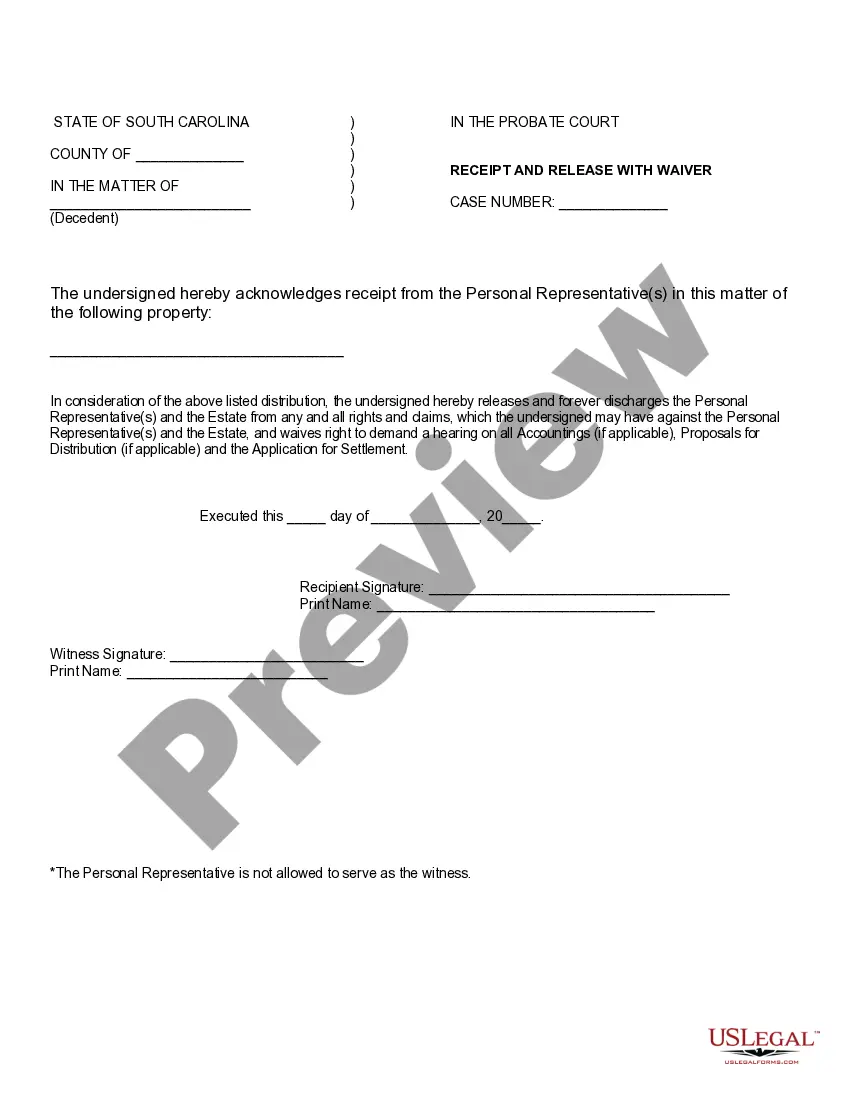

The South Carolina Receipt and Release with Waiver is a legal document used to protect the interests of both parties involved in a transaction. It is a contract that is signed by both parties and outlines the rights and obligations of both parties in regard to the agreement. This document is commonly used for real estate transactions, loan agreements, and any other financial exchange. It is important to note that this document is not legally binding until it is signed by both parties. There are several types of South Carolina Receipt and Release with Waiver documents, including the General Release, the Release of Liability, and the Release of Claims. The General Release is used for any transaction that does not involve any form of legal action, while the Release of Liability is used to protect one party from being held responsible for any future damages or losses. The Release of Claims is used to release one party from any future claims that may arise from the transaction. All three of these documents must be signed by both parties in order for them to be legally binding.

South Carolina Receipt and Release with Waiver

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

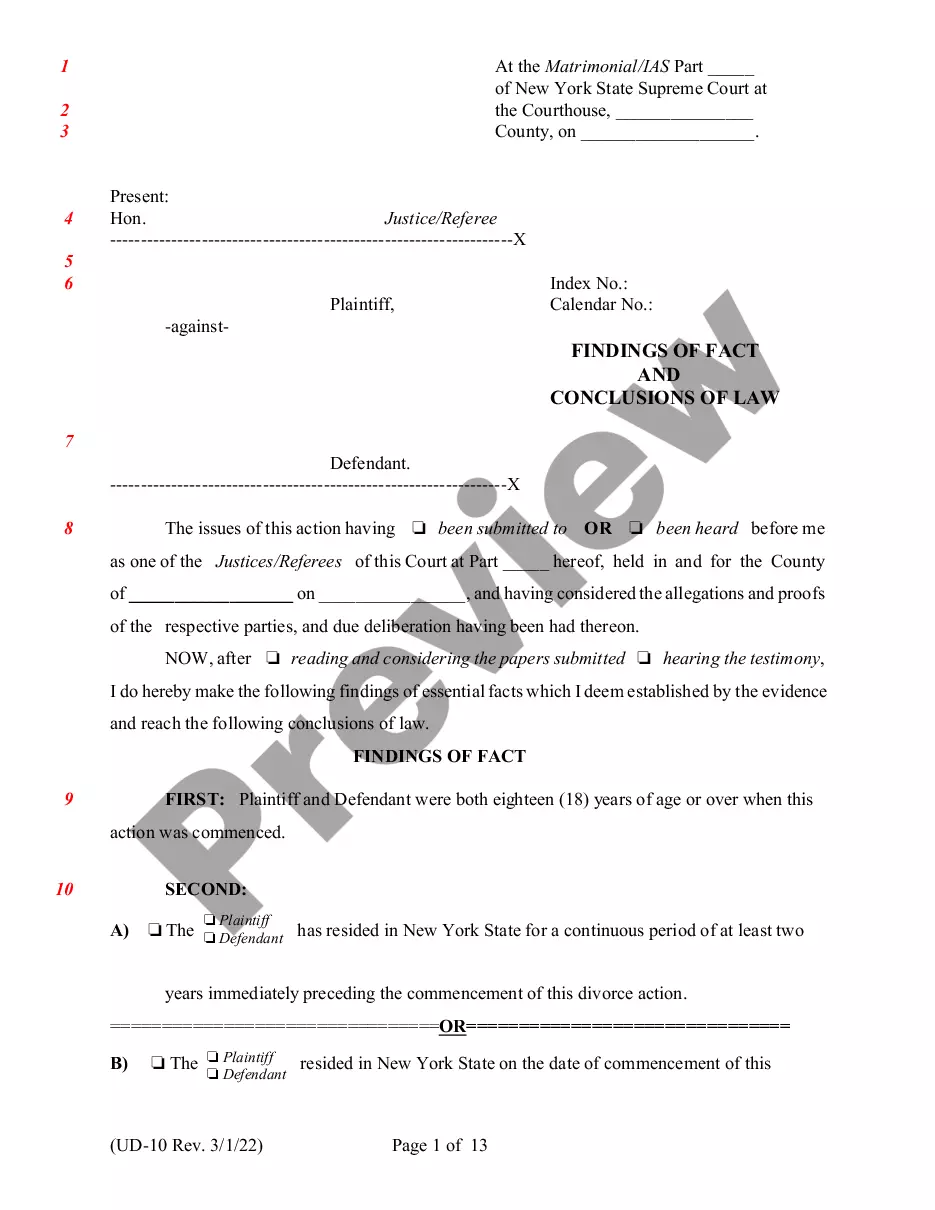

How to fill out South Carolina Receipt And Release With Waiver?

Working with official paperwork requires attention, accuracy, and using well-drafted templates. US Legal Forms has been helping people countrywide do just that for 25 years, so when you pick your South Carolina Receipt and Release with Waiver template from our service, you can be certain it meets federal and state regulations.

Working with our service is straightforward and fast. To get the required paperwork, all you’ll need is an account with a valid subscription. Here’s a quick guide for you to find your South Carolina Receipt and Release with Waiver within minutes:

- Make sure to attentively look through the form content and its correspondence with general and legal requirements by previewing it or reading its description.

- Search for another formal blank if the previously opened one doesn’t match your situation or state regulations (the tab for that is on the top page corner).

- Log in to your account and download the South Carolina Receipt and Release with Waiver in the format you prefer. If it’s your first experience with our service, click Buy now to continue.

- Create an account, select your subscription plan, and pay with your credit card or PayPal account.

- Decide in what format you want to save your form and click Download. Print the blank or upload it to a professional PDF editor to submit it paper-free.

All documents are drafted for multi-usage, like the South Carolina Receipt and Release with Waiver you see on this page. If you need them one more time, you can fill them out without re-payment - simply open the My Forms tab in your profile and complete your document any time you need it. Try US Legal Forms and accomplish your business and personal paperwork quickly and in full legal compliance!

Form popularity

FAQ

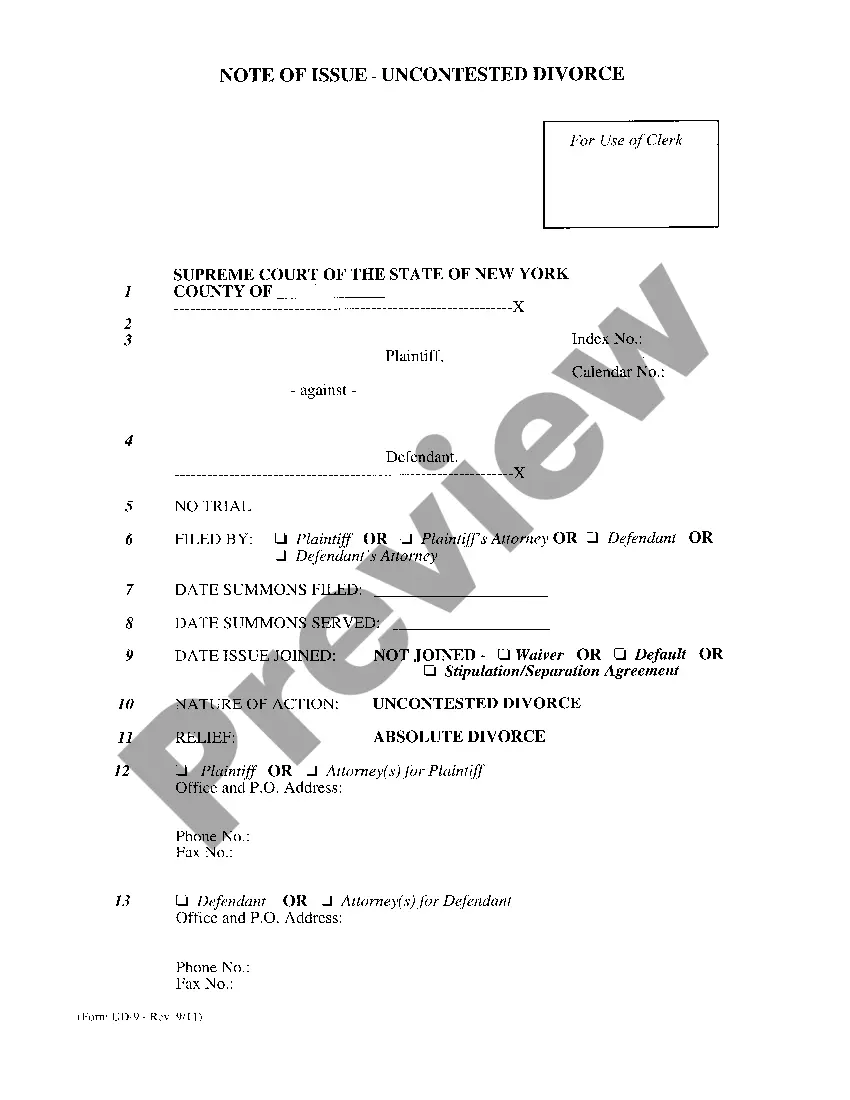

The appointment of a witness, a witness's spouse, or a witness's issue is valid, if otherwise so, and the individual so appointed, in such case, is entitled by law to take or receive any commissions or other compensation on account thereof.

In South Carolina, you can make a living trust to avoid probate for virtually any asset you own?real estate, bank accounts, vehicles, and so on. You need to create a trust document (it's similar to a will), naming someone to take over as trustee after your death (called a successor trustee).

Current through 2023 Act No. 5. Section 62-2-202 - Probate estate (a) For purposes of this Part, probate estate means the decedent's property passing under the decedent's will plus the decedent's property passing by intestacy, reduced by funeral and administration expenses and enforceable claims.

Any executor, devisee, legatee, guardian, attorney, or other person who fails to deliver to the judge of the probate court having jurisdiction to admit it to probate any last will and testament, including any codicil or codicils thereto, upon conviction must be punished as for a misdemeanor.

SECTION 62-2-101. Intestate estate. Any part of the estate of a decedent not effectively disposed of by his will passes to his heirs as prescribed in the following sections of this Code.

In most cases, probate is a legal responsibility in South Carolina. However, probate can be avoided if the decedent's assets were placed in a living trust before they died with beneficiaries designated to inherit the estate.

Exempt property. The surviving spouse of a decedent who was domiciled in this State is entitled from the estate to a value not exceeding twenty-five thousand dollars in excess of any security interests therein in household furniture, automobiles, furnishings, appliances, and personal effects.

Waiver of statutory filing requirements: If filed by all of the necessary parties, the estate can be administered without the need for a Final Accounting, Proposal for Distribution, or Notice of Right to Demand Hearing.