This form is a Warranty Deed where the grantor is a corporation and the grantee is a corporation. Upon ordering, you may download the form in Word, Rich Text or Wordperfect formats.

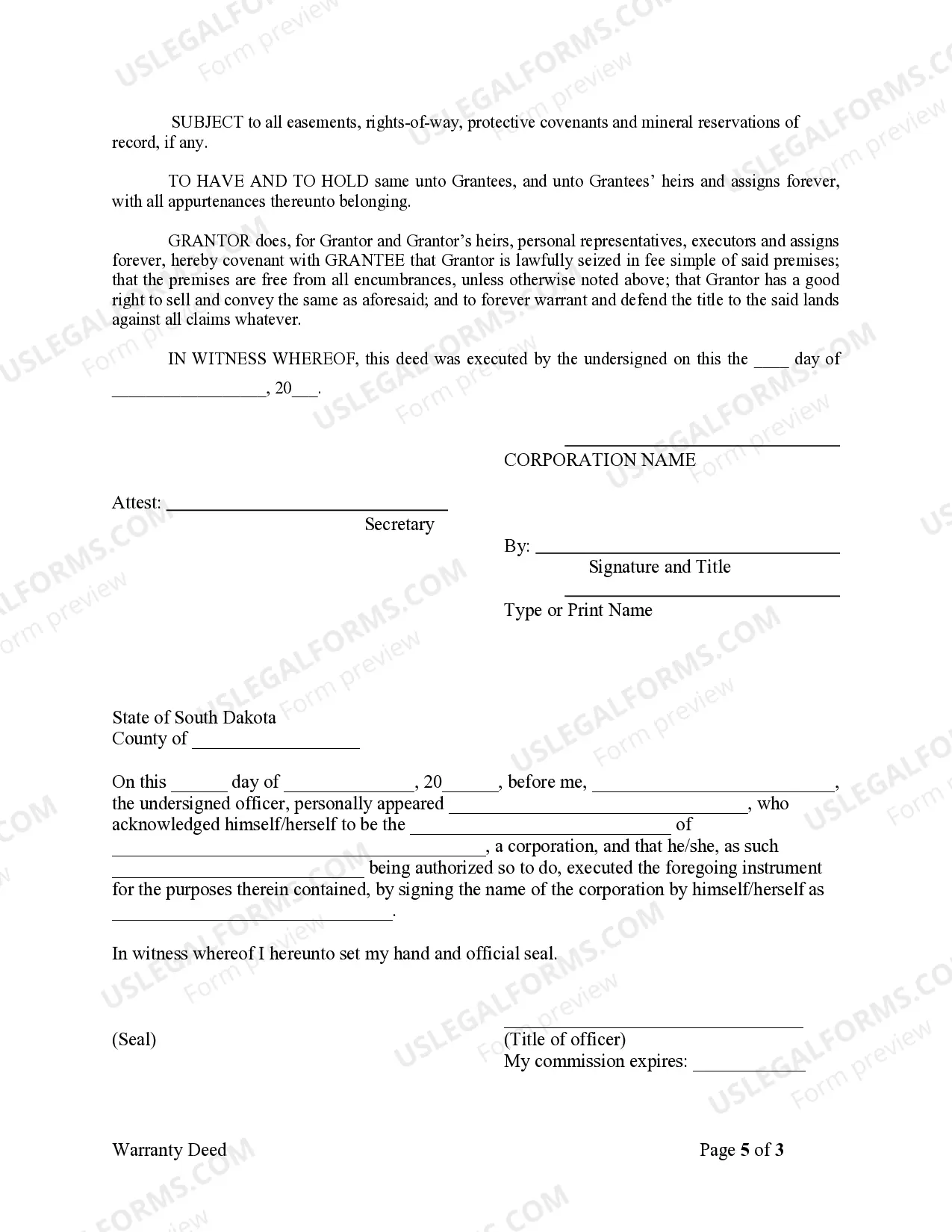

South Dakota Warranty Deed from Corporation to Corporation

Description Password Warrant Let

How to fill out South Dakota Warranty Deed Blank?

Creating documents isn't the most straightforward process, especially for people who almost never deal with legal papers. That's why we advise utilizing correct South Dakota Warranty Deed from Corporation to Corporation samples made by professional lawyers. It gives you the ability to stay away from difficulties when in court or dealing with formal organizations. Find the documents you want on our site for top-quality forms and exact explanations.

If you’re a user having a US Legal Forms subscription, just log in your account. As soon as you are in, the Download button will automatically appear on the template webpage. After downloading the sample, it’ll be saved in the My Forms menu.

Customers without an active subscription can easily create an account. Utilize this brief step-by-step guide to get the South Dakota Warranty Deed from Corporation to Corporation:

- Ensure that the form you found is eligible for use in the state it is needed in.

- Verify the document. Use the Preview option or read its description (if readily available).

- Buy Now if this sample is what you need or utilize the Search field to find another one.

- Choose a suitable subscription and create your account.

- Utilize your PayPal or credit card to pay for the service.

- Download your file in a required format.

Right after completing these simple steps, you are able to fill out the form in a preferred editor. Double-check completed info and consider requesting a lawyer to examine your South Dakota Warranty Deed from Corporation to Corporation for correctness. With US Legal Forms, everything gets much easier. Try it out now!

Special Warranty Deed Form South Dakota Form popularity

South Dakota Warranty Paper Other Form Names

Form Relock Password FAQ

A special warranty deed is a deed to real estate where the seller of the propertyknown as the grantorwarrants only against anything that occurred during their physical ownership. In other words, the grantor doesn't guarantee against any defects in clear title that existed before they took possession of the property.

A statutory warranty deed is different from a warranty deed because it is a shorter form made available through your state's statutes and it may not outright list the promise that the title is guaranteed to be clear. Instead, because it is a statutory form, this guarantee is implied and is still legally enforceable.

It's important to note that a warranty deed does not actually prove the grantor has ownership (a title search is the best way to prove that), but it is a promise by the grantor that they are transferring ownership and if it turns out they don't actually own the property, the grantor will be responsible for compensating

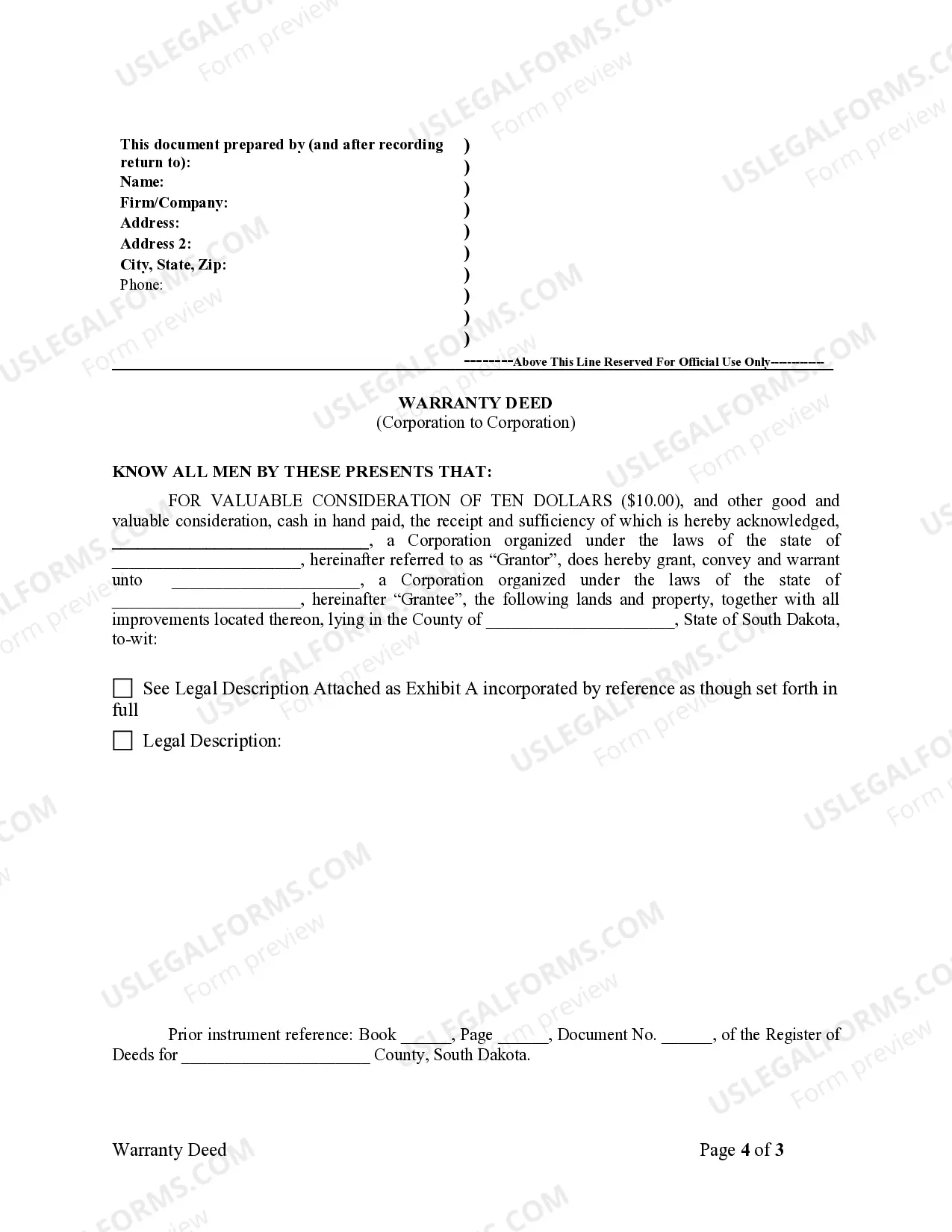

The original deed is returned to the owner of the property from the office of the recorder after proper entry. The office of the Recorder of Deeds maintains a set of indexes about each deed recorded, for an easy search. Almost all states have a grantor-grantee index including a reference to all documents recorded.

Corporate warranty deeds offer the seller's guarantee to the buyer in regards to the validity of the chain of title. Generally, special warranty deeds only protect against problems occurring since the seller purchased the property.

Typically, the lender will provide you with a copy of the deed of trust after the closing. The original warranty deeds are often mailed to the grantee after they are recorded. These are your original copies and should be kept in a safe place, such as a fireproof lockbox or a safe deposit box at a financial institution.

Special warranties allow the transfer of property title between seller and buyer. The purchase of title insurance can mitigate the risk of prior claims to the special warranty deed.

A warranty deed is a higher level of protection produced by the seller upon the real estate closing. It includes a full legal description of the property, and confirms the title is clear and free from all liens, encumbrances, or title defects. Most property sales make use of a warranty deed.

A warranty deed, also known as a general warranty deed, is a legal real estate document between the seller (grantor) and the buyer (grantee). The deed protects the buyer by pledging that the seller holds clear title to the property and there are no encumbrances, outstanding liens, or mortgages against it.