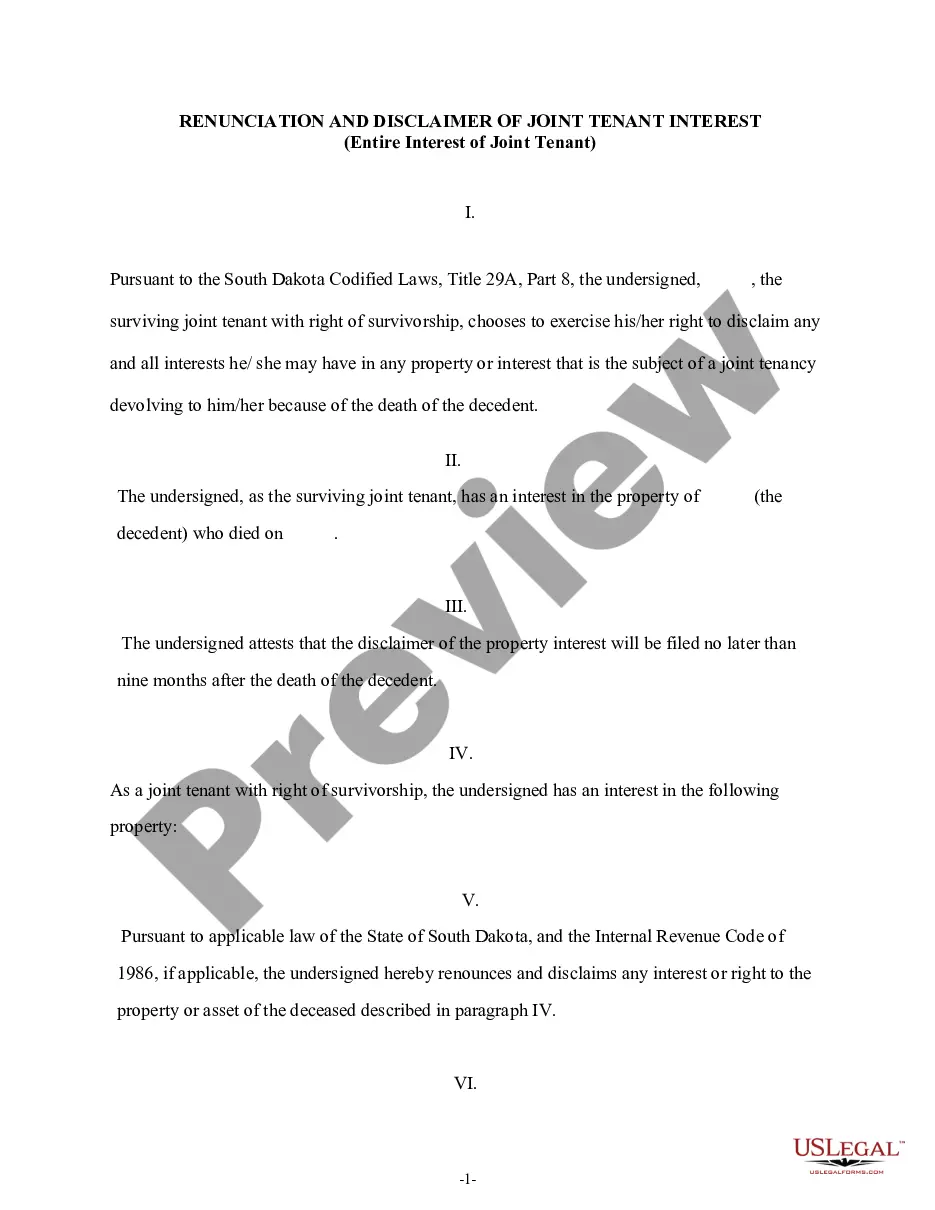

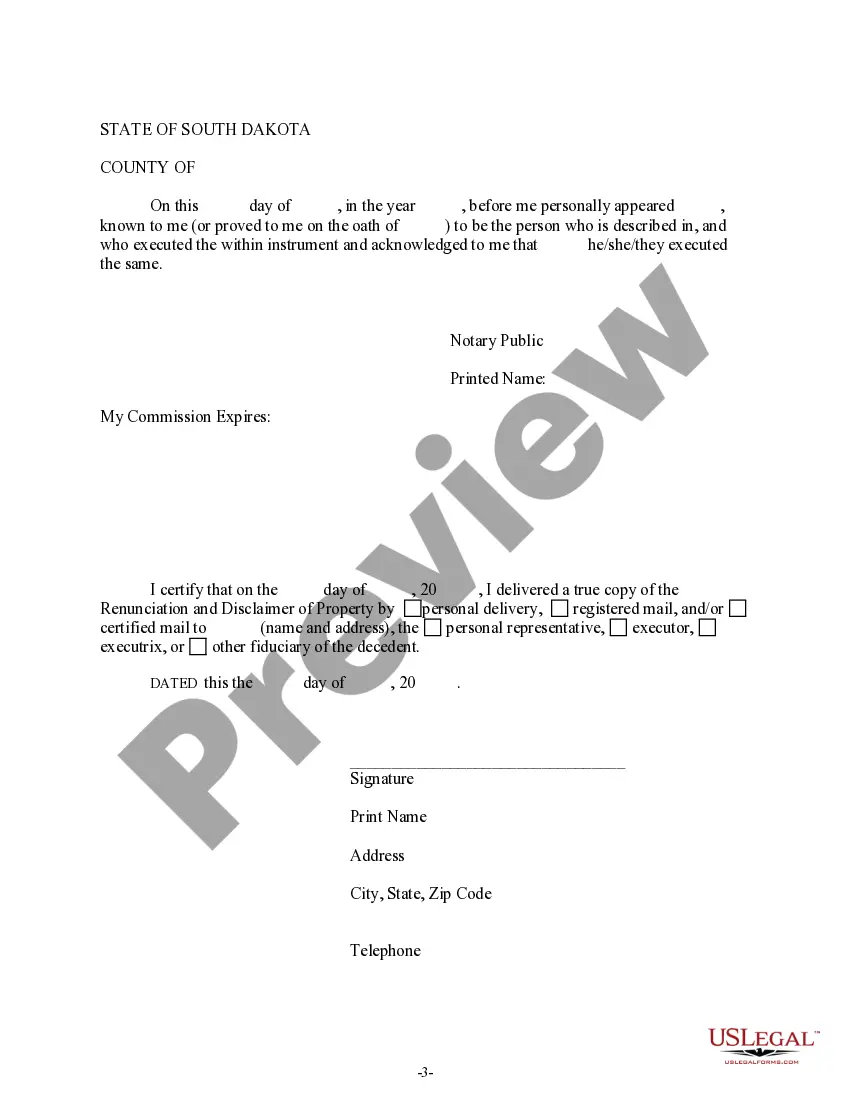

This form is a Renunciation and Disclaimer of a Joint Tenant Interest where the surviving joint tenant gained an interest in the share of the decedent upon the decedent's death, but, pursuant to the South Dakota Codified Laws, Title 29A, Part 8, has chosen to disclaim the entire joint tenant interest. The disclaimer will relate back to the death of the decedent and will serve as an irrevocable refusal to accept the property. The form also contains a state specific acknowledgment and a certificate to verify delivery of the documentation.

South Dakota Renunciation And Disclaimer of Joint Tenant or Tenancy Interest

Description

How to fill out South Dakota Renunciation And Disclaimer Of Joint Tenant Or Tenancy Interest?

The work with documents isn't the most straightforward process, especially for those who rarely deal with legal papers. That's why we recommend utilizing correct South Dakota Renunciation And Disclaimer of Joint Tenant or Tenancy Interest templates created by professional attorneys. It gives you the ability to eliminate problems when in court or working with formal organizations. Find the templates you require on our website for high-quality forms and exact explanations.

If you’re a user having a US Legal Forms subscription, just log in your account. When you’re in, the Download button will automatically appear on the template webpage. Soon after getting the sample, it will be saved in the My Forms menu.

Customers with no a subscription can quickly get an account. Look at this short step-by-step help guide to get your South Dakota Renunciation And Disclaimer of Joint Tenant or Tenancy Interest:

- Be sure that file you found is eligible for use in the state it is required in.

- Confirm the file. Use the Preview feature or read its description (if offered).

- Buy Now if this template is the thing you need or utilize the Search field to find a different one.

- Choose a convenient subscription and create your account.

- Utilize your PayPal or credit card to pay for the service.

- Download your document in a wanted format.

After finishing these simple steps, you are able to complete the form in your favorite editor. Recheck completed information and consider requesting a legal representative to review your South Dakota Renunciation And Disclaimer of Joint Tenant or Tenancy Interest for correctness. With US Legal Forms, everything gets much easier. Try it now!

Form popularity

FAQ

The surviving spouse can serve as the sole trustee, but cannot have any power to direct the beneficial enjoyment of the disclaimed property unless the power is limited by an "ascertainable standard." This is necessary both to qualify the disclaimer and to avoid any taxable general power of appointment.

Any disclaimer of an interest in a trust by a trust beneficiary must be made to the trustee of that trust. For a disclaimer to be valid, it must be supported by some evidence that the beneficiary is disclaiming their interest. Silence or otherwise passive behaviour will not suffice.

The beneficiary can avoid receiving the trust assets through a disclaimer. A disclaimer is a legal act where the beneficiary instructs the trustee to disregard the beneficiary as though he was dead, as though he predeceased the trust's intended end.

Yes, a fiduciary can disclaim an interest in property if the will, trust or power of attorney gives the fiduciary that authority or if the appropriate probate court authorizes the disclaimer.The primary reason an executor or trustee might disclaim property passing to an estate or trust is to save death taxes.

Jointly owned property is treated as consisting of a both present and a future interest in the jointly owned property. Thus, a surviving spouse may disclaim the future interest in jointly owned property on the death of their spouse, including assets that were held by the spouses as tenants by the entirety.

It must be in writing. It must be made within 9 months of the date of death of the decedent. The disclaimant cannot receive any benefits from the assets.

Property owned in joint tenancy automatically passes, without probate, to the surviving owner(s) when one owner dies. Setting up a joint tenancy is easy, and it doesn't cost a penny.

A disclaimer trust is a clause typically included in a person's will that establishes a trust upon their death, subject to certain specifications. This allows certain assets to be moved into the trust by the surviving spouse without being subject to taxation.

Danger #1: Only delays probate. Danger #2: Probate when both owners die together. Danger #3: Unintentional disinheriting. Danger #4: Gift taxes. Danger #5: Loss of income tax benefits. Danger #6: Right to sell or encumber. Danger #7: Financial problems.