South Dakota Workers Compensation Monthly Payment (Expenditure) Report

Description

How to fill out South Dakota Workers Compensation Monthly Payment (Expenditure) Report?

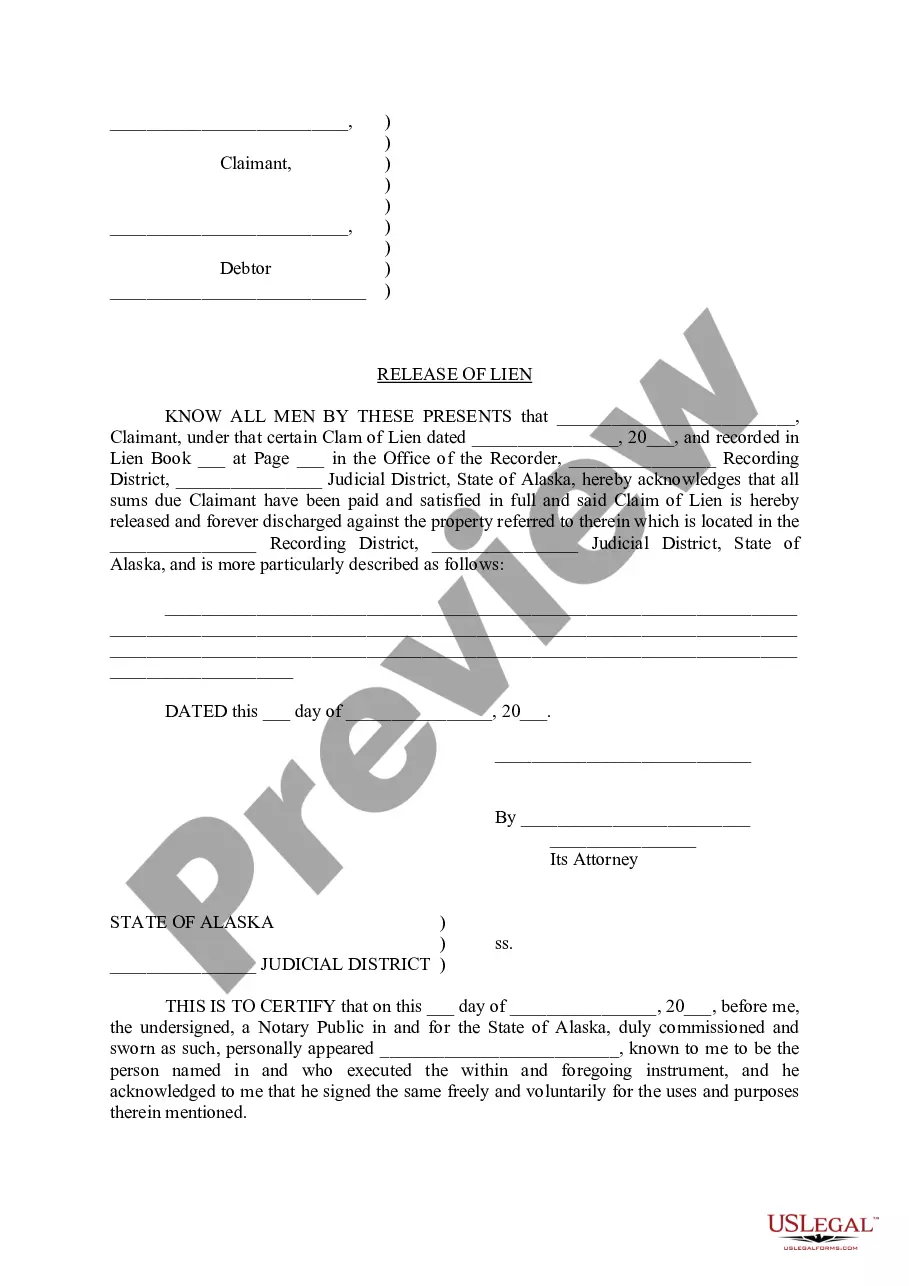

Access to quality South Dakota Workers Compensation Monthly Payment (Expenditure) Report forms online with US Legal Forms. Prevent hours of wasted time browsing the internet and lost money on documents that aren’t updated. US Legal Forms gives you a solution to exactly that. Get over 85,000 state-specific legal and tax templates that you could download and fill out in clicks within the Forms library.

To find the sample, log in to your account and then click Download. The file will be saved in two places: on the device and in the My Forms folder.

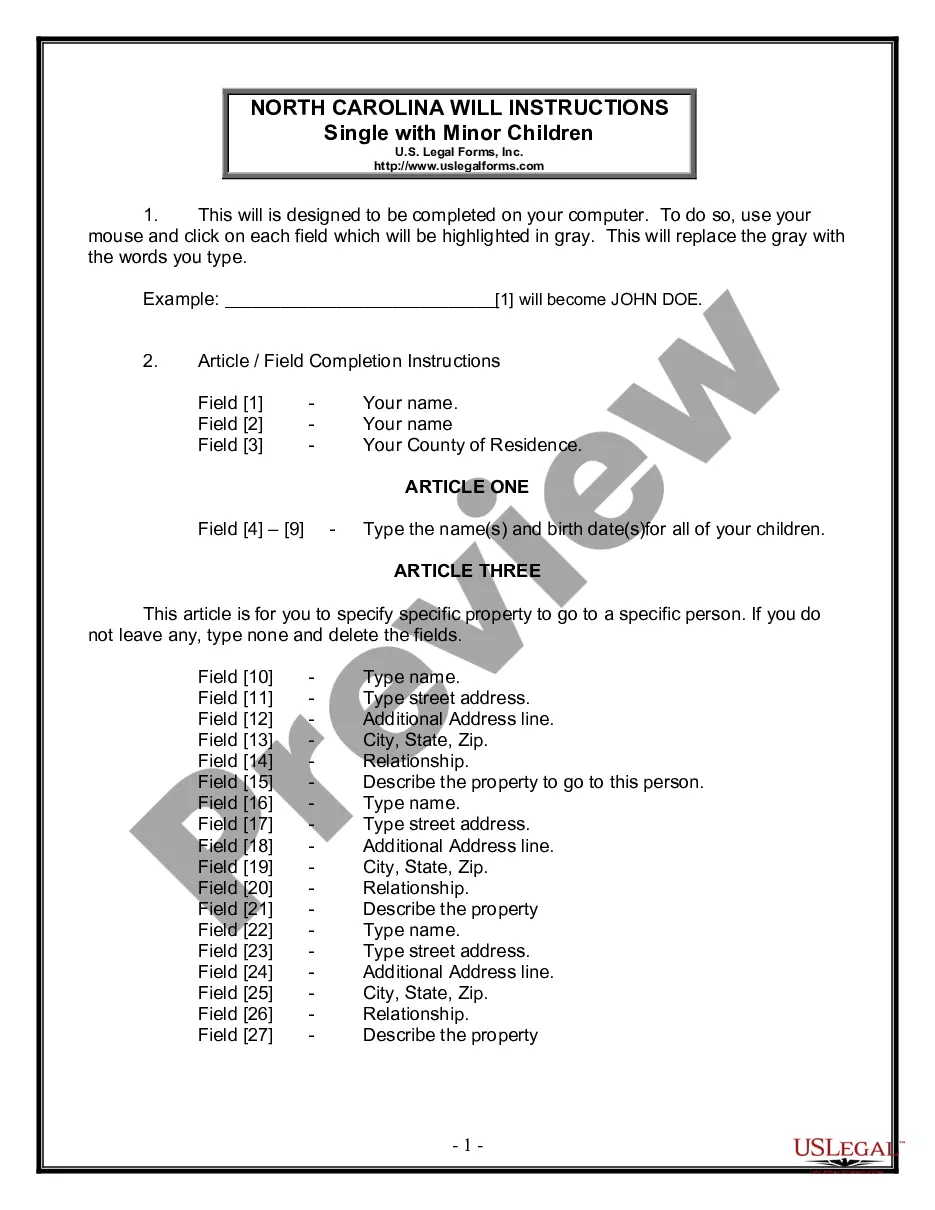

For individuals who don’t have a subscription yet, take a look at our how-guide listed below to make getting started easier:

- Find out if the South Dakota Workers Compensation Monthly Payment (Expenditure) Report you’re considering is appropriate for your state.

- View the form making use of the Preview function and read its description.

- Check out the subscription page by clicking Buy Now.

- Choose the subscription plan to continue on to sign up.

- Pay out by card or PayPal to finish creating an account.

- Pick a preferred file format to save the file (.pdf or .docx).

Now you can open the South Dakota Workers Compensation Monthly Payment (Expenditure) Report template and fill it out online or print it and do it by hand. Consider mailing the papers to your legal counsel to ensure everything is filled in properly. If you make a error, print and fill sample again (once you’ve created an account all documents you save is reusable). Make your US Legal Forms account now and get access to more templates.

Form popularity

FAQ

A workers' compensation rate is represented as the cost per $100 in payroll. For example: A rate of $1.68 means that a business with $100,000 in payroll would pay $1,680 annually in work comp premiums. A rate of $0.35 means that a business with $100,000 in payroll would pay $350 annually in work comp premiums.

Workers Compensation Calculator Most often, benefits are calculated and paid based on the average weekly wage. This is calculated by multiplying the employee's daily wage by the number of days worked in a full year. That number is then divided by 52 weeks to get the average weekly wage.

A workers' compensation rate is represented as the cost per $100 in payroll. For example: A rate of $1.68 means that a business with $100,000 in payroll would pay $1,680 annually in work comp premiums. A rate of $0.35 means that a business with $100,000 in payroll would pay $350 annually in work comp premiums.

To calculate your regular weekly wage, you divide your annual salary by 52. If someone makes $52,000 a year, this would amount to $1,000 weekly. The maximum benefit would be $666.66 in this case as state law stipulates the maximum benefit is 2/3 of your pretax gross wage.

The worker compensation costs associated with selling and general administration should be reported as an expense on the income statement. Any worker compensation insurance costs that have been prepaid should be reported as a current asset (such as Prepaid Insurance) on the balance sheet.

Medical expenses. Lost wages. Ongoing care costs. Funeral expenses.

First Aid Treatment is Usually Not Enough. Injuries Outside the Office Are Covered. Injuries Outside the Scope of Employment. Cumulative Events and Injuries. Mental Health Conditions.

Workers' compensation covers most work-related injuriesbut not all. Generally, workers' comp doesn't cover injuries that happen because you were intoxicated or using illegal drugs.

Medical bills are paid as they are incurred. The employee's doctor should bill the employer or the employer's workers' compensation insurance company directly. It's important to note that the amount of medical bills does not impact other workers' compensation benefits that the employee is able to receive.