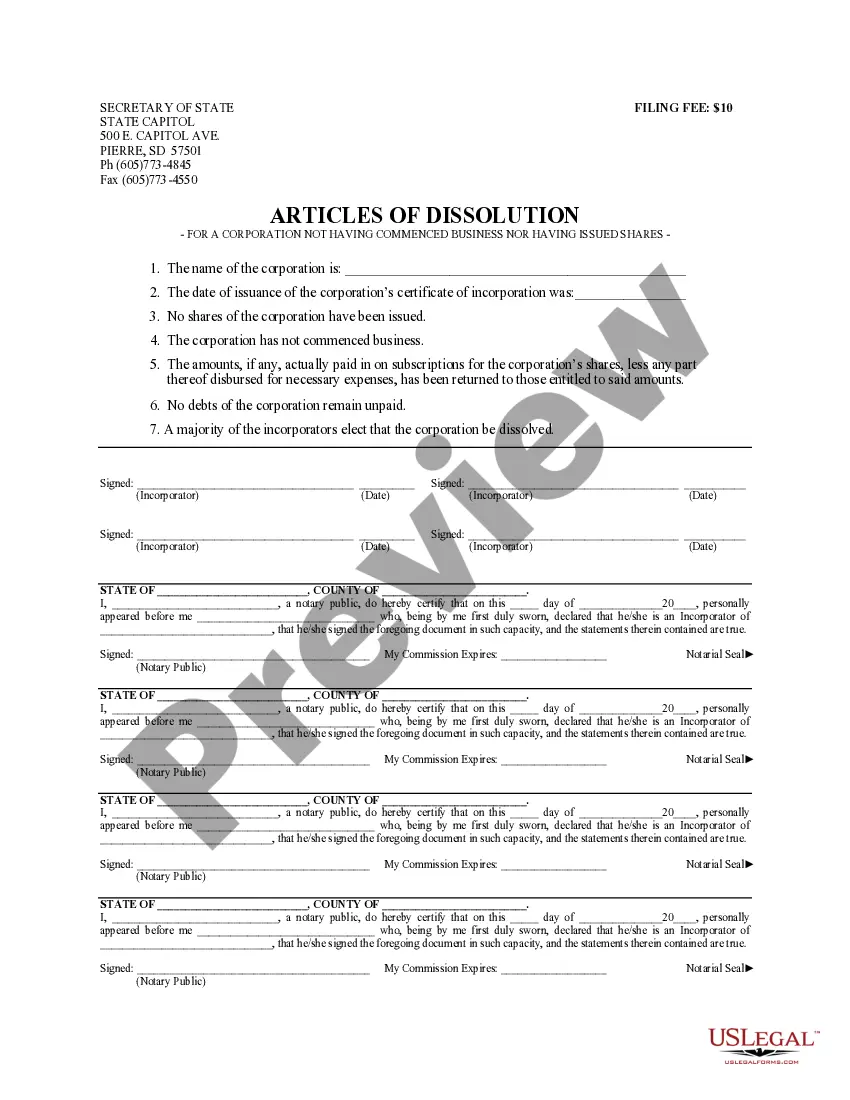

The dissolution of a corporation package contains all forms to dissolve a corporation in South Dakota, step by step instructions, addresses, transmittal letters, and other information.

South Dakota Dissolution Package to Dissolve Corporation

Description Sd Dissolution Blank

How to fill out Communicates Underlined Dissolution?

Get access to top quality South Dakota Dissolution Package to Dissolve Corporation forms online with US Legal Forms. Steer clear of hours of lost time browsing the internet and dropped money on forms that aren’t updated. US Legal Forms provides you with a solution to just that. Find over 85,000 state-specific legal and tax templates that you could save and submit in clicks within the Forms library.

To receive the sample, log in to your account and then click Download. The document will be stored in two places: on the device and in the My Forms folder.

For those who don’t have a subscription yet, take a look at our how-guide listed below to make getting started simpler:

- See if the South Dakota Dissolution Package to Dissolve Corporation you’re considering is appropriate for your state.

- See the form using the Preview function and browse its description.

- Go to the subscription page by simply clicking Buy Now.

- Select the subscription plan to keep on to sign up.

- Pay out by credit card or PayPal to finish making an account.

- Pick a favored format to download the document (.pdf or .docx).

Now you can open up the South Dakota Dissolution Package to Dissolve Corporation template and fill it out online or print it out and get it done yourself. Think about mailing the file to your legal counsel to ensure all things are completed properly. If you make a error, print and fill application once again (once you’ve registered an account every document you save is reusable). Make your US Legal Forms account now and get access to a lot more forms.

Pack Dissolve Corporation Form popularity

Sd Dissolution Corporation Other Form Names

South Dakota Dissolution Corporation FAQ

Dissolving the CorporationCalifornia's General Corporation Law (GCL) provides for voluntary dissolution if shareholders holding shares with at least 50 percent of the voting power vote for dissolution.

An inactive business is a business that still exists but has no activity, which means no business transactions during a specific year.Even if the business has no income, it may still be considered active for tax purposes. There are many reasons a business may become inactive.

Step 1: Corporation or LLC action. Step 2: Filing the Certificate of Dissolution with the state. Step 3: Filing federal, state, and local tax forms. Step 4: Notifying creditors your business is ending. Step 5: Settling creditors' claims.

In most states, to keep a corporation active, the owners must file annual reports and income tax returns. They may have to pay annual fees as well. Failure to do these things can render the corporation inactive. A corporation may also voluntarily become inactive by ceasing to do business.

Failing to dissolve the corporation allows third parties to continue to sue the corporation as if it is still in operation. A judgment might mean that shareholders use the money received from distributed assets when the corporation closed down to satisfy judgments against the corporation.

There is no fee to file the certificate of dissolution. However, there is a non-refundable $15 special handling fee for processing documents delivered in person at the Sacramento SOS office. It can take the SOS many weeks to process a certificate. However, expedited service is available for an additional fee.

Dissolve the Legal Entity (LLC or Corporation) with the State. An LLC or Corporation needs to be officially dissolved. Pay Any Outstanding Bills. You need to satisfy any company debts before closing the business. Cancel Any Business Licenses or Permits. File Your Final Federal and State Tax Returns.

Just as you filed paperwork with the state to form your LLC, you must file articles of dissolution or a similar document to dissolve the LLC. These papers are filed with the same state agency that handed your original LLC formationusually the secretary of state.