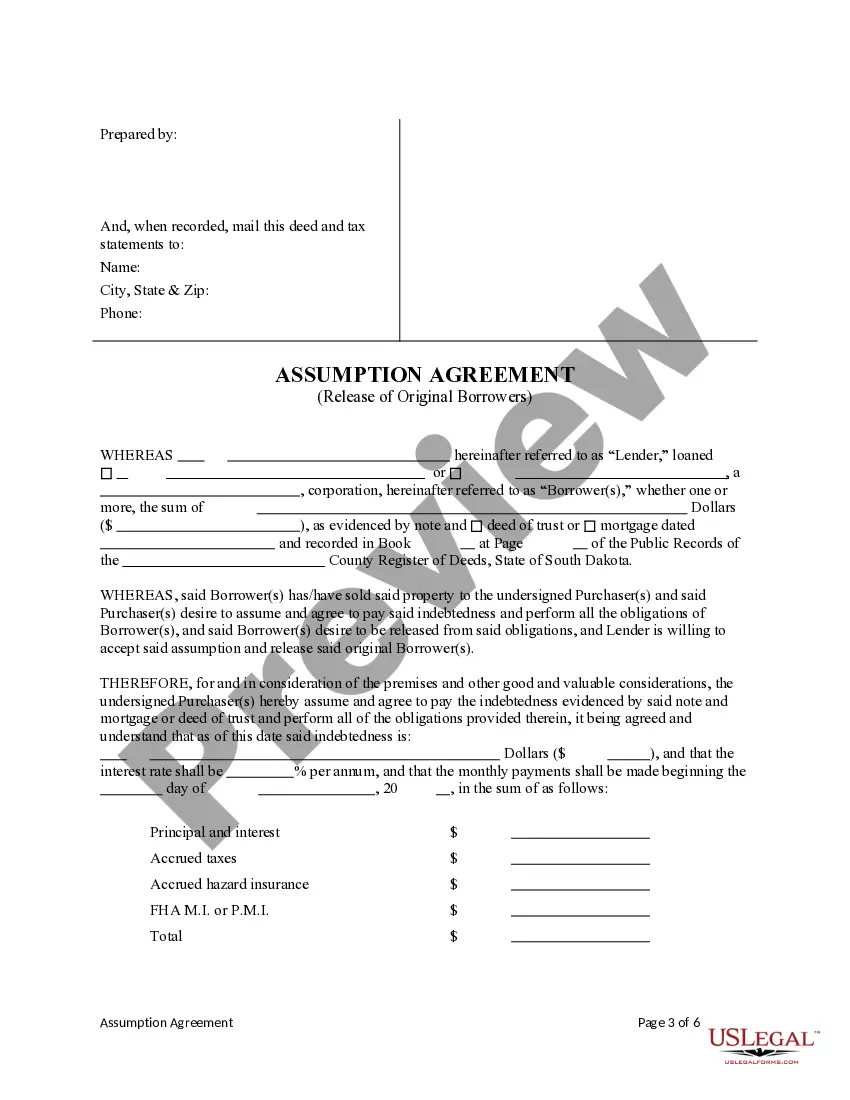

This Assumption Agreement of Deed of Trust and Release of Original Mortgagors form is for the lender, mortgagees and new purchasers to sign whereby the new purchasers of the property assume and agree to pay the debt to the lender, and the lender releases the original mortgagors from any future liability on the loan.

South Dakota Assumption Agreement of Mortgage and Release of Original Mortgagors

Description

How to fill out South Dakota Assumption Agreement Of Mortgage And Release Of Original Mortgagors?

Access to high quality South Dakota Assumption Agreement of Mortgage and Release of Original Mortgagors forms online with US Legal Forms. Prevent hours of misused time looking the internet and dropped money on files that aren’t updated. US Legal Forms gives you a solution to exactly that. Find more than 85,000 state-specific authorized and tax templates that you can download and complete in clicks in the Forms library.

To receive the example, log in to your account and click Download. The document will be saved in two places: on the device and in the My Forms folder.

For those who don’t have a subscription yet, take a look at our how-guide below to make getting started simpler:

- See if the South Dakota Assumption Agreement of Mortgage and Release of Original Mortgagors you’re considering is appropriate for your state.

- View the form using the Preview function and read its description.

- Check out the subscription page by clicking Buy Now.

- Choose the subscription plan to continue on to sign up.

- Pay out by credit card or PayPal to complete creating an account.

- Choose a favored file format to save the file (.pdf or .docx).

Now you can open up the South Dakota Assumption Agreement of Mortgage and Release of Original Mortgagors template and fill it out online or print it out and do it yourself. Take into account mailing the papers to your legal counsel to make certain all things are completed correctly. If you make a mistake, print and complete application once again (once you’ve registered an account every document you download is reusable). Create your US Legal Forms account now and access more samples.

Form popularity

FAQ

What is a mortgage assumption agreement? It's actually pretty self-explanatory. A person who assumes a mortgage takes over a payment from the previous homeowner. Basically, the agreement shifts the financial responsibility of the loan to a different borrower.

Having an assumable loan might give a seller a marketing edge, particularly if mortgage rates have risen since the seller got the loan. For a buyer, assuming a mortgage can save thousands of dollars in interest payments and closing costs but it could require making a big down payment.

Keep in mind that the average loan assumption takes anywhere from 45-90 days to complete. The more issues there are with underwriting, the longer you'll have to wait to finalize your agreement.

An assumable mortgage is an arrangement in where an outstanding mortgage and its terms can be transferred from the current owner to a buyer.

You will need a minimum credit score of 580 to 620, depending on individual lender guidelines. Your household income cannot exceed 115% of the average median income for the area. Your debt ratios should not exceed 29% for your housing expenses and 41% for your total monthly expenses.

An assumable mortgage allows a buyer to take over the seller's mortgage. Once the assumption is complete, you take over the payments on a monthly basis, and the person you assume the loan from is released from further liability. If you assume someone's mortgage, you're agreeing to take on their debt.

It is a legal contract that effectuates an agreement between two parties, whereby one party agrees to assume the responsibilities, interests, rights, and obligations of another party in respect to a separate agreement made between the latter and a third party.

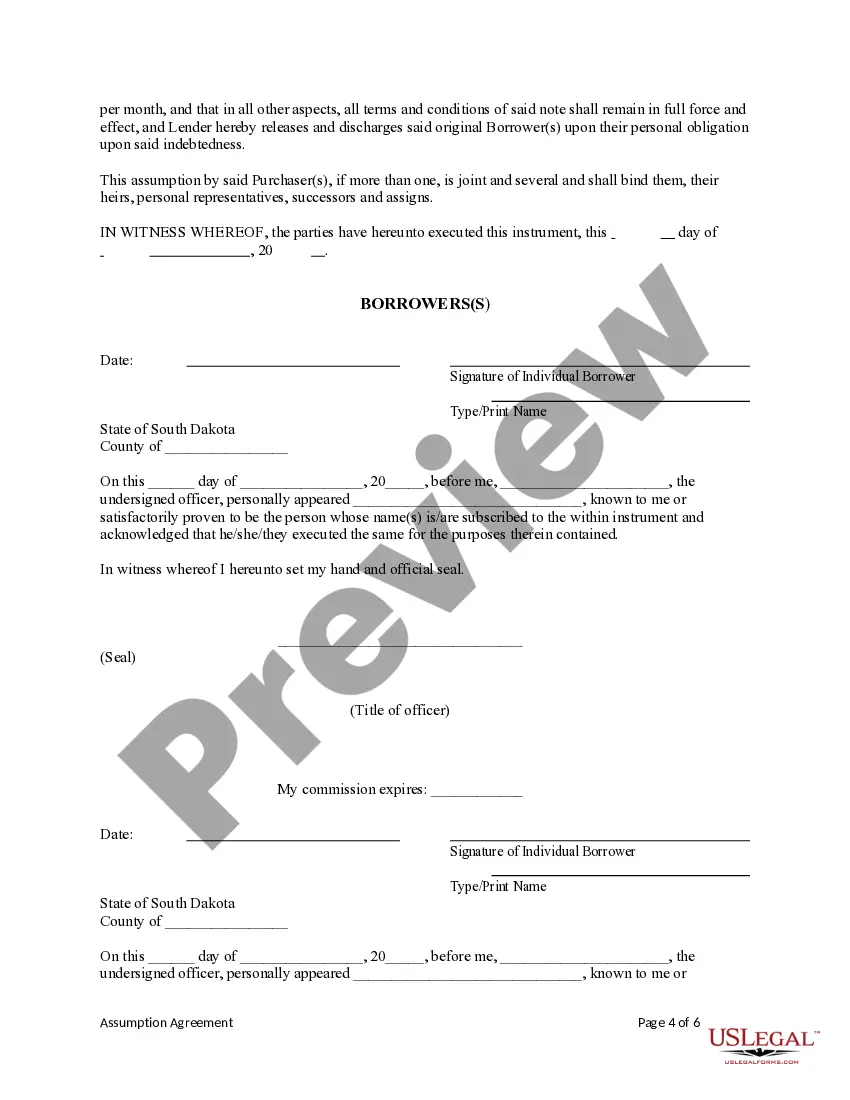

The seller may also be required to sign the assumption agreement and the terms may release the seller from responsibility. The lender usually requires a credit history from the buyer before approving the assumption and the payment of assumption fee(s).