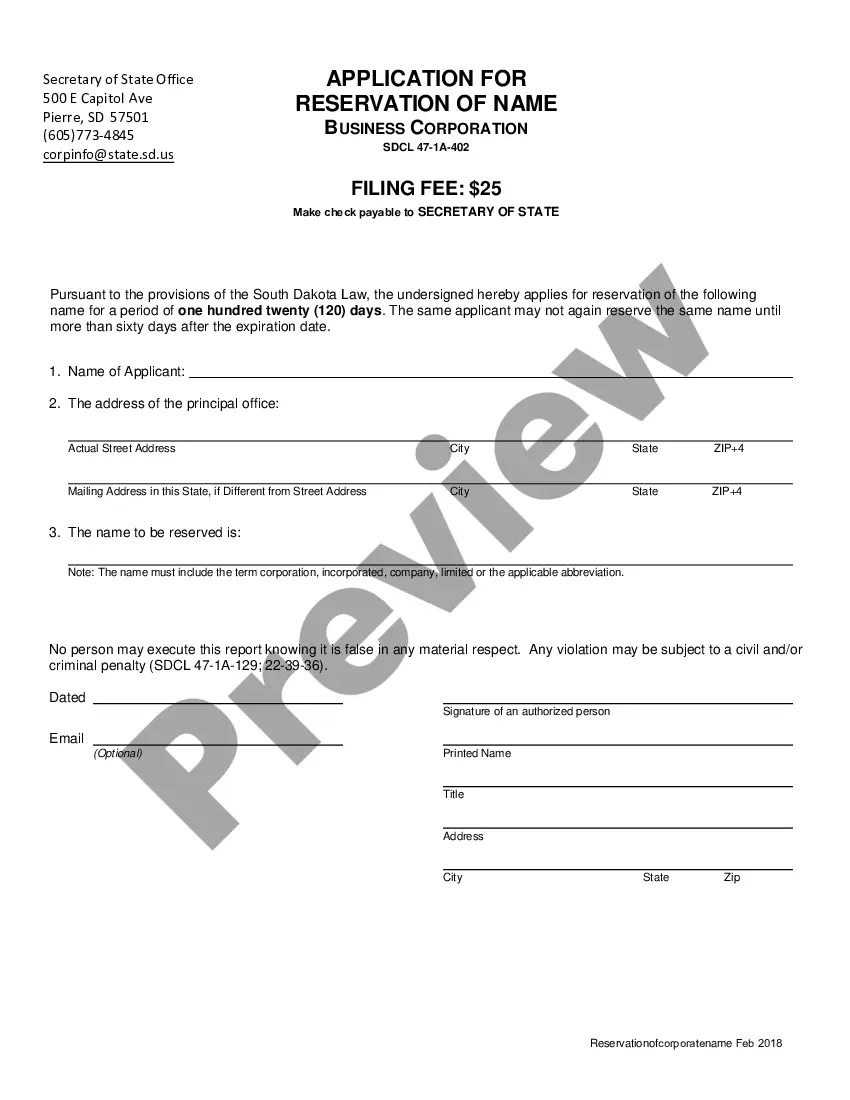

File this Name Reservation form to reserve a unique business name for your LLC.

South Dakota Application for LLC Name Reservation

Description

How to fill out South Dakota Application For LLC Name Reservation?

Access to high quality Application for LLC Name Reservation - South Dakota samples online with US Legal Forms. Avoid hours of misused time looking the internet and dropped money on forms that aren’t updated. US Legal Forms provides you with a solution to just that. Get above 85,000 state-specific legal and tax templates that you can save and fill out in clicks in the Forms library.

To find the example, log in to your account and click Download. The document is going to be saved in two places: on the device and in the My Forms folder.

For individuals who don’t have a subscription yet, take a look at our how-guide below to make getting started simpler:

- Find out if the Application for LLC Name Reservation - South Dakota you’re looking at is appropriate for your state.

- View the sample making use of the Preview function and browse its description.

- Check out the subscription page by clicking Buy Now.

- Select the subscription plan to keep on to sign up.

- Pay by card or PayPal to finish creating an account.

- Choose a preferred file format to download the document (.pdf or .docx).

You can now open the Application for LLC Name Reservation - South Dakota template and fill it out online or print it out and do it yourself. Think about sending the file to your legal counsel to make sure all things are filled out properly. If you make a error, print and complete application again (once you’ve made an account all documents you save is reusable). Create your US Legal Forms account now and get much more forms.

Form popularity

FAQ

STEP 1: Name your South Dakota LLC. STEP 2: Choose a South Dakota Registered Agent. STEP 3: File the South Dakota LLC Articles of Organization. STEP 4: Create Your South Dakota LLC Operating Agreement. STEP 5: Get an EIN for Your South Dakota LLC.

How much does it cost to form an LLC in South Dakota? The South Dakota Secretary of State charges $165 to file the Articles of Organization. There is an additional $15 filing fee if submitted by mail. You can reserve your LLC name with the South Dakota Secretary of State for $25.

If money's tight, or you don't want to use a company formation service, we've got good news for you you can form an LLC yourself. Although you'll still need to pay your state filing fees (they're unavoidable!), you can save on the costs of having your LLC filed through a professional incorporation business.

The filing fee is between $150 & $165 depending on how you file.

The least expensive way to form your LLC is filing the forms yourself, although it will depend on the filing fees in your state. Incorporation statements for LLCs are typically the Articles of Organization.

When you form a corporation or LLC, you need to pay a one-time filing fee to the state's secretary of state office. Arkansas, Colorado, Hawaii, Iowa, Oklahoma and Mississippi all boast the lowest corporation formation fee at $50. It costs $310 to incorporate in Texas.

Business Name. Your LLC must have a name that is unique and is not the same or confusingly similar to another business. Registered Agent. Operating Agreement. Articles of Organization. Business Licenses and Permits. Statement of Information Form. Tax Forms.

Choose a name for your LLC. File Articles of Organization. Choose a registered agent. Decide on member vs. manager management. Create an LLC operating agreement. Comply with other tax and regulatory requirements. File annual reports. Out of state LLC registration.