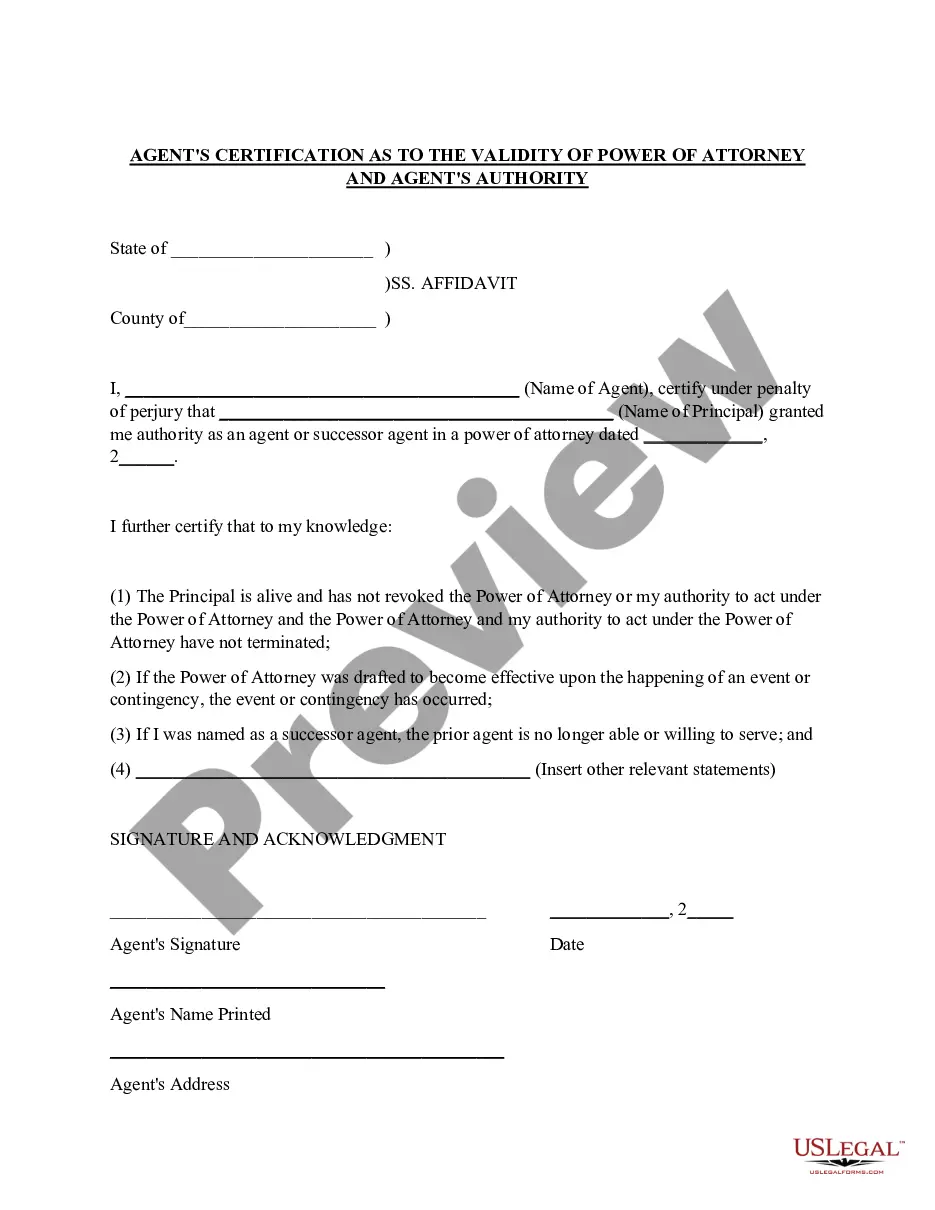

South Dakota Agent's Certification as to Power of Attorney

Description

How to fill out South Dakota Agent's Certification As To Power Of Attorney?

Get access to high quality South Dakota Agent's Certification as to Power of Attorney samples online with US Legal Forms. Steer clear of hours of lost time browsing the internet and dropped money on forms that aren’t up-to-date. US Legal Forms offers you a solution to exactly that. Find more than 85,000 state-specific legal and tax templates that you could download and complete in clicks in the Forms library.

To find the example, log in to your account and click on Download button. The document is going to be saved in two places: on the device and in the My Forms folder.

For individuals who don’t have a subscription yet, look at our how-guide listed below to make getting started easier:

- Find out if the South Dakota Agent's Certification as to Power of Attorney you’re considering is appropriate for your state.

- View the sample utilizing the Preview option and read its description.

- Visit the subscription page by clicking Buy Now.

- Choose the subscription plan to go on to register.

- Pay out by card or PayPal to finish creating an account.

- Choose a favored file format to download the file (.pdf or .docx).

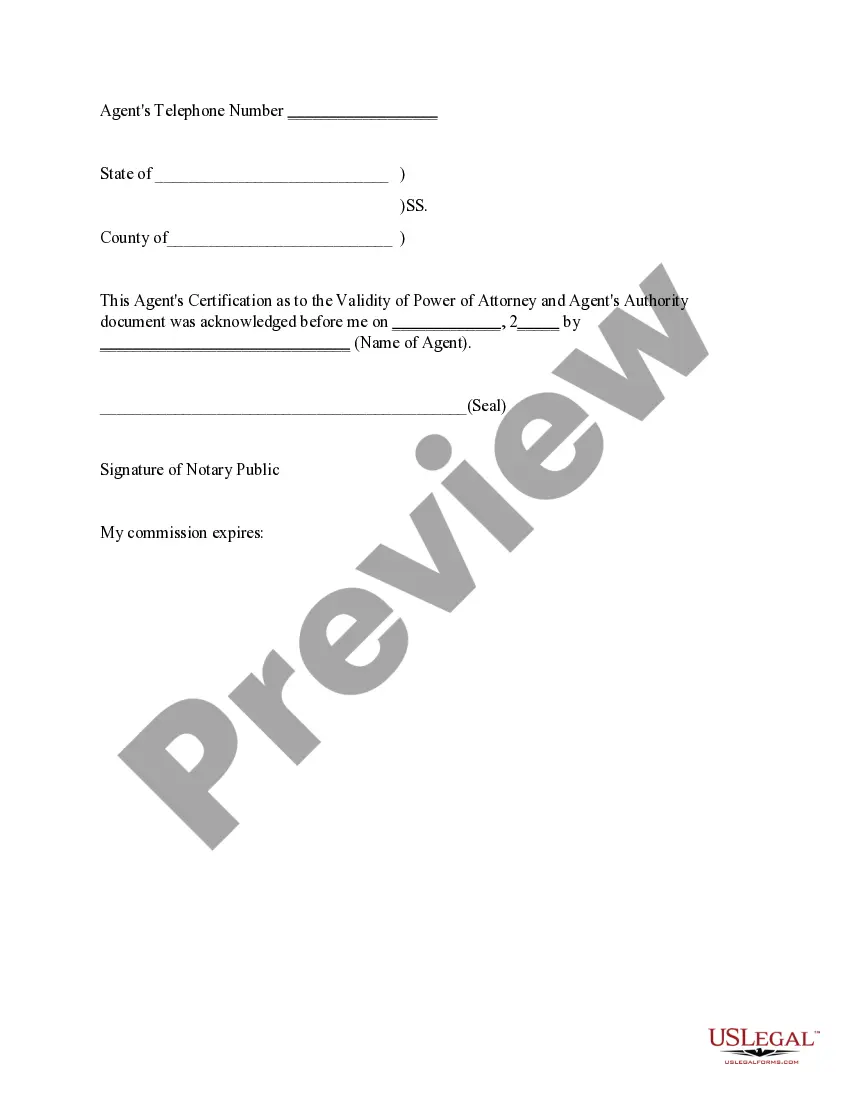

Now you can open up the South Dakota Agent's Certification as to Power of Attorney sample and fill it out online or print it out and get it done yourself. Take into account sending the file to your legal counsel to be certain things are filled in correctly. If you make a error, print out and fill sample again (once you’ve made an account every document you save is reusable). Create your US Legal Forms account now and access a lot more templates.

Form popularity

FAQ

In many states, notarization is required by law to make the durable power of attorney valid. But even where law doesn't require it, custom usually does. A durable power of attorney that isn't notarized may not be accepted by people with whom your attorney-in-fact tries to deal.

Who can make a power of attorney? Anyone over 18 can make a power of attorney as long as they understand what they are signing (that is, if they have mental capacity).

The person named in a power of attorney to act on your behalf is commonly referred to as your "agent" or "attorney-in-fact." With a valid power of attorney, your agent can take any action permitted in the document. Often your agent must present the actual document to invoke the power.

A Financial Power of Attorney: is a legal document that allows one person to act for another person, but the authority comes with duties and responsibilities. The giver of the authority is known as the principal, while the receiver is referred to as an agent.

An agent under a durable power of attorney, appointment of health care agent, or a successor trustee, is the person who will handle specific decisions and issues on your behalf should you become incapacitated. A personal representative, or successor trustee, will handle your affairs upon your death.

Signing Requirements: No specific signing requirement; however, it is suggested that the document be notarized. Tax Power of Attorney (Form RV-071) Used when you wish to appoint another to take care of your tax issues in front of the tax authority, such as to obtain information and make filings, etc.

Most states do not require the power of attorney (POA) to have both signatures as only the principal is required to sign.The person bestowing the authority is the principal, and the person appointed to act is the agent, sometimes called the attorney-in-fact.

The durable power of attorney appoints an agent to manage the principal's financial affairs and conduct business during the period the principal is unable to make their own decisions. A durable power of attorney remains effective throughout the period the principal is incapable of handling their own affairs.