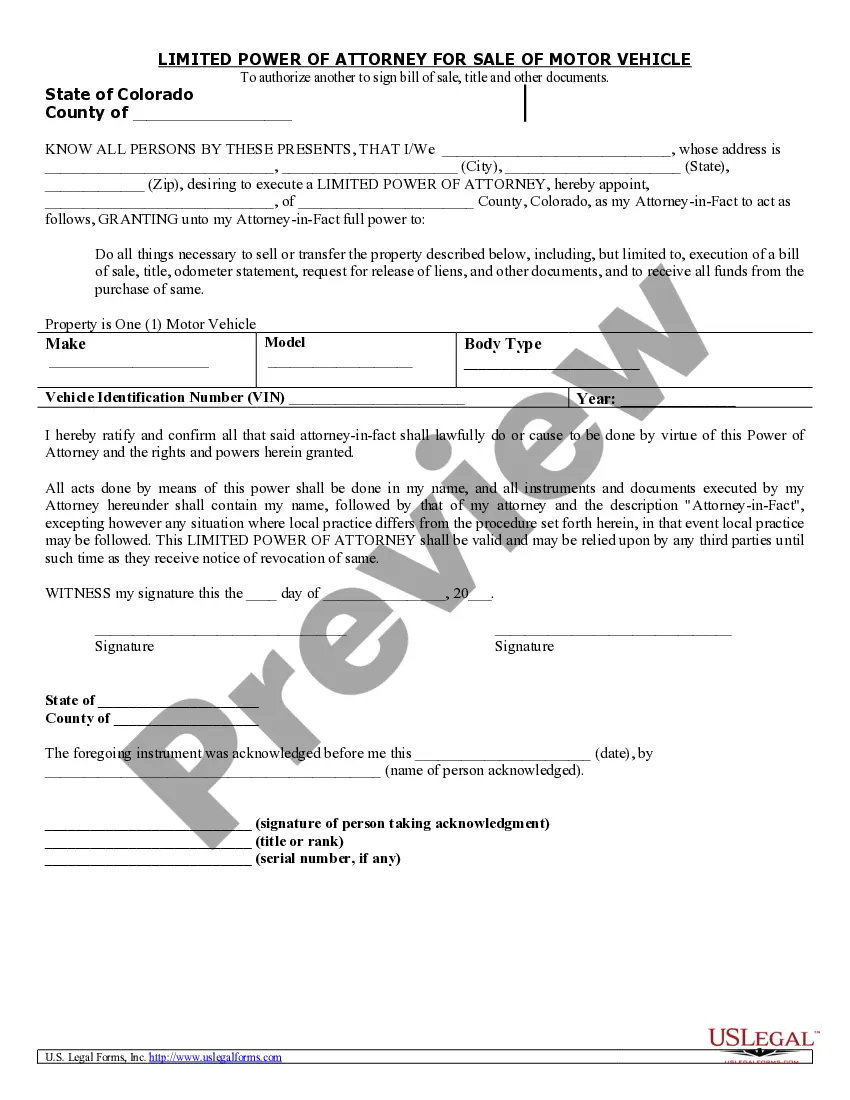

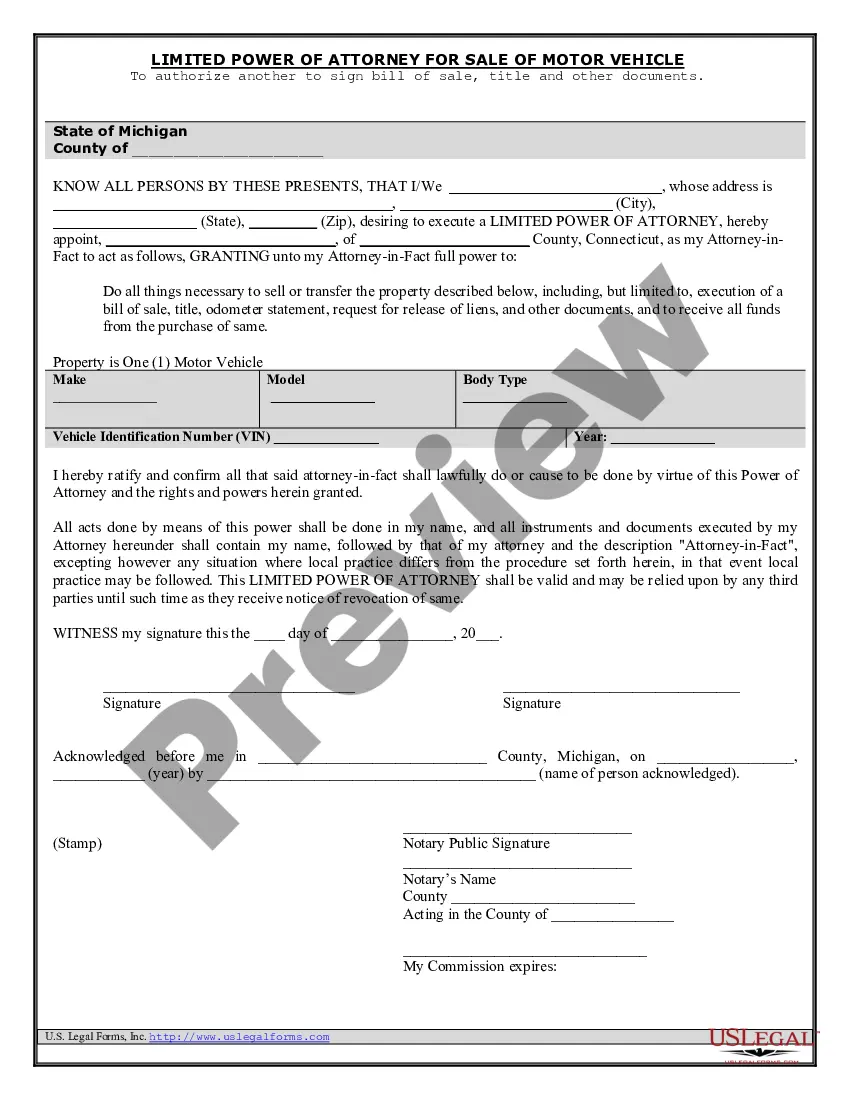

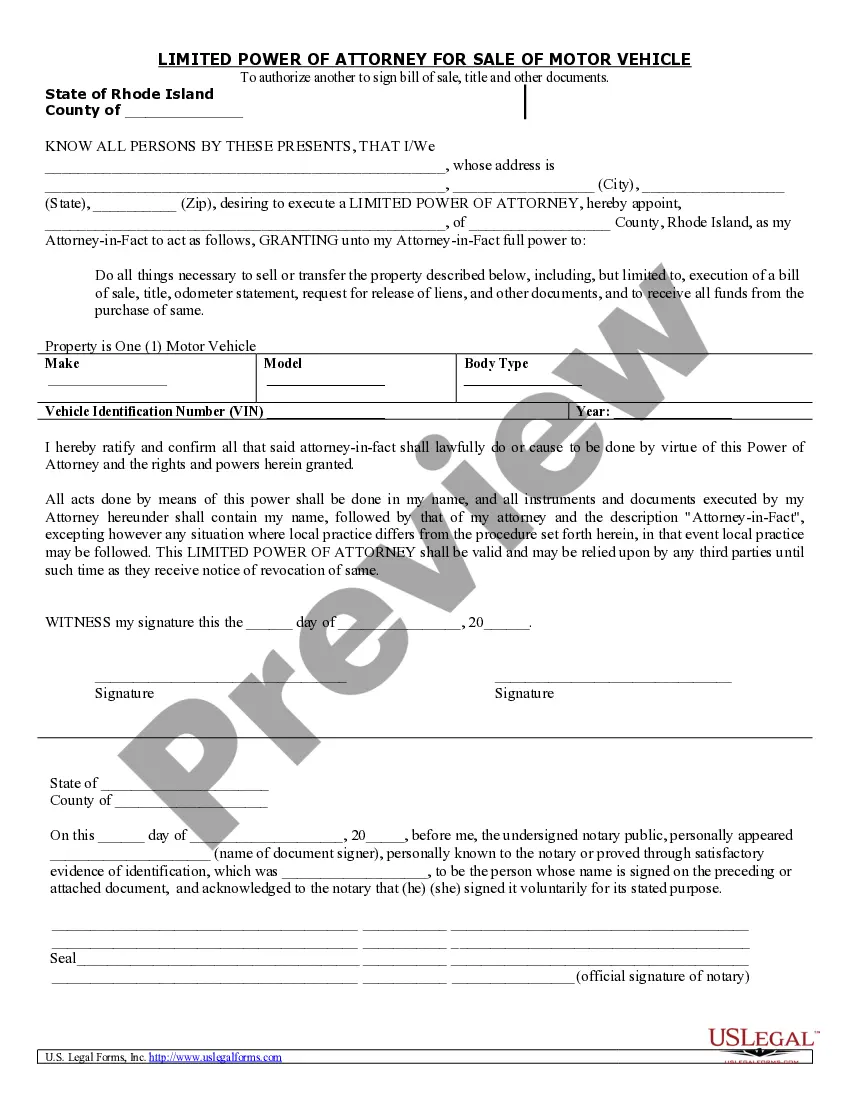

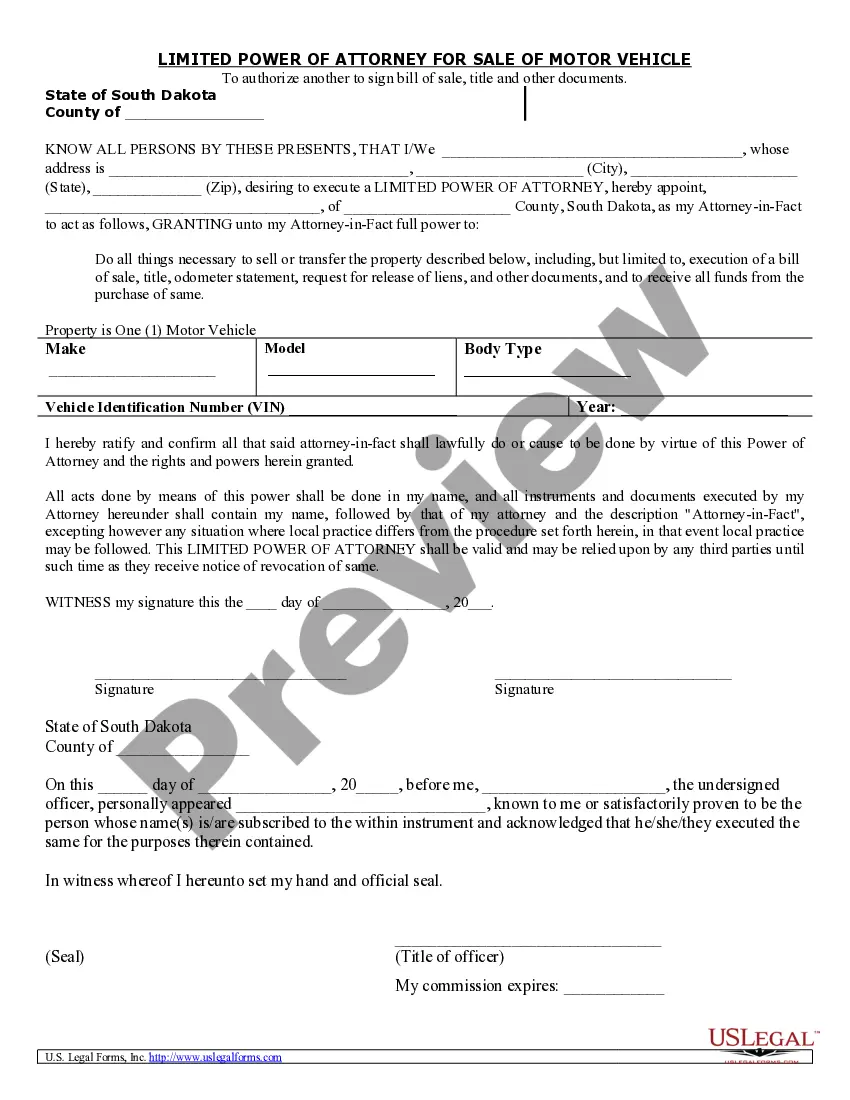

This is a limited power of attorney authorizing your agent to execute a bill of sale, title and other documents in connection with the sale of a motor vehicle. This form contains a state specific acknowledgment. This form allows your agent to do all things necessary to sell or transfer property, including the execution of a bill of sale, title, odometer statement, request for release of liens and other documents and to receive all funds from the purchase of the same.

South Dakota Power of Attorney for Sale of Motor Vehicle

Description Power Of Attorney For Selling Car

How to fill out South Dakota Power Of Attorney For Sale Of Motor Vehicle?

Get access to quality South Dakota Power of Attorney for Sale of Motor Vehicle samples online with US Legal Forms. Avoid hours of lost time looking the internet and lost money on files that aren’t up-to-date. US Legal Forms gives you a solution to just that. Find around 85,000 state-specific authorized and tax samples that you could download and submit in clicks in the Forms library.

To receive the sample, log in to your account and click Download. The file will be stored in two places: on the device and in the My Forms folder.

For people who don’t have a subscription yet, check out our how-guide below to make getting started easier:

- Find out if the South Dakota Power of Attorney for Sale of Motor Vehicle you’re considering is suitable for your state.

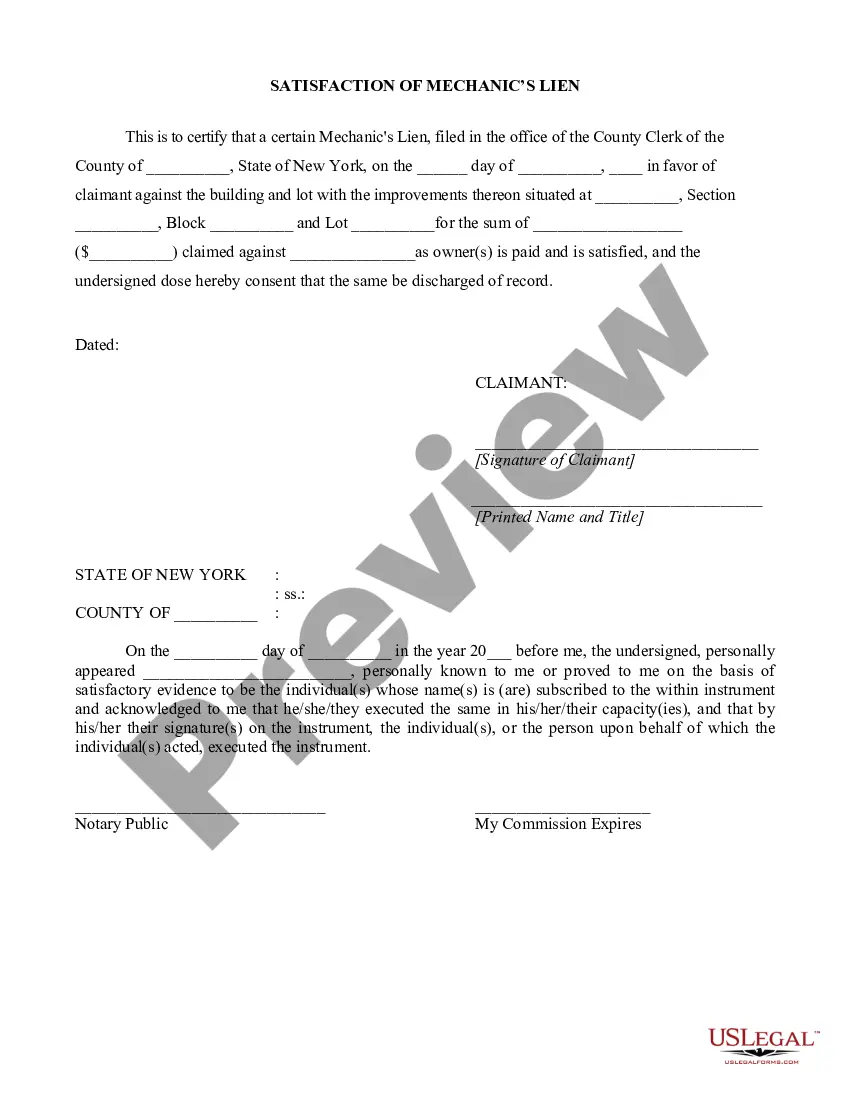

- Look at the sample utilizing the Preview function and browse its description.

- Go to the subscription page by clicking Buy Now.

- Select the subscription plan to go on to register.

- Pay by credit card or PayPal to finish making an account.

- Choose a preferred file format to save the document (.pdf or .docx).

You can now open the South Dakota Power of Attorney for Sale of Motor Vehicle sample and fill it out online or print it and do it by hand. Think about mailing the document to your legal counsel to be certain everything is filled out properly. If you make a mistake, print and fill sample again (once you’ve made an account every document you save is reusable). Create your US Legal Forms account now and access a lot more samples.

Power Of Attorney Vehicle Title Form popularity

Sd Vehicle Bill Of Sale Other Form Names

FAQ

A power of attorney (or POA) is a legal document that grants a person or organization the legal authority to act on another's behalf and make certain decisions for them.A power of attorney needs to be signed in front of a licensed notary public in order to be legally binding.

No, a South Dakota bill of sale is not required to register a vehicle. However, South Dakota does provide a Bill of Sale (Form MV-16) for your personal use for motor vehicle sales. You should also complete a South Dakota Application for Motor Vehicle Title & Registration (Form-0864 V 21).

Most states do not require a POA to be in writing in order to be effective, except in specific cases established by statute.As a result, most POAs can be executed electronically with or without authorization under the eCommerce laws, since there is no writing or signature requirement to begin with.

Complete a bill of sale with the buyer, and make sure both you sign it. Get a lien release. If the car is less than 10 years old, complete the odometer disclosure section on the Application for Motor Vehicle Title and Registration. Complete the Seller's Report of Sale from and file it with the county treasurer.

When you're ready to have the title transferred, make sure the agent signs the title or deed in their capacity as your agent. They should sign either: a) Jane Smith principal's name, by Sally Stevens agent's name under Power of Attorney, or b) Sally Stevens, attorney-in-fact for Jane Smith.

Remember that all of the authorized agents under the power of attorney or representatives in an estate must sign the listing agreement, disclosure documents, etc. For example, when there are two executors in an estate, then they both must sign the Listing Contract.

Signing Requirements: No specific signing requirement; however, it is suggested that the document be notarized. Tax Power of Attorney (Form RV-071) Used when you wish to appoint another to take care of your tax issues in front of the tax authority, such as to obtain information and make filings, etc.

In many states, notarization is required by law to make the durable power of attorney valid. But even where law doesn't require it, custom usually does. A durable power of attorney that isn't notarized may not be accepted by people with whom your attorney-in-fact tries to deal.

While laws vary between states, a POA can't typically add or remove signers from your bank account unless you include this responsibility in the POA document.If you don't include a clause giving the POA this authority, then financial institutions won't allow your POA to make ownership changes to your accounts.