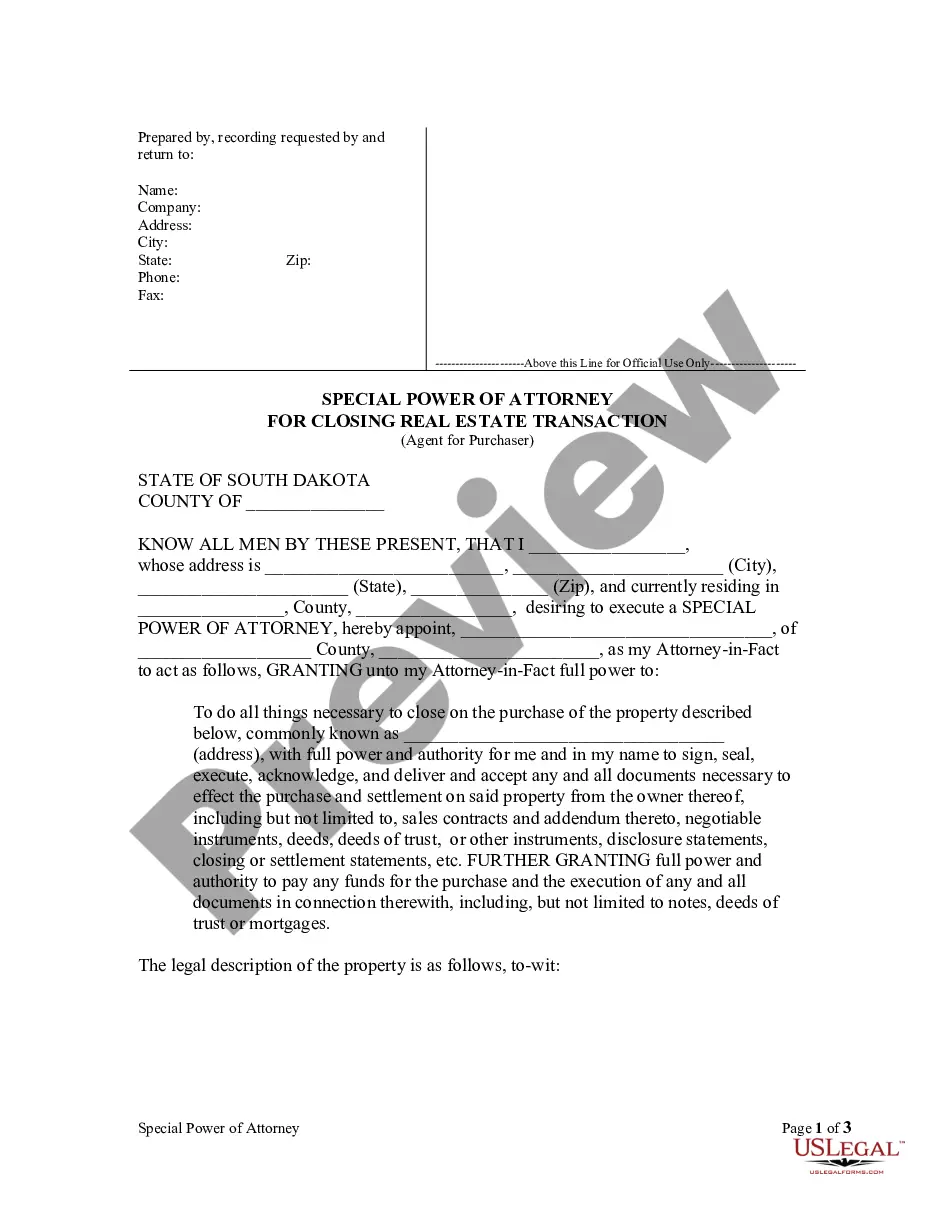

This Power of Attorney for Real Estate Transaction form is for a Purchaser to authorize an attorney-in-fact to execute all documents and do all things necessary to purchase a particular parcel of real estate for purchaser, including loan documents. This form must be signed and notarized.

South Dakota Special or Limited Power of Attorney for Real Estate Purchase Transaction by Purchaser

Description

How to fill out South Dakota Special Or Limited Power Of Attorney For Real Estate Purchase Transaction By Purchaser?

Access to quality South Dakota Special or Limited Power of Attorney for Real Estate Purchase Transaction by Purchaser samples online with US Legal Forms. Avoid hours of lost time browsing the internet and lost money on forms that aren’t up-to-date. US Legal Forms offers you a solution to just that. Find over 85,000 state-specific authorized and tax forms that you could save and complete in clicks in the Forms library.

To get the example, log in to your account and click on Download button. The file will be stored in two places: on the device and in the My Forms folder.

For individuals who don’t have a subscription yet, take a look at our how-guide listed below to make getting started easier:

- See if the South Dakota Special or Limited Power of Attorney for Real Estate Purchase Transaction by Purchaser you’re considering is suitable for your state.

- See the sample making use of the Preview option and read its description.

- Go to the subscription page by simply clicking Buy Now.

- Select the subscription plan to continue on to register.

- Pay out by credit card or PayPal to finish creating an account.

- Select a preferred file format to download the document (.pdf or .docx).

You can now open the South Dakota Special or Limited Power of Attorney for Real Estate Purchase Transaction by Purchaser sample and fill it out online or print it out and get it done by hand. Take into account sending the document to your legal counsel to ensure all things are filled out correctly. If you make a error, print out and fill sample again (once you’ve registered an account every document you save is reusable). Create your US Legal Forms account now and access much more forms.

Form popularity

FAQ

An estate consists of cash, cars, real estate and anything else owned by the deceased that has value.A deceased person's heirs receive any amount left over after all debts are settled, as dictated by the terms of a valid will.

The primary purpose of an estate plan is to help you examine your financial needs and assets in order to make sure that your heirs are provided for in the best possible way, including lifetime planning as well as disposition of property at death.

Estate administration is the process that occurs after a person dies. During this process, the decedent's probate assets are collected, creditors are paid, and then the remaining assets are distributed to the decedent's beneficiaries in accordance with the decedent's will.

An estate is the economic valuation of all the investments, assets, and interests of an individual. The estate includes a person's belongings, physical and intangible assets, land and real estate, investments, collectibles, and furnishings.Estate taxes may be levied on the value of one's estate at death.

Unfortunately, every estate is different, and that means timelines can vary. A simple estate with just a few, easy-to-find assets may be all wrapped up in six to eight months. A more complicated affair may take three years or more to fully settle.

An estate, in common law, is the net worth of a person at any point in time alive or dead. It is the sum of a person's assets legal rights, interests and entitlements to property of any kind less all liabilities at that time.The term is also used to refer to the sum of a person's assets only.

An estate consists of cash, cars, real estate and anything else owned by the deceased that has value.A deceased person's heirs receive any amount left over after all debts are settled, as dictated by the terms of a valid will.

Noun. a piece of landed property, especially one of large extent with an elaborate house on it: to have an estate in the country. Law. property or possessions. the legal position or status of an owner, considered with respect to property owned in land or other things.

Estate: The assets you own at your death that could be used to pay your debts, including all personal property, real property, and other liquid assets.