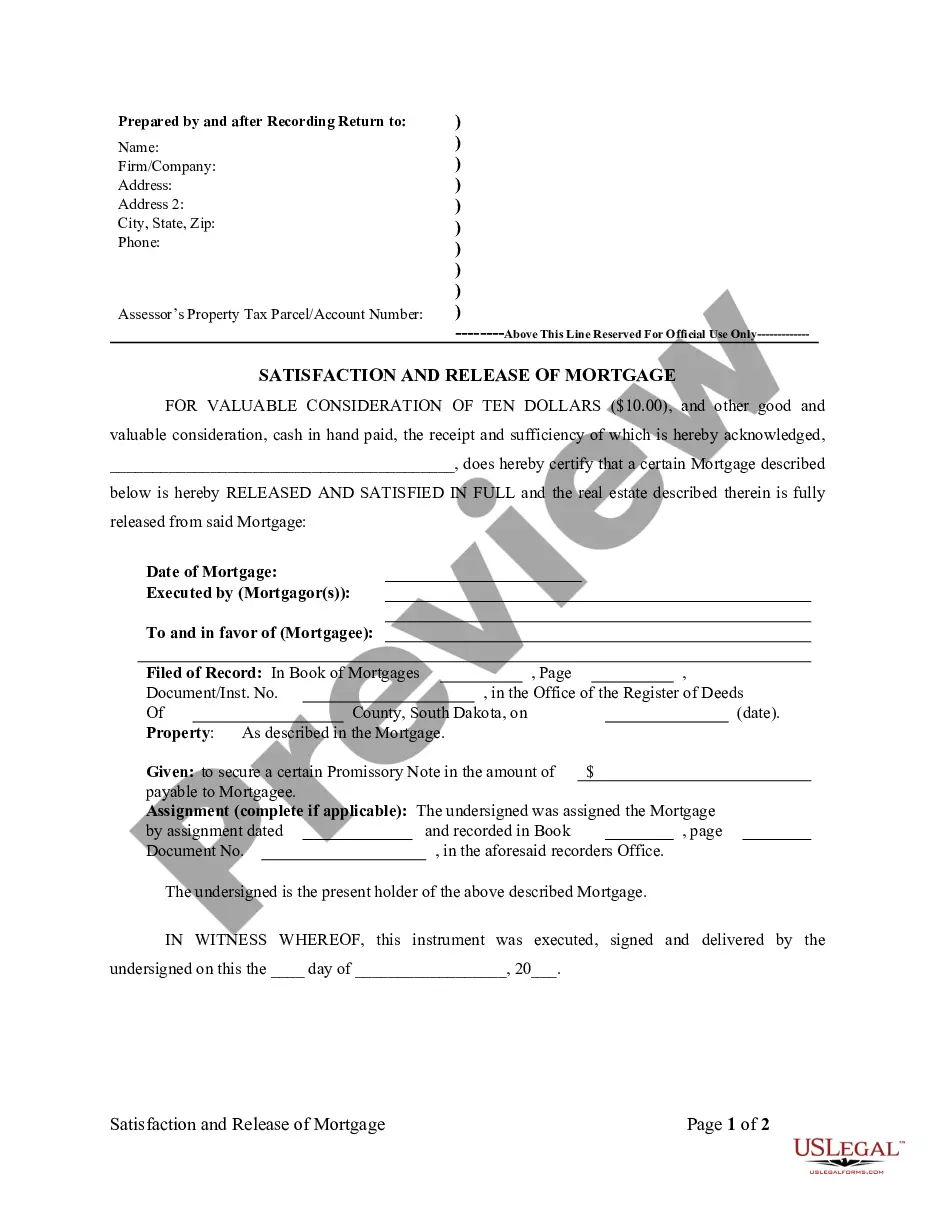

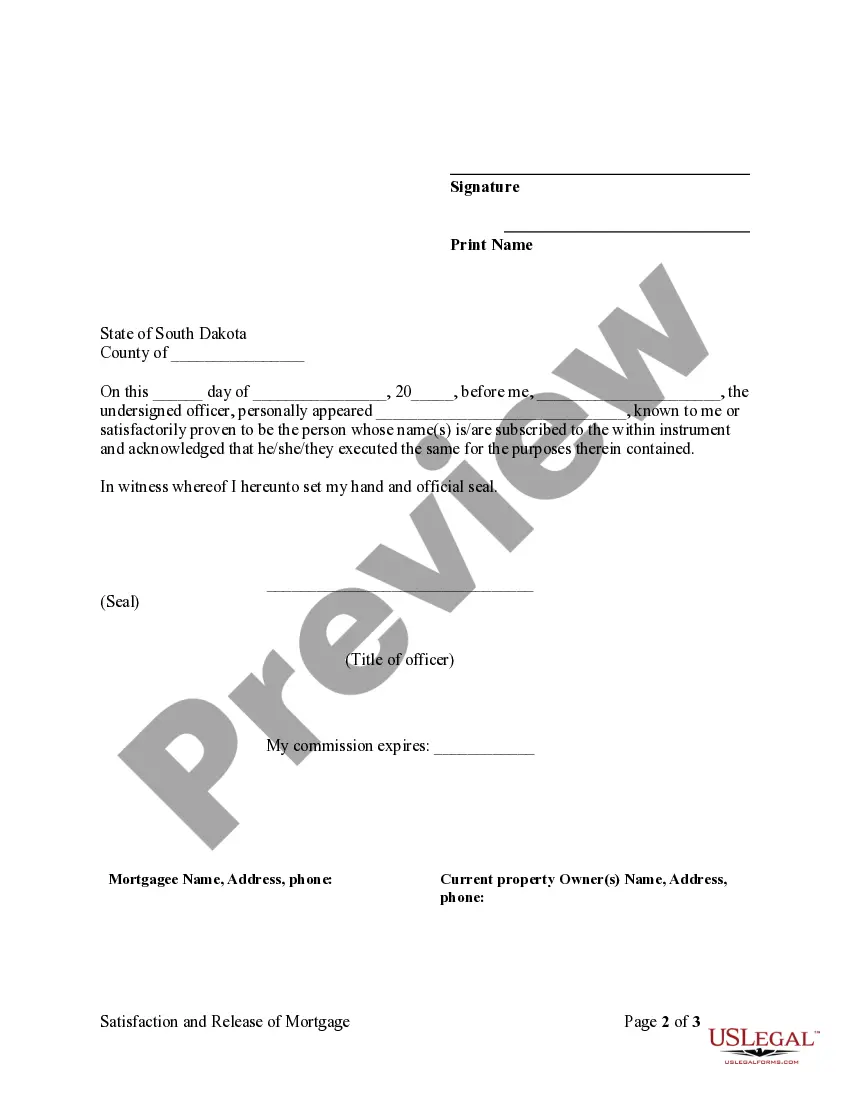

This form is for the satisfaction or release of a deed of trust for the state of South Dakota by an Individual. This form complies with all state statutory laws and requires signing in front of a notary public. The described real estate is therefore released from the mortgage.

South Dakota Release of Mortgage by Lender - Individual Lender or Holder

Description

How to fill out South Dakota Release Of Mortgage By Lender - Individual Lender Or Holder?

Access to top quality South Dakota Release of Mortgage by Lender - Individual Lender or Holder samples online with US Legal Forms. Prevent days of misused time browsing the internet and lost money on files that aren’t up-to-date. US Legal Forms provides you with a solution to exactly that. Get above 85,000 state-specific legal and tax forms you can download and complete in clicks in the Forms library.

To receive the example, log in to your account and click Download. The file is going to be stored in two places: on the device and in the My Forms folder.

For people who don’t have a subscription yet, take a look at our how-guide below to make getting started easier:

- Check if the South Dakota Release of Mortgage by Lender - Individual Lender or Holder you’re considering is appropriate for your state.

- View the form utilizing the Preview function and browse its description.

- Visit the subscription page by simply clicking Buy Now.

- Select the subscription plan to continue on to register.

- Pay by card or PayPal to finish creating an account.

- Choose a preferred file format to save the file (.pdf or .docx).

Now you can open the South Dakota Release of Mortgage by Lender - Individual Lender or Holder sample and fill it out online or print it and do it yourself. Think about sending the document to your legal counsel to ensure all things are filled in correctly. If you make a error, print and complete sample once again (once you’ve created an account all documents you download is reusable). Create your US Legal Forms account now and access a lot more forms.

Form popularity

FAQ

Total closing costs to purchase a $300,000 home could cost anywhere from approximately $6,000 to $12,000 or even more. The funds can't typically be borrowed because that would raise the buyer's loan ratios to a point where they might no longer qualify.

When a borrower prepays their mortgage or makes the final mortgage payment, a satisfaction of mortgage document must be prepared, signed, and filed by the financial institution in ownership of the mortgage. The satisfaction of mortgage document is created by a lending institution and their legal counsel.

Closing costs typically range from 3% to 6% of the home's purchase price. 1feff Thus, if you buy a $200,000 house, your closing costs could range from $6,000 to $12,000. Closing fees vary depending on your state, loan type, and mortgage lender, so it's important to pay close attention to these fees.

The buyer receives the deed from the seller and becomes the legal owner.A contract for deed is a contract where the seller remains the legal owner of the property and the buyer makes monthly payments to the seller to buy the house. The seller remains the legal owner of the property until the contract is paid.

The best guess most financial advisors and websites will give you is that closing costs are typically between 2 and 5% of the home value. True enough, but even on a $150,000 house, that means closing costs could be anywhere between $3,000 and $7,500 that's a huge range!

In South Dakota, typical closing costs including origination fees charged by the lender and third-party fees like appraisals, flood certification fees, and the fee charged by the closing attorney. According to a study from Bankrate, closing fees in South Dakota typically average $1,814.

While the buyers will typically be responsible for the lion's share, sellers should expect to pay between 1-3% of the home's final sale price at closing.