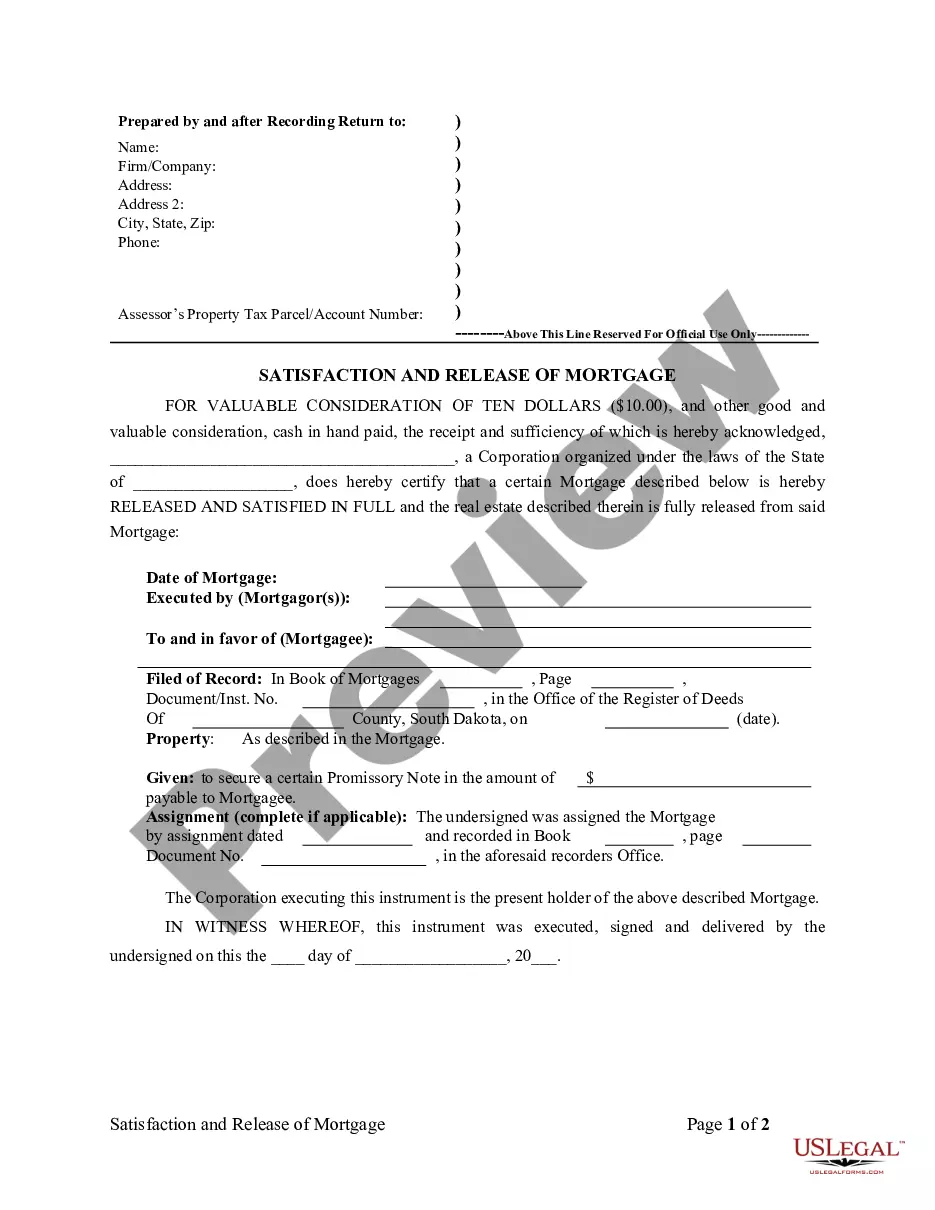

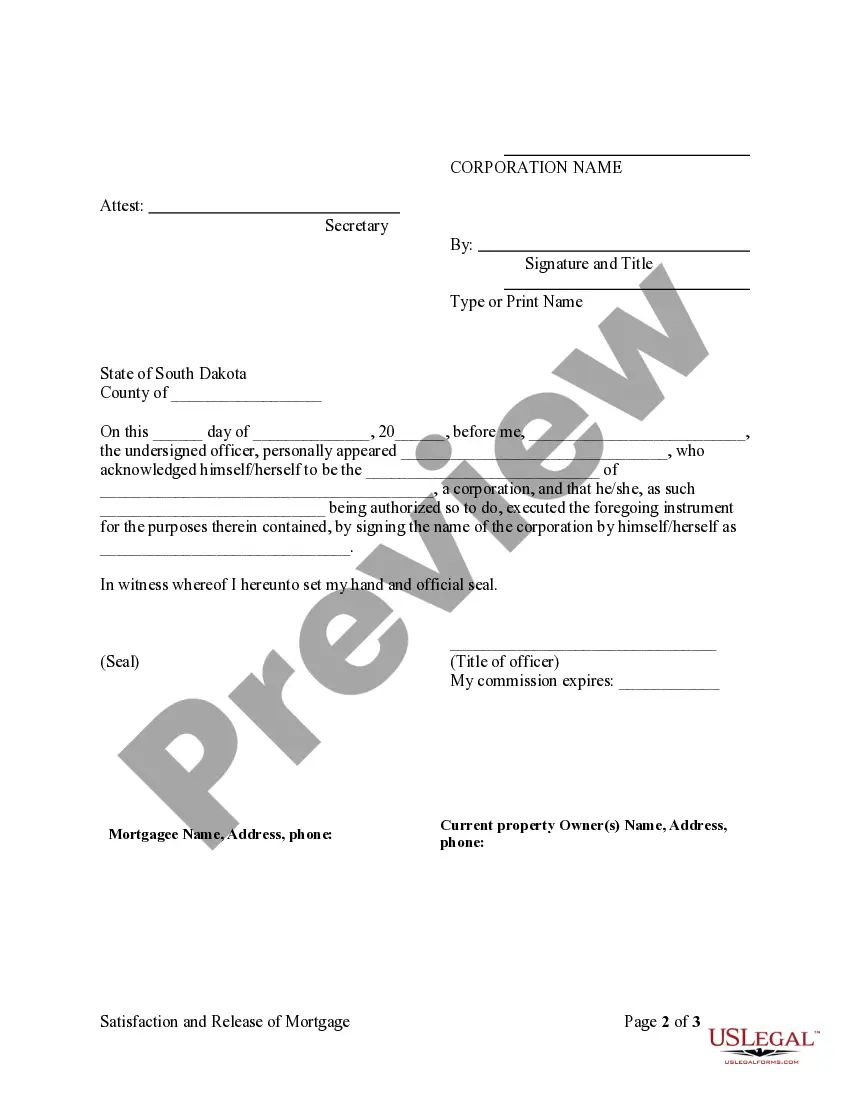

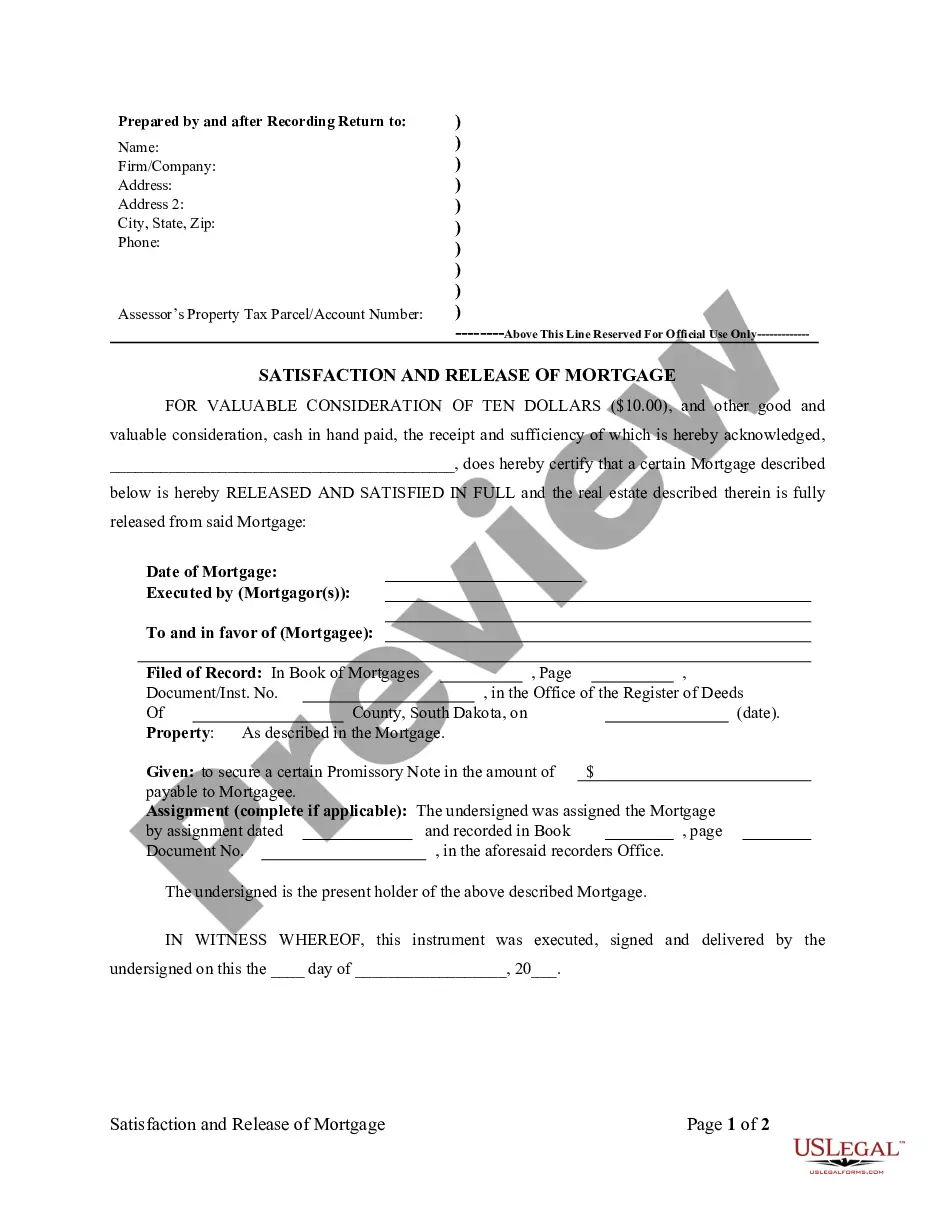

This Release - Satisfaction - Cancellation Deed of Trust - by Corporate Lender is for the satisfaction or release of a mortgage for the state of South Dakota by a Corporation. This form complies with all state statutory laws and requires signing in front of a notary public. The described real estate is therefore released from the mortgage.

South Dakota Release of Mortgage by Lender - by Corporate Lender

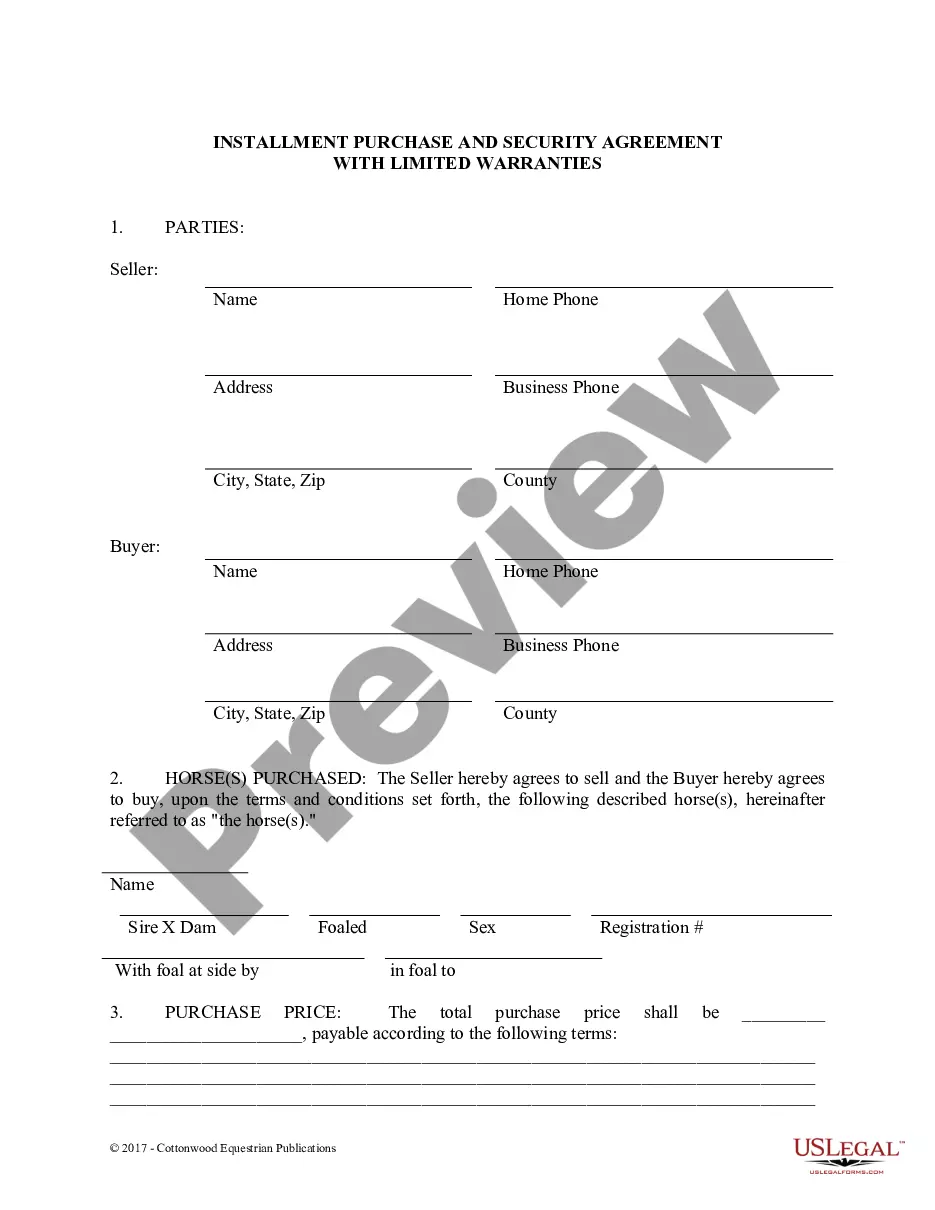

Description Mortgage Real Estate Buy

How to fill out Sd Release Mortgage Purchase?

Access to high quality South Dakota Release of Mortgage by Lender - by Corporate Lender templates online with US Legal Forms. Steer clear of hours of wasted time looking the internet and dropped money on files that aren’t up-to-date. US Legal Forms gives you a solution to exactly that. Get above 85,000 state-specific authorized and tax templates that you can download and complete in clicks in the Forms library.

To receive the example, log in to your account and click on Download button. The document is going to be stored in two places: on your device and in the My Forms folder.

For those who don’t have a subscription yet, take a look at our how-guide below to make getting started simpler:

- Check if the South Dakota Release of Mortgage by Lender - by Corporate Lender you’re looking at is appropriate for your state.

- Look at the form using the Preview function and read its description.

- Check out the subscription page by clicking on Buy Now button.

- Choose the subscription plan to continue on to register.

- Pay by credit card or PayPal to complete creating an account.

- Select a preferred format to download the document (.pdf or .docx).

Now you can open the South Dakota Release of Mortgage by Lender - by Corporate Lender template and fill it out online or print it out and get it done yourself. Take into account mailing the papers to your legal counsel to make sure everything is filled out correctly. If you make a mistake, print and complete sample once again (once you’ve registered an account all documents you download is reusable). Make your US Legal Forms account now and get more samples.

Release Mortgage Real Online Form popularity

Mortgage Corporate Estate Other Form Names

Release Mortgage Real Blank FAQ

When you pay off your loan and you have a mortgage, the lender will send you or the local recorder of deeds or office that handles the filing of real estate documents a release of mortgage.On the other hand, when you have a trust deed or deed of trust, the lender files a release deed.

People can just let the home go to foreclosure, and this will affect their scores for seven years. Or they can do a deed in lieu of foreclosure. With a deed in lieu, you voluntarily give your home to the lender in exchange for the cancellation of your loan. This, too, can create a negative mark on your credit history.

A Satisfaction of Mortgage, also known as a Mortgage Lien Release, is a legal document provided by the mortgagee (financial institution) advising that the mortgage has been paid in full, all terms of the loan have been satisfied and there will no longer be a lien on the property.

Step 1 Identify the parties. The appropriate parties should be documented on the Satisfaction of Mortgage. Step 2 Fill and Sign. The Satisfaction of Mortgage should be signed by the mortgagee, after it has been issued. Step 3 File and Record the Form.

In California, only the lien holder the mortgage lender can remove the lien. California law is fairly strict, however, as it give the lender just 30 days to issue and record the appropriate release.

In order to clear the title to the real property owned by the mortgagor, the Satisfaction of Mortgage document must be recorded with the County Recorder or Recorder of Deeds. If the mortgagee fails to record a satisfaction within the set time limits, the mortgagee may be responsible for damages set out by statute.

A Mortgage Release is where you, the homeowner, voluntarily transfer the ownership of your property to the owner of your mortgage in exchange for a release from your mortgage loan and payments.Depending on your situation, you may be required to make a financial contribution to receive a mortgage release.

DON'T: Make large deposits or withdrawals. Part of the mortgage application process includes providing recent bank statements. DON'T: Change jobs. DON'T: Make large purchases on credit. DON'T: Run up a home equity line of credit. DON'T: Close credit accounts. DON'T: Make payments on collection accounts.

A Satisfaction of Mortgage, sometimes called a release of mortgage, is a document that acknowledges that the terms of a Mortgage Agreement have been satisfied, meaning that a borrower has repaid their mortgage loan to the lender.