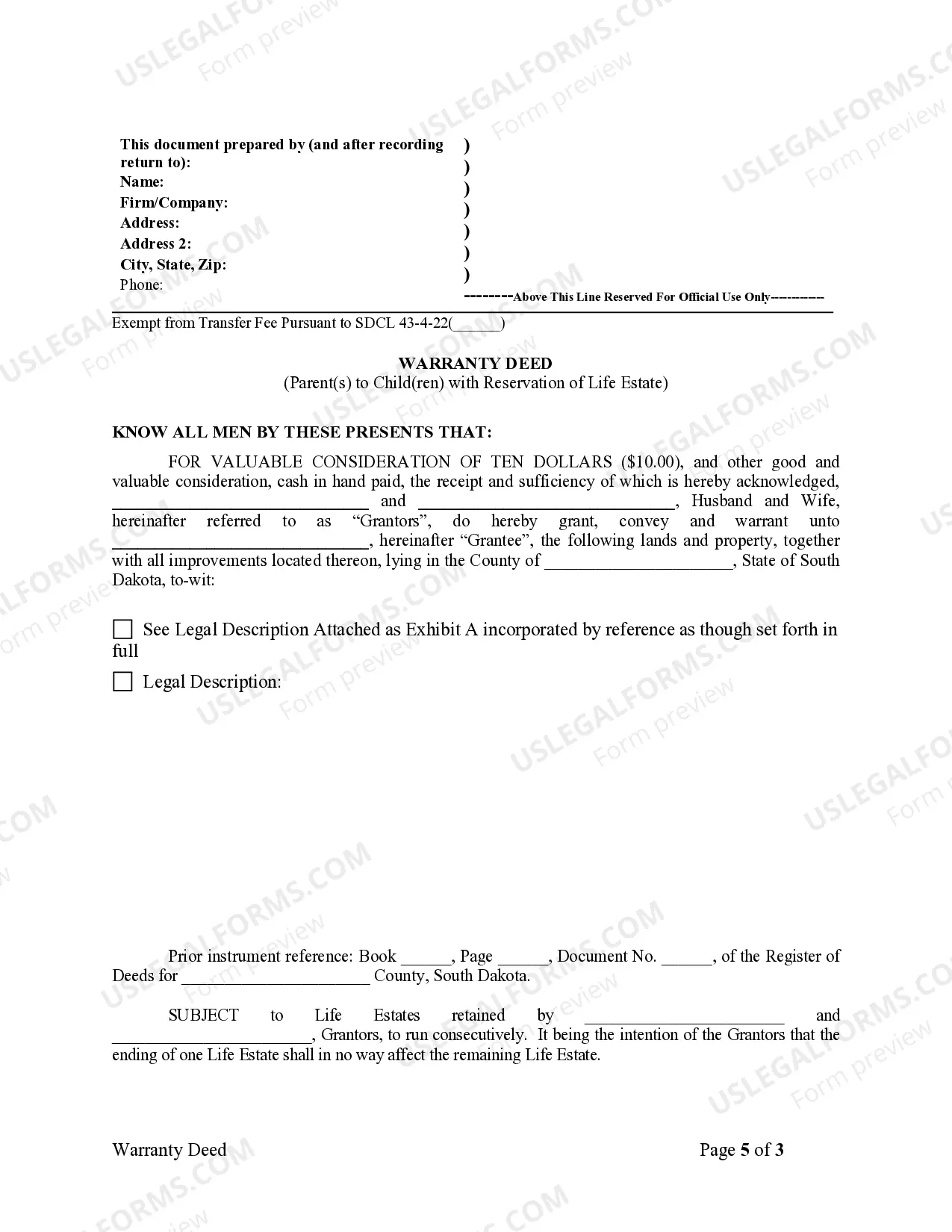

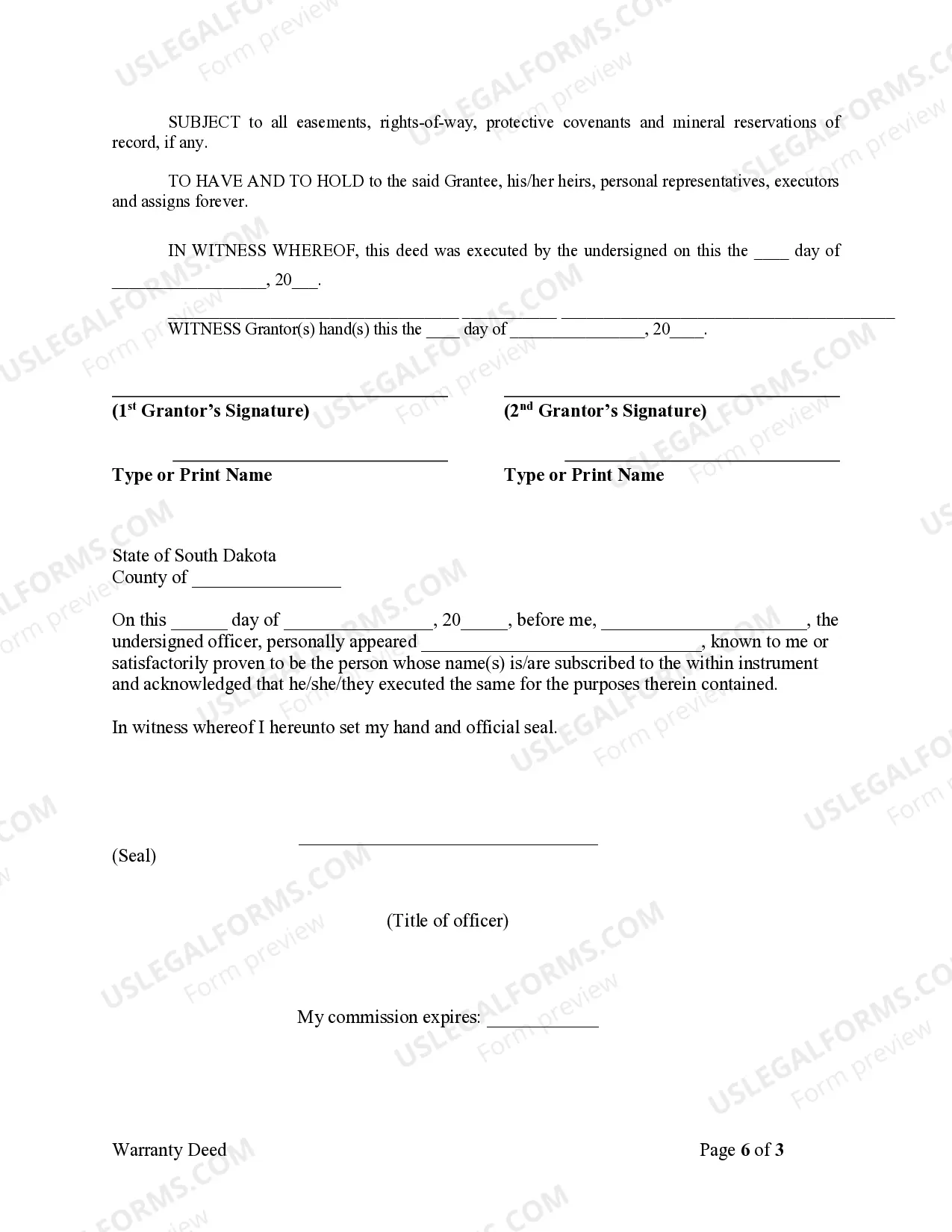

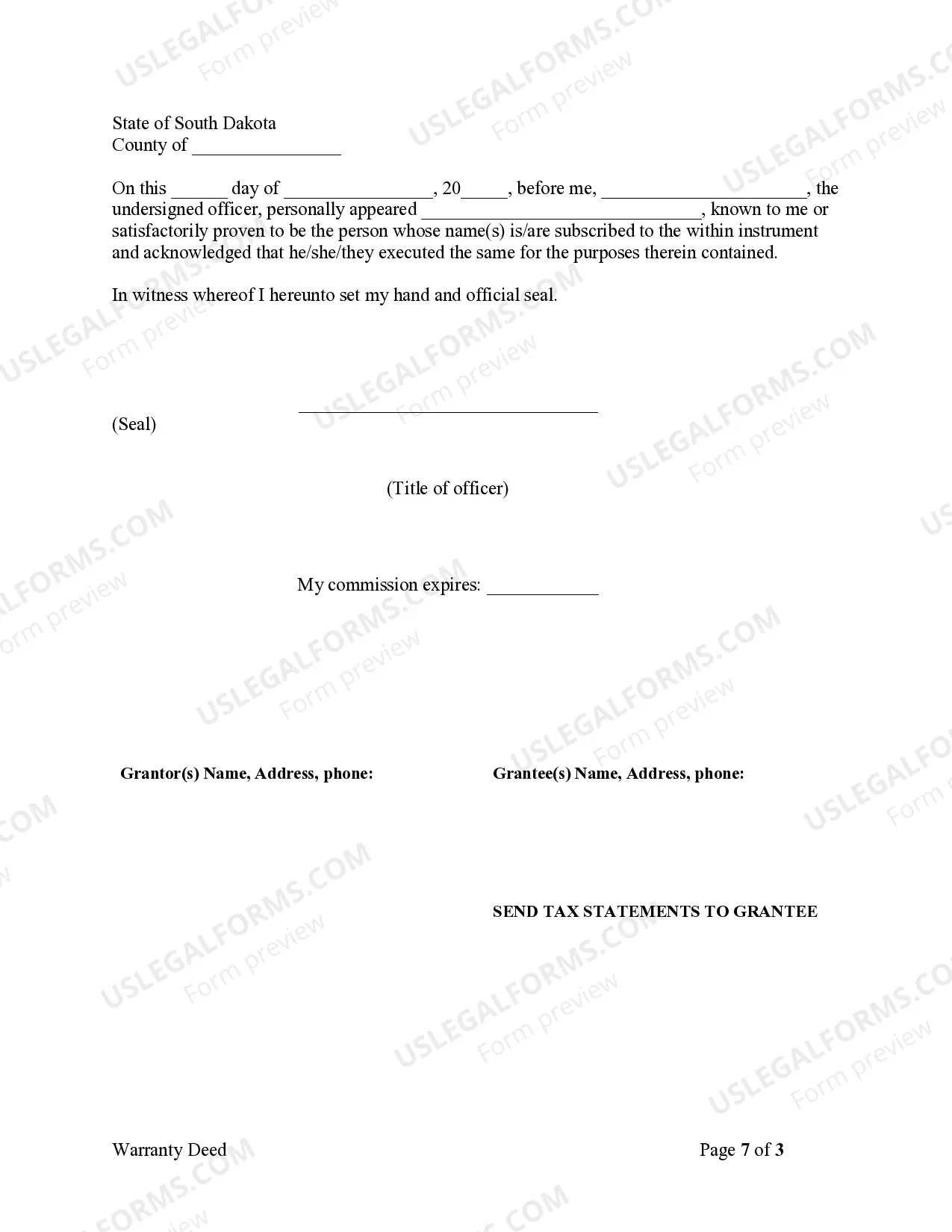

This form is a Warranty Deed where the grantor(s) retains a life estate in the described property.

South Dakota Warranty Deed for Parents to Child with Reservation of Life Estate

Description Life Estate Deed South Dakota

How to fill out South Dakota Warranty Deed For Parents To Child With Reservation Of Life Estate?

Among lots of paid and free templates that you’re able to get on the net, you can't be sure about their accuracy and reliability. For example, who created them or if they’re qualified enough to deal with the thing you need them to. Always keep calm and use US Legal Forms! Find South Dakota Warranty Deed for Parents to Child with Reservation of Life Estate templates created by skilled legal representatives and avoid the high-priced and time-consuming process of looking for an attorney and then having to pay them to draft a document for you that you can find on your own.

If you have a subscription, log in to your account and find the Download button next to the form you’re searching for. You'll also be able to access your previously acquired samples in the My Forms menu.

If you’re utilizing our website the very first time, follow the guidelines below to get your South Dakota Warranty Deed for Parents to Child with Reservation of Life Estate quick:

- Ensure that the document you find applies in your state.

- Look at the file by reading the description for using the Preview function.

- Click Buy Now to begin the ordering process or find another example using the Search field in the header.

- Select a pricing plan and create an account.

- Pay for the subscription with your credit/debit/debit/credit card or Paypal.

- Download the form in the required format.

When you’ve signed up and bought your subscription, you can use your South Dakota Warranty Deed for Parents to Child with Reservation of Life Estate as often as you need or for as long as it remains active in your state. Edit it with your favorite editor, fill it out, sign it, and print it. Do a lot more for less with US Legal Forms!

Dakota Warranty Form popularity

FAQ

Gift Taxes In most cases, no gift tax should be owed as a result of the creation of the Life Estate form. However, since you may be required to file a gift tax return, it is important to consult your accountant prior to filing your income tax return for the year in which the transfer was made.

What happens to a life estate after someone dies? Upon the life tenant's death, the property passes to the remainder owner outside of probate.They can sell the property or move into and claim it as their primary residence (homestead). Property taxes will not be reassessed.

A person owns property in a life estate only throughout their lifetime. Beneficiaries cannot sell property in a life estate before the beneficiary's death. One benefit of a life estate is that property can pass when the life tenant dies without being part of the tenant's estate.

Can a life estate deed be changed? It is challenging to modify or change a life estate deed. The grantor cannot change the life estate as he or she has no power to do so after creating the life estate deed unless all of the future tenants agree. It requires the permission or consent of every one of the beneficiaries.

A life estate, when used to gift property, splits ownership between the giver and receiver. Many parents set up a life estate to reduce their assets in order to qualify for Medicaid. Even though the parent still retains some interest in the property, Medicaid does not count it as an asset.

The life tenant is responsible for the payment of real estate taxes on the property.

A California Revocable Transfer-On-Death Deed does not take effect until the property owner dies.As long as the original owner is alive, he can revoke the transfer, sell the property, add or remove beneficiaries, and otherwise maintain complete control over the property.

A life estate is usually property that has been acquired during the lifetime of a person with his or her ownership only lasting through the time he or she lives.This also means he or she cannot sell it, rent it or alter it until the life tenant passes on or leaves permanently.

A life estate deed permits the property owner to have full use of their property until their death, at which point the ownership of the property is automatically transferred to the beneficiary.