South Dakota Statement of Qualification of A Foreign LLLP

Description

How to fill out South Dakota Statement Of Qualification Of A Foreign LLLP?

If you’re looking for a way to properly complete the South Dakota Statement of Qualification of A Foreign LLLP without hiring a lawyer, then you’re just in the right spot. US Legal Forms has proven itself as the most extensive and reliable library of formal templates for every private and business scenario. Every piece of paperwork you find on our online service is drafted in accordance with federal and state regulations, so you can be certain that your documents are in order.

Adhere to these straightforward instructions on how to acquire the ready-to-use South Dakota Statement of Qualification of A Foreign LLLP:

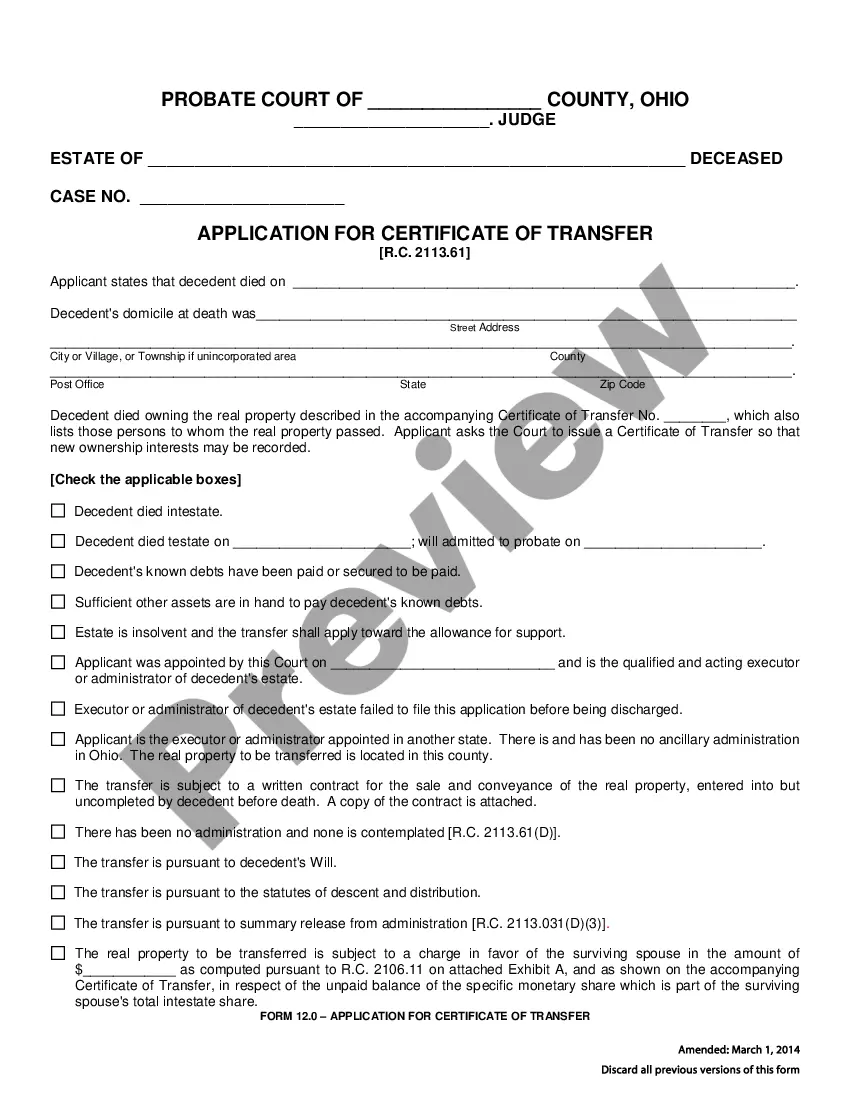

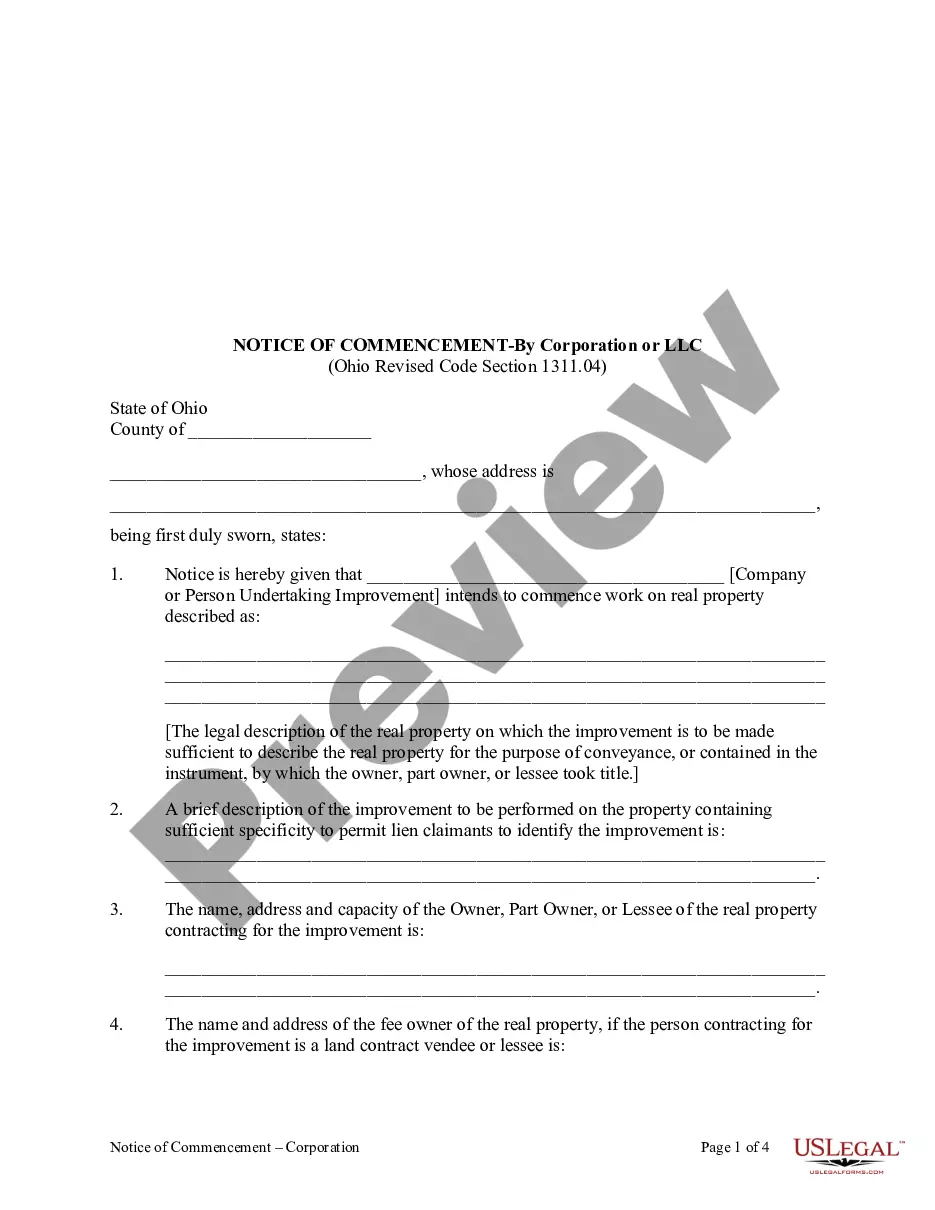

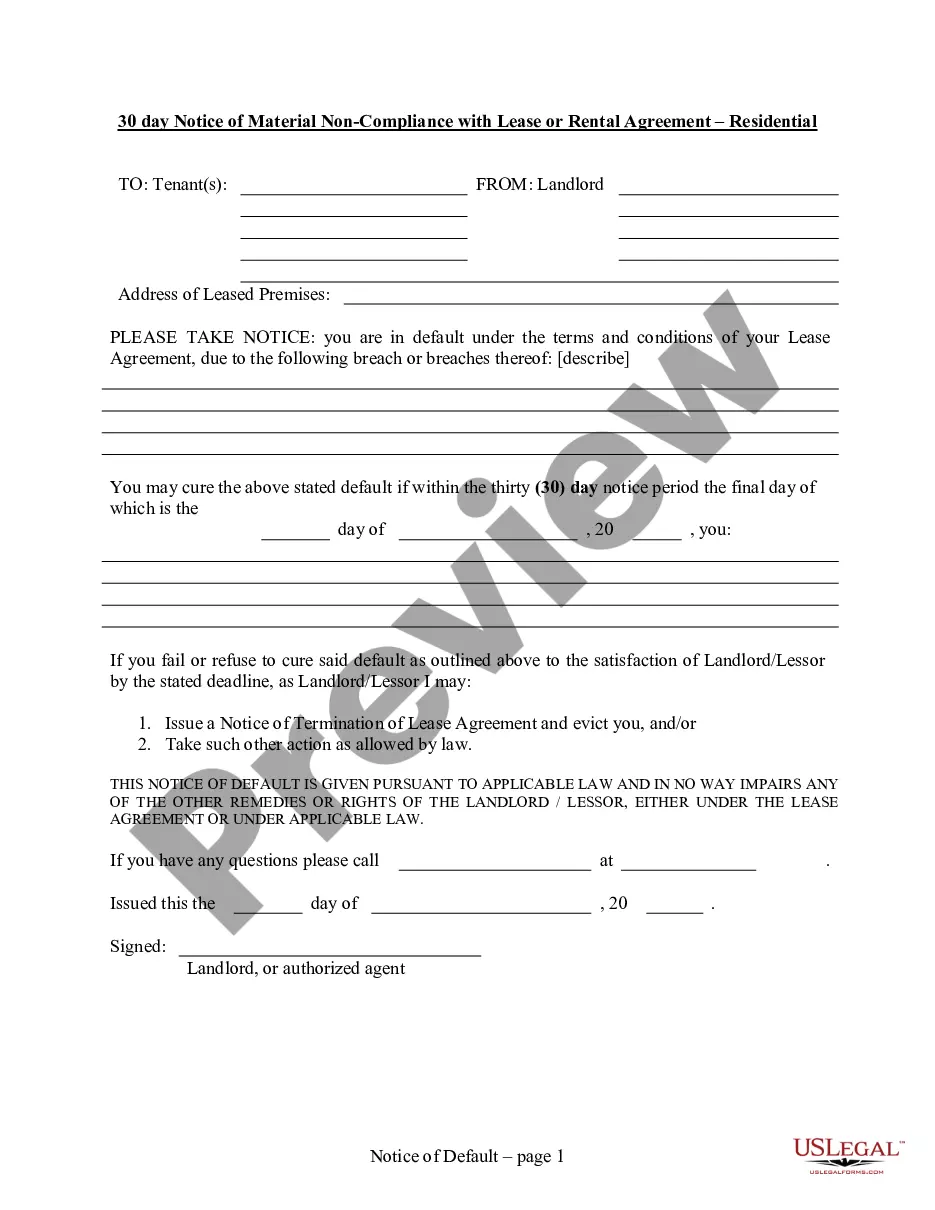

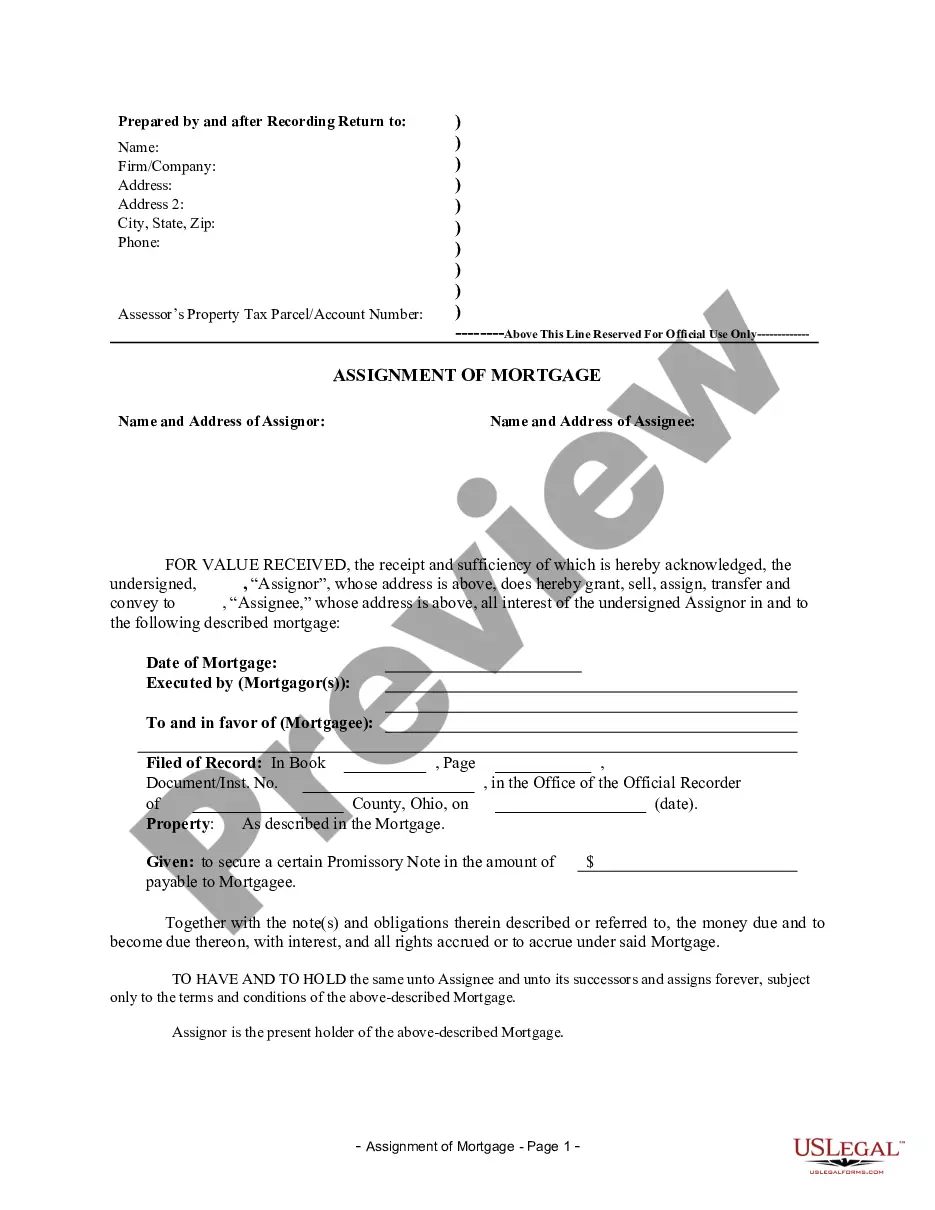

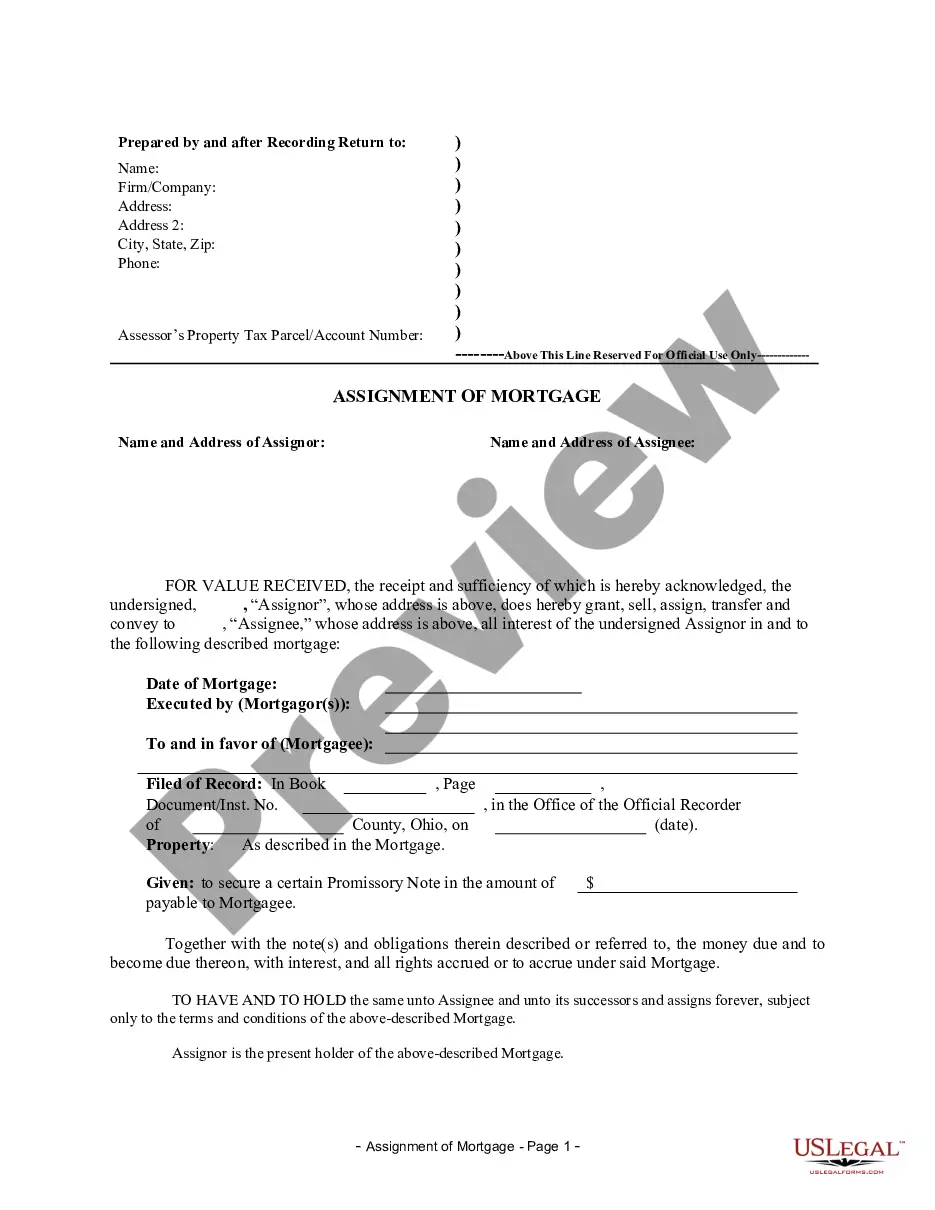

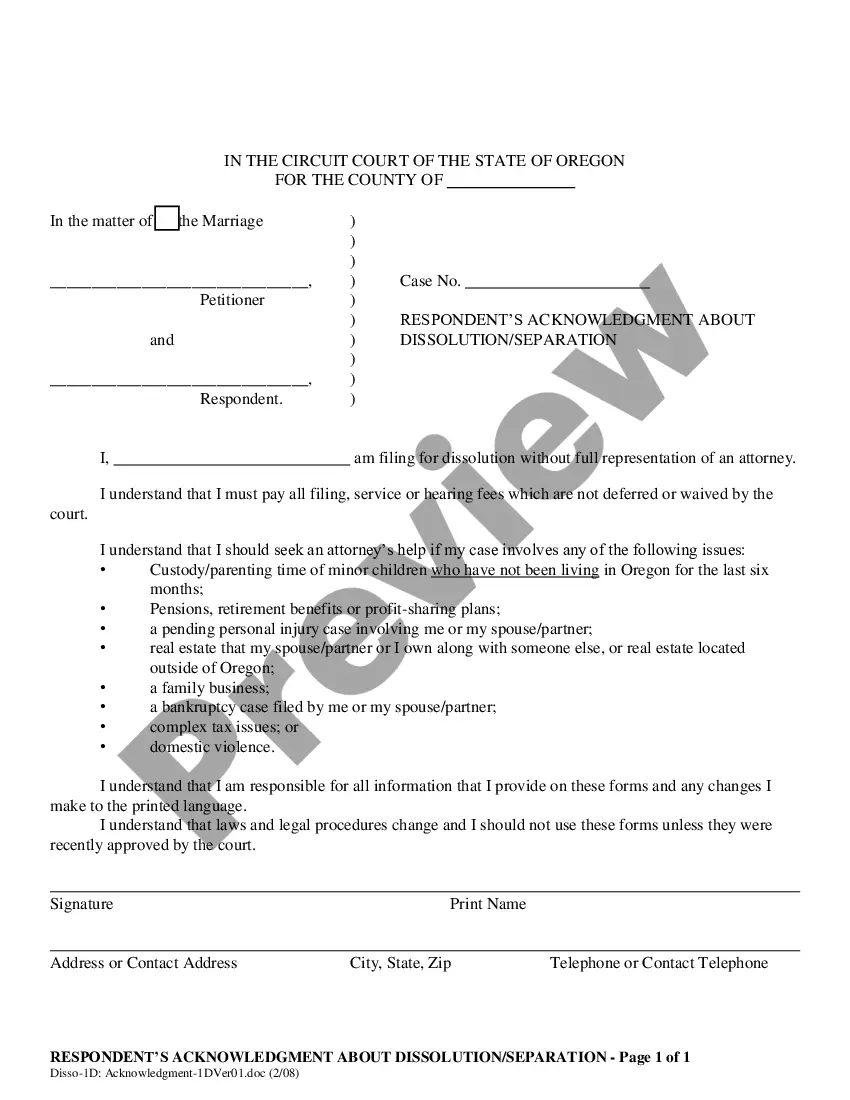

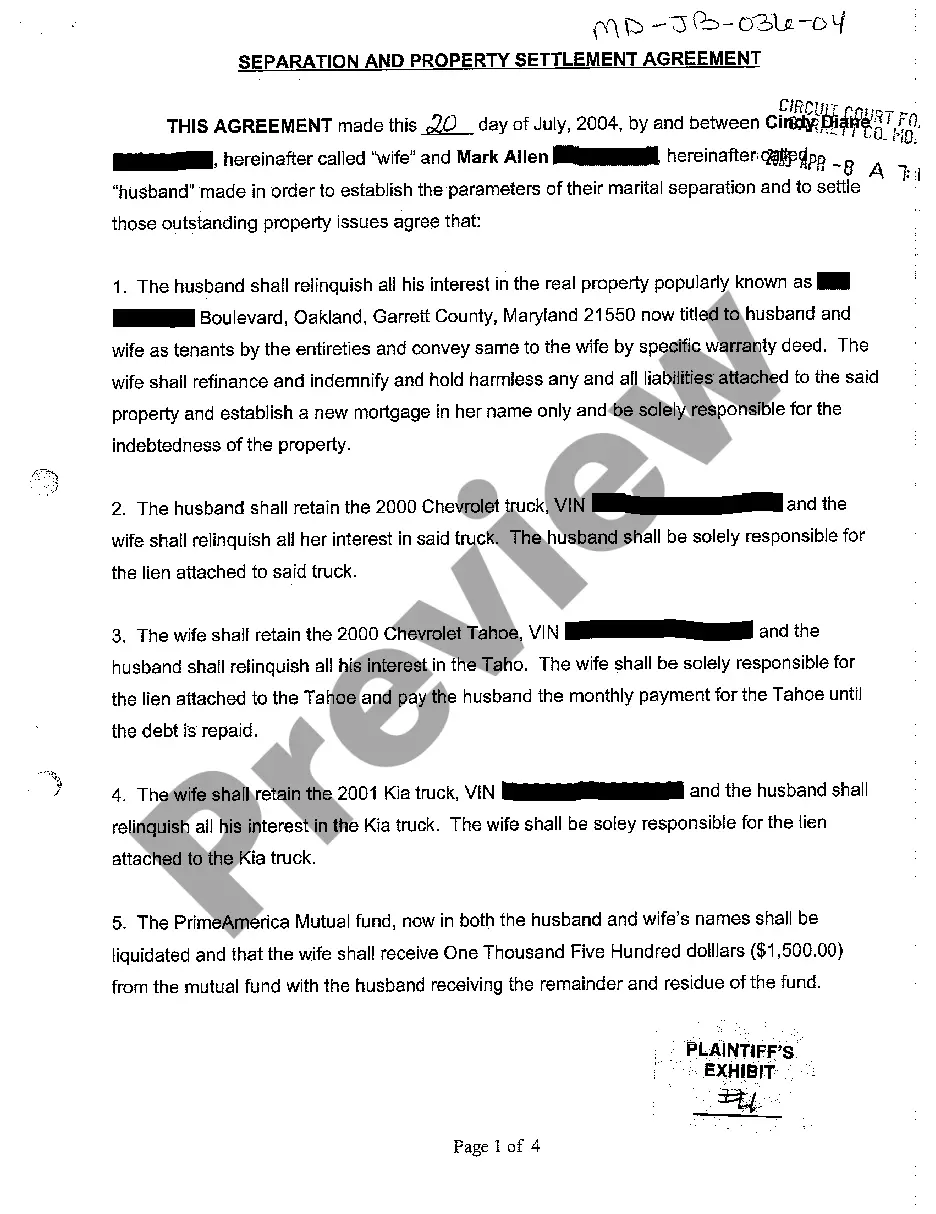

- Ensure the document you see on the page complies with your legal situation and state regulations by examining its text description or looking through the Preview mode.

- Type in the form name in the Search tab on the top of the page and choose your state from the dropdown to find an alternative template in case of any inconsistencies.

- Repeat with the content verification and click Buy now when you are confident with the paperwork compliance with all the demands.

- Log in to your account and click Download. Register for the service and choose the subscription plan if you still don’t have one.

- Use your credit card or the PayPal option to purchase your US Legal Forms subscription. The document will be available to download right after.

- Choose in what format you want to save your South Dakota Statement of Qualification of A Foreign LLLP and download it by clicking the appropriate button.

- Add your template to an online editor to complete and sign it rapidly or print it out to prepare your hard copy manually.

Another great thing about US Legal Forms is that you never lose the paperwork you acquired - you can pick any of your downloaded blanks in the My Forms tab of your profile any time you need it.

Form popularity

FAQ

No double taxation Unlike some other types of business entities (notably, C corps), LLPs aren't subject to double taxation.

It costs $150 to form an LLC in South Dakota. This is a fee paid for the Articles of Organization. You'll file this form with the South Dakota Secretary of State. And once approved, your LLC will go into existence.

A limited liability partnership is similar to a limited liability company (LLC) in that all partners are granted limited liability protection. However, in some states the partners in an LLP get less liability protection than in an LLC. LLP requirements vary from state to state.

(6) The filing of a statement of qualification establishes that a partnership has satisfied all conditions precedent to the qualification of the partnership as a limited liability partnership.

An LLP has a separate legal entity under the law. A partnership firm has no separate legal status apart from its partners. The partner's liability of an LLP is limited to the extent of their capital contribution to the LLP. The partner's liability of a partnership firm has unlimited liability.

Formation. An LLP is formed by filing a statement of qualification with the state. LLP status is effective on the date that statement is filed, unless a later date is specified in the statement. The filing of a statement of qualification to transform a partnership into an LLP does not create a new partnership.

You amend the articles of your South Dakota Corporation by submitting the completed Amendment to Articles of Incorporation form in duplicate by mail or in person, along with the filing fee to the South Dakota Secretary of State.

You can form a business surrounding your professional services by forming a limited liability partnership (LLP).