South Dakota Self-Insurance Aggregate Surety Bond Form

Description

How to fill out South Dakota Self-Insurance Aggregate Surety Bond Form?

How much time and resources do you often spend on composing official documentation? There’s a better option to get such forms than hiring legal experts or wasting hours searching the web for a proper template. US Legal Forms is the top online library that offers professionally drafted and verified state-specific legal documents for any purpose, like the South Dakota Self-Insurance Aggregate Surety Bond Form.

To get and prepare an appropriate South Dakota Self-Insurance Aggregate Surety Bond Form template, adhere to these simple steps:

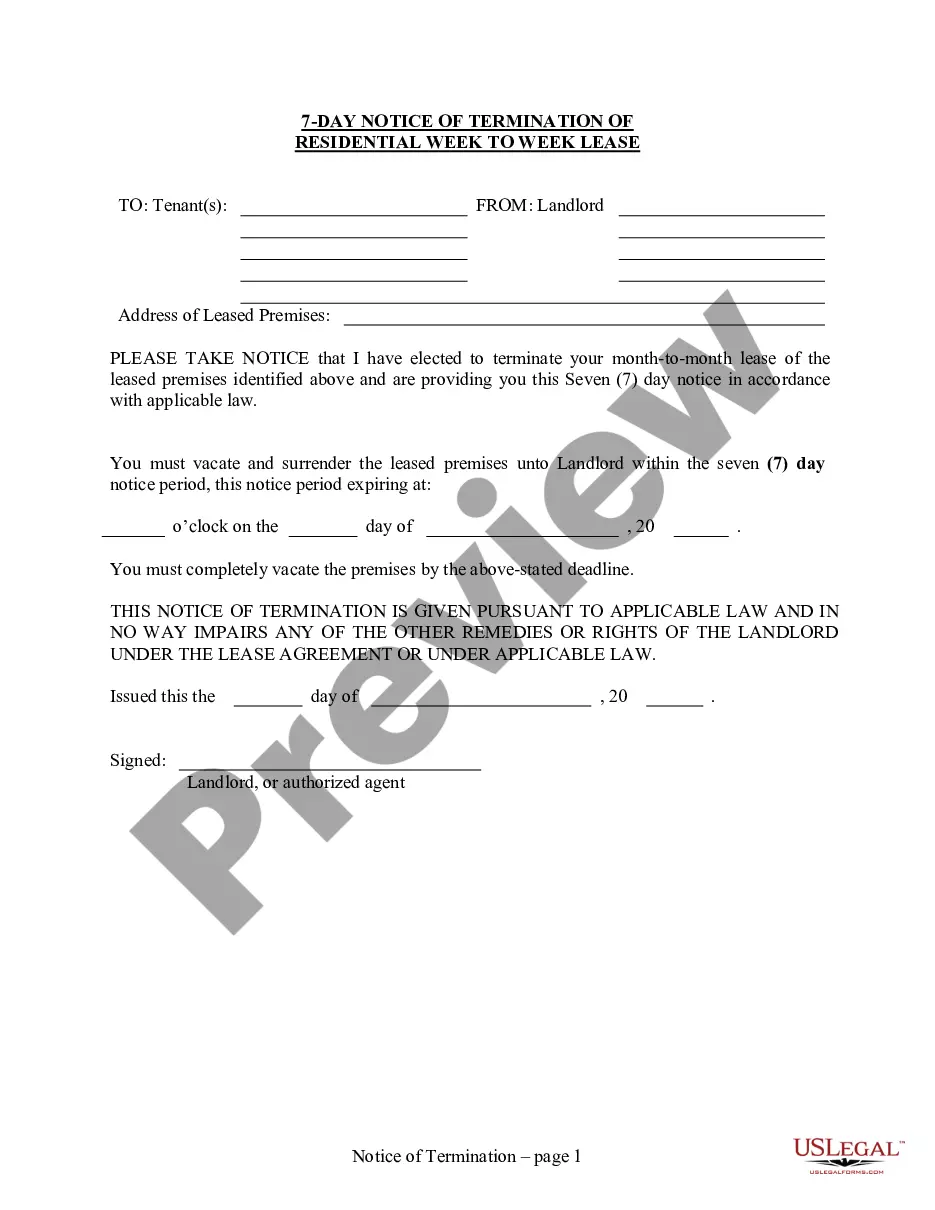

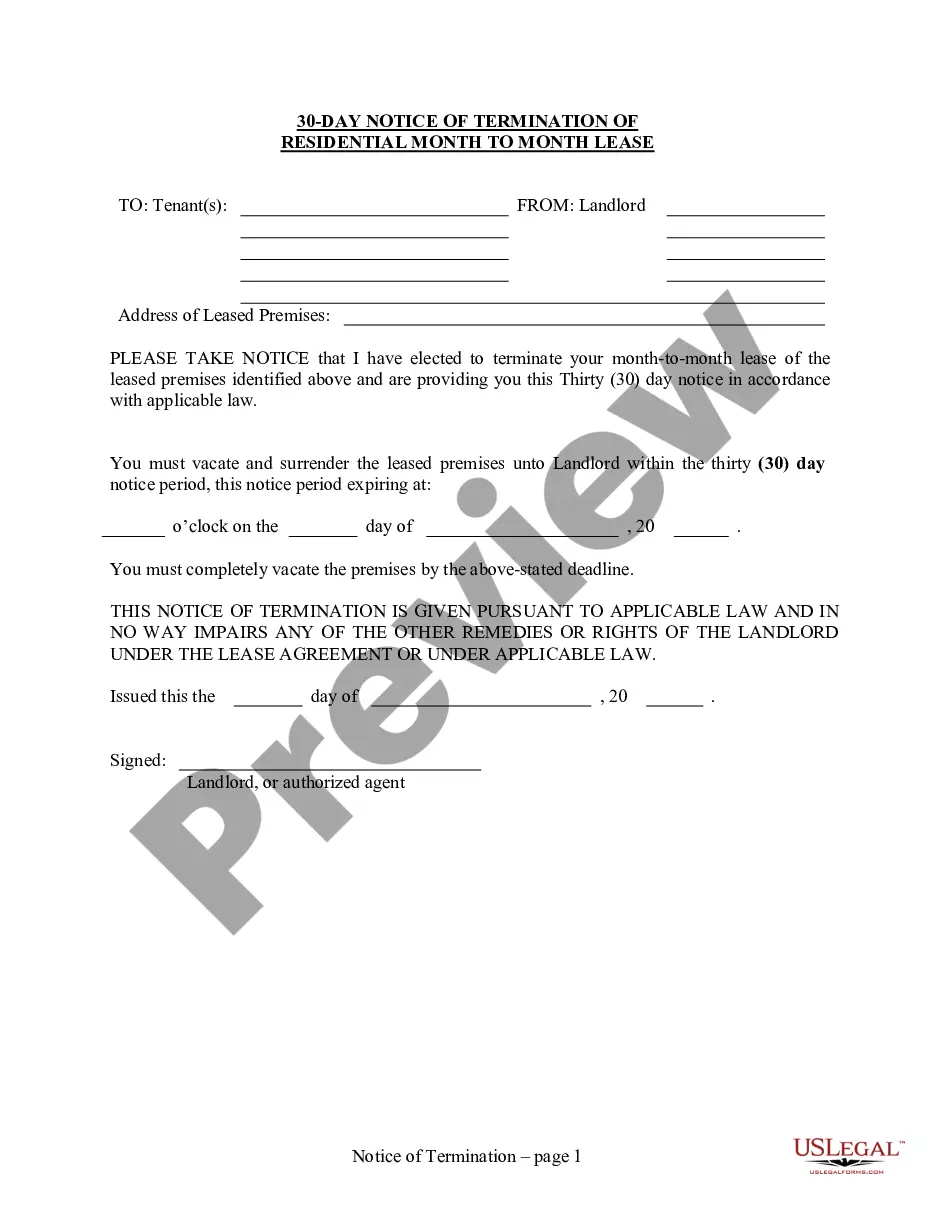

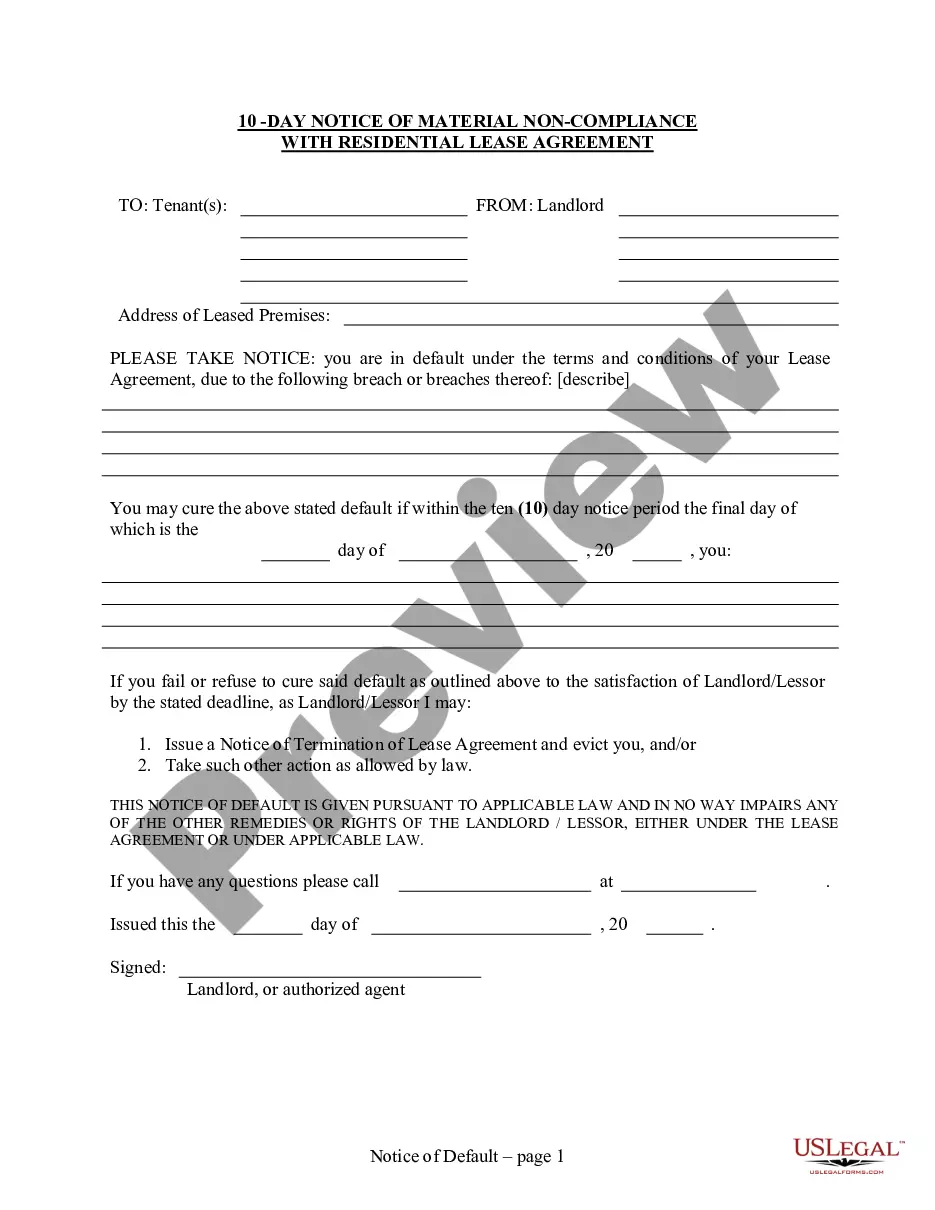

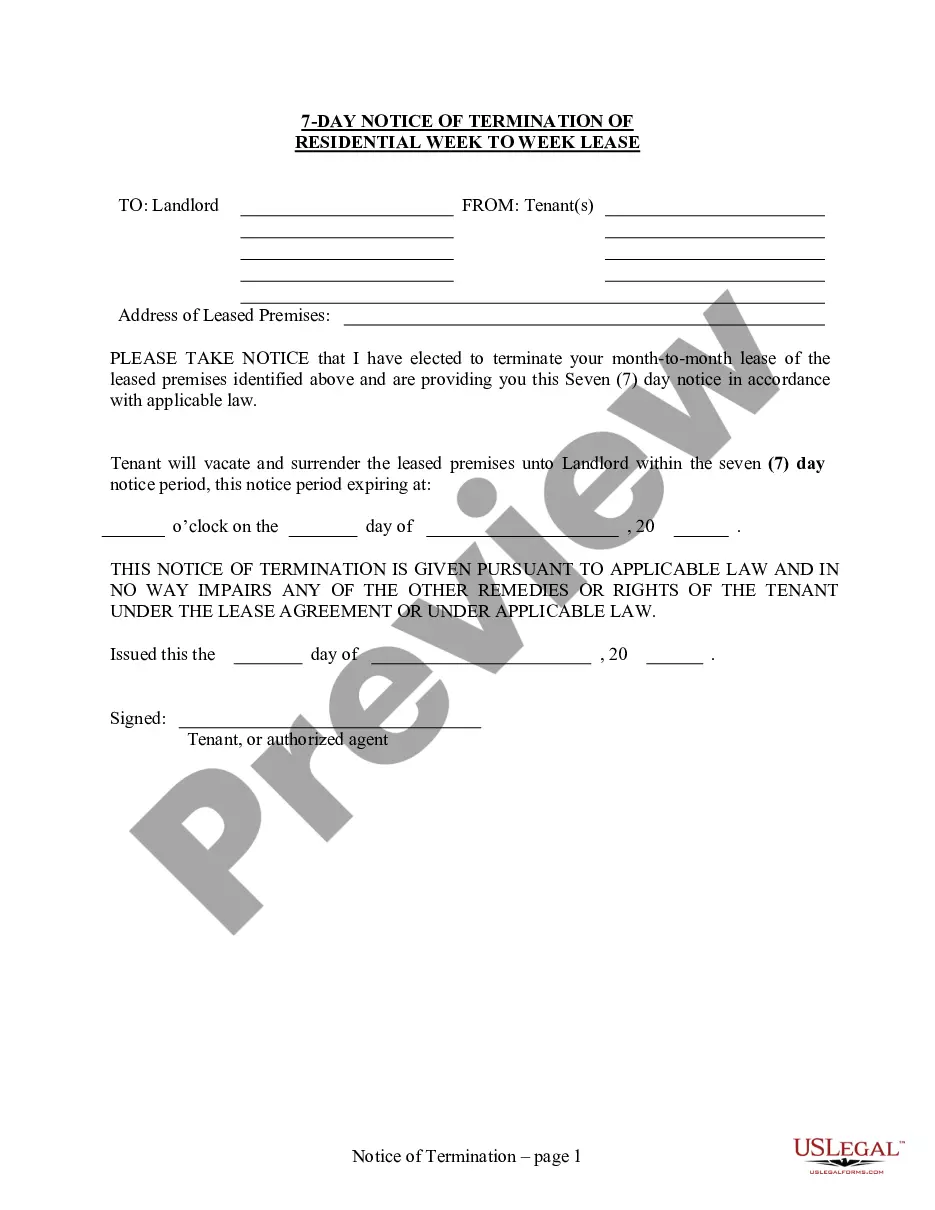

- Examine the form content to ensure it meets your state regulations. To do so, check the form description or use the Preview option.

- If your legal template doesn’t meet your requirements, find another one using the search bar at the top of the page.

- If you already have an account with us, log in and download the South Dakota Self-Insurance Aggregate Surety Bond Form. If not, proceed to the next steps.

- Click Buy now once you find the right blank. Opt for the subscription plan that suits you best to access our library’s full service.

- Sign up for an account and pay for your subscription. You can make a payment with your credit card or via PayPal - our service is absolutely reliable for that.

- Download your South Dakota Self-Insurance Aggregate Surety Bond Form on your device and complete it on a printed-out hard copy or electronically.

Another benefit of our library is that you can access previously acquired documents that you safely store in your profile in the My Forms tab. Pick them up anytime and re-complete your paperwork as often as you need.

Save time and effort preparing formal paperwork with US Legal Forms, one of the most trustworthy web solutions. Sign up for us now!

Form popularity

FAQ

Insurance pays on behalf of you; surety bonds are just a guarantee of payment to another party. The primary difference between a surety bond and insurance is that insurance will pay for losses in a claim, whereas a bonding company will guarantee your obligations are fulfilled.

There are many types of surety bonds, and each state has its own bonding requirements for different industries. However, there are three major types of surety bonds that you should know: license and permit bonds, construction and performance bonds, and court bonds.

insurer's bond is a type of surety bond that provides a promise to pay selfinsured losses in case the promisor (selfinsurer) is unable to meet its obligations.

How to Get a Surety Bond Find the bond requirements in your state for your specific business or industry. Confirm the bond coverage amount needed. Contact a surety company that's licensed to sell bonds in your state. Provide the business details and financial information needed for your quote. Receive your bond quote.

Surety bonds are often issued by banks and insurance companies. They are usually obtained through brokers and dealers who, like insurance agents, obtain a commission on sales.

You can get a surety bond from an insurance agency or a surety bond agency. Many people choose to get their Marland bond through a surety bond agency because of better rates. Many surety bond companies allow you to apply online for your bond. Browse available Maryland bonds.

A surety bond is a contractual agreement between three parties: a principal, an obligee and a surety company. The obligee is the party that requires the principal to obtain a surety bond as a condition of conducting business, and the principal is the party that actually would purchase the surety bond.

A surety bond (pronounced "shur-ih-tee bond") can be defined in its simplest form as a written agreement to guarantee compliance, payment, or performance of an act. Surety is a unique type of insurance because it involves a three-party agreement.