South Dakota Self-Insured Employers Plan for Managed Care is a health care plan designed for businesses with more than one employee. This plan is an alternative to traditional health insurance, as it allows employers to self-insure their employees and manage their own health care costs. This plan offers comprehensive coverage for medical, mental health, vision, and pharmacy services. It also provides preventive care, managed care services, and cost-sharing arrangements. There are two main types of South Dakota Self-Insured Employers Plan for Managed Care: the Fully Insured Plan and the Self-Insured Plan. The Fully Insured Plan is a traditional employer health insurance plan that requires the employer to pay a fixed premium to a third-party insurance company. The Self-Insured Plan allows the employer to set aside funds to pay for health care costs directly. Both plans provide the same level of coverage, however, the employer is responsible for setting up the plan, managing the costs, and administering the services. This plan is only available to employers in South Dakota.

South Dakota Self-Insured Employers Plan for Managed Care

Description

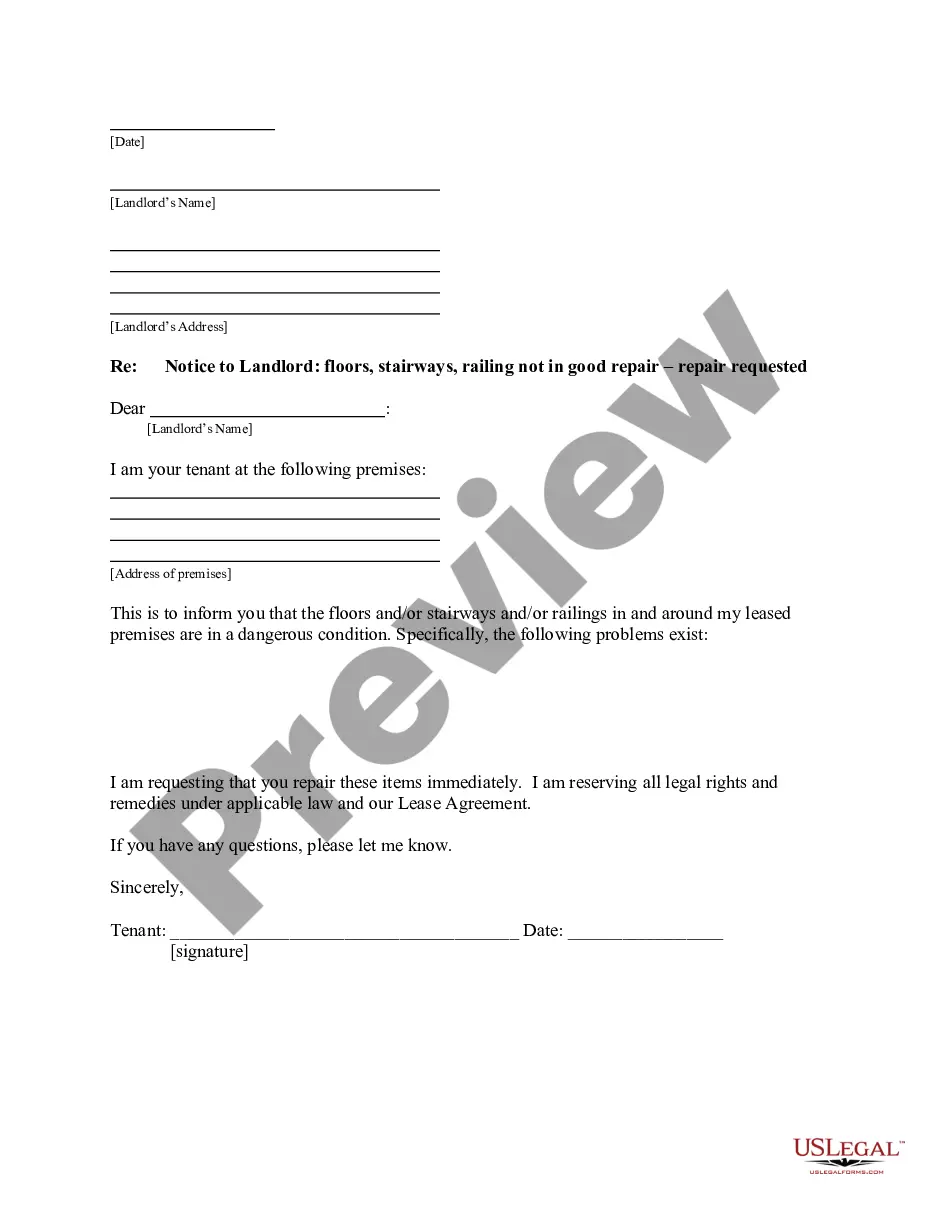

How to fill out South Dakota Self-Insured Employers Plan For Managed Care?

US Legal Forms is the most simple and affordable way to find suitable legal templates. It’s the most extensive online library of business and individual legal documentation drafted and checked by lawyers. Here, you can find printable and fillable templates that comply with federal and local regulations - just like your South Dakota Self-Insured Employers Plan for Managed Care.

Getting your template requires just a couple of simple steps. Users that already have an account with a valid subscription only need to log in to the website and download the form on their device. Afterwards, they can find it in their profile in the My Forms tab.

And here’s how you can get a professionally drafted South Dakota Self-Insured Employers Plan for Managed Care if you are using US Legal Forms for the first time:

- Look at the form description or preview the document to make certain you’ve found the one meeting your requirements, or locate another one utilizing the search tab above.

- Click Buy now when you’re certain about its compatibility with all the requirements, and choose the subscription plan you like most.

- Register for an account with our service, sign in, and pay for your subscription using PayPal or you credit card.

- Select the preferred file format for your South Dakota Self-Insured Employers Plan for Managed Care and download it on your device with the appropriate button.

After you save a template, you can reaccess it anytime - simply find it in your profile, re-download it for printing and manual completion or upload it to an online editor to fill it out and sign more effectively.

Take full advantage of US Legal Forms, your trustworthy assistant in obtaining the corresponding official paperwork. Give it a try!

Form popularity

FAQ

Workers' compensation benefits for injured workers in South Dakota include: Medical care, including the cost of surgery, hospitalization, and prosthetics. Temporary total disability benefits, equal to two-thirds of the employee's average weekly wage.

How can I calculate my temporary total disability (TTD) benefits? Usually TTD benefits are equal to two-thirds of your prior gross (before tax) income. Your gross income includes overtime and the market value of board, lodging, and fuel.

There is no law in South Dakota requiring any employer to carry workers' compensation insurance. However, it is highly recommended. An uninsured employer may be sued in civil court by an injured worker.

In response to this growing differential, some large self-insured employers?for example, Berkshire Hathaway, JPMorgan Chase, and Amazon?have created an entity to address the cost of their health care benefits, and some large self-insured employers have begun to directly negotiate prices with hospitals.

Five day work week. Insurer has 20 days from receipt of injury report to complete investigation and if necessary can request up to an additional 30 days to investigate (Form 106), payment or denial then due. Form 106 must be submitted via SD DLR web application.

Temporary total disability (TTD) payments are usually two-thirds of the wages you were earning before you were injured. Example: If the gross wages that you would be earning if you were not injured are $300 per week, your TTD payments are $200 per week.

Compensation and Other Rates Weekly Workers' Compensation Rate: Effective July 1, 2022, the minimum is $488 and the maximum is $975.

Temporary Total Disability (TTD) Benefits: An injured worker's wage paid is 66 2/3%. The weekly payment minimum is $299, 50% of the state average weekly wage or the injured workers average wage if it is less. The weekly maximum is $597, 100% of the South Dakota state average weekly wage.