South Dakota Trust Operational Agreement

Description

How to fill out South Dakota Trust Operational Agreement?

How much time and resources do you often spend on drafting formal paperwork? There’s a better way to get such forms than hiring legal experts or spending hours browsing the web for an appropriate blank. US Legal Forms is the premier online library that provides professionally drafted and verified state-specific legal documents for any purpose, including the South Dakota Trust Operational Agreement.

To obtain and prepare an appropriate South Dakota Trust Operational Agreement blank, follow these simple steps:

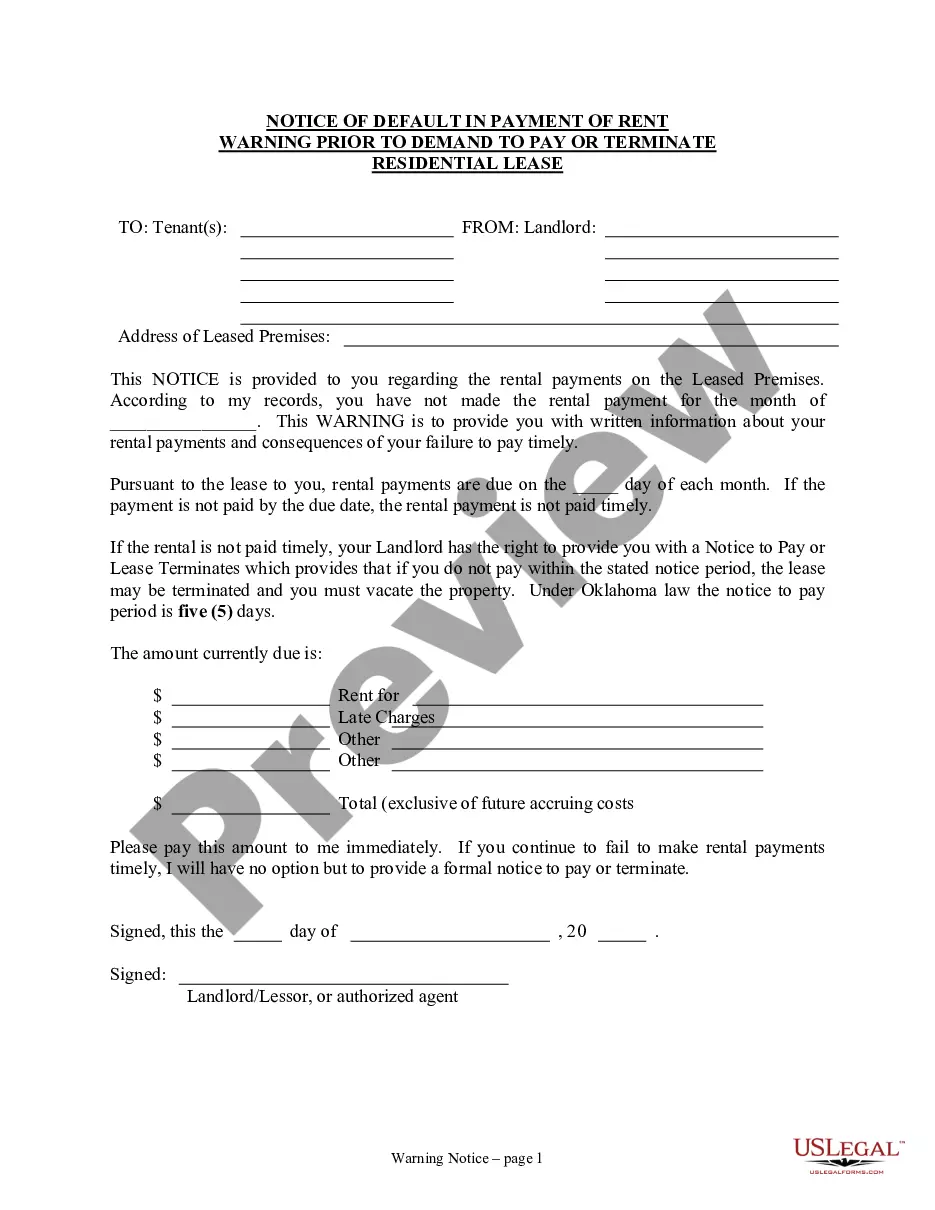

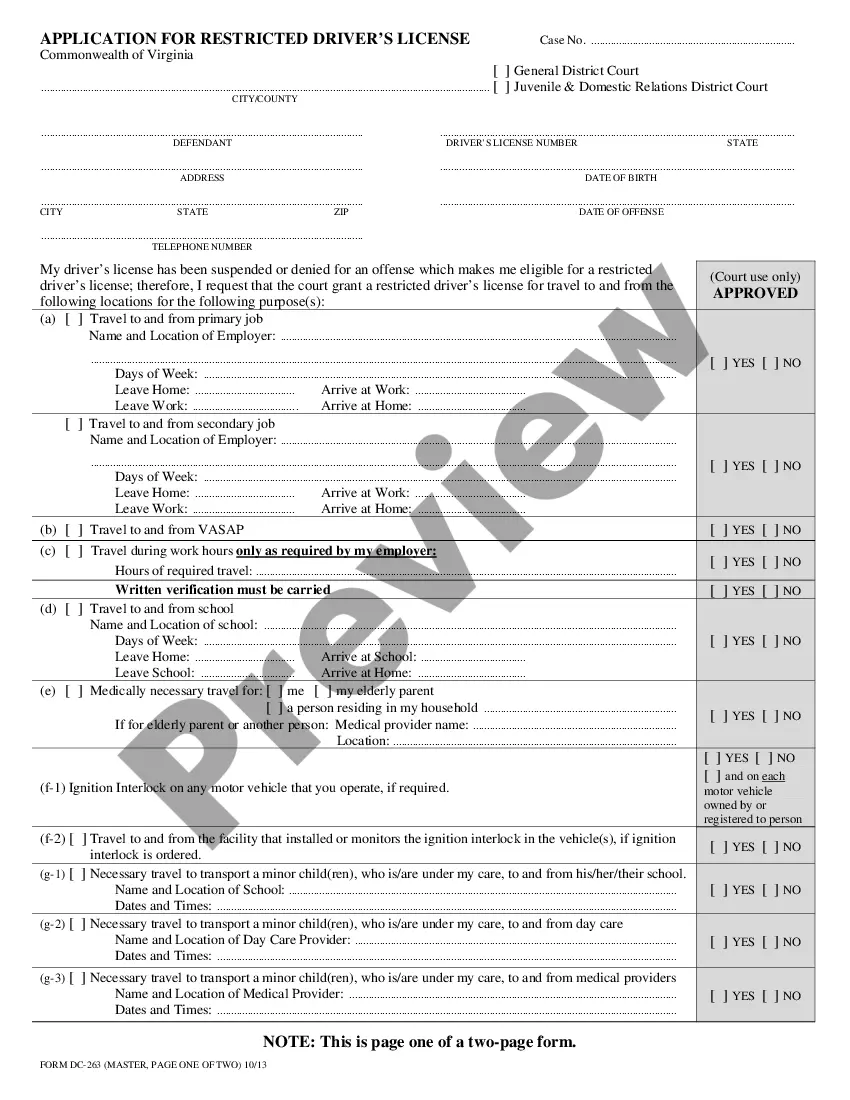

- Examine the form content to make sure it meets your state requirements. To do so, read the form description or take advantage of the Preview option.

- In case your legal template doesn’t meet your needs, locate another one using the search tab at the top of the page.

- If you are already registered with our service, log in and download the South Dakota Trust Operational Agreement. If not, proceed to the next steps.

- Click Buy now once you find the correct blank. Select the subscription plan that suits you best to access our library’s full opportunities.

- Register for an account and pay for your subscription. You can make a transaction with your credit card or through PayPal - our service is absolutely secure for that.

- Download your South Dakota Trust Operational Agreement on your device and fill it out on a printed-out hard copy or electronically.

Another advantage of our library is that you can access previously purchased documents that you securely keep in your profile in the My Forms tab. Pick them up anytime and re-complete your paperwork as often as you need.

Save time and effort preparing formal paperwork with US Legal Forms, one of the most reliable web solutions. Sign up for us now!

Form popularity

FAQ

Operating agreements aren't required in the state of South Dakota, but having one can benefit your business.

The primary drawbacks to establishing a South Dakota dynastic trust are the restrictions on your financial flexibility once the trust is established and the limited flexibility imposed on beneficiaries.

Doing so is an excellent decision because having a living trust will allow you to create a strong estate plan and protect all your assets after you die. Living trusts in South Dakota have favorable laws that give you a chance to securely house all your assets and have massive control over your wealth distribution.

Because South Dakota has no Rule Against Perpetuities, South Dakota grantors may establish a dynasty trust to retain control over trust assets forever?or at least until a court decides that the burden of administering the trust outweighs the benefit for existing beneficiaries.

A South Dakota Dynasty Trust is a very powerful planning tool that preserves family wealth over generations, allowing a trust to live in perpetuity (forever), therefore never subjecting the assets to federal estate taxation through a forced distribution.

Unparalleled Tax Efficiency South Dakota has no state income, capital gains, dividend/interest, or intangible tax. South Dakota also has no state inheritance or estate tax. As such, assets held in a South Dakota trust are taxed under South Dakota tax law and not subject to other state's high tax rates.

South Dakota is a pure no income/capital gains tax state for trusts. However, if income is distributed from the trust to a beneficiary, the distributed income is generally taxed at the beneficiary's personal rates in his/her tax residence jurisdiction.

South Dakota is a pure no income/capital gains tax state for trusts. However, if income is distributed from the trust to a beneficiary, the distributed income is generally taxed at the beneficiary's personal rates in his/her tax residence jurisdiction.