South Dakota Independent Contractor Affidavit of Exempt Status and Fact Sheet

Description

How to fill out South Dakota Independent Contractor Affidavit Of Exempt Status And Fact Sheet?

If you’re looking for a way to appropriately complete the South Dakota Independent Contractor Affidavit of Exempt Status and Fact Sheet without hiring a lawyer, then you’re just in the right spot. US Legal Forms has proven itself as the most extensive and reliable library of formal templates for every individual and business situation. Every piece of paperwork you find on our online service is designed in accordance with nationwide and state laws, so you can be sure that your documents are in order.

Follow these simple instructions on how to obtain the ready-to-use South Dakota Independent Contractor Affidavit of Exempt Status and Fact Sheet:

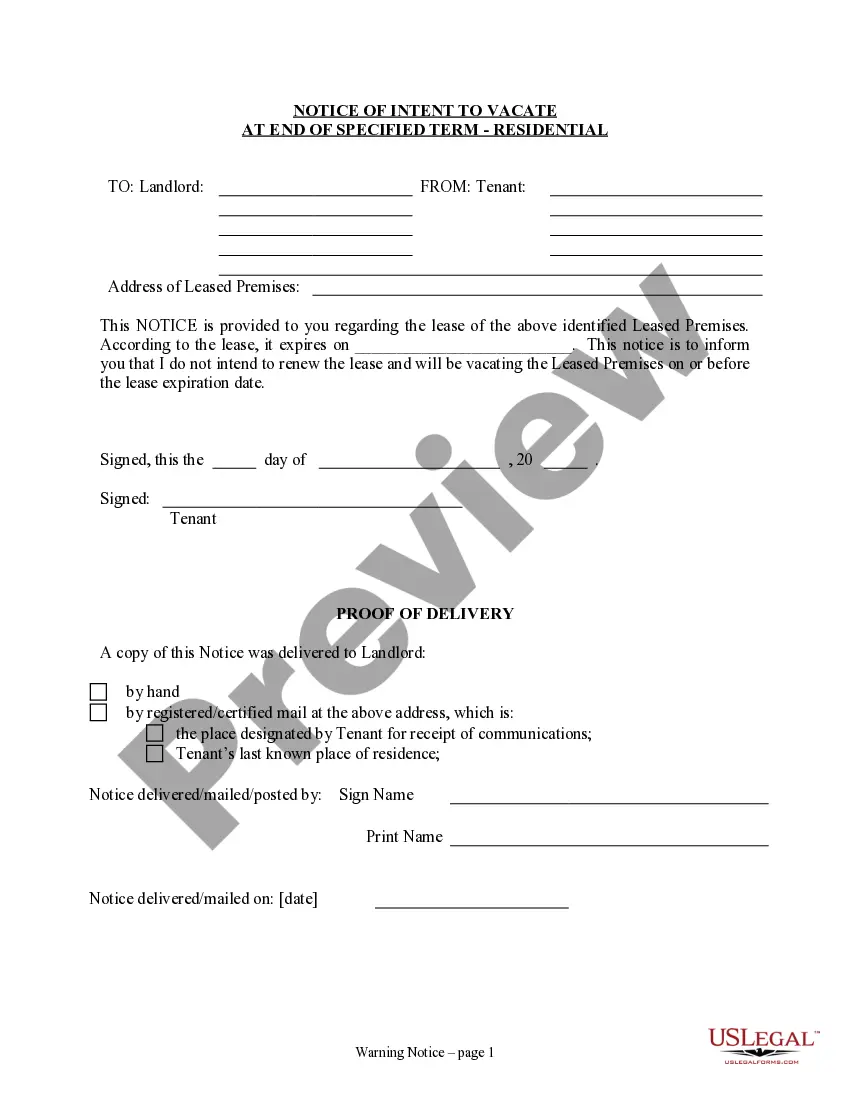

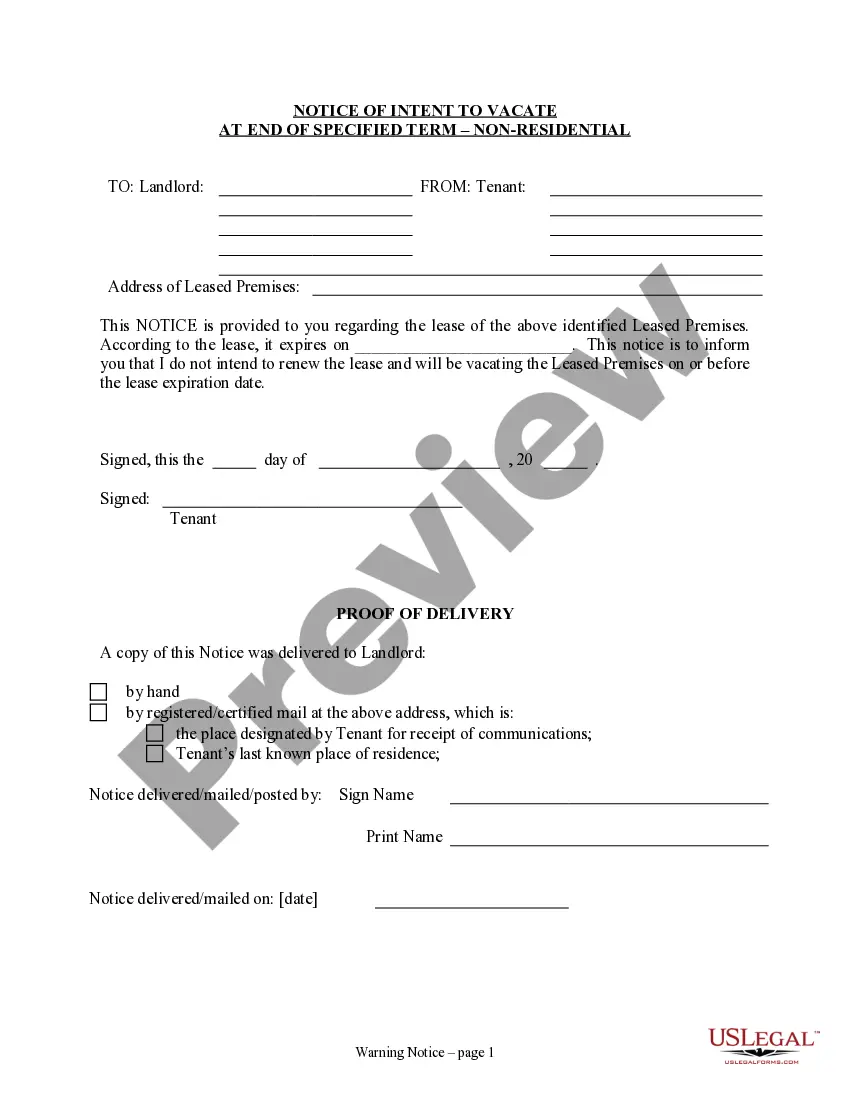

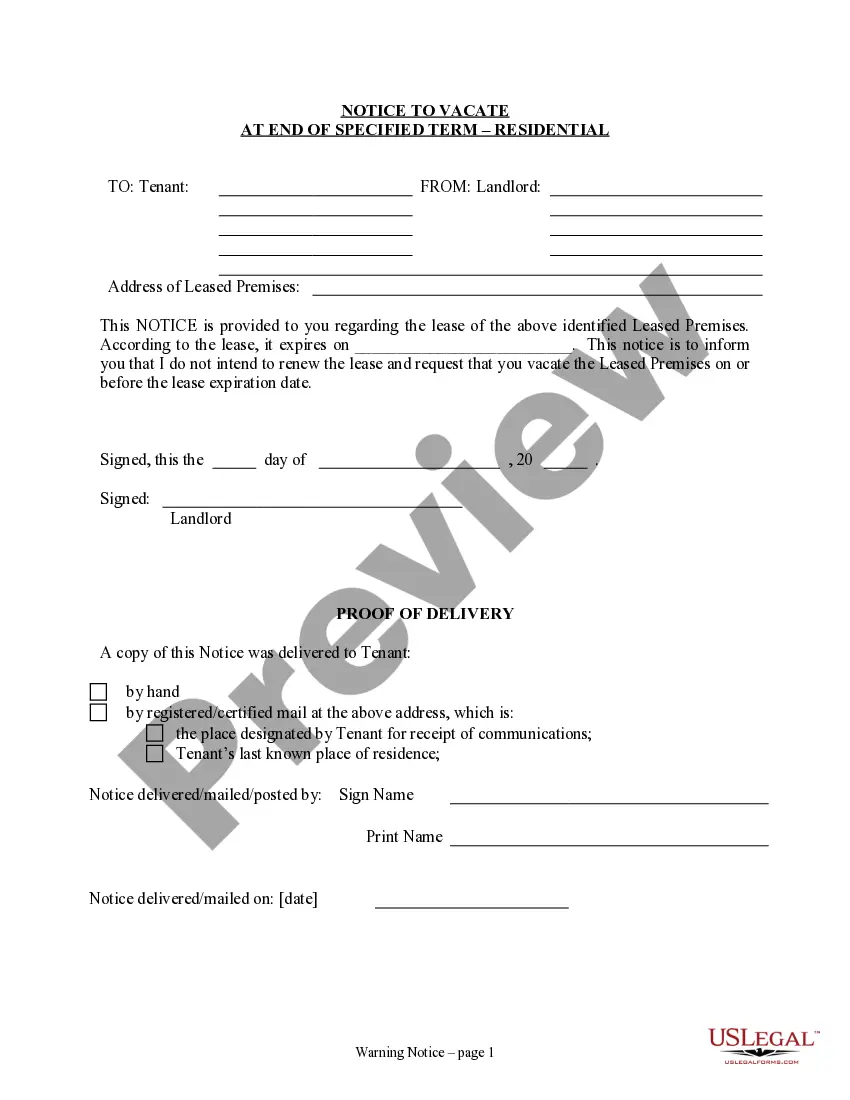

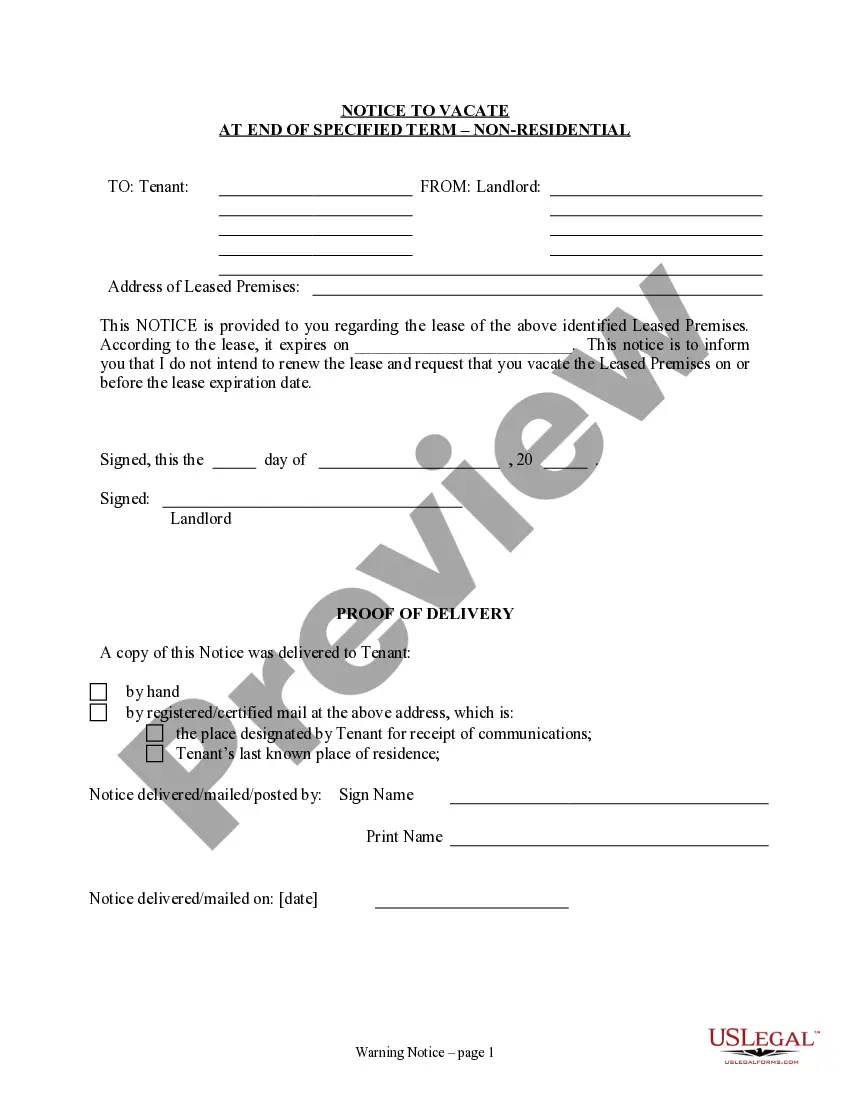

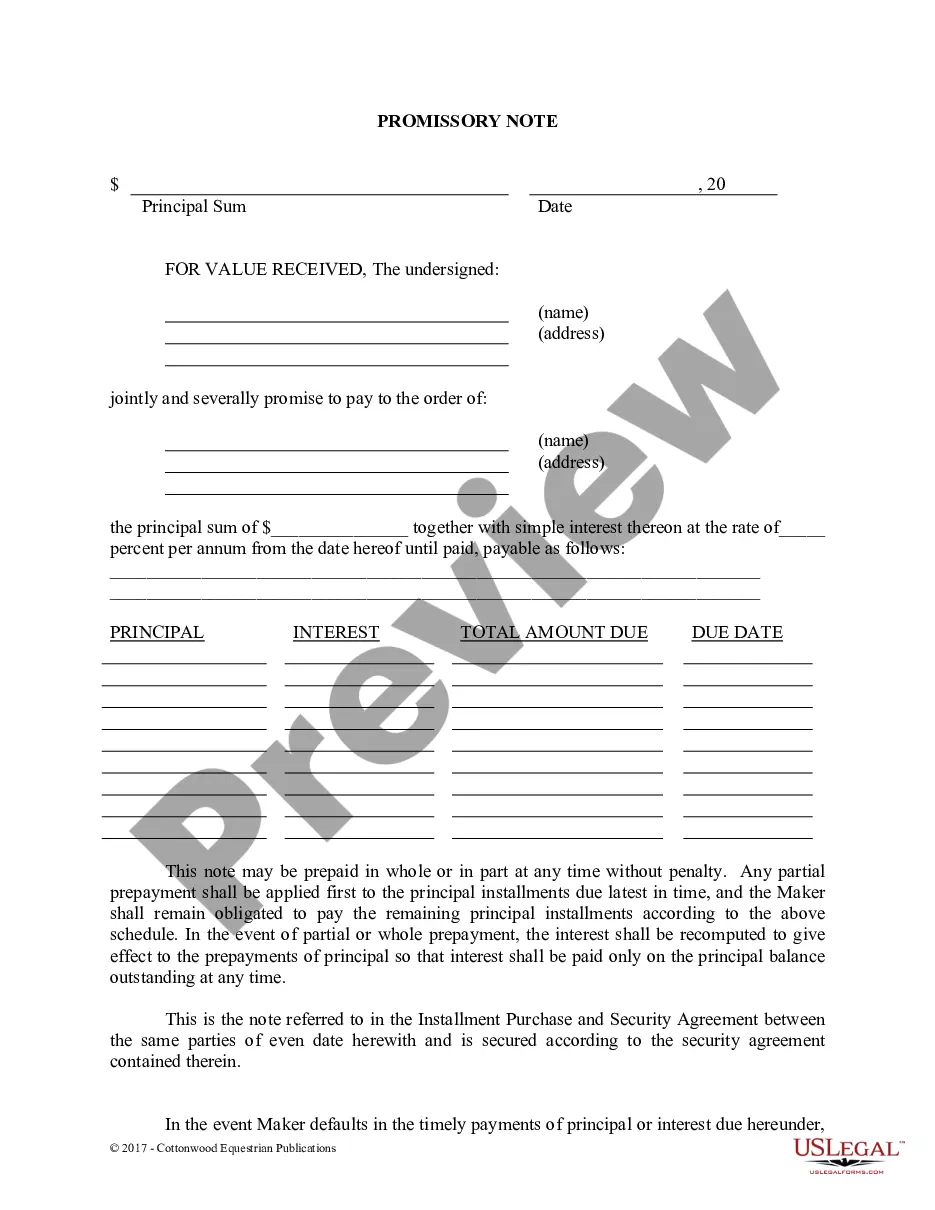

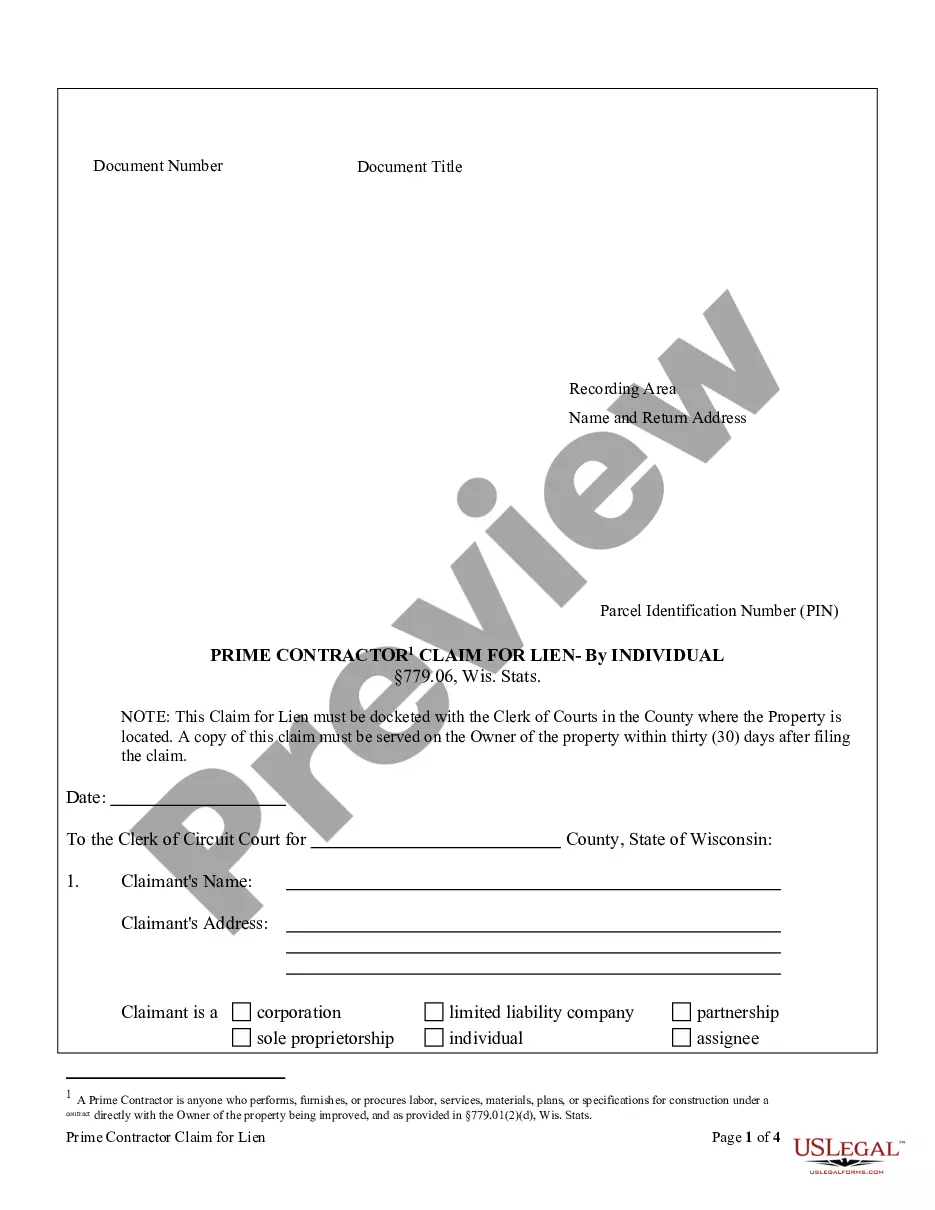

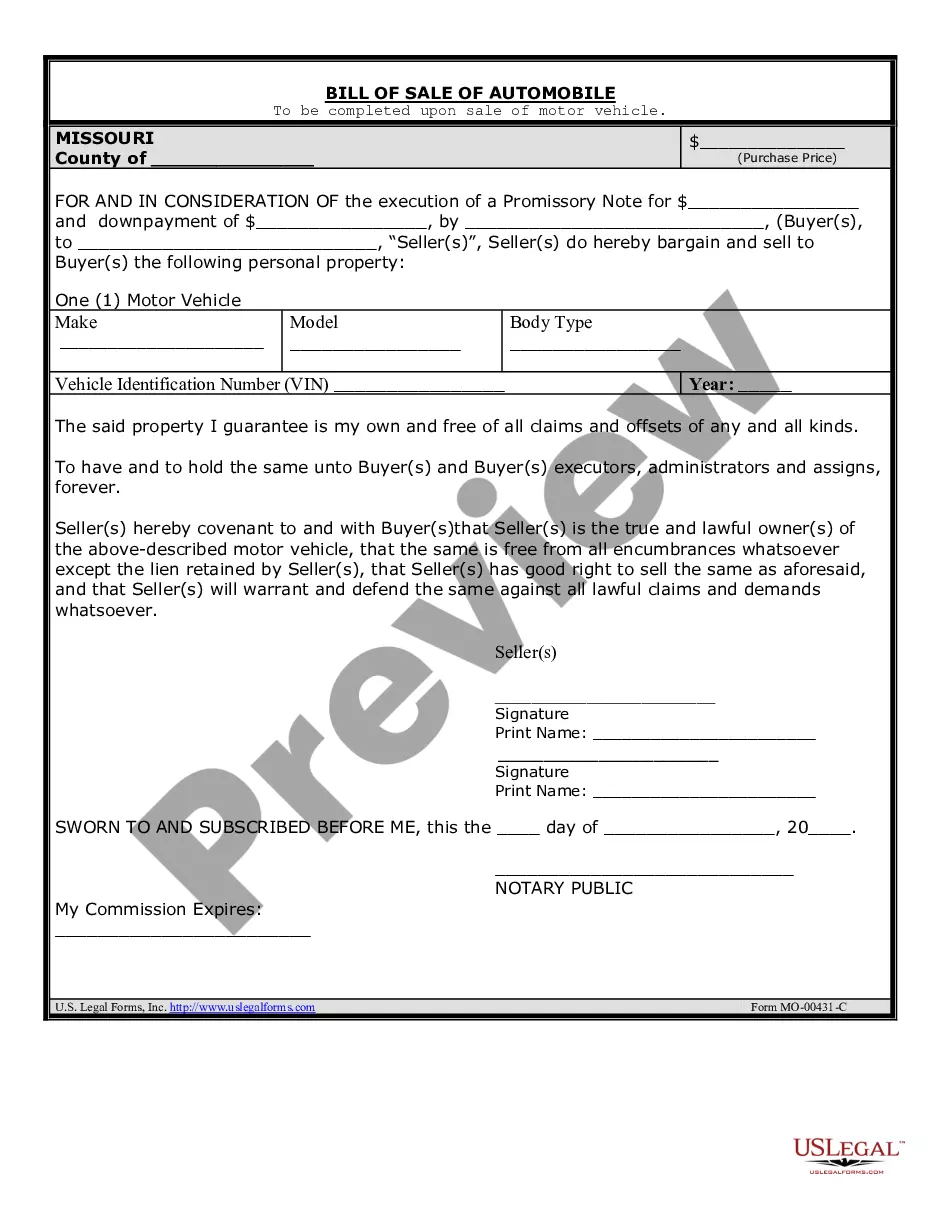

- Make sure the document you see on the page corresponds with your legal situation and state laws by examining its text description or looking through the Preview mode.

- Enter the form name in the Search tab on the top of the page and select your state from the dropdown to find an alternative template in case of any inconsistencies.

- Repeat with the content check and click Buy now when you are confident with the paperwork compliance with all the demands.

- Log in to your account and click Download. Create an account with the service and choose the subscription plan if you still don’t have one.

- Use your credit card or the PayPal option to pay for your US Legal Forms subscription. The document will be available to download right after.

- Decide in what format you want to get your South Dakota Independent Contractor Affidavit of Exempt Status and Fact Sheet and download it by clicking the appropriate button.

- Add your template to an online editor to fill out and sign it rapidly or print it out to prepare your hard copy manually.

Another great advantage of US Legal Forms is that you never lose the paperwork you purchased - you can find any of your downloaded templates in the My Forms tab of your profile any time you need it.

Form popularity

FAQ

How long do I have to file a workers' compensation claim? The South Dakota Workers' Compensation Act provides that you have one year from the date of your accident to file a Notice of Claim.

There is no law in South Dakota requiring any employer to carry workers' compensation insurance. However, it is highly recommended. An uninsured employer may be sued in civil court by an injured worker.

Aside from the obvious need to seek medical treatment for the injury, state law requires you to give written notice of an injury to your employer within three business days. Employees who fail to do so risk the loss of their workers' compensation benefits.

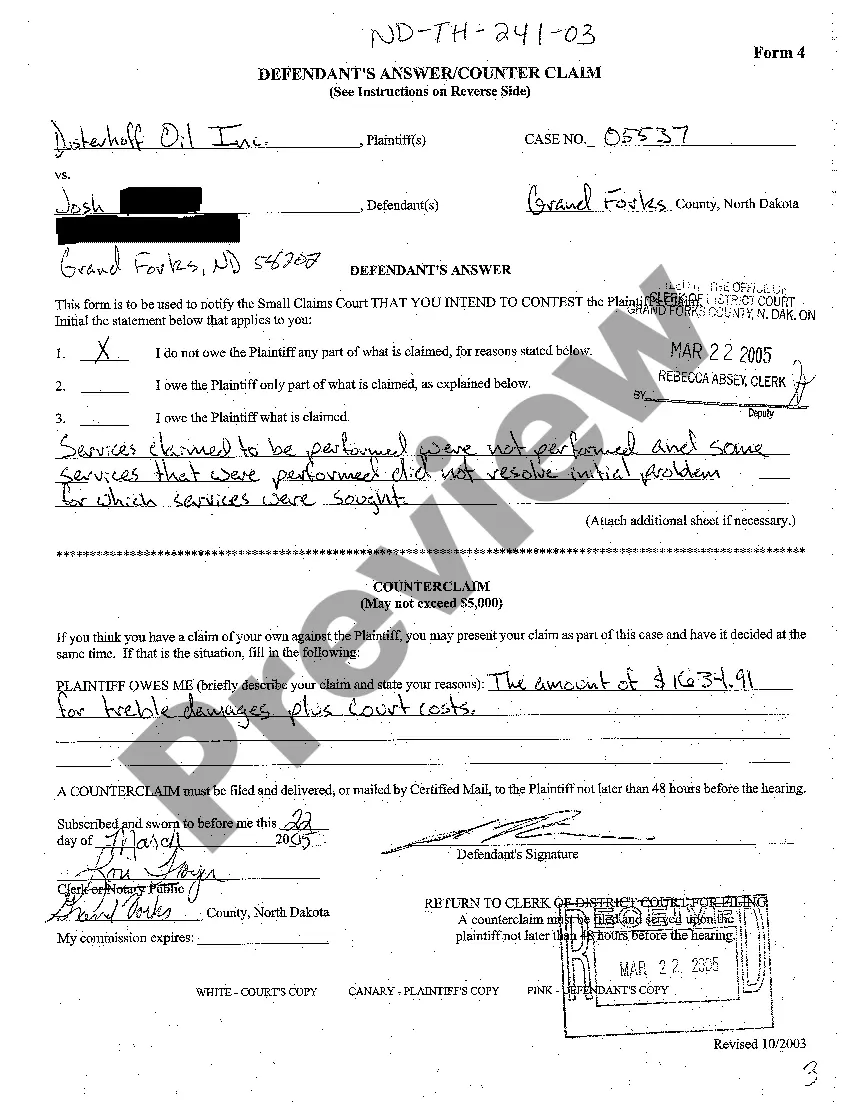

Independent contractor affidavit of exempt status--Rebuttable presumption. Any independent contractor who is not an employer or a general contractor and is not covered under a workers' compensation insurance policy may sign an affidavit of exempt status under the South Dakota Workers' Compensation Law.

A workers' compensation claim must be filed within two years from the date the employer/insurer notifies the employee and the South Dakota Department of Labor, in writing, of the denial of a claim, in whole or in part.