South Dakota Chattel Mortgage on Mobile Home

Description

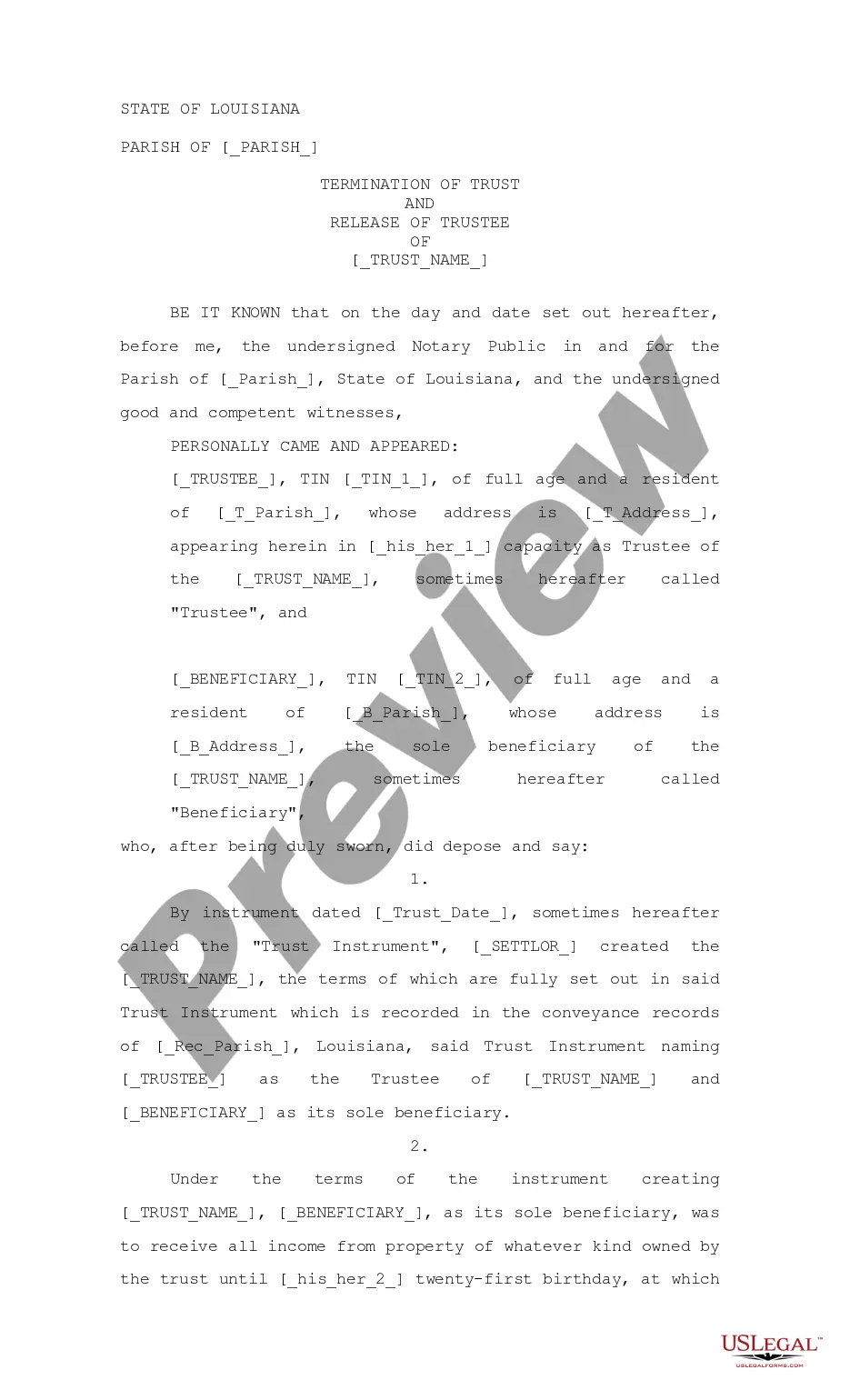

How to fill out Chattel Mortgage On Mobile Home?

If you wish to comprehensive, acquire, or produce legal file themes, use US Legal Forms, the biggest selection of legal varieties, which can be found on the web. Use the site`s basic and hassle-free search to discover the paperwork you want. Various themes for enterprise and specific reasons are categorized by groups and claims, or keywords and phrases. Use US Legal Forms to discover the South Dakota Chattel Mortgage on Mobile Home with a couple of click throughs.

When you are previously a US Legal Forms consumer, log in for your profile and click on the Obtain key to get the South Dakota Chattel Mortgage on Mobile Home. Also you can gain access to varieties you earlier saved from the My Forms tab of your profile.

If you work with US Legal Forms for the first time, refer to the instructions under:

- Step 1. Ensure you have chosen the form for the proper town/land.

- Step 2. Use the Preview method to look over the form`s content. Don`t overlook to learn the information.

- Step 3. When you are not satisfied together with the kind, make use of the Lookup area towards the top of the display to locate other models of the legal kind web template.

- Step 4. When you have found the form you want, select the Get now key. Select the prices program you favor and add your credentials to register for an profile.

- Step 5. Process the transaction. You can use your credit card or PayPal profile to complete the transaction.

- Step 6. Find the format of the legal kind and acquire it on the device.

- Step 7. Complete, modify and produce or indication the South Dakota Chattel Mortgage on Mobile Home.

Each and every legal file web template you buy is yours permanently. You may have acces to every kind you saved with your acccount. Select the My Forms segment and select a kind to produce or acquire yet again.

Be competitive and acquire, and produce the South Dakota Chattel Mortgage on Mobile Home with US Legal Forms. There are many skilled and state-specific varieties you can use for your personal enterprise or specific requirements.

Form popularity

FAQ

Compare the Best Mobile Home Loans CompanyStarting Interest RateLoan Terms (range)Manufactured Nationwide Best OverallVaries15, 20, or 30 yearsManufacturedHome.Loan Best for Good CreditVariesVaries21st Mortgage Corporation Best for Bad CreditVariesVarieseLend Best for Low Down PaymentVariesVaries1 more row

Conventional Mortgages Conventional mortgages are the most common type of mortgage. That said, conventional loans may have different requirements for a borrower's minimum credit score and debt-to-income (DTI) ratio than other loan options.

Typically, a mobile home has to be built after 1976 to qualify for a mortgage, as we'll explain below. In this case your loan would work almost exactly the same as financing for traditional ?stick-built? houses.

Most lenders will not give you a conventional loan for a mobile or manufactured home because these structures are not considered real property. If you have a manufactured home that meets some very specific criteria, however, conventional mortgage sources Freddie Mac and Fannie Mae do actually offer specialized loans.

Best Mobile Home Loans Reviews Best for Rural Areas: USDA. ... Best for a Variety of Loan Options: Vanderbilt Mortgage and Finance. ... Best for Low Credit Scores: Manufactured Nationwide. ... Best for Good Credit Scores: ManufacturedHome. ... Best for Mobile Homes Within a Community or Park: 21st Mortgage Corporation.

Vanderbilt Mortgage can finance mobile, modular or manufactured homes, both new and pre-owned. While the application itself is similar, there are some differences between both. Terms and conditions for the loans may differ, and the way you apply can also vary.