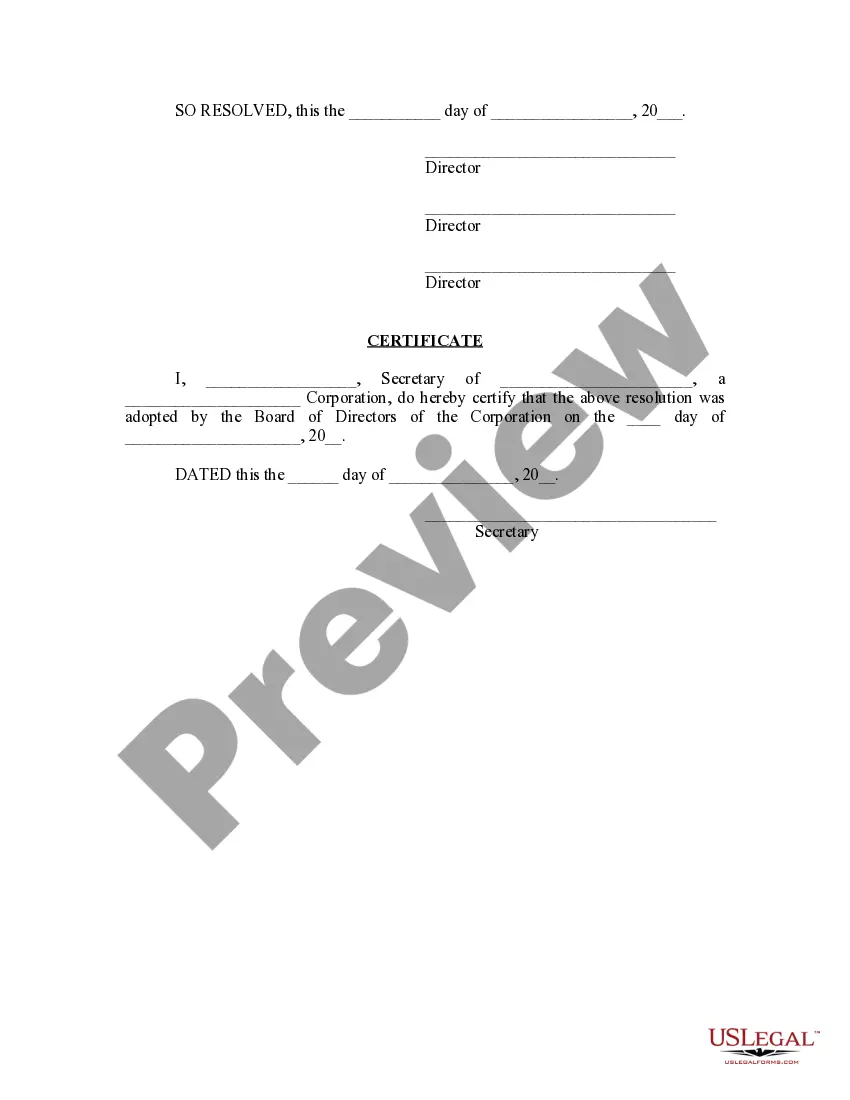

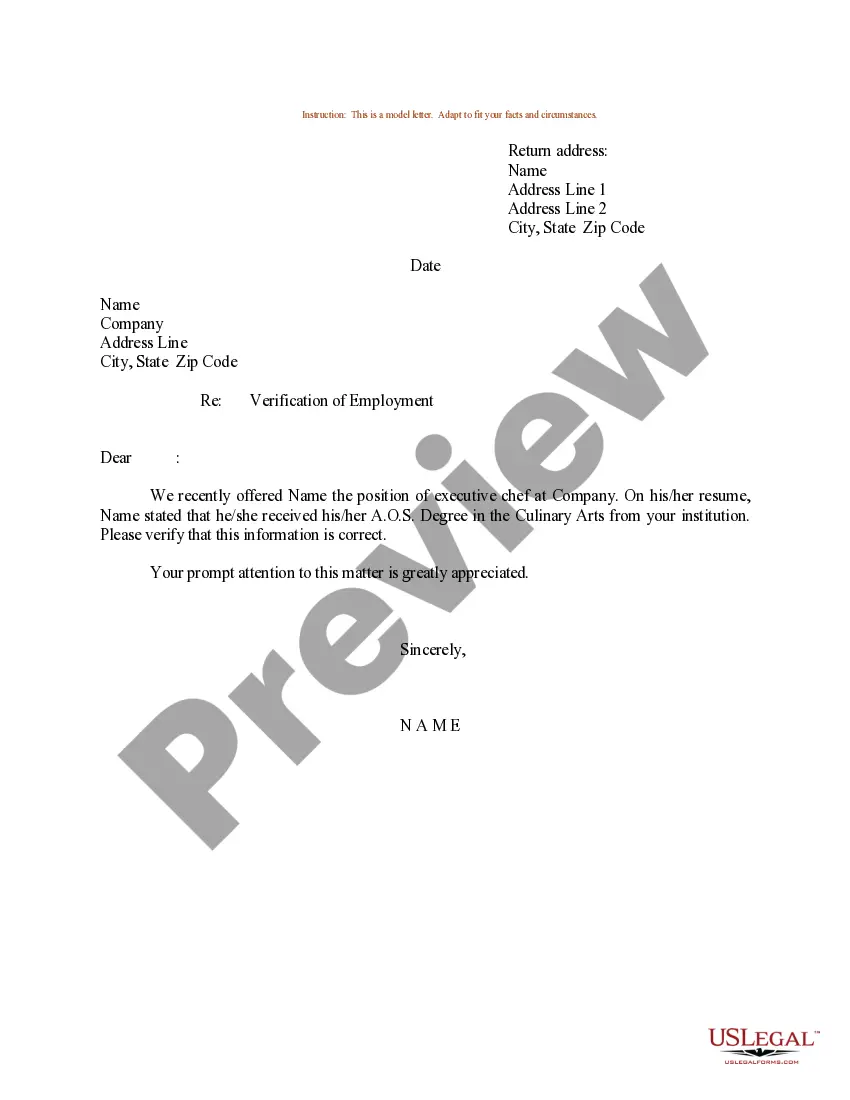

The South Dakota Issue Capital Stock — Resolution For— - Corporate Resolutions is a legal document used by corporations in the state of South Dakota to authorize the issuance of capital stock. This form is typically drafted and approved by the corporation's board of directors during a formal meeting. The purpose of this resolution is to outline the details of the capital stock issuance, including the number of shares to be issued, the par value or stated value of the shares, and any other terms and conditions associated with the issuance. It serves as an official record of the corporation's decision to create and sell shares of stock. By filing this resolution with the appropriate state authorities, the corporation ensures compliance with South Dakota corporate laws and regulations. It provides transparency and accountability to stakeholders, including shareholders, by documenting the decision-making process of the board of directors. The South Dakota Issue Capital Stock — Resolution For— - Corporate Resolutions may include various types, depending on the specific purpose of the stock issuance. Some common types include: 1. Common Stock Issuance Resolution: This type of resolution authorizes the issuance of common stock, which represents the basic ownership interest in the corporation. Common stockholders typically have voting rights and may receive dividends, but their claims on the corporation's assets are subordinate to those of preferred stockholders. 2. Preferred Stock Issuance Resolution: This resolution authorizes the issuance of preferred stock, which entitles the shareholders to certain preferences and rights over common stockholders. Preferred stockholders often have a fixed dividend rate, priority in receiving dividends, and preference in the event of liquidation. 3. Stock Option Plan Resolution: This type of resolution is used to establish and implement an employee stock option plan. It authorizes the creation and issuance of stock options to employees, granting them the right to purchase a specific number of shares at a predetermined price within a specified time period. 4. Stock Split Resolution: This resolution is used to approve a stock split, which increases the number of outstanding shares while proportionally reducing the par value or stated value per share. The purpose of a stock split is to make the stock more affordable and increase liquidity in the market. It is important for corporations in South Dakota to consult with legal professionals or experts to ensure the accuracy and compliance of their capital stock issuance resolutions. By using the South Dakota Issue Capital Stock — Resolution For— - Corporate Resolutions, corporations can effectively manage their stock offerings and maintain transparency within their governance practices.

South Dakota Issue Capital Stock - Resolution Form - Corporate Resolutions

Description

How to fill out South Dakota Issue Capital Stock - Resolution Form - Corporate Resolutions?

Are you presently within a placement that you need paperwork for sometimes enterprise or specific reasons just about every working day? There are a variety of authorized record themes accessible on the Internet, but finding kinds you can rely on is not simple. US Legal Forms delivers a large number of develop themes, such as the South Dakota Issue Capital Stock - Resolution Form - Corporate Resolutions, that are created in order to meet state and federal requirements.

If you are previously knowledgeable about US Legal Forms internet site and get an account, basically log in. Afterward, you can obtain the South Dakota Issue Capital Stock - Resolution Form - Corporate Resolutions template.

Unless you offer an bank account and want to start using US Legal Forms, follow these steps:

- Find the develop you need and ensure it is for that appropriate city/area.

- Use the Preview option to check the shape.

- See the information to actually have chosen the correct develop.

- If the develop is not what you are looking for, utilize the Search industry to obtain the develop that fits your needs and requirements.

- When you obtain the appropriate develop, just click Get now.

- Pick the costs program you desire, fill in the specified details to generate your bank account, and pay money for the order with your PayPal or Visa or Mastercard.

- Select a convenient data file structure and obtain your version.

Locate each of the record themes you may have bought in the My Forms food selection. You can get a further version of South Dakota Issue Capital Stock - Resolution Form - Corporate Resolutions any time, if required. Just click on the necessary develop to obtain or print the record template.

Use US Legal Forms, the most considerable variety of authorized varieties, in order to save some time and avoid mistakes. The assistance delivers expertly manufactured authorized record themes that can be used for a variety of reasons. Generate an account on US Legal Forms and begin creating your lifestyle easier.