South Dakota Direct Deposit Form for Social Security

Description

How to fill out Direct Deposit Form For Social Security?

Are you currently in a situation where you require documents for both professional or personal purposes almost every day.

There are numerous legal document templates available online, but locating reliable ones can be challenging.

US Legal Forms provides thousands of template forms, such as the South Dakota Direct Deposit Form for Social Security, which are designed to comply with federal and state regulations.

Once you find the right form, click Get now.

Choose a payment plan, fill in the necessary information to create your account, and finalize your purchase using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have your account, simply Log In.

- Then, you can download the South Dakota Direct Deposit Form for Social Security template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct city/state.

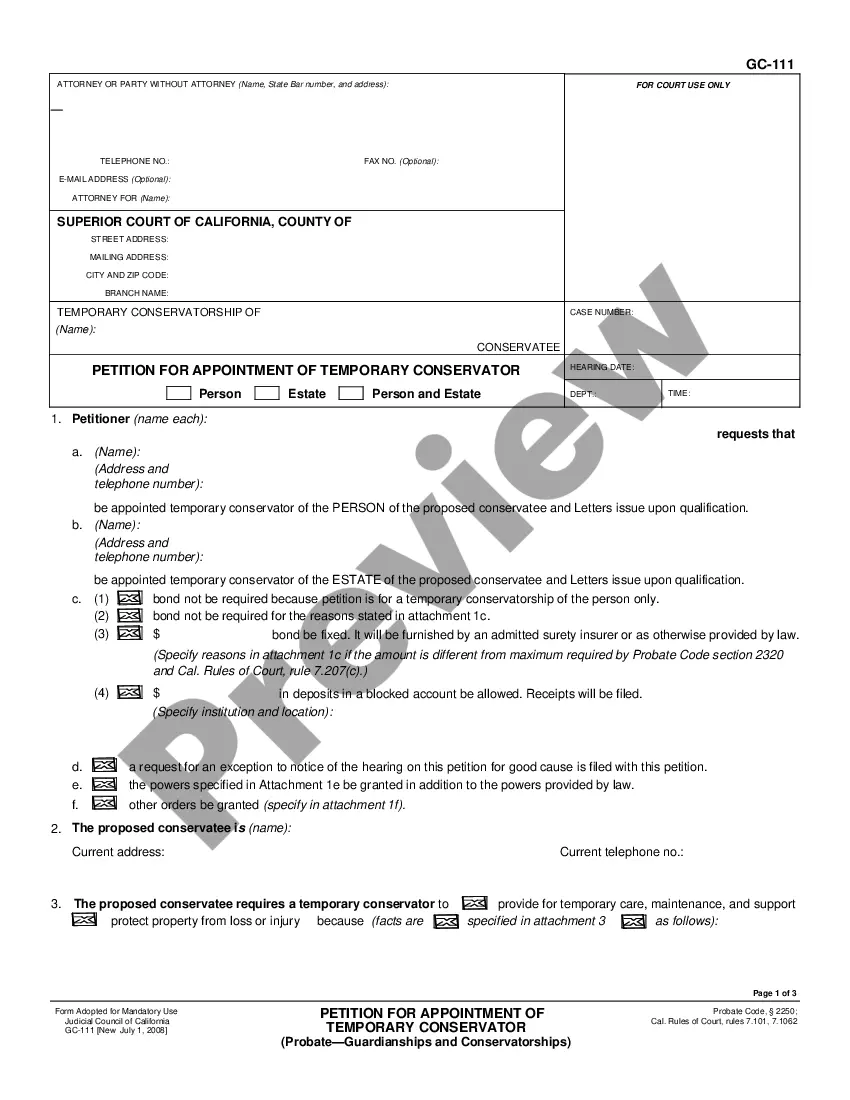

- Use the Preview button to examine the form.

- Check the description to make sure you have selected the right form.

- If the form is not what you are looking for, use the Search field to find the form that fits your needs and requirements.

Form popularity

FAQ

If you already receive benefits (retirement, survivors, or disability) and you have a bank account, you can start or update your direct deposit by using the My Profile tab in your personal my Social Security account. You can also decide when your change will take effect.

If you get Social Security benefits, you must receive your payments electronically. You can do so by signing up for direct deposit, which sends payments directly into your bank account. Or, you can have your benefits automatically deposited into your Direct Express® Debit MasterCardA® account.

Complete a direct deposit form yourselfDownload the form (PDF)Locate your 9-digit routing and account number - here's how to find them.Fill in your other personal information.Give the completed form to your employer.

The most convenient way to change your direct deposit information with us is by creating a my Social Security account online at . Once you create your account, you can update your bank information from anywhere.

Use our pre-filled form Or you can download a blank Direct Deposit/Automatic Payments Set-up Guide (PDF) and fill in the information yourself. For accounts with checks, a diagram on the form shows you where you can find the information you'll need.

Step 1: Choose an account. On EasyWeb, go to the Accounts page.Step 2: Select the direct deposit form. On the Account Activity page, select Direct deposit form (PDF) to download and open a copy of your form.Step 3: Access the form. If you're using Adobe Reader, the form will open in a new window.

Another way to change your direct deposit is by calling Social Security at 1-800-772-1213 (TTY 1-800-325-0778) to make the change over the phone. If you prefer to speak to someone in-person, you can visit your local Social Security office with the necessary information.

How Long Does It Take to Change to Direct Deposit with Social Security? Once you sign up (regardless of the method), it takes 30 to 60 days for any direct deposit changes or new accounts to take effect. Make sure you don't close or switch your bank account before you see that first successful deposit.

You can sign up online at Go Direct®, by calling 1-800-333-1795, in person at your bank, savings and loan or credit union, or calling Social Security. Then, just relax.

Enroll in direct deposit of federal benefits in one of 3 ways:Online at the U.S. Treasury at 800.333. 1795. 1795.Schedule an appointment at your nearest financial center.