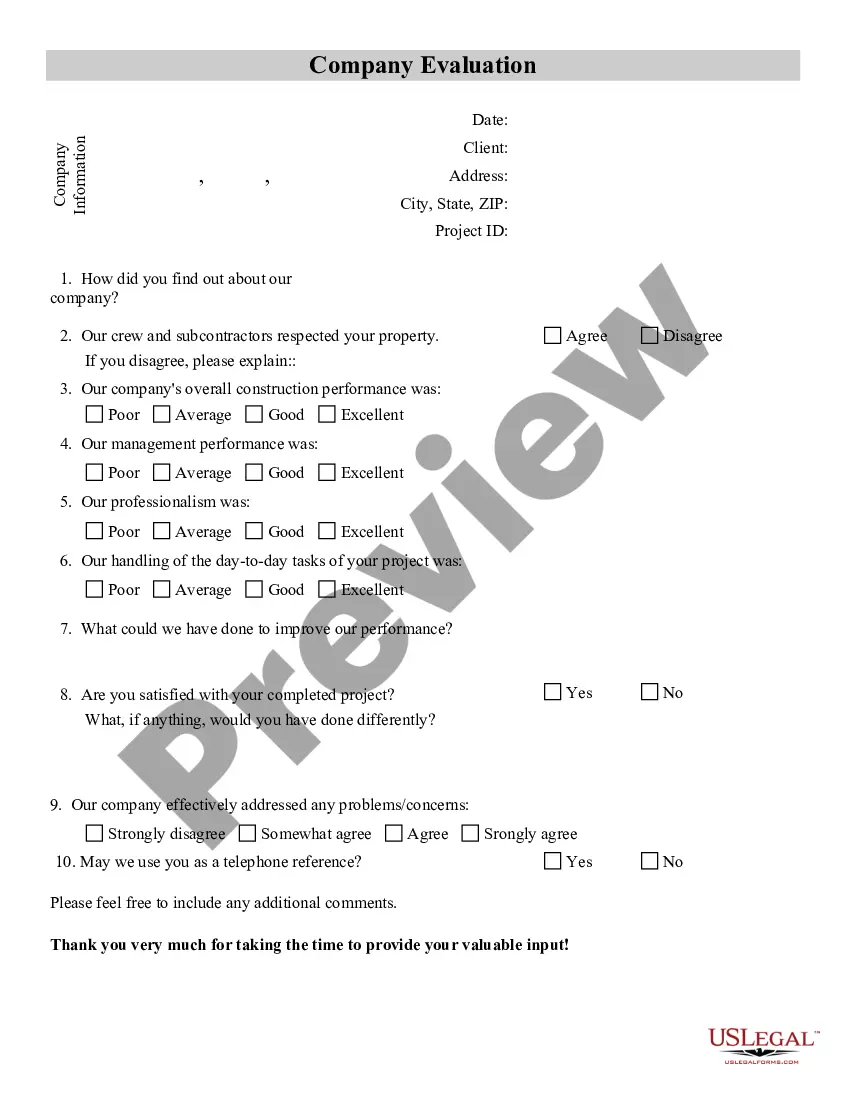

South Dakota Construction Company Evaluation by a Customer

Description

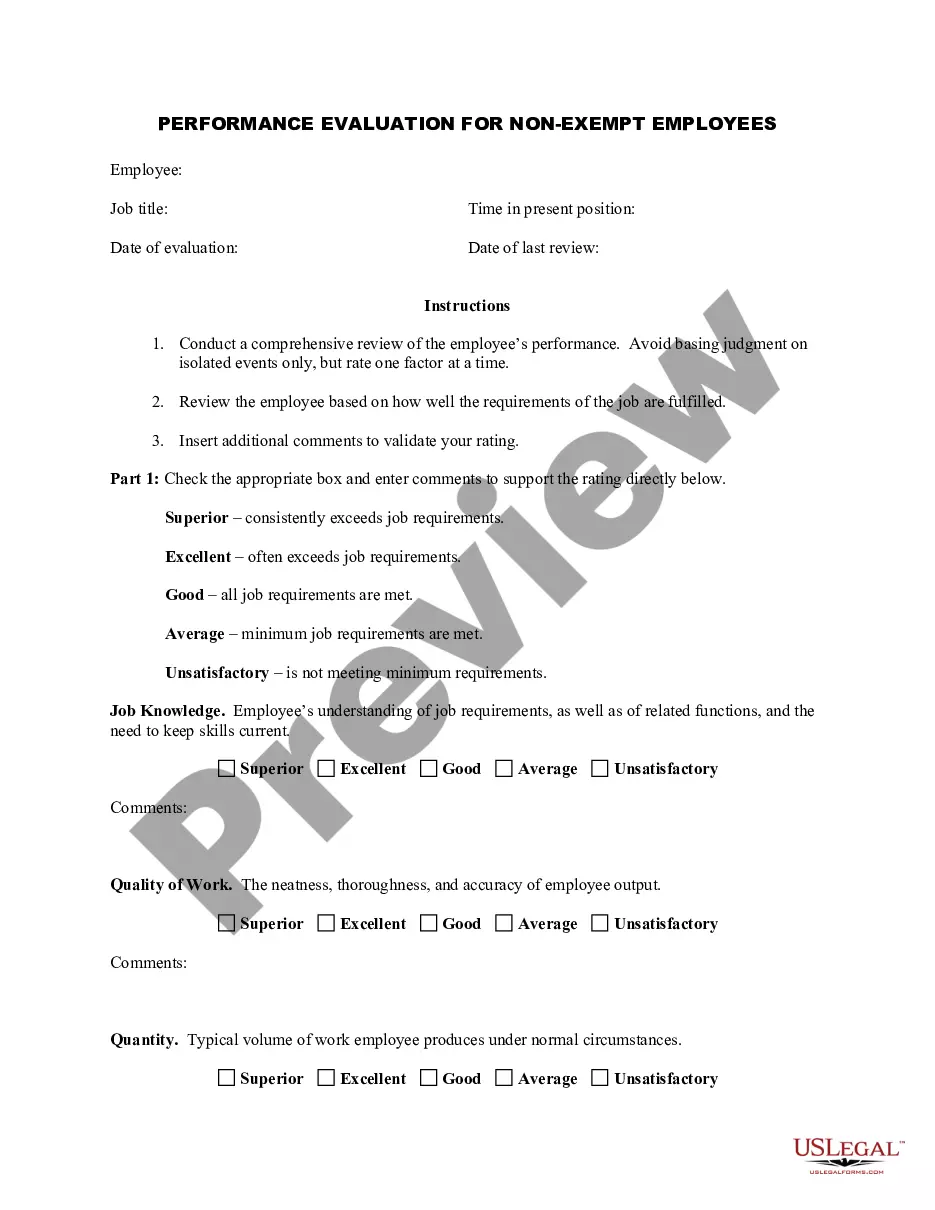

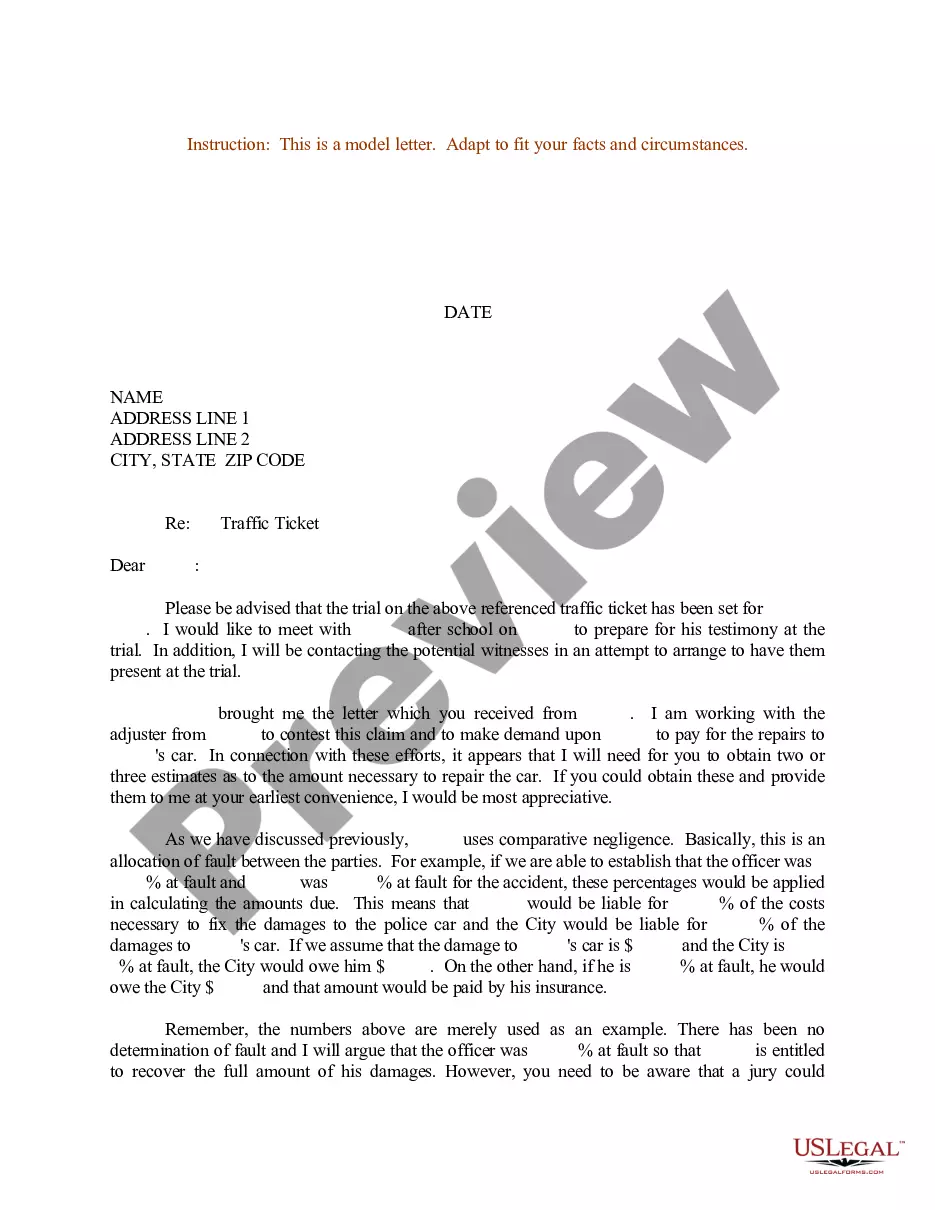

How to fill out Construction Company Evaluation By A Customer?

In case you need to extensive, acquire, or print valid document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Make use of the website's simple and user-friendly search to find the documents you require.

Various templates for business and personal needs are organized by categories and states, or keywords.

Each legal document template you purchase belongs to you permanently. You can access any forms you saved in your account. Click the My documents section and choose a form to print or download again.

Complete and download, and print the South Dakota Construction Company Assessment by a Client with US Legal Forms. There are numerous professional and state-specific forms available for your business or personal requirements.

- Use US Legal Forms to find the South Dakota Construction Company Assessment by a Client in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Purchase option to obtain the South Dakota Construction Company Assessment by a Client.

- You can also access forms you previously saved in the My documents section of your account.

- If this is your first time using US Legal Forms, follow the steps below.

- Step 1. Ensure you have picked the form for the correct state/region.

- Step 2. Utilize the Preview option to review the content of the form. Always remember to read through the summary.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find alternative templates.

- Step 4. Once you have found the form you need, click the Purchase now option. Choose your preferred payment plan and provide your details to sign up for an account.

- Step 5. Process the transaction. You may use your Visa or Mastercard or PayPal account to complete the payment.

- Step 6. Select the format of the legal form and download it to your device.

- Step 7. Fill out, revise, and print or sign the South Dakota Construction Company Assessment by a Client.

Form popularity

FAQ

Excise tax is a specific tax applied to particular goods or services, while sales tax is a general tax applied to most retail sales. In South Dakota, excise taxes often target specific items, such as fuel or tobacco, while sales tax applies broadly. Understanding this difference will empower you as you conduct a South Dakota Construction Company Evaluation by a Customer to anticipate all additional fees.

The South Dakota excise tax is a tax levied on specific goods and services, designed to raise revenue for the state. This might include taxes on items such as fuel, alcohol, and certain construction materials. During a South Dakota Construction Company Evaluation by a Customer, knowing about these taxes can prepare you for the total project costs.

Engineering services are generally exempt from sales tax in South Dakota. However, if those services result in the sale of tangible personal property, then tax may apply to that specific portion. It is essential to clarify these details during your South Dakota Construction Company Evaluation by a Customer to ensure clear financial expectations.

In South Dakota, the responsibility for paying excise tax typically falls on the consumer or end-user. This tax is applied to specific goods and services, which means that when you engage with a South Dakota construction company, any applicable excise tax may be included in your overall costs. Understanding this helps customers make informed decisions during a South Dakota Construction Company Evaluation by a Customer.

In South Dakota, the excise tax rate for contractors is typically 2% of the gross receipts from construction projects. This rate applies to most contractor services, although specific exceptions may exist depending on project type and funding sources. To ensure you are calculating this tax correctly, consider resources or services that offer a South Dakota construction company evaluation by a customer.

Certain entities in South Dakota may be exempt from excise tax, such as government agencies and nonprofit organizations. Additionally, specific projects may qualify for exemption based on their nature or funding. It is important to verify your eligibility by consulting local regulations or a knowledgeable construction company. A South Dakota construction company evaluation by a customer may also reveal helpful insights into exemption criteria.

To figure out your excise tax, start by determining the taxable value of your construction project. This includes all materials, labor costs, and related expenses. Once you have the total, multiply it by the excise tax rate set by South Dakota law. For an accurate breakdown, consider reviewing user experiences through a South Dakota construction company evaluation by a customer, which can provide insights on various projects.

In South Dakota, construction labor is generally exempt from sales tax, but it’s crucial to understand specific situations that may require taxes. For instance, when labor is performed on exempt projects, it remains nontaxable. However, if you hire a contractor who doesn't differentiate between taxable and nontaxable services, you could face unexpected charges. Always seek a South Dakota construction company evaluation by a customer to gain clarity on such matters.

To figure excise tax in South Dakota, you need to identify the total value of the construction project. Typically, the excise tax is calculated as a percentage of this total. You can then multiply the total project value by the applicable excise tax rate. For more precise calculations, consider consulting a South Dakota construction company evaluation by a customer that outlines these details.

In South Dakota, the taxation of labor depends on the type of service provided. While some labor is exempt, numerous construction-related services may incur sales tax. As you evaluate a South Dakota construction company, it's critical to factor in how labor expenditures will affect your overall budget. Utilizing resources like uslegalforms can help clarify these details and contribute to an informed evaluation process.