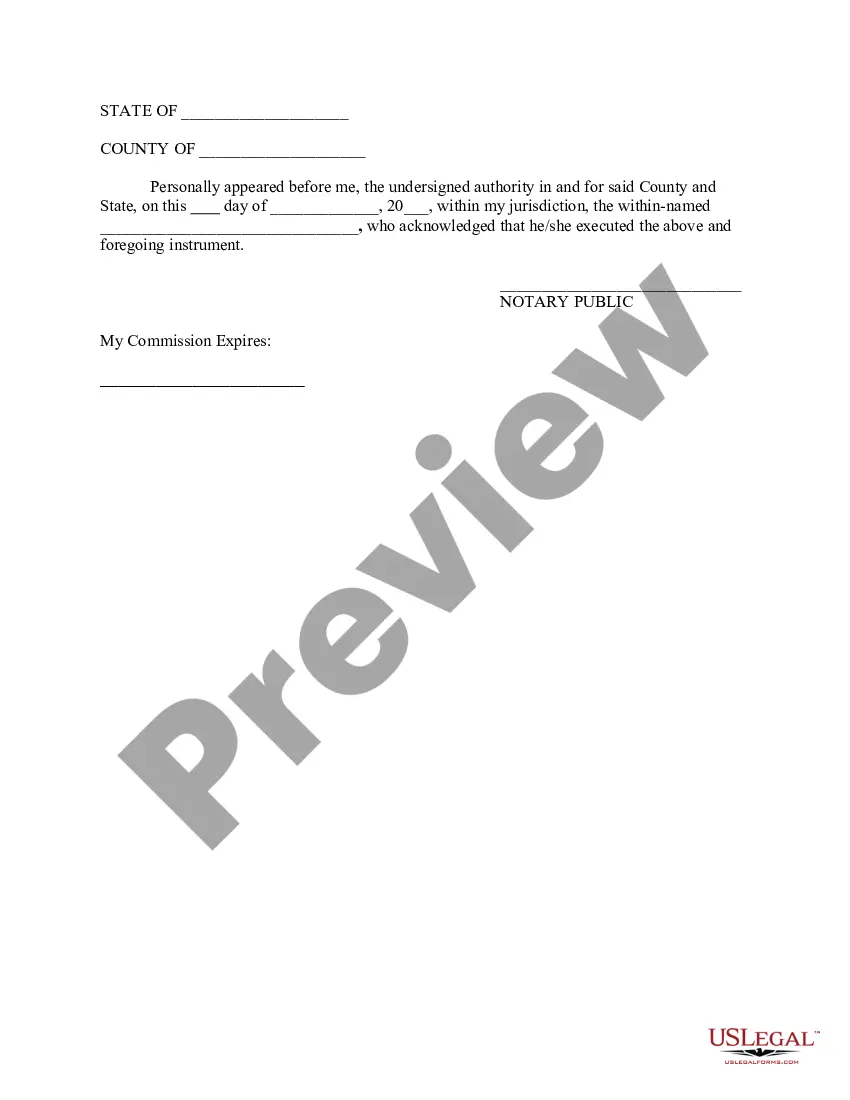

Title: South Dakota Certificate of Heir for Transfer of Title to Motor Vehicle without Probate (Vehicle not Bequeathed in Will) Explained Description: If you find yourself in possession of a motor vehicle in South Dakota that was not specifically bequeathed in a will, the South Dakota Certificate of Heir can be your solution to transferring the title without going through the probate process. This detailed description will explain the purpose of this certificate, the steps involved, and the different types of certificates available. Keywords: South Dakota Certificate of Heir, Transfer of Title, Motor Vehicle, Probate, Vehicle not Bequeathed, Will Types of South Dakota Certificates of Heir: There are two types of certificates available in South Dakota to obtain a transfer of title for a motor vehicle when it's not specifically bequeathed in a will: 1. South Dakota Certificate of Heir (Form MV-608): This is the primary form used to obtain a transfer of title without probate. It must be completed by the rightful heirs or beneficiaries of the deceased individual who owned the vehicle. This form requires the necessary details and signatures of all the heirs, as well as a notarization. 2. South Dakota Certificate of Heir by Obliged (Form MV-608-O): This form is used when the heir(s) are obligated to pay off certain debts or fulfill obligations associated with the deceased owner's estate relating to the motor vehicle. It includes additional information, such as the details of the obligations, completed by the obliged(s). Steps to Obtain a Transfer of Title without Probate: To obtain a transfer of title for a motor vehicle without going through the probate process in South Dakota, follow these steps: 1. Verify Ownership: Determine if you are a rightful heir entitled to the vehicle by confirming your relationship to the deceased owner. 2. Obtain the Required Forms: Obtain the South Dakota Certificate of Heir (Form MV-608) or the South Dakota Certificate of Heir by Obliged (Form MV-608-O) based on your specific circumstances. 3. Complete the Forms: Fill out the chosen form(s) accurately, providing all necessary information required by the South Dakota Department of Revenue. 4. Include Supporting Documents: Attach relevant supporting documents, such as the death certificate of the deceased owner and any proof of obligations if applying for the Certificate of Heir by Obliged. 5. Obtain Signatures: Ensure all heirs or obliges involved sign the form(s) in the presence of a notary public. 6. Submit the Application: Submit the completed form(s), supporting documents, and any applicable fees to the South Dakota Department of Revenue, Motor Vehicle Division. 7. Await Approval: Wait for the Department of Revenue to process your application. Once approved, they will issue a new title in the name(s) of the rightful heir(s) or beneficiary(IES). By utilizing the South Dakota Certificate of Heir, individuals can avoid the complex probate process while still obtaining legal ownership and a valid title for a motor vehicle not specifically bequeathed in a will. Ensure all required forms and documents are accurately completed to facilitate a smooth transfer of title.

South Dakota Certificate of Heir to obtain Transfer of Title to Motor Vehicle without Probate (Vehicle not Bequeathed in Will)

Description

How to fill out South Dakota Certificate Of Heir To Obtain Transfer Of Title To Motor Vehicle Without Probate (Vehicle Not Bequeathed In Will)?

If you have to full, down load, or print authorized papers templates, use US Legal Forms, the biggest assortment of authorized varieties, which can be found online. Take advantage of the site`s basic and practical research to obtain the paperwork you will need. Various templates for business and person uses are sorted by classes and suggests, or keywords. Use US Legal Forms to obtain the South Dakota Certificate of Heir to obtain Transfer of Title to Motor Vehicle without Probate (Vehicle not Bequeathed in Will) within a number of mouse clicks.

If you are already a US Legal Forms client, log in for your bank account and click on the Obtain option to get the South Dakota Certificate of Heir to obtain Transfer of Title to Motor Vehicle without Probate (Vehicle not Bequeathed in Will). You may also gain access to varieties you earlier downloaded inside the My Forms tab of the bank account.

If you are using US Legal Forms the first time, follow the instructions below:

- Step 1. Be sure you have selected the shape to the appropriate city/country.

- Step 2. Make use of the Review solution to examine the form`s content. Don`t overlook to see the description.

- Step 3. If you are unhappy with all the type, make use of the Research discipline at the top of the screen to locate other models of the authorized type web template.

- Step 4. Once you have found the shape you will need, go through the Acquire now option. Choose the prices plan you like and include your credentials to sign up for the bank account.

- Step 5. Process the financial transaction. You may use your credit card or PayPal bank account to perform the financial transaction.

- Step 6. Find the formatting of the authorized type and down load it on your product.

- Step 7. Complete, change and print or sign the South Dakota Certificate of Heir to obtain Transfer of Title to Motor Vehicle without Probate (Vehicle not Bequeathed in Will).

Every single authorized papers web template you buy is your own property permanently. You possess acces to each and every type you downloaded inside your acccount. Go through the My Forms section and pick a type to print or down load again.

Remain competitive and down load, and print the South Dakota Certificate of Heir to obtain Transfer of Title to Motor Vehicle without Probate (Vehicle not Bequeathed in Will) with US Legal Forms. There are many expert and express-certain varieties you can utilize for the business or person demands.