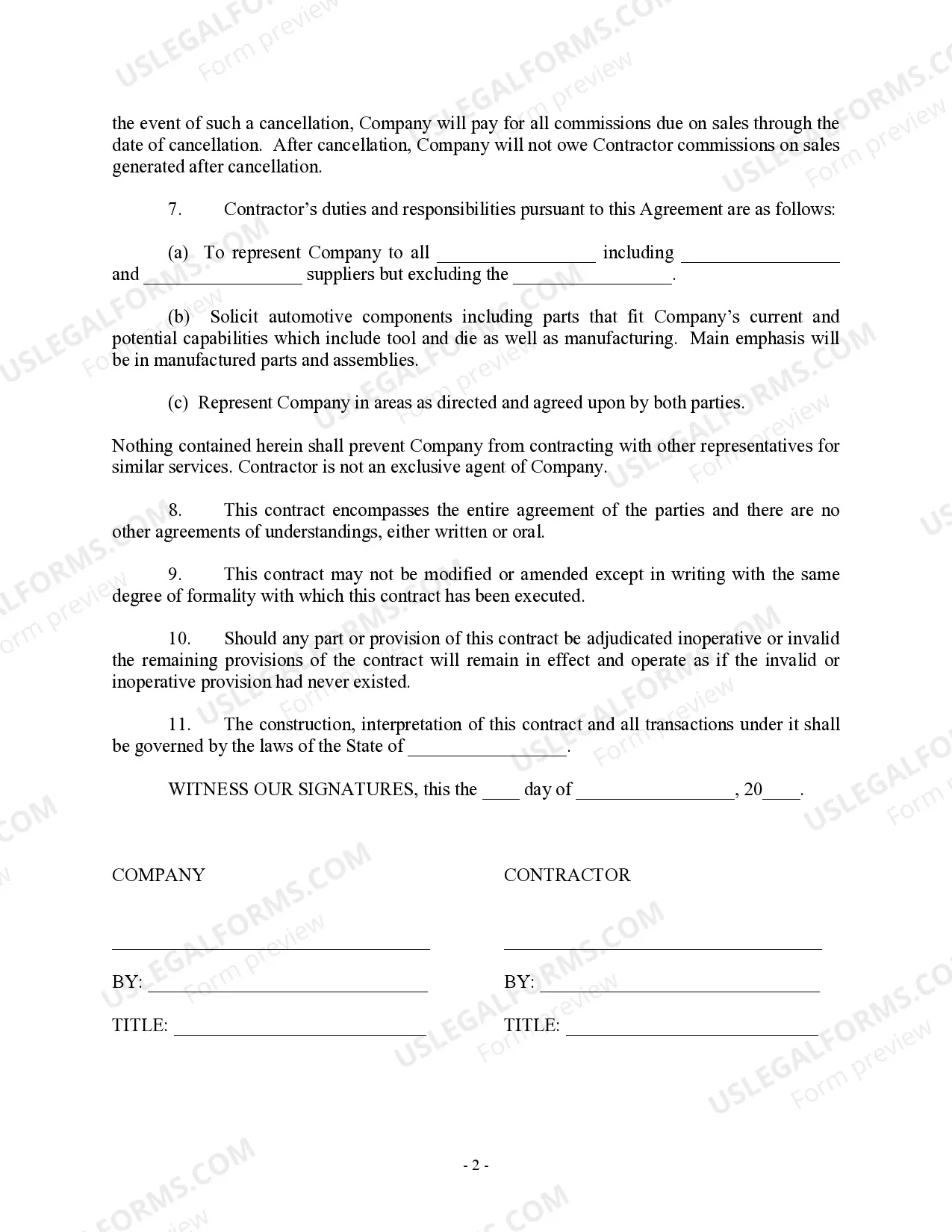

South Dakota Employment Agreement — Percentage of Sale— - Self-Employed Independent Contractor is a legal document that outlines the terms and conditions of the working relationship between a self-employed individual and a company in the state of South Dakota. This agreement specifically applies to independent contractors who are compensated based on a percentage of sales. In this employment agreement, the parties involved will be referred to as the "Contractor" and the "Company." The agreement will cover essential aspects such as the nature of the work, compensation structure, duration of the agreement, and other vital terms. The South Dakota Employment Agreement — Percentage of Sale— - Self-Employed Independent Contractor typically consists of the following sections: 1. Introduction: This section states the effective date and purpose of the agreement, identifying the involved parties. 2. Recitals: This portion provides a brief overview of the contractor's skills, qualifications, and the nature of the business conducted by the company. 3. Obligations and Duties: Here, the agreement outlines the contractor's responsibilities, including sales targets, marketing efforts, customer service, and any additional duties they may be required to perform. 4. Compensation and Payment Terms: This section specifies how the contractor will be compensated for their services. It includes the percentage of sales they will earn, as well as any additional commission structures, bonuses, or incentives. 5. Independent Contractor Relationship: The agreement clarifies that the contractor is not an employee of the company, but an independent contractor responsible for their own taxes, insurance, and other legal obligations. 6. Confidentiality and Non-Disclosure: This section ensures that the contractor will maintain the confidentiality of any proprietary or sensitive information they come across during the course of their work. 7. Term and Termination: The agreement defines the duration of the agreement and the conditions under which either party can terminate it, including notice periods and any penalties or obligations that may arise in such instances. 8. Intellectual Property: This section addresses the ownership and rights of any intellectual property created by the contractor during their engagement with the company. 9. Governing Law and Jurisdiction: The agreement specifies that it will be governed by and interpreted according to the laws of South Dakota. It also states which jurisdiction will have the authority to settle any disputes that may arise. 10. Severability: This section ensures that if any provision of the agreement is found to be invalid or unenforceable, the remaining provisions will still be in effect. Different types of South Dakota Employment Agreement — Percentage of Sale— - Self-Employed Independent Contractor may exist based on specific industry requirements or unique terms negotiated between the contractor and the company. Examples of variations include agreements tailored for real estate agents, sales representatives, insurance brokers, or any profession where sales play a significant part in compensation. It is crucial for both parties to thoroughly review and understand the South Dakota Employment Agreement — Percentage of Sale— - Self-Employed Independent Contractor before signing it to ensure that their rights, obligations, and expectations are clearly defined and protected under the law. Professional legal advice should be sought if needed.

South Dakota Employment Agreement - Percentage of Sales - Self-Employed Independent Contractor

Description

How to fill out South Dakota Employment Agreement - Percentage Of Sales - Self-Employed Independent Contractor?

If you wish to full, obtain, or print out authorized papers templates, use US Legal Forms, the most important assortment of authorized forms, which can be found on the web. Make use of the site`s basic and hassle-free research to find the documents you want. Numerous templates for enterprise and personal uses are categorized by groups and states, or search phrases. Use US Legal Forms to find the South Dakota Employment Agreement - Percentage of Sales - Self-Employed Independent Contractor within a number of clicks.

If you are previously a US Legal Forms client, log in in your accounts and click on the Acquire option to find the South Dakota Employment Agreement - Percentage of Sales - Self-Employed Independent Contractor. You can also access forms you earlier downloaded within the My Forms tab of your accounts.

If you are using US Legal Forms initially, follow the instructions below:

- Step 1. Be sure you have chosen the shape for the correct area/country.

- Step 2. Take advantage of the Review option to look over the form`s content. Never overlook to read through the description.

- Step 3. If you are not satisfied together with the kind, utilize the Research discipline at the top of the screen to locate other variations in the authorized kind web template.

- Step 4. After you have found the shape you want, select the Buy now option. Select the pricing program you choose and put your references to sign up to have an accounts.

- Step 5. Approach the financial transaction. You can utilize your bank card or PayPal accounts to finish the financial transaction.

- Step 6. Choose the formatting in the authorized kind and obtain it on your own system.

- Step 7. Complete, change and print out or sign the South Dakota Employment Agreement - Percentage of Sales - Self-Employed Independent Contractor.

Each and every authorized papers web template you purchase is yours for a long time. You have acces to each and every kind you downloaded with your acccount. Click the My Forms area and select a kind to print out or obtain again.

Be competitive and obtain, and print out the South Dakota Employment Agreement - Percentage of Sales - Self-Employed Independent Contractor with US Legal Forms. There are thousands of skilled and state-certain forms you may use for the enterprise or personal requirements.