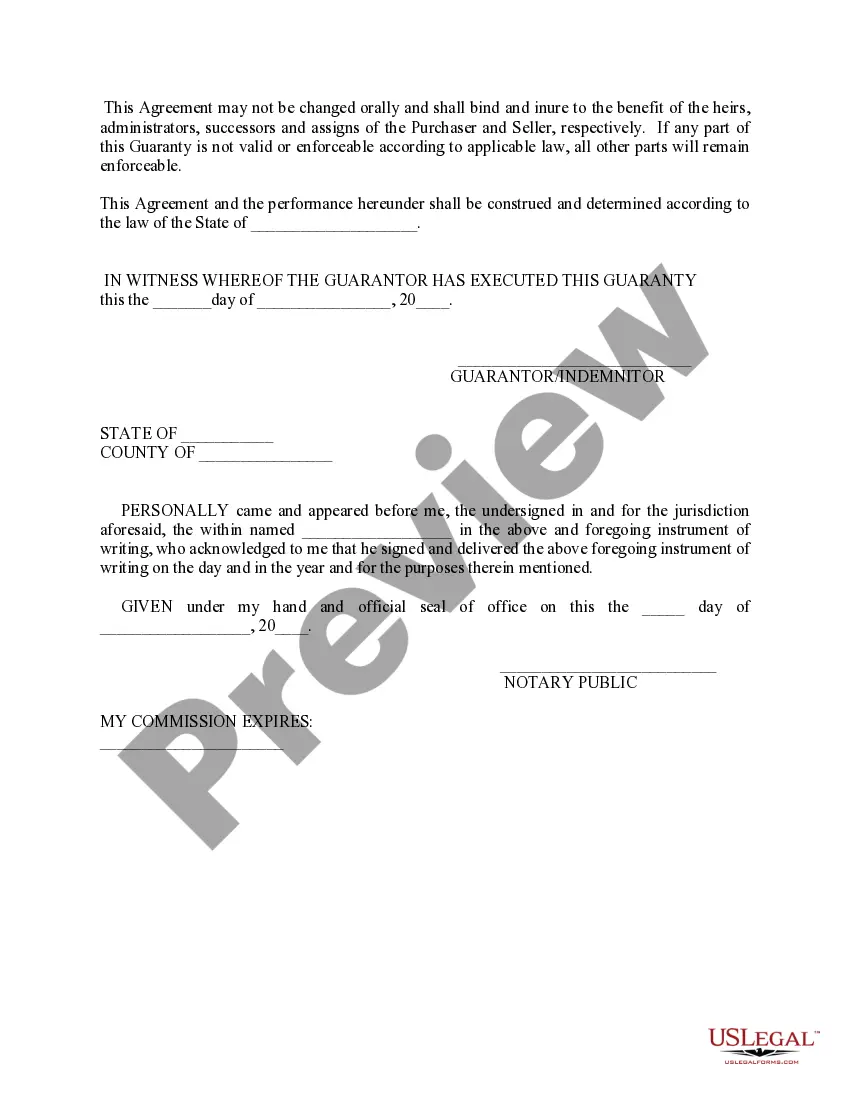

South Dakota General Guaranty and Indemnification Agreement

Description

How to fill out General Guaranty And Indemnification Agreement?

Are you in a situation where you require documents for various organizational or personal purposes almost daily.

There are numerous valid document templates available online, but finding reliable ones isn’t easy.

US Legal Forms provides a vast array of template forms, such as the South Dakota General Guaranty and Indemnification Agreement, designed to meet both state and federal requirements.

Once you find the right form, click Acquire now.

Choose the pricing plan you prefer, fill in the required information to create your account, and complete the transaction using your PayPal or credit card. Select a suitable file format and download your copy. You can view all the document templates you’ve bought in the My documents section. You can obtain an additional copy of the South Dakota General Guaranty and Indemnification Agreement anytime, if needed. Just click the needed form to download or print the document template. Use US Legal Forms, the most comprehensive collection of legal forms, to save time and avoid mistakes. The service offers professionally crafted legal document templates that can be utilized for a variety of purposes. Create an account on US Legal Forms and start making your life easier.

- If you are already familiar with the US Legal Forms site and have an account, simply Log In.

- After that, you can download the South Dakota General Guaranty and Indemnification Agreement template.

- If you don’t have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct city/region.

- Use the Review button to examine the document.

- Check the details to confirm that you have selected the right form.

- If the form isn’t what you’re looking for, utilize the Search field to find the form that fits your needs and criteria.

Form popularity

FAQ

A surety's undertaking is an original one, by which he becomes primarily liable with the principle debtor, while a guarantor is not a party to the principal obligation and bears only a secondary liability.2 Stated somewhat differently, the distinction between a suretyship and guaranty is that a surety is in the first

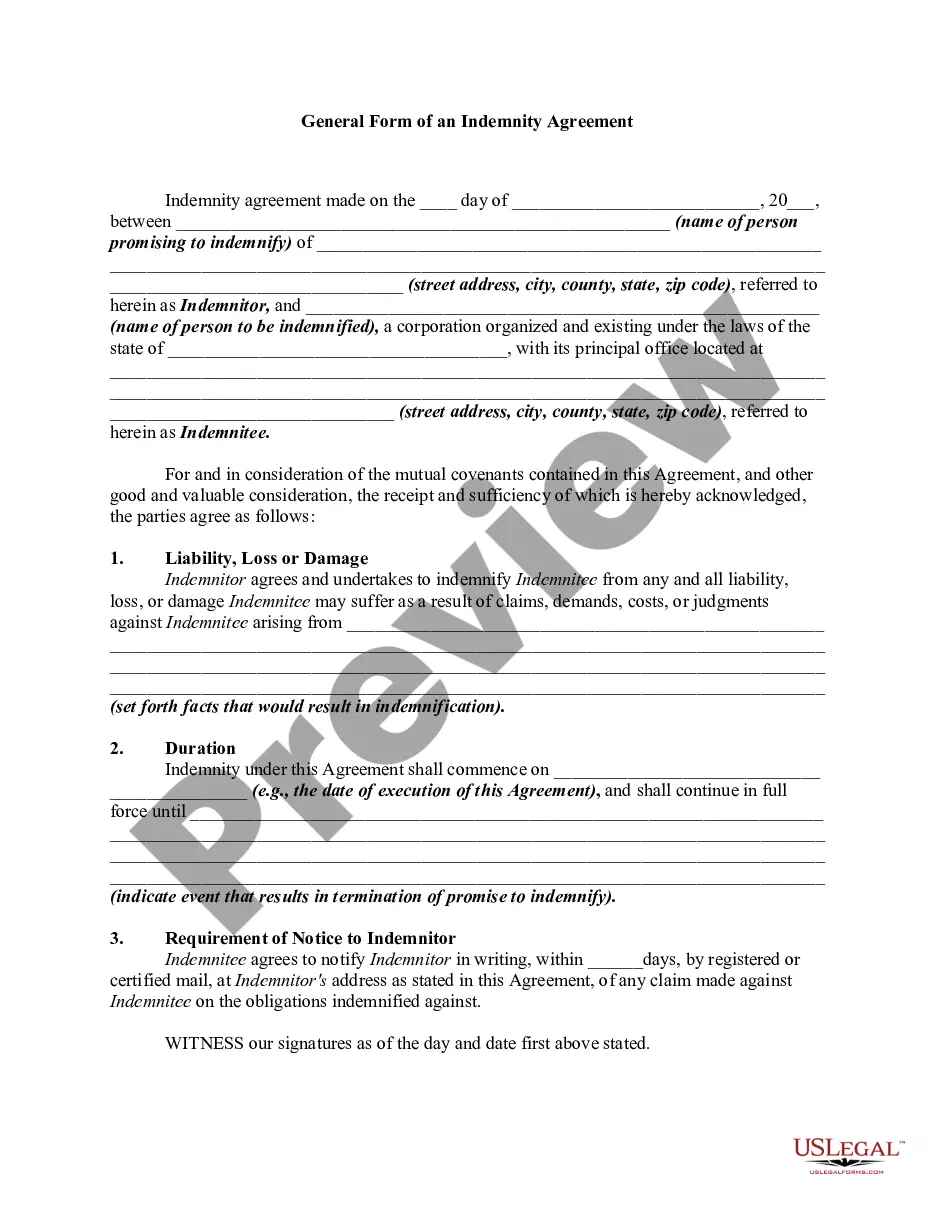

When the term indemnity is used in the legal sense, it may also refer to an exemption from liability for damages. Indemnity is a contractual agreement between two parties. In this arrangement, one party agrees to pay for potential losses or damages caused by another party.

The key differences between guarantees and indemnities include: a guarantee is a secondary liability, which means that there will be another person who is primarily liable for the obligation; whereas, an indemnity imposes a primary liability.

The surety is the guarantee of the debts of one party by another. A surety is an organization or person that assumes the responsibility of paying the debt in case the debtor policy defaults or is unable to make the payments. The party that guarantees the debt is referred to as the surety, or as the guarantor.

An indemnity agreement is a contract that protect one party of a transaction from the risks or liabilities created by the other party of the transaction. Hold harmless agreement, no-fault agreement, release of liability, or waiver of liability are other terms for an indemnity agreement.200c

The contract of indemnity is the contract where one person compensates for the loss of the other. Contract of guarantee is a contract between three people where the third person intervenes to pay the debt if the debtor is at default in paying back.

A guarantee is an agreement to meet someone else's agreement to do something usually to make a payment. An indemnity is an agreement to pay for a cost or reimburse a loss incurred by someone else.

The key differences between guarantees and indemnities include: a guarantee is a secondary liability, which means that there will be another person who is primarily liable for the obligation; whereas, an indemnity imposes a primary liability.

Company/Business/Individual Name shall fully indemnify, hold harmless and defend and its directors, officers, employees, agents, stockholders and Affiliates from and against all claims, demands, actions, suits, damages, liabilities, losses, settlements, judgments, costs and expenses (including but not

Guaranty Agreement a two-party contract in which the first party agrees to perform in the event that a second party fails to perform. Unlike a surety, a guarantor is only required to perform after the obligee has made every reasonable and legal effort to force the principal's performance.