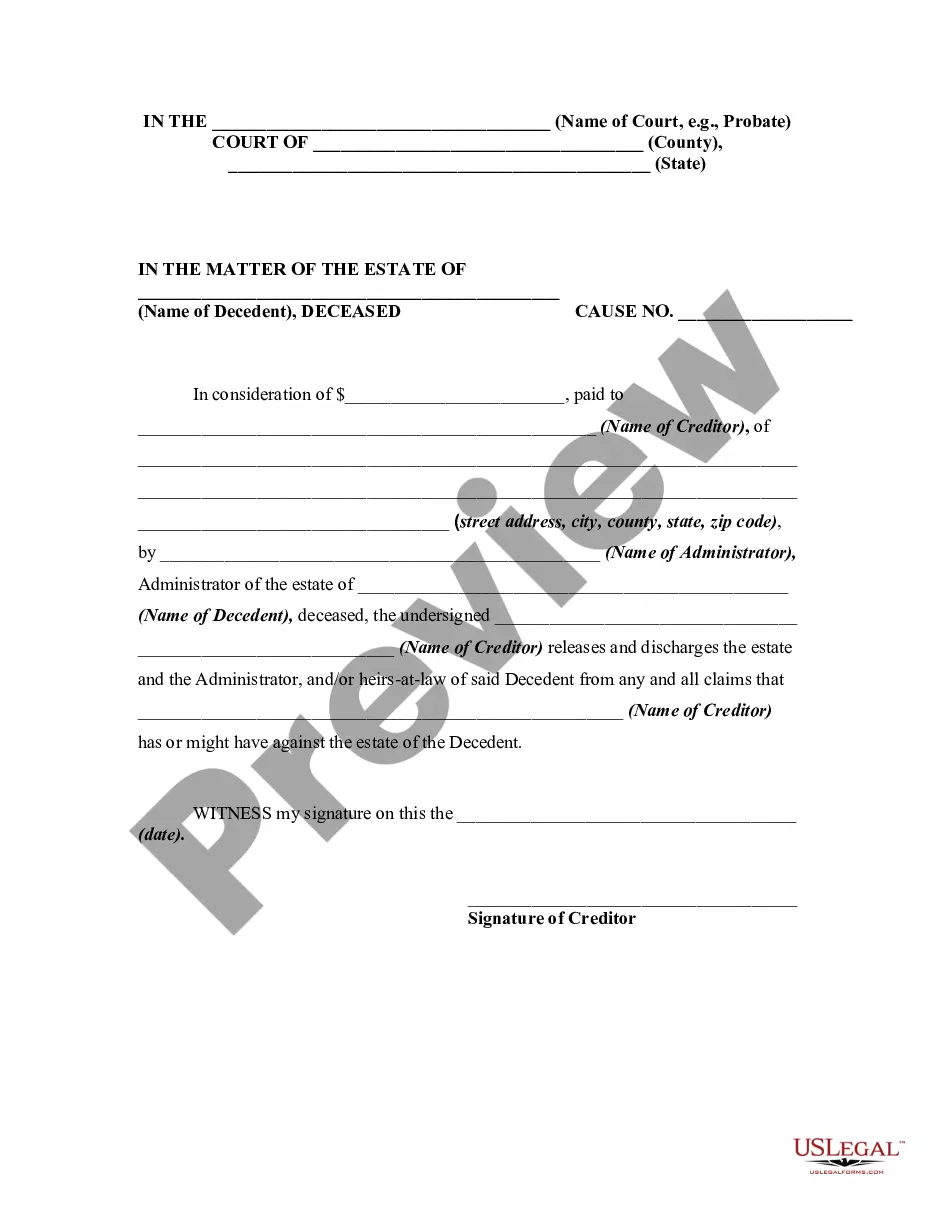

A claim may be presented to the personal representative (i.e., executor or administrator) at any time before the estate is closed if suit on the claim has not been barred by the general statute of limitations or a statutory notice to creditors. Claims may generally be filed against an estate on any debt or other monetary obligation that could have been brought against the decedent during his/her life.

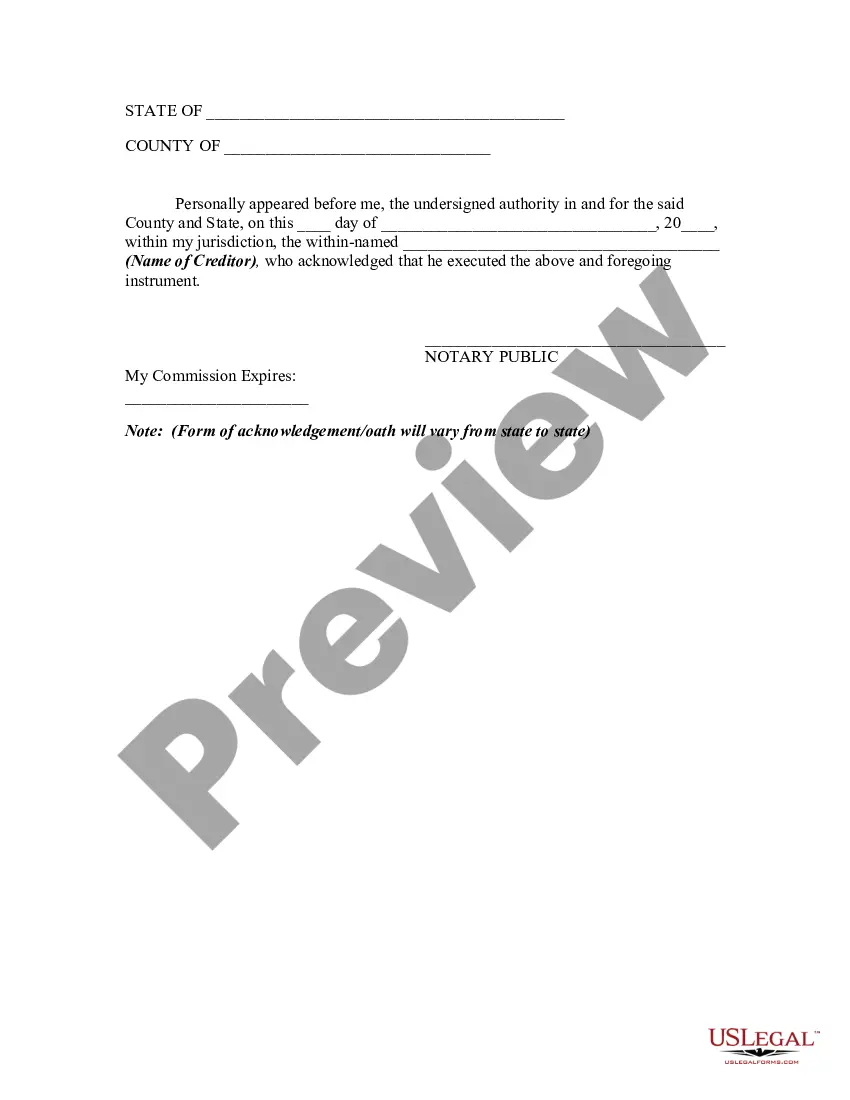

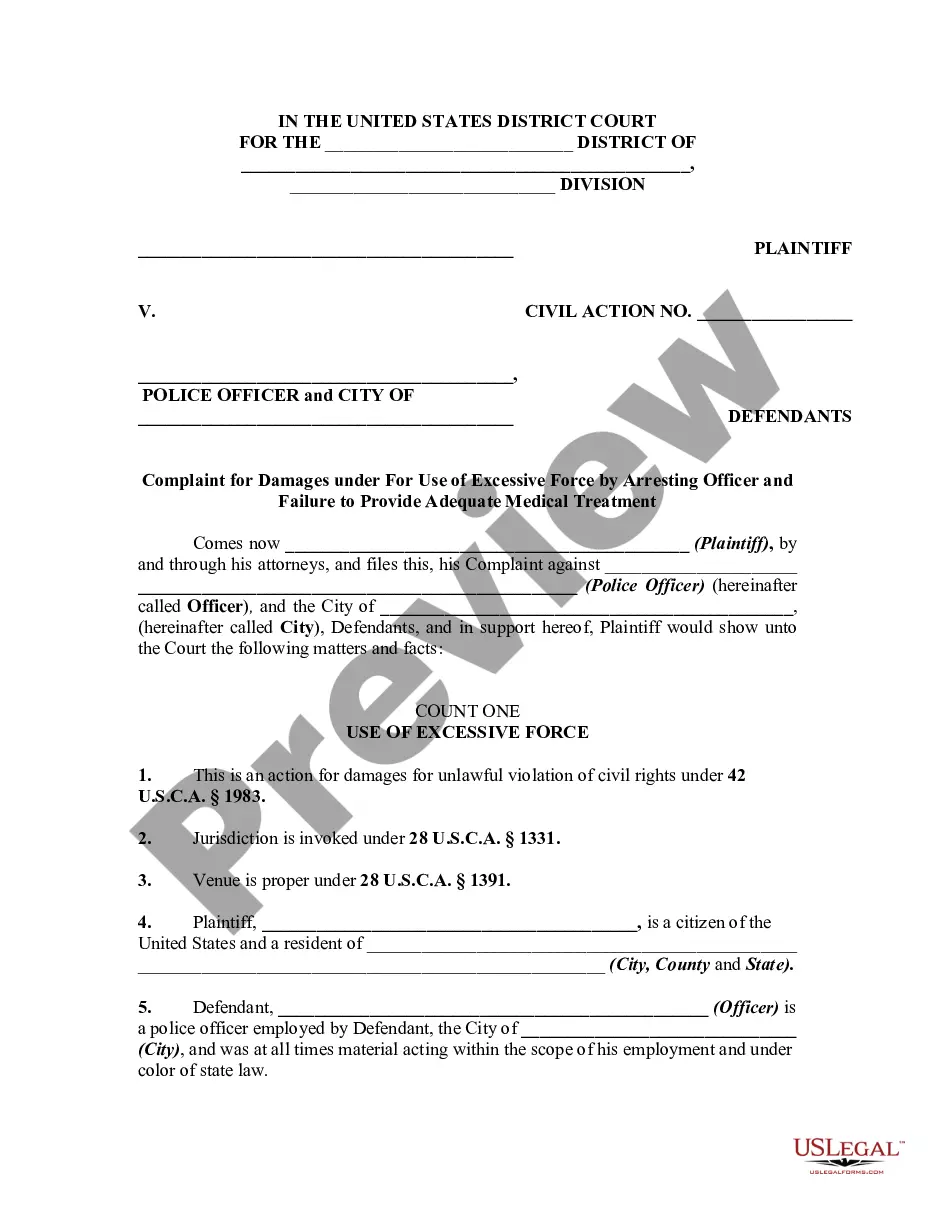

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.