South Dakota Shareholders Agreement - Short Form

Description

How to fill out Shareholders Agreement - Short Form?

Have you ever found yourself in a situation where you need documents for either business or personal purposes frequently.

There are numerous legal document templates available online, but locating reliable ones isn't straightforward.

US Legal Forms offers a vast array of template options, including the South Dakota Shareholders Agreement - Short Form, which can be tailored to meet both state and federal requirements.

Once you find the right template, click Acquire now.

Select the pricing plan you desire, complete the necessary information to create your account, and make your purchase using PayPal or credit card. Choose a convenient file format and download your copy. Access all the document templates you have purchased in the My documents menu. You can acquire an additional copy of the South Dakota Shareholders Agreement - Short Form at any time if needed. Just click on the desired template to download or print the format. Use US Legal Forms, the most extensive collection of legal templates, to save time and avoid mistakes. The service provides professionally crafted legal document templates that you can utilize for a variety of purposes. Create your account on US Legal Forms and start simplifying your life.

- If you are already acquainted with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the South Dakota Shareholders Agreement - Short Form template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the template you need and ensure it is suitable for your specific city/state.

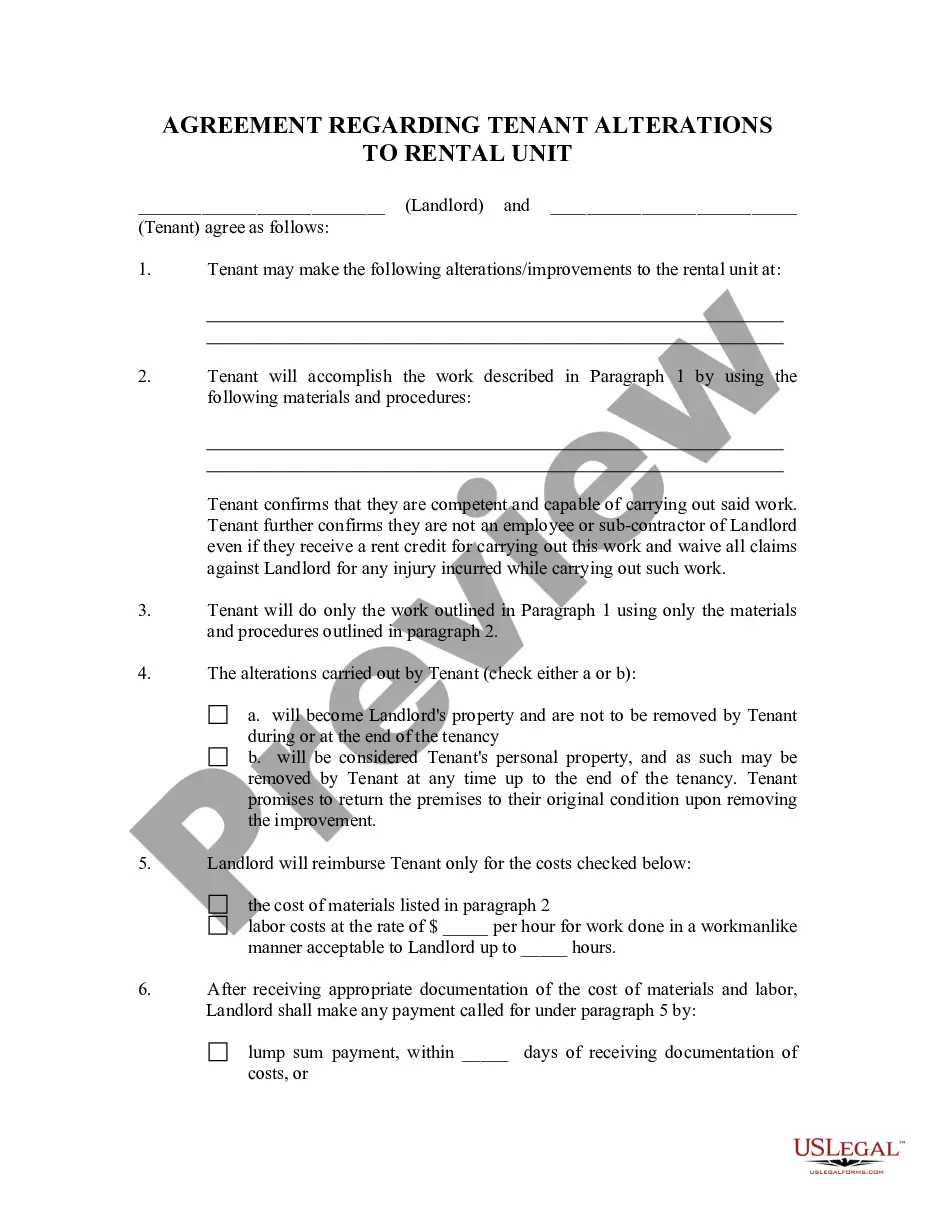

- Use the Preview button to view the form.

- Check the description to confirm that you have selected the correct template.

- If the template isn't what you're looking for, utilize the Search field to find the one that meets your preferences and requirements.

Form popularity

FAQ

While an operating agreement is not mandated by South Dakota law, it provides significant benefits for your business. This document can clarify roles, responsibilities, and distribution of profits among shareholders. Opting for a South Dakota Shareholders Agreement - Short Form can enhance your business operations, ensuring everyone is on the same page. Leveraging platforms like US Legal Forms can make the drafting process smooth and efficient.

South Dakota does not have a universal business license requirement, but specific industries may need permits or licenses. It's essential to check with local and state agencies to confirm your obligations. Including provisions in your South Dakota Shareholders Agreement - Short Form can help clarify responsibilities regarding licenses and permits. US Legal Forms can assist you in staying informed about licensing regulations.

Yes, South Dakota requires businesses to have a registered agent. This individual or entity is responsible for receiving legal documents on behalf of your business. Having a registered agent ensures you stay compliant with state laws and receive important notifications promptly. Consider integrating this aspect into your South Dakota Shareholders Agreement - Short Form for added legality.

An operating agreement is not strictly required in South Dakota, but it is highly recommended. This document outlines the management structure and operating procedures of your business. A well-crafted South Dakota Shareholders Agreement - Short Form can provide clarity and prevent disputes among shareholders. Using a platform like US Legal Forms can simplify the creation of this essential agreement.

To obtain a shareholders agreement, you can either draft one yourself using a template or hire a lawyer to create a custom agreement tailored to your business needs. Platforms like uslegalforms offer valuable resources, including a South Dakota Shareholders Agreement - Short Form that you can modify as per your requirements. Ensuring that your agreement is comprehensive is crucial for safeguarding your business interests.

Typically, a shareholders agreement is drawn up by business owners or legal professionals experienced in corporate law. Many businesses opt to use legal service platforms, like uslegalforms, to access templates for a South Dakota Shareholders Agreement - Short Form that simplify drafting. Engaging a lawyer is advisable to ensure that all legal requirements are met and customized effectively.

The common abbreviation for shareholder agreement is 'SHA.' This abbreviation is frequently used in business discussions and documentation, including when referring to a South Dakota Shareholders Agreement - Short Form. Understanding this term can facilitate clearer communication while drafting agreements and related business documents.

Creating a shareholder agreement involves outlining the roles, rights, and responsibilities of each shareholder in the business. Begin by gathering all shareholders and discussing critical aspects such as profit distribution, management structure, and transfer of shares. You can refer to a South Dakota Shareholders Agreement - Short Form template to streamline your process and ensure that all vital clauses are addressed.

Yes, you can draft your own shareholders agreement, but it's vital to ensure it covers all necessary aspects such as ownership, voting rights, and dispute resolution. Utilizing a template for a South Dakota Shareholders Agreement - Short Form can ease the process and help you include all crucial details. However, consulting with a legal professional is recommended to ensure compliance with state laws and regulations.

To obtain a tax ID number in South Dakota, you can apply online through the IRS website or by submitting Form SS-4. This process allows you to quickly acquire your tax ID, which is essential for any business, especially when drafting a South Dakota Shareholders Agreement - Short Form. After receiving your tax ID, you can proceed with the formalities of setting up your business structure and shareholders agreement.