The South Dakota Agreement for Sale of Business by Sole Proprietorship with Leased Premises is a legally binding contract that outlines the terms and conditions of the sale of a business by a sole proprietorship in South Dakota where the premises are leased. This agreement is crucial for protecting the interests of both the buyer and the seller, as it clearly defines the rights and responsibilities of each party involved in the transaction. Some important keywords relevant to this agreement include: 1. Agreement for sale of business: This refers to a legal document that embodies the terms and conditions under which a business is sold from one party (the seller) to another (the buyer). 2. Sole proprietorship: A type of business structure where an individual owns and operates the business as a single person, assuming all risks and liabilities. 3. Leased premises: This refers to the real estate or property that is rented or leased by the sole proprietorship, essentially serving as the location of the business operations. 4. Terms and conditions: Specific provisions that outline the obligations, rights, and expectations of both the buyer and the seller. These terms cover various aspects of the sale, such as purchase price, payment terms, transfer of assets, inventory, and intellectual property. 5. Rights and responsibilities: These are the privileges and duties that both parties have under the agreement. The seller may have responsibilities to provide accurate financial records, disclose any existing liabilities, and ensure a smooth transition, while the buyer may have the right to inspect and assess the business before finalizing the purchase. 6. Liabilities: Any debts, obligations, or claims that can be attributed to the business. It is important to clearly state the extent to which the buyer will assume these liabilities, if any, and how they will be addressed in the agreement. 7. Purchase price: The agreed-upon amount at which the business will be sold. This should be clearly stated, along with the payment terms, such as a lump sum payment, installment payments, or the inclusion of financing options. Types of South Dakota Agreements for Sale of Business by Sole Proprietorship with Leased Premises: 1. Standard Agreement: This is the most common type of agreement used for the sale of a business by a sole proprietorship with leased premises in South Dakota. It covers all the essential elements required for a smooth transaction and typically includes provisions addressing assets, liabilities, purchase price, and terms of payment. 2. Non-Disclosure Agreement: In some cases, a non-disclosure agreement may be necessary to protect sensitive or confidential information about the business during the negotiation process. This type of agreement ensures that both parties involved in the transaction maintain confidentiality and do not disclose any proprietary information to third parties. 3. Lease Assignment Agreement: If the buyer intends to continue leasing the premises where the business is located, a separate lease assignment agreement may be required. This agreement transfers the lease from the seller to the buyer and outlines the terms and conditions under which the buyer can assume the lease. In conclusion, the South Dakota Agreement for Sale of Business by Sole Proprietorship with Leased Premises is a comprehensive contract that facilitates the smooth transfer of a business from a sole proprietorship to a buyer. It covers crucial aspects such as purchase price, assets, liabilities, payment terms, and lease agreements. Different variations of this agreement may include non-disclosure agreements and lease assignment agreements, depending on the specific circumstances of the transaction.

South Dakota Agreement for Sale of Business by Sole Proprietorship with Leased Premises

Description

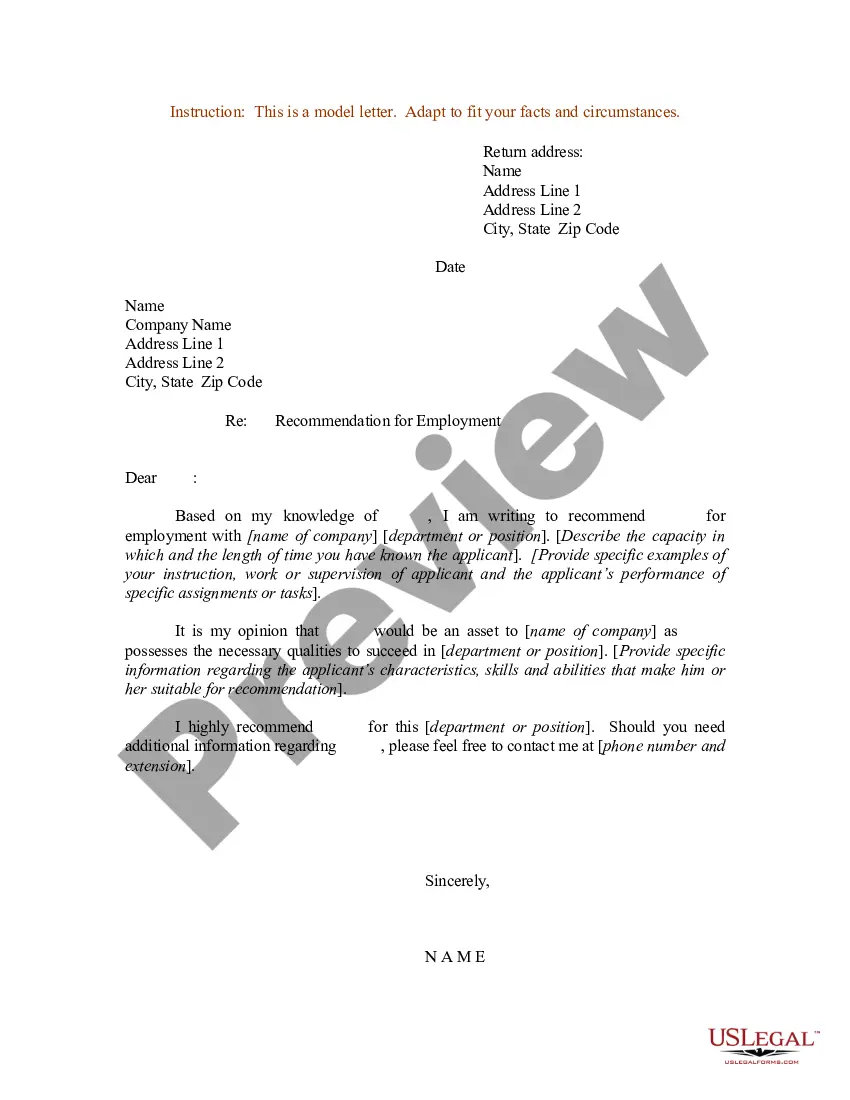

How to fill out South Dakota Agreement For Sale Of Business By Sole Proprietorship With Leased Premises?

If you want to complete, down load, or printing legitimate document themes, use US Legal Forms, the greatest selection of legitimate forms, which can be found online. Utilize the site`s basic and convenient look for to discover the files you require. Different themes for business and person uses are categorized by types and claims, or search phrases. Use US Legal Forms to discover the South Dakota Agreement for Sale of Business by Sole Proprietorship with Leased Premises in just a number of mouse clicks.

Should you be presently a US Legal Forms customer, log in to your account and click on the Down load button to obtain the South Dakota Agreement for Sale of Business by Sole Proprietorship with Leased Premises. You may also gain access to forms you formerly acquired within the My Forms tab of your account.

Should you use US Legal Forms the very first time, follow the instructions below:

- Step 1. Be sure you have selected the shape for the proper town/region.

- Step 2. Take advantage of the Preview choice to examine the form`s articles. Never forget about to see the information.

- Step 3. Should you be not satisfied with the form, utilize the Research discipline at the top of the display to locate other variations in the legitimate form design.

- Step 4. Once you have discovered the shape you require, click on the Get now button. Opt for the costs plan you like and add your references to register to have an account.

- Step 5. Method the deal. You can utilize your charge card or PayPal account to complete the deal.

- Step 6. Choose the format in the legitimate form and down load it on your product.

- Step 7. Total, modify and printing or signal the South Dakota Agreement for Sale of Business by Sole Proprietorship with Leased Premises.

Each and every legitimate document design you purchase is your own forever. You might have acces to each form you acquired in your acccount. Go through the My Forms section and choose a form to printing or down load again.

Contend and down load, and printing the South Dakota Agreement for Sale of Business by Sole Proprietorship with Leased Premises with US Legal Forms. There are thousands of specialist and express-distinct forms you may use for the business or person needs.