South Dakota Trust Agreement - Family Special Needs

Description

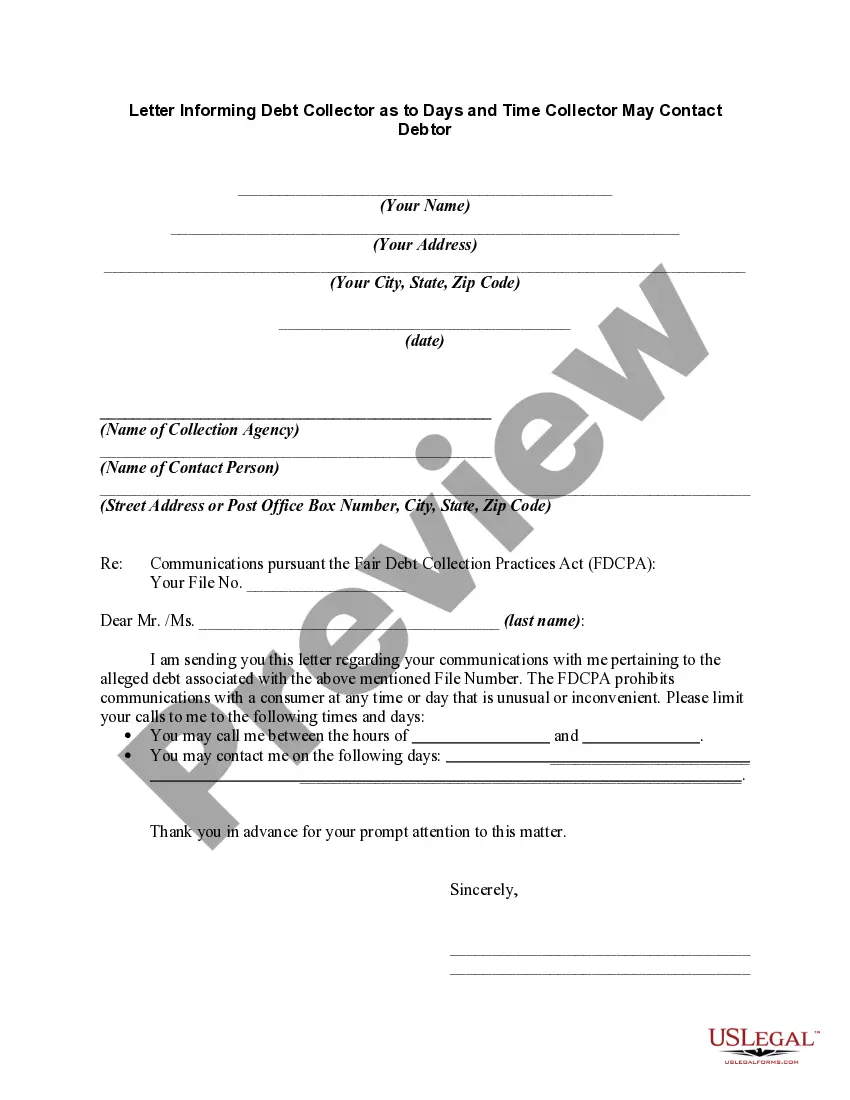

How to fill out Trust Agreement - Family Special Needs?

Selecting the correct authorized document format could be challenging.

It goes without saying that there are numerous templates available on the web, but how can you find the authorized version you require.

Utilize the US Legal Forms website. The service provides thousands of templates, such as the South Dakota Trust Agreement - Family Special Needs, that you can employ for both business and personal purposes.

If the form does not meet your needs, use the Search field to find the correct document. Once you are certain the form is suitable, select the Acquire now button to get the form. Choose your desired pricing plan and enter the required information. Create your account and complete the transaction using your PayPal account or credit card. Select the document format and download the authorized file format to your device. Fill out, modify, print, and sign the obtained South Dakota Trust Agreement - Family Special Needs. US Legal Forms is the largest collection of authorized documents where you can discover various file templates. Take advantage of the service to acquire professionally crafted papers that comply with state requirements.

- All of the documents are reviewed by experts and comply with federal and state regulations.

- If you are already a registered user, Log In to your account and click the Download button to obtain the South Dakota Trust Agreement - Family Special Needs.

- Use your account to search through the authorized documents you may have purchased previously.

- Navigate to the My documents section of your account and download another copy of the document you need.

- If you are a new user of US Legal Forms, here are straightforward steps you can follow.

- First, ensure you have selected the correct form for your locality. You can review the form using the Review button and check the form details to confirm it’s appropriate for you.

Form popularity

FAQ

Setting up a trust in South Dakota involves several key steps. First, you must decide on the type of trust that fits your situation, such as a South Dakota Trust Agreement - Family Special Needs. Consulting with a legal professional or using user-friendly platforms like USLegalForms can simplify the process, ensuring your trust complies with state laws and effectively serves your family’s needs.

South Dakota does not impose state income tax on trusts, which is a significant advantage. This lack of taxation can lead to increased growth of the assets in your trust over time. Therefore, utilizing a South Dakota Trust Agreement - Family Special Needs allows families to maximize resources while providing for those with special needs.

Opening a trust in South Dakota could be a wise decision based on your financial goals and family needs. This state provides a favorable environment for trust management with minimal regulatory hassles. Specifically, a South Dakota Trust Agreement - Family Special Needs caters to families wanting to establish dedicated support for members with special needs.

Setting up a trust in South Dakota can be highly beneficial. With robust legal protections and tax advantages, many individuals find peace of mind in knowing their assets are safeguarded. A South Dakota Trust Agreement - Family Special Needs is especially valuable for ensuring that your family's needs are met without disruption.

The best state to set up a trust depends on your specific needs, but South Dakota is often regarded as an excellent choice. It offers strong privacy laws, no state income tax, and flexible trust management options. A South Dakota Trust Agreement - Family Special Needs can benefit families seeking to secure financial stability for their disabled loved ones.

Yes, you can write your own will in South Dakota. However, to ensure that your wishes are clearly understood and legally binding, it is advisable to follow the state's legal requirements. A South Dakota Trust Agreement - Family Special Needs can provide additional assurance for managing assets, especially for loved ones with special needs.

The ideal living situation for someone on disability often depends on personal preferences and specific needs. Many find that supportive communities or group homes offer the needed resources and social interaction. When creating a South Dakota Trust Agreement - Family Special Needs, consider discussing these options to ensure the best living environment for your loved one, providing both support and independence.

For a disabled beneficiary, a special needs trust is often the best choice. This type of trust preserves eligibility for government benefits while providing additional financial support. When considering a South Dakota Trust Agreement - Family Special Needs, it’s crucial to structure it correctly to ensure that the beneficiary receives the care they require without jeopardizing their public assistance.

A discretionary trust grants the trustee the power to decide how assets are distributed to beneficiaries. This can lead to uncertainty, as beneficiaries may not have guaranteed access to the funds they need. Additionally, a discretionary trust can complicate financial planning for families, especially when dealing with a South Dakota Trust Agreement - Family Special Needs, which aims to provide security for loved ones with disabilities.

The best trust for a disabled person often includes a South Dakota Trust Agreement - Family Special Needs. This type of trust helps manage assets without jeopardizing government benefits like Social Security or Medicaid. It allows you to provide financial support while ensuring that your loved one remains eligible for essential assistance. Consulting with a professional can help you tailor the trust to meet specific needs and ensure compliance with relevant laws.