South Dakota Leaseback Provision in Sales Agreement

Description

How to fill out Leaseback Provision In Sales Agreement?

You can spend multiple hours online searching for the legal document template that meets the federal and state requirements you need.

US Legal Forms offers thousands of legal documents that can be reviewed by experts.

You can easily download or print the South Dakota Leaseback Provision in Sales Agreement from our service.

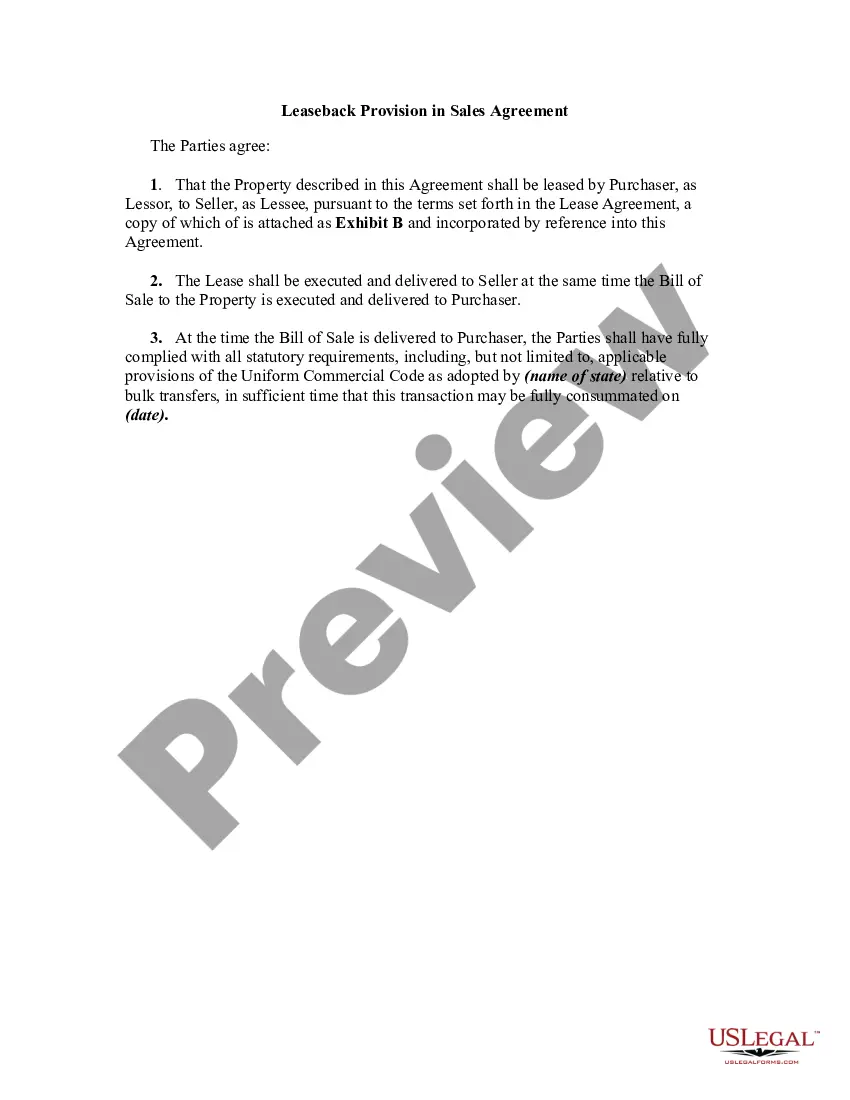

If available, use the Preview button to browse through the document template as well.

- If you already have a US Legal Forms account, you can Log In and click the Download button.

- Then, you can complete, modify, print, or sign the South Dakota Leaseback Provision in Sales Agreement.

- Every legal document template you receive is yours permanently.

- To obtain another copy of a purchased form, visit the My documents tab and click the corresponding button.

- If you are visiting the US Legal Forms website for the first time, follow the simple instructions outlined below.

- First, ensure that you have selected the correct document template for the county/city you have chosen.

- Read the form description to ensure you have selected the right form.

Form popularity

FAQ

The 22-42-5 law in South Dakota focuses on regulations concerning increased fines for specific violations tied to property disputes. It’s essential for landlords and tenants to understand how this law might apply, especially when negotiating terms related to the South Dakota Leaseback Provision in Sales Agreements. Ensuring compliance helps both parties avoid potential legal pitfalls.

A sale and leaseback agreement is a financial transaction where one sells an asset and leases it back immediately. This kind of arrangement can be beneficial for businesses needing liquidity while still operating from their original premises. Understanding the South Dakota Leaseback Provision in Sales Agreements can help individuals make informed decisions regarding property transactions and financing.

Law 43-32-26 in South Dakota pertains to the right of landlords to enter leased premises under specific, reasonable circumstances. Awareness of this law is essential for both landlords and tenants in maintaining rights and responsibilities associated with properties, especially in the context of the South Dakota Leaseback Provision in Sales Agreements. Clear communication about entry procedures can foster a healthy landlord-tenant relationship.

In South Dakota, property may be considered abandoned after 30 days of non-payment or failed upkeep. This timeframe can significantly impact landlords using the South Dakota Leaseback Provision in Sales Agreements, as it may provide grounds for action. It's important for landlords to maintain clear communication and enforce lease terms to protect their interests.

In South Dakota, it is legal to record a conversation if at least one party consents. Therefore, if you are part of the conversation, you can record it without notifying the other participants. While this may not directly relate to the South Dakota Leaseback Provision in Sales Agreements, understanding privacy laws is essential for all involved in real estate transactions.

The statute of limitations on debt collection in South Dakota is generally six years. This period applies to most written contracts, including sales agreements involving leasebacks. Knowing these timelines is crucial, as it affects both landlords and tenants when navigating disputes or pursuing claims related to the South Dakota Leaseback Provision in Sales Agreements.

In South Dakota, there are no state-wide limits on how much a landlord can increase rent. However, a landlord must provide proper notice to tenants, allowing them sufficient time to prepare for the change. This flexibility can benefit landlords looking to adapt their rental agreements in conjunction with the South Dakota Leaseback Provision in Sales Agreements. Tenants should always review their lease for specifics.

The length of a leaseback in Texas is typically specified in the sales contract and can range from a short-term option to a long-term agreement lasting several years. The South Dakota Leaseback Provision in Sales Agreement provides a reliable framework to guide these arrangements. Ensure you negotiate terms that truly reflect your needs.

A leaseback in Texas can last anywhere from a month to several years, depending on your agreement with the buyer. Implementing the South Dakota Leaseback Provision in Sales Agreement can give you extended flexibility and security in managing your property. Consult with a legal expert to explore what best suits your situation.

In most cases, once you sign a lease in Texas, you are legally binding and cannot back out without penalty. However, if there is a South Dakota Leaseback Provision in your Sales Agreement, certain conditions may allow for cancellation within a specified timeframe. Always review your agreement carefully to understand your rights and options.