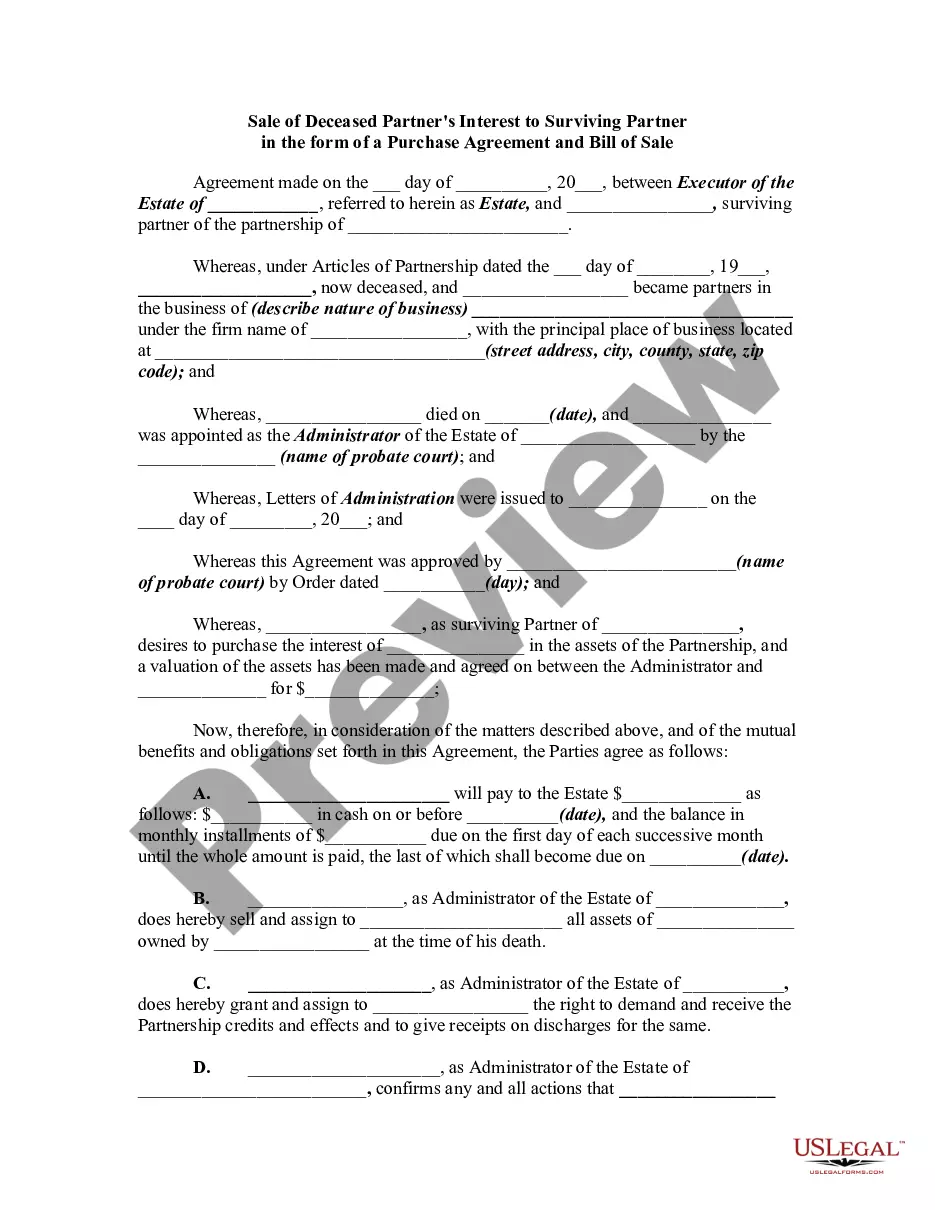

Title: South Dakota Sale of Deceased Partner's Interest to Surviving Partner: Purchase Agreement and Bill of Sale Keywords: South Dakota, sale, deceased partner's interest, surviving partner, purchase agreement, bill of sale Introduction: In case of the unfortunate passing of a partner in a business or partnership located in South Dakota, it is crucial to establish a legal process for transferring the deceased partner's interest to the surviving partner. The sale of a deceased partner's interest is typically formalized through a Purchase Agreement and Bill of Sale. This document helps ensure a seamless transition of ownership and protects the rights and interests of both parties involved. South Dakota recognizes this process and provides guidelines for executing the sale in a fair and legal manner. Types of South Dakota Sale of Deceased Partner's Interest to Surviving Partner: 1. Voluntary Purchase Agreement: When both partners willingly choose to facilitate the sale of a deceased partner's interest, they can enter into a voluntary purchase agreement. This type of agreement allows the surviving partner to purchase the deceased partner's interest as per the terms and conditions mutually agreed upon. 2. Statutory Buyout: In certain situations, South Dakota's partnership law may provide for a statutory buyout. This occurs when the partnership agreement contains a specific provision enabling the surviving partner to purchase the deceased partner's interest automatically, without requiring a separate agreement or negotiation. In such cases, the purchase agreement and bill of sale should refer to the relevant statute and make specific reference to the automatic buyout provision. Components of Purchase Agreement and Bill of Sale: 1. Identifying Information: Include the legal names and addresses of both the surviving partner and the deceased partner's estate or designated representative. 2. Partnership Details: Clearly state the name of the partnership and provide its principal place of business within South Dakota. Mention the effective date of the partnership and any relevant details regarding its formation. 3. Representation and Warranties: Specify that the surviving partner represents they have the legal capacity to enter into the agreement and that the deceased partner's estate holds the authority to sell the interest being transferred. Both parties should warrant that there are no undisclosed liabilities or encumbrances associated with the deceased partner's portion of the partnership. 4. Purchase Price and Payment Terms: Outline the agreed-upon purchase price for the deceased partner's interest in the partnership. Specify the payment method, whether it will be a lump sum or installments, and any agreed-upon interest rate or terms of repayment. 5. Division of Assets and Liabilities: Address the allocation of assets and liabilities between the surviving partner and the deceased partner's estate. Specifically define how existing debts, assets, inventory, intellectual property, and other partnership-related items will be divided. 6. Transfer of Interest: Explicitly state that the deceased partner's interest is being transferred to the surviving partner through this sale. Specify the effective date of the transfer and any additional documentation required to complete the transfer, such as filing forms with the South Dakota Secretary of State. 7. Indemnification and Release: Include clauses that protect both parties from future claims and liabilities arising from the partnership. Clearly establish the surviving partner's indemnification from any present or future claims against the deceased partner's estate pertaining to their interest in the partnership. 8. Governing Law and Dispute Resolution: Specify that the purchase agreement and bill of sale will be governed by South Dakota law. Detail the chosen method of resolving disputes and potentially include a mediation or arbitration clause. Conclusion: Executing a South Dakota Sale of Deceased Partner's Interest to the Surviving Partner in the form of a Purchase Agreement and Bill of Sale is a vital step in ensuring a smooth transfer of ownership and maintaining the operational continuity of a partnership. By carefully considering the different types of agreements and including essential elements within the document, both parties can protect their rights and interests while honoring the legacy of the deceased partner.

South Dakota Sale of Deceased Partner's Interest to Surviving Partner in the form of a Purchase Agreement and Bill of Sale

Description

How to fill out South Dakota Sale Of Deceased Partner's Interest To Surviving Partner In The Form Of A Purchase Agreement And Bill Of Sale?

Are you currently in a place in which you require paperwork for both company or individual purposes almost every working day? There are tons of legitimate record layouts accessible on the Internet, but discovering ones you can rely on isn`t effortless. US Legal Forms delivers a large number of develop layouts, just like the South Dakota Sale of Deceased Partner's Interest to Surviving Partner in the form of a Purchase Agreement and Bill of Sale, that are composed to satisfy state and federal needs.

Should you be presently knowledgeable about US Legal Forms web site and possess an account, just log in. Afterward, it is possible to obtain the South Dakota Sale of Deceased Partner's Interest to Surviving Partner in the form of a Purchase Agreement and Bill of Sale template.

Unless you provide an account and want to begin using US Legal Forms, follow these steps:

- Find the develop you want and ensure it is to the appropriate area/state.

- Take advantage of the Preview option to check the shape.

- Look at the outline to actually have chosen the proper develop.

- In case the develop isn`t what you`re trying to find, make use of the Research area to find the develop that fits your needs and needs.

- If you discover the appropriate develop, simply click Buy now.

- Pick the rates program you would like, fill in the specified details to generate your money, and pay money for the order using your PayPal or credit card.

- Select a practical paper structure and obtain your copy.

Get all of the record layouts you have bought in the My Forms menus. You can obtain a additional copy of South Dakota Sale of Deceased Partner's Interest to Surviving Partner in the form of a Purchase Agreement and Bill of Sale any time, if required. Just select the necessary develop to obtain or printing the record template.

Use US Legal Forms, one of the most substantial variety of legitimate varieties, to save time and steer clear of mistakes. The services delivers appropriately created legitimate record layouts which you can use for a variety of purposes. Generate an account on US Legal Forms and begin generating your lifestyle a little easier.