South Dakota Letter Notifying Social Security Administration of Identity Theft of Minor

Description

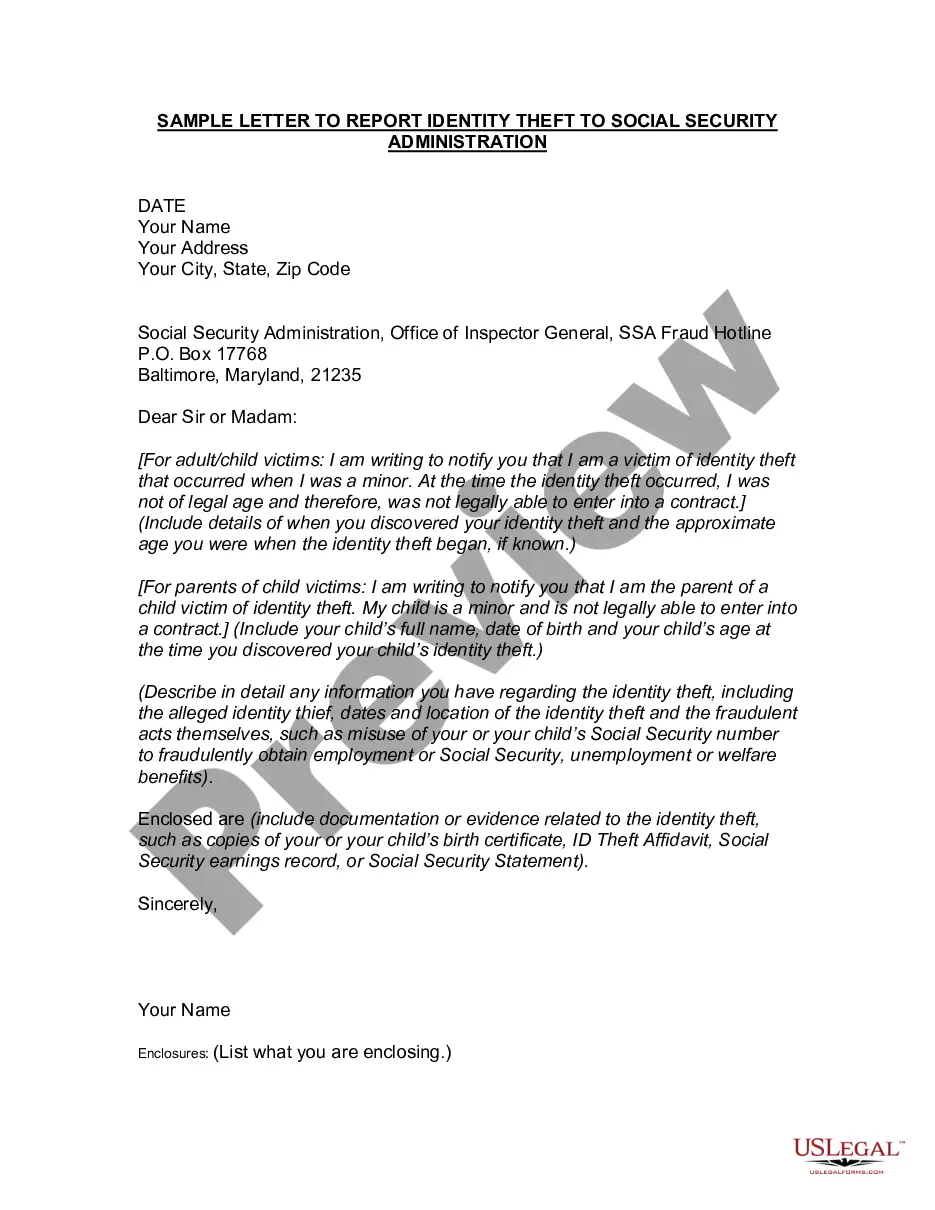

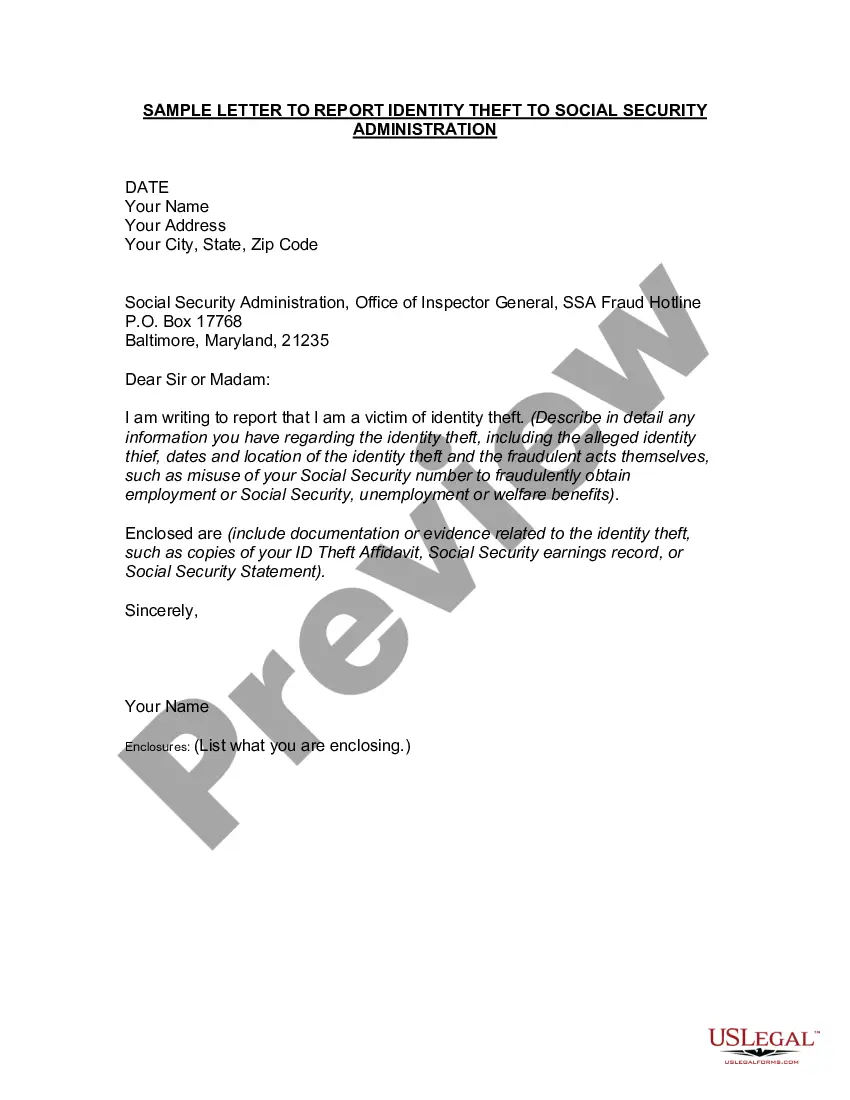

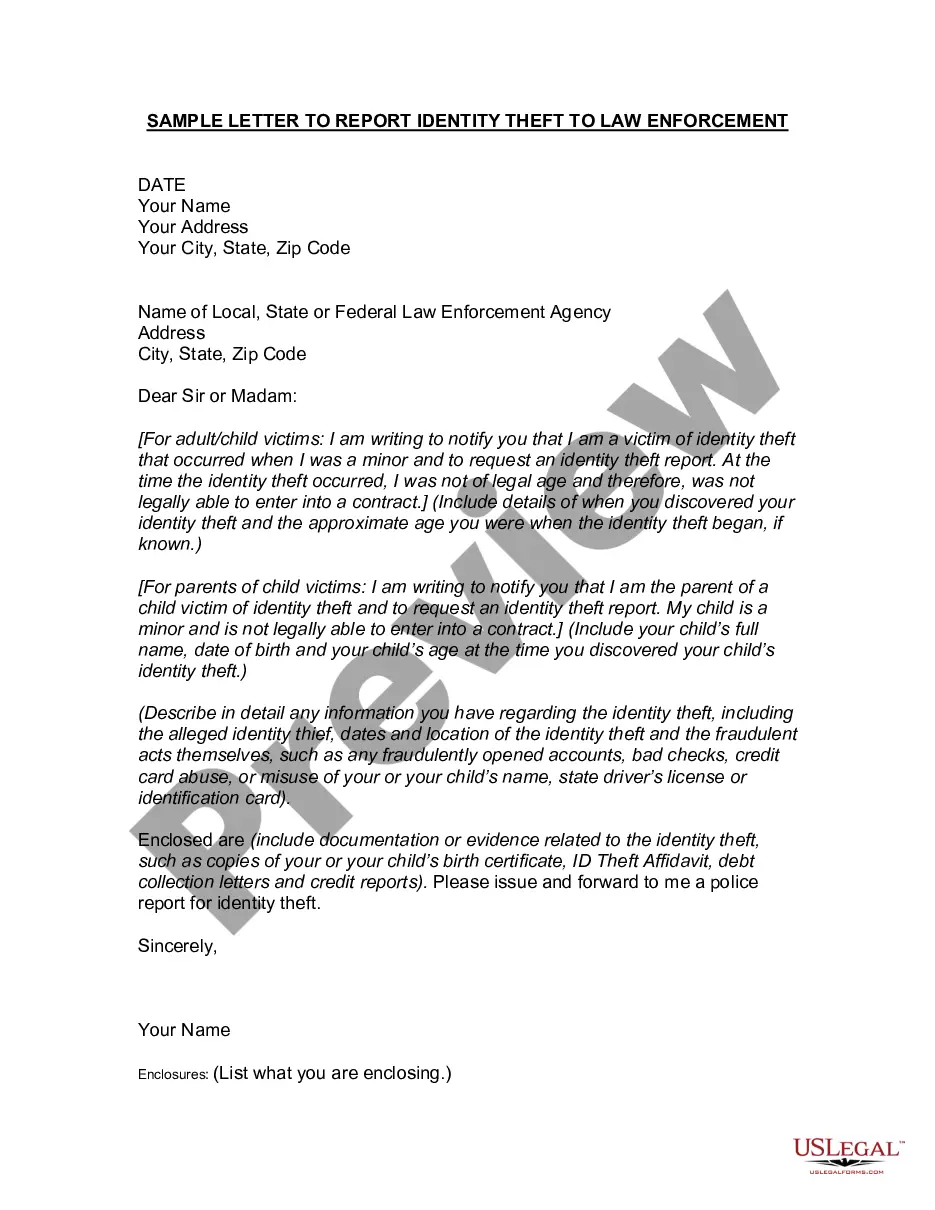

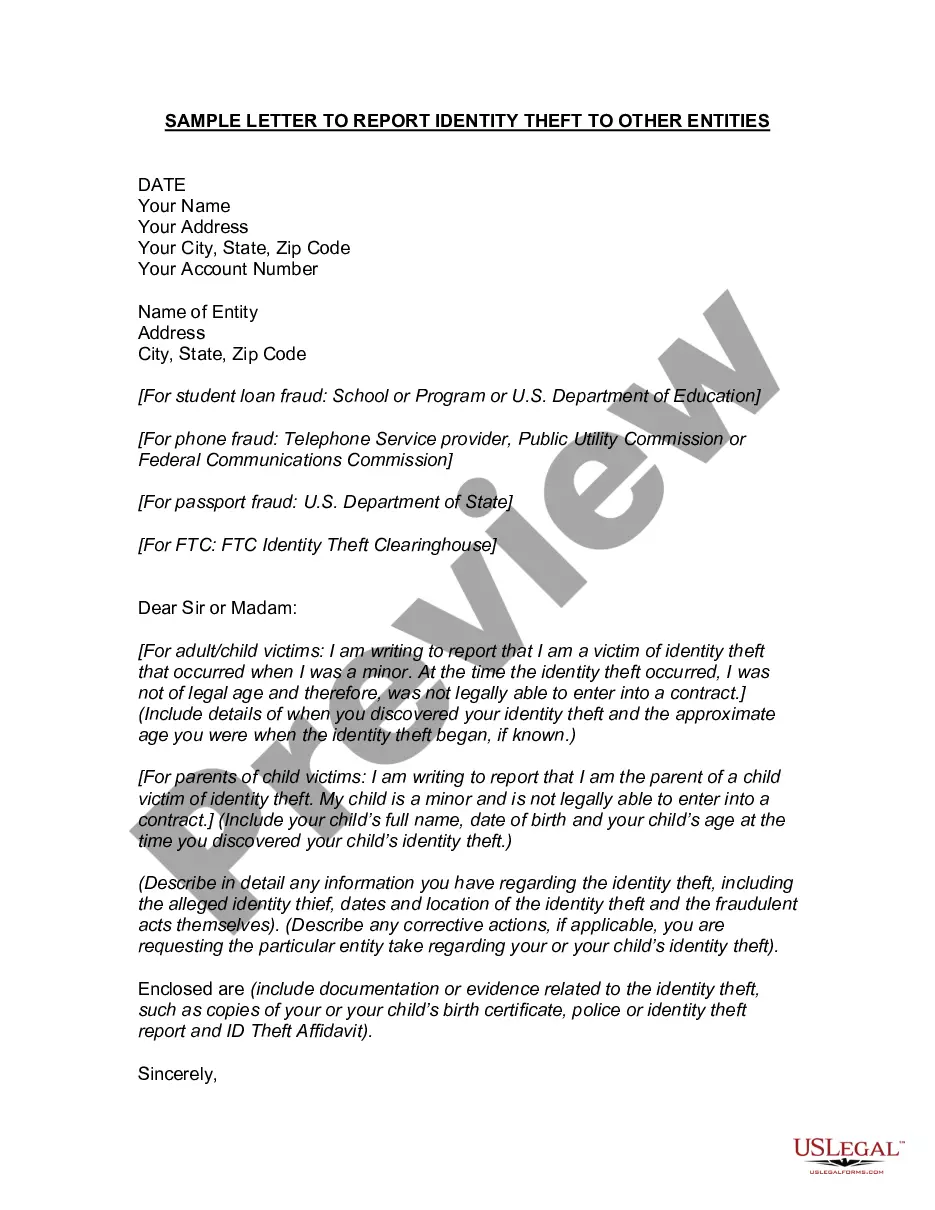

How to fill out Letter Notifying Social Security Administration Of Identity Theft Of Minor?

Have you been in a situation in which you need paperwork for either organization or person uses nearly every working day? There are plenty of legitimate record layouts accessible on the Internet, but getting versions you can trust isn`t effortless. US Legal Forms gives a large number of develop layouts, such as the South Dakota Letter Notifying Social Security Administration of Identity Theft of Minor, which are composed to meet federal and state needs.

In case you are currently informed about US Legal Forms site and have an account, merely log in. After that, you are able to download the South Dakota Letter Notifying Social Security Administration of Identity Theft of Minor template.

Unless you have an bank account and wish to start using US Legal Forms, abide by these steps:

- Get the develop you need and ensure it is for the appropriate city/state.

- Make use of the Preview key to review the shape.

- Read the information to actually have chosen the appropriate develop.

- In case the develop isn`t what you are trying to find, take advantage of the Research industry to discover the develop that suits you and needs.

- Once you find the appropriate develop, click Buy now.

- Opt for the prices prepare you want, fill out the required info to create your bank account, and pay money for an order utilizing your PayPal or bank card.

- Select a hassle-free data file format and download your copy.

Discover all of the record layouts you have purchased in the My Forms food list. You can aquire a further copy of South Dakota Letter Notifying Social Security Administration of Identity Theft of Minor at any time, if necessary. Just go through the required develop to download or produce the record template.

Use US Legal Forms, by far the most comprehensive collection of legitimate kinds, to save some time and steer clear of errors. The support gives skillfully manufactured legitimate record layouts which can be used for a selection of uses. Produce an account on US Legal Forms and start creating your daily life easier.

Form popularity

FAQ

Check your bank, investment, and credit card accounts for unfamiliar transactions. Flag anything and follow up with either the vendor or your bank or credit card company. Don't ignore small transactions. Identity thieves may make small purchases to test if a card or account number works before moving on to larger ones.

You may be a victim of identity theft if: bills do not arrive. statements show transactions you did not make. creditors ask you about an account or card you have not applied for.

You can contact the OIG's fraud hotline at 1-800-269-0271 or submit a report online at oig.ssa.gov. Our investigations are most successful when you provide as much information as possible about the alleged suspect(s) and victim(s) involved.

Sometimes more than one person uses the same Social Security number, either on purpose or by accident. If you suspect someone is using your number for work purposes, you should contact us to report the problem.

Consumers can report identity theft at IdentityTheft.gov, the federal government's one-stop resource to help people report and recover from identity theft. The site provides step-by-step advice and helpful resources like easy-to-print checklists and sample letters.

Start by checking to see if your child has a credit report. If they do, that may be a red flag indicating possible identity theft. If a credit report is found, inform the credit bureau it may be fraudulent. You may need to provide documents to credit bureaus to verify your child's identity and your own.

Look out for notifications that a tax return has been filed under your name. Additionally, if you receive a W-2, 1099, or any other tax form from a company you've never worked for, it might mean that someone obtained your Social Security number and is using it for employment purposes.

Warning signs of identity theft Debt collection calls for accounts you did not open. Information on your credit report for accounts you did not open. Denials of loan applications. Mail stops coming to, or is missing from, your mailbox.