South Dakota Letter from Known Imposter to Creditor Accepting Responsibility for Accounts, Charges or Debits

Description

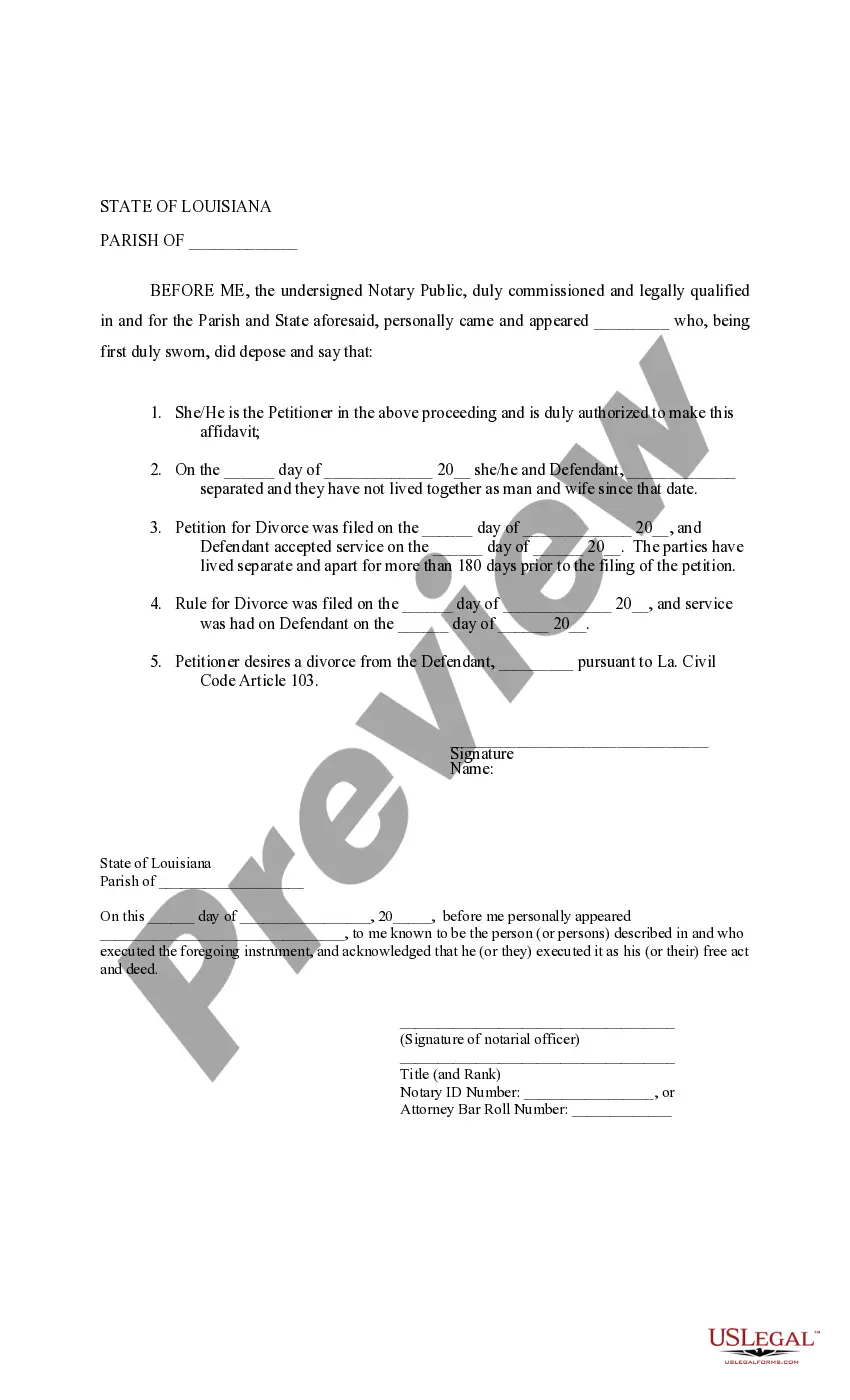

How to fill out Letter From Known Imposter To Creditor Accepting Responsibility For Accounts, Charges Or Debits?

If you need to finalize, acquire, or print official document templates, utilize US Legal Forms, the top choice of official forms, which are accessible online. Take advantage of the site's straightforward and user-friendly search to locate the documents you require. Diverse templates for business and personal purposes are organized by categories and titles, or keywords. Use US Legal Forms to find the South Dakota Letter from Known Imposter to Creditor Accepting Responsibility for Accounts, Charges or Debits with just a few clicks.

If you are already a US Legal Forms customer, Log In to your account and click the Get option to obtain the South Dakota Letter from Known Imposter to Creditor Accepting Responsibility for Accounts, Charges or Debits. You can also access forms you have previously downloaded in the My documents section of your account.

If you are using US Legal Forms for the first time, follow the steps outlined below: Step 1. Ensure you have selected the form for the correct state/region. Step 2. Use the Preview feature to review the form's details. Be sure to read the summary. Step 3. If you are not satisfied with the form, utilize the Search box at the top of the screen to find alternative versions of the official form template. Step 4. Once you have located the form you need, click the Get now option. Choose the pricing plan you prefer and enter your credentials to register for an account. Step 5. Complete the payment process. You can use your credit card or PayPal account to finalize the transaction. Step 6. Select the format of the official form and download it to your device. Step 7. Complete, edit, and print or sign the South Dakota Letter from Known Imposter to Creditor Accepting Responsibility for Accounts, Charges or Debits.

Avoid altering or deleting any HTML tags. Only synonymize plain text outside of the HTML tags.

- Every official document template you purchase belongs to you for years.

- You can access each form you downloaded through your account.

- Select the My documents section and choose a form to print or download again.

- Complete and download, and print the South Dakota Letter from Known Imposter to Creditor Accepting Responsibility for Accounts, Charges or Debits with US Legal Forms.

- There are millions of professional and state-specific forms available for your business or personal needs.

Form popularity

FAQ

Schemes to commit identity theft or fraud may also involve violations of other statutes such as identification fraud (18 U.S.C. § 1028), credit card fraud (18 U.S.C. § 1029), computer fraud (18 U.S.C. § 1030), mail fraud (18 U.S.C. § 1341), wire fraud (18 U.S.C. § 1343), or financial institution fraud (18 U.S.C. § 1344 ...

It is the unlawful violation of an individual's right to the protection of his/her privacy. This illegitimate acquisition of your information can be performed in a variety of ways. Most commonly, identity theft includes stealing, misrepresenting or hijacking the identity of another person or business.

Codified Law 22-30A-1 | South Dakota Legislature. 22-30A-1. Theft--Violation. Any person who takes, or exercises unauthorized control over, property of another, with intent to deprive that person of the property, is guilty of theft.

Codified Laws § 32-12-17.3. It is a Class 1 misdemeanor for any person to display or cause or permit to be displayed or have in his possession any canceled, fictitious or fraudulently altered nondriver identification card.

Identity theft--Felony. (2) Accesses or attempts to access the financial resources of that person through the use of identifying information; such person commits the crime of identity theft. Identity theft committed pursuant to this section is a Class 6 felony.