South Dakota Sample Letter for Special Discount Offer

Description

How to fill out Sample Letter For Special Discount Offer?

Are you presently in a circumstance where you require documents for either professional or personal purposes almost daily? There are numerous legal document templates accessible online, but locating versions you can depend on is not straightforward.

US Legal Forms provides thousands of form templates, including the South Dakota Sample Letter for Special Discount Offer, which are designed to comply with state and federal regulations.

If you are already acquainted with the US Legal Forms website and have an account, simply Log In. After that, you can download the South Dakota Sample Letter for Special Discount Offer template.

- Obtain the form you need and confirm it is for your correct city/county.

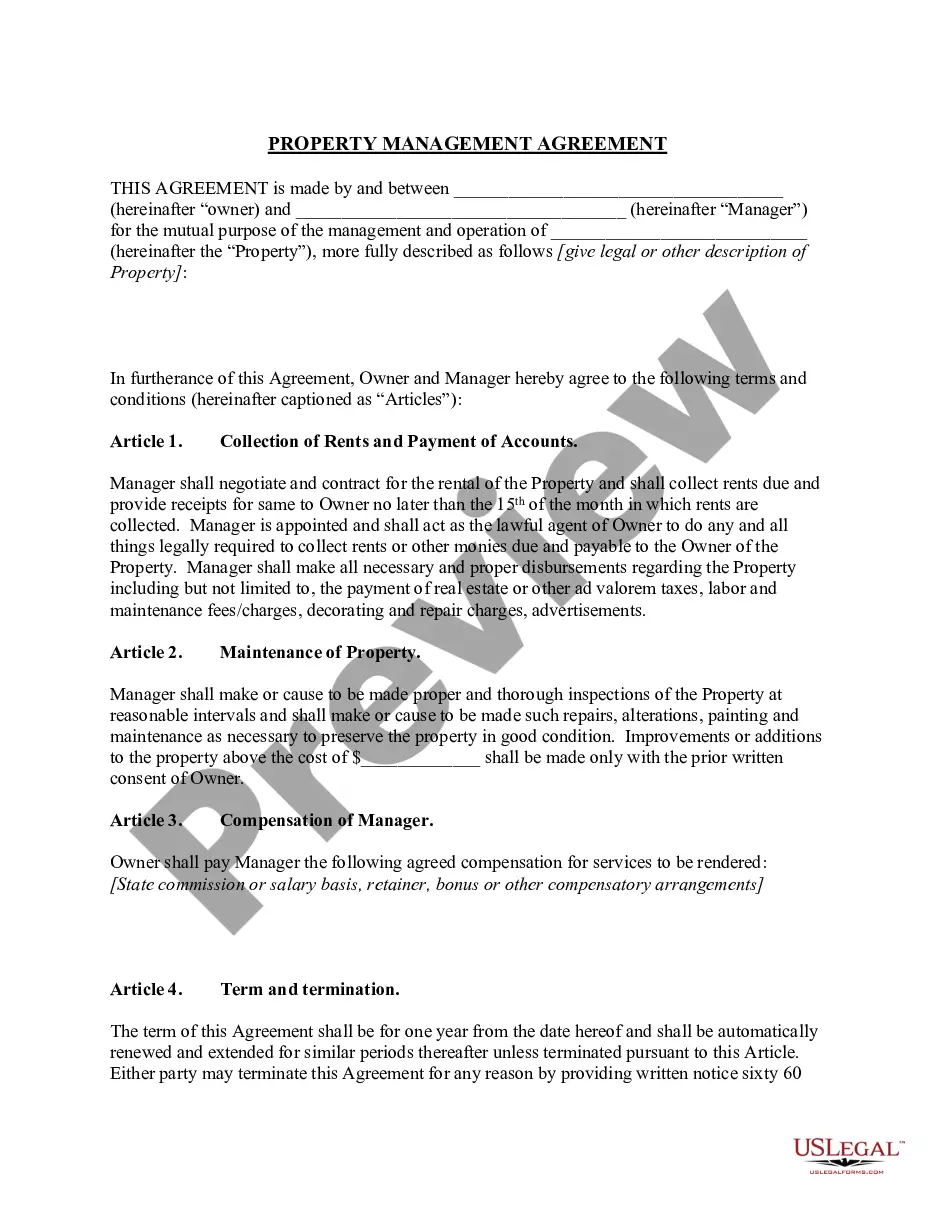

- Utilize the Preview button to view the form.

- Review the details to ensure you have selected the right form.

- If the form does not match your requirements, use the Research field to find the appropriate form that meets your needs.

- Once you find the correct form, simply click Buy now.

- Select the payment plan you desire, complete the necessary information to create your account, and pay for the order using your PayPal or Visa or Mastercard.

- Choose a suitable file format and download your copy.

Form popularity

FAQ

In South Dakota, if you do not have any taxable income, you are not required to file a state tax return. Additionally, those who solely derive income from sources outside of South Dakota may also not need to file. It is always wise to review your income sources carefully. You can refer to a South Dakota Sample Letter for Special Discount Offer for more guidance if you are uncertain about your specific situation.

Applying for a sales tax license in South Dakota is a straightforward process. You simply fill out the application form available on the South Dakota Department of Revenue’s website. Ensure you provide all necessary information, as incomplete applications can delay processing. For ease in navigating this process, a South Dakota Sample Letter for Special Discount Offer can serve as a valuable resource.

Residents of South Dakota do not need to file a state tax return due to the absence of a state income tax. This simplifies the tax process considerably for individuals and businesses. If you have additional income from outside the state, you may still have reporting responsibilities. When in doubt, reference a South Dakota Sample Letter for Special Discount Offer for more clarity regarding your obligations.

South Dakota's lack of a state income tax is a strategic choice to attract businesses and residents. The state's economy relies on sales tax and other forms of revenue. This creates a favorable environment for individuals and corporations looking for lower tax burdens. Utilizing a South Dakota Sample Letter for Special Discount Offer can further enhance your financial advantages.

You can file your federal tax return without filing a state return; however, this is not recommended for residents of South Dakota. The state does not impose an income tax, so many individuals find their tax obligations are less complicated. It is wise to consider the nuances of your situation. If you need guidance, the South Dakota Sample Letter for Special Discount Offer may provide useful insights.

You can get South Dakota license plates by visiting your local county treasurer's office. Bring your vehicle title, proof of insurance, and identification. If you are new to the area, the South Dakota Sample Letter for Special Discount Offer can help you articulate your request for information or assistance, making the process smoother as you settle into your new environment.

To obtain a seller's permit in South Dakota, you must apply through the South Dakota Department of Revenue. The application process is straightforward and can often be completed online. Additionally, the South Dakota Sample Letter for Special Discount Offer may assist you in crafting any communications or requests needed during this process, ensuring you meet all documentation requirements.

Yes, you need a business license to sell online in South Dakota. This license ensures that you comply with state regulations and tax obligations. To streamline your process, consider using the South Dakota Sample Letter for Special Discount Offer as a template for communicating with local authorities. This approach can help you efficiently set up your online business and avoid potential setbacks.